Summary:

- Merck has been the best performing Big Pharma stock apart from Eli Lilly over the past 3 years, 1 year, and 3 months.

- The company drove $59.3bn of revenues in 2022, up >20%. Guidance for FY22 is for $57.7bn – $58.9bn, reflecting falling COVID antiviral sales.

- Keytruda is Merck’s most important asset, the cancer drug driving >40% of revenues in Q1’23. Its patent protection may expire in 2028 although Merck believes they can be extended.

- If patents are extended thanks to a subcutaneous version, Merck could become the largest global Pharma by revenue and will deserve a higher valuation than its current $281bn.

- The company has completed some strong M&A activity in recent years which protects against early Keytruda loss of exclusivity. As such, the company looks like a solid buy even at all-time high prices.

JasonDoiy/iStock Unreleased via Getty Images

Investment Overview – Why Big Pharma Company Valuations Often Seem To Defy Logic

Of all the industry sectors to invest in, “Big Pharma” companies are arguably valued more on the basis of “Jam Tomorrow” than any other.

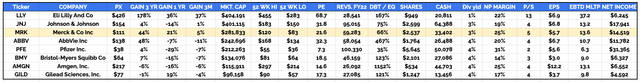

What do I mean by that? Consider the table below, which contains some facts and figures relating to what I refer to as the “Big 8” US Pharmas – Eli Lilly (LLY) Johnson & Johnson (JNJ), Merck & Co (NYSE:MRK) – the subject of this analysis – AbbVie (ABBV), Pfizer (PFE), Bristol-Myers Squibb (BMY), Amgen (AMGN) and Gilead Sciences (GILD).

“Big 8” US Pharmas compared (my table using data from Google Finance, Trading View)

I have ordered this table in terms of market cap valuation – at the top we have Eli Lilly, market cap of $404bn, and at the bottom we have Gilead Sciences, market cap of $96bn. You may therefore expect that Lilly’s revenue generation will be ~4x higher than Gilead’s since it is valued 4x more, or that its net income is 4x higher.

Neither of these conclusions would be correct, however. Lilly’s revenues were $28.5bn in 2022, whilst Gilead’s were $27bn. Lilly earned net income of $6.2bn, whilst Gilead generated net income of $4.5bn. The difference of $1.5bn between the 2 companies in both categories is not in any way comparable to the $300bn difference in market cap valuations.

Even more staggeringly, Lilly’s 2022 revenues are 4x less than Pfizer’s revenues of $100.3bn, and Pfizer’s cash position of $50bn is 2.5x that of Lilly’s. Yet Lilly’s valuation is nearly $200bn greater than Pfizer’s. What is the explanation – and how does it relate to Merck?

The answer to the first question is that investors buying Lilly stock today are not buying based on today’s performance, rather they are buying a share of the performance they believe Lilly will generate in 5-10 years’ time, thanks primarily to a single pipeline drug candidate – its GL1P receptor co-agonist Tirzepatide, which is patent protected, and which analysts believe will generate revenues of >$50bn per annum in the twin indications of Type 2 diabetes and obesity.

In other words, Pfizer may be the company generating >$100bn revenues in 2022, thanks to its COVID vaccine and antiviral, but in 2030, the market believes it will be Lilly generating triple-digit-billion revenues, not Pfizer.

Although it would be foolish to believe that the stock market is a meritocracy, and that correlations between revenue and profit generation and valuation are concrete, at the same time you have to wonder at the logic of valuing a company nearly twice as much as another company based on the revenues it may earn one day in the future. After all, Pfizer’s earnings from Comirnaty and Paxlovid are already in the bank, whilst Lilly hasn’t even yet secured approval for Tirzepatide in obesity.

Why Merck Stock May Represent The Most Sensible Buy In Big Pharma

This brings us to Merck, which to my mind may be the most sensibly valued of all the “Big Pharma” concerns. That does not necessarily make Merck stock the best investment opportunity, but there are elements of certainty and measurable performance here that may be missing from Lilly and Pfizer’s valuations.

In Lilly’s case, the market may be expecting too much from a new drug in Tirzepatide that has barely yet made a commercial sale, whilst in Pfizer’s case, its share count is so vast, and COVID-drug revenue boost so unexpected, it is no wonder the market is struggling to find a valuation metric that works.

Merck’s current market cap of $282bn gives it a price to sales ratio of ~5x, which matches the current average of the “Big 8” – although it should be noted Lilly’s much higher P/S ratio of 13x, reflecting the market’s wild optimism on Tirzepatide, skews the average upward slightly.

Like all of the “Big 8”, Merck pays a reasonably generous dividend of $0.73 per quarter, which currently yields 2.63%, just below average for the sector. In FY22, Merck delivered net income of $14.5bn, which is the third highest of the “Big 8” after Pfizer – $31bn, and Johnson & Johnson – $17.9bn. Its price to earnings (“PE”) ratio of 22x is only the fifth lowest, but competitive nonetheless, and indicative of share price growth potential.

Merck’s share price performance has been the best in the “Big 8” sector after Eli Lilly, up 44% over a 3-year period, and up 21% over a 1-year period, making Merck stock the only other stock besides Lilly’s to be up versus 1 year ago.

Whilst most of the “Big 8” have seen their valuations fall in the face of drug pricing regulations brought in by the Inflation Reduction Act (“IRA”), which prevents drug companies raising prices by more than the current rate of inflation, and prevailing economic headwinds, Merck’s share price has kept climbing. The company’s net profit margin of 25% is the second best in the sector, behind only Pfizer.

To summarize, you could argue that of all the “Big 8” US Pharmas, at this moment of time Merck is in the sweet spot for investors. There is not too much burden of expectation on the company, creating an almost ludicrously high valuation as may be the case with e.g. Lilly. There has been no reaction to the short term nature of some of its revenues streams, an issue which seems to be weighing down Pfizer.

The Pharma additionally generated a very healthy $59.3bn of revenues in FY22, and earned a very healthy profit. Leaving aside “jam tomorrow”, and analyzing Pharma’s based on their current strengths, and trying to ignore anomalous valuations at either end of the spectrum, most investors may logically conclude that Merck offers the best investment opportunity for an everyday investor with a medium appetite for risk.

This being the Pharmaceutical industry, however, that does not mean Merck is free from challenges, or that past performance is indicative of future performance. Let’s now take a deeper dive look at Merck’s product portfolio and pipeline.

Merck & Co – Products And Performance Review

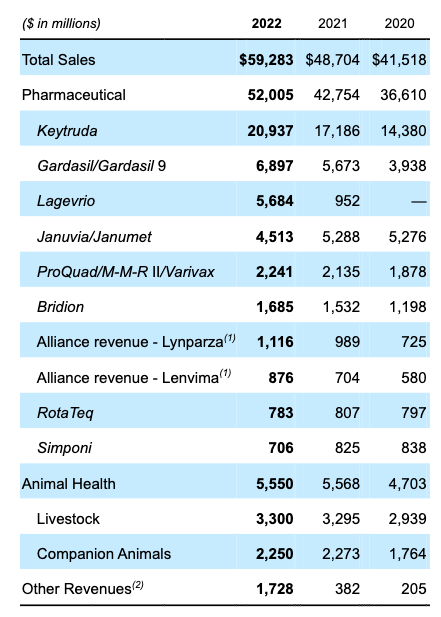

Merck major product revenues overview (Merck 10K 2022)

As we can see in the table above, taken from Merck’s 2022 10K submission, the New Jersey based Pharma increased revenues by 22% last year. The gains essentially come from 2 sources – COVID antiviral Lagevrio, and cancer drug Keytruda.

Lagevrio, an oral COVID antiviral, experienced explosive revenue growth in 2022, but with pandemic pressures easing, these revenues will not repeat in 2023. In fact, in Q1’23 revenues from Lagevrio fell to just $392m, from $3.25bn in Q1’22, causing total revenues to fall from $15.9bn in Q1’22, to $14.5bn – down 9% year-on-year. Guidance for 2023 of $57.7bn – $58.9bn of revenues reflects the decline in Lagevrio sales, although guidance for GAAP EPS of $5.85 – $5.97 would still be an improvement on 2022.

Keytruda revenues grew by 20% in 2022, to $20.9bn, making the programmed death-1 (“PD1”) immune checkpoint inhibitor the world’s third best-selling drug last year, after Pfizer’s Covid drugs Comirnaty and Paxlovid. Unlike Pfizer’s antiviral and vaccine, however, whose sales will likely decline by >50% in 2023, Keytruda continues to go from strength to strength, its sales hitting $5.8bn in Q1’23 – up from $4.8bn in the prior year period.

A question worth asking is whether Merck may be too reliant on its cancer wonder drug, which accounted for >40% of the company’s total revenues in Q1’23? Keytruda’s patent protection is currently set to expire in 2028, meaning generic versions of the drug will be permitted to enter the market, driving down Keytruda’s average selling price and market share. Typically, post patent expiry, a drug’s sales decline by at least 25% per annum.

During the pandemic, bipartisan pressure on drug companies around drug pricing eased off, as Pharmas rose to the challenge posed by COVID with government support, but now it is back, and Keytruda is in the government’s crosshairs. Merck has developed a subcutaneous version of Keytruda which, if successful, could see new patents awarded to the drug, extending its protection for perhaps another decade.

Senator Warren has written to the US Patent and Trademark Office to request intense scrutiny of any applications made by Merck, and the outcome of this process will play a hugely significant role in the Pharma’s long term share price performance, with tens of billions of revenues per annum at stake.

It has to be said that these are battles that Pharma’s often win – witness AbbVie’s successful protection of Humira’s patents for almost a decade longer than expected, allowing Humira to become the world’s best-selling drug, generating revenues >$20bn per annum.

Away from Keytruda however Merck has several other thriving franchises. Its vaccines division is strong, for example, with lead product Gardasil, designed to prevent human papillomavirus, generating revenues of $6.9bn in FY22 – up 22% year-on-year, and continuing to progress in Q1’23, earning $1.97bn – up 35% year-on-year. Proquad, a measles vaccine, drove 12% annual growth in Q1’23, reaching $528m of revenues.

Merck’s Hospital Acute Care and Animal Health divisions provide a steady source of income – ~$3.5bn and $5.5bn respectively. Neither division offers great growth potential, but both provide a solid revenue ballast and are relatively recession proof. On the less positive side, the diabetes franchise, consisting of Januvia and Janumet, is shrinking, as is the immunology franchise, with sales of simponi and remicade slipping in Q1’23.

Merck Product Pipeline Review

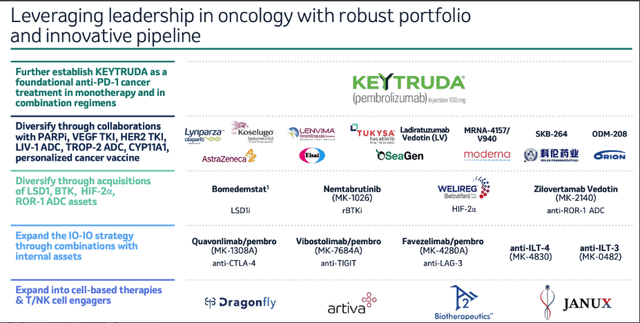

Whilst there seems little doubt that the Keytruda patent extension is the number one priority for Merck between now and the end of the decade, and will be the focus of most Wall Street analysis of the company just as Humira’s loss of exclusivity dominated discussion of AbbVie, Merck is working hard to try to decrease its reliance on its most valuable asset.

Merck’s oncology pipeline (presentation)

I shared this slide from Merck’s January JP Morgan Healthcare Conference presentation in a previous post on Merck in which I mapped out forward sales projections for the company for approved and pipeline products to 2030.

As we can see it shows that Merck has plenty of opportunities in play, although ironically, Keytruda aside, oncology is not a traditional strength of Merck. Besides Keytruda, there are only 2 other approved oncology drugs in Merck’s portfolio. Lynparza, a PARP inhibitor indicated for ovarian cancer marketed and sold by AstraZeneca (AZN), who pay royalties to Merck under a licensing deal, and Lenvima, a thyroid cancer drug marketed and sold by Japanese Pharma Eisai, who also pay royalties to Merck.

In my previous note I stuck my neck out and “guesstimated” that the oncology pipeline could provide an additional ~$7.5bn of revenues per annum for Merck. At that time it also looked as though Merck would complete a buyout of Seagen (SGEN), an antibody drug conjugate (“ADC”) specialist with 4 approved drugs, generating ~$1.5bn revenues, but in fact it was Pfizer that ultimately swooped for Seagen. ADCs may be an unproven drug class at present, and the $43bn that Pfizer paid for Seagen looks excessive, but it is also possible that Merck may live to regret not completing this deal.

Instead, Merck is focused more on developing partnerships with other companies in oncology (who wouldn’t want to partner with Keytruda?), which is a cheaper alternative and maintains its relatively strong – compared with other pharmas at least – debt to equity ratio. At present, Merck has current assets of $33bn, current liabilities of ~$23bn, and long term debt of $28bn – a level of leverage that more conservative investors are likely to feel comfortable with.

In oncology, arguably Merck’s most exciting opportunity outside of Keytruda, is its partnership with Moderna (MRNA), the messenger-RNA giant, on the “personalized cancer vaccine” MRNA-4157. In studies, this “vaccine” which can be custom built for patients according to the specific genetic nature of their cancer, cut the risk of disease recurrence or death by 44% versus Keytruda alone as an adjuvant treatment in a Phase 2b study.

Moderna believes this may form the basis of an accelerated approval application to the FDA, although it’s hard to argue that PCV’s are guaranteed to be competitive in oncology markets, and by selecting melanoma as its initial target, Moderna and Merck selected a relatively straightforward target. The jury is still out on this drug class in my opinion, meaning it is hard to project what the revenue opportunity looks like – it could be anything from $1bn, to >$15bn per annum in my view.

Meanwhile, away from oncology, in April Merck announced the $10.8bn acquisition of Prometheus Biosciences at $200 per share. Immunology markets are vast, and with AbbVie’s Humira finally losing patent protection, there is market share up for grabs. Merck apparently fought off competition from AbbVie and Bristol Myers Squibb to make the deal, the goal being Prometheus’ lead candidate PRA023.

PRA023 could win approval in both Ulcerative Colitis and Crohn’s Disease, based on very solid Phase 2 data, and there may be further label expansion opportunities. The drug targets the protein TL1A, which belong to the tumor necrosis factor (“TNF”) superfamily – in other words, it has a similar mechanism of action (“MoA”) to the all-conquering Humira.

There is inevitably a lot of competition in immunology markets – I recently posted on Roivant Sciences (ROIV), which has its own TL1A targeting drug in development, whilst AbbVie’s Skyrizi and Rinvoq, Johnson & Johnson’s Stelara, Sanofi’s Dupixent, Amgen’s Enbrel, BMY’s Orencia and Zeposia, and Pfizer’s Xeljanz are the current incumbents, generating >$50bn between them.

Last year, Merck spent $11.bn acquiring Acceleron and its drug candidate Sotatercept, which targets Pulmonary Arterial Hypertension (“PAH”) and reduced risk of death by 84% versus placebo in a clinical study. The drug could change the way PAH is treated, and perhaps generate peak revenues >$2.5bn, although as always, the competition is intense – United Therapeutics (UTHR) is the current leader in PAH treatment, and the company has seen off plenty of competing therapies in the past.

Concluding Thoughts: The Keytruda Patent Issue Is Key To Merck’s Valuation – Although It Is Making The Right Moves In Other Fields

Merck is the third largest US Pharma by revenues, and given Johnson & Johnson will soon spin out its consumer health division, and Pfizer’s COVID franchise revenues are falling rapidly, there is an argument that by the end of the decade, Merck could become the largest.

For that to happen, Merck desperately needs to protect its lead asset and extend patent protection. It’s tough to predict how this scenario may play out – Pharma’s have powerful lobbyists, while the government is more determined than ever to hold Pharma’s feet to the fire over drug pricing and so-called “patent thickets”.

The only way that Merck will grow revenues after 2028 is if the company can extend Keytruda’s patent protection, and if it cannot, a decline in the company’s share price from its current all-time high price of >$110 is likely inevitable.

That does not mean that Merck is a busted flush if the patent issue dispute does not go the company’s way however. Merck has made some good strategic acquisitions, in my view, targeting immunology and respiratory disease markets which are often overlooked but are large and lucrative nonetheless.

Ultimately, by eschewing the Seagen deal Merck has apparently favored its PCV opportunity with Moderna over ADCs, and although it is unclear which approach will generate the best results, from Merck’s perspective, its partnership with Moderna is some $43bn cheaper than acquiring Seagen would have been!

Although Merck does not provide the kind of detailed forward product approval and revenues guidance that AbbVie and BMY management do, meaning there is less clarity around what revenues will look like in 5-10 years’ time, it has at least 4 more years of selling and marketing Keytruda whilst AbbVie and BMY’s key assets – Humira and Revlimid – are already facing patent expiries.

Those extra years of exclusivity are worth as much as $100bn to Merck, and if the patent expiration is postponed, there seems little doubt that Merck’s revenues could top $70bn per annum, and that its market cap valuation could roar past $300bn, and perhaps exceed $350bn based on a rule of thumb valuation of 5x sales.

That means – to my mind at least – that Merck stock could climb 25% higher than its current price of $111, and when we consider the downside protection that Merck’s management has put in place through its M&A spree and its established divisions such as animal health and hospital care, I don’t see the company’s valuation slipping much below $250bn even if Keytruda fails to extend patents.

In conclusion, Merck stock looks a good buy even at the current all-time high share price, with 25% upside in play, in my estimation, and good downside protection, including the dividend, of course. It may lack the “wow-factor” of Eli Lilly and its miracle weight-loss drug, but Merck is an appealing buy for any investor not completely sold on the “jam tomorrow” thesis, but keen to buy Pharma stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, BMY, GILD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.