Summary:

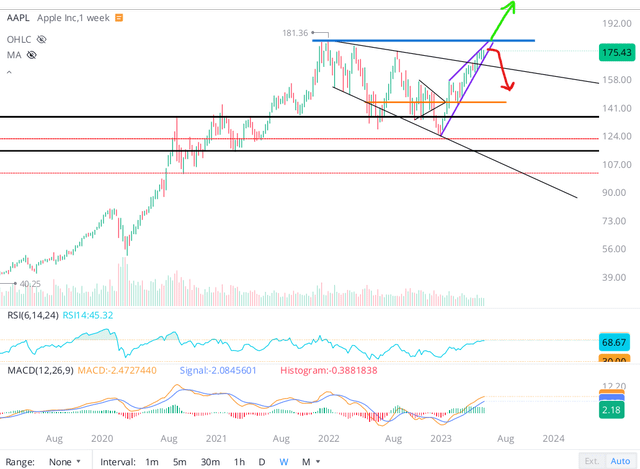

- Amid heightened investor interest in technology stocks due to AI hype taking over the market recently, Apple is sitting in a resistance zone ($175-180) right under its all-time highs.

- However, Apple’s rich valuations remain unjustified by recent financial performance and near-term business outlook. Moreover, AAPL may have already run its race, with the chart showing clear signs of exhaustion.

- With the treasury rates surging higher in recent weeks, the rising wedge formed on Apple’s stock chart is likely to result in a resolution to the downside.

- In this note, I lay out the reasoning for my (near-term) bearish stance on Apple.

- Spoiler alert: I rate Apple a tactical “Sell” in the $175-180 range.

Firn

Introduction

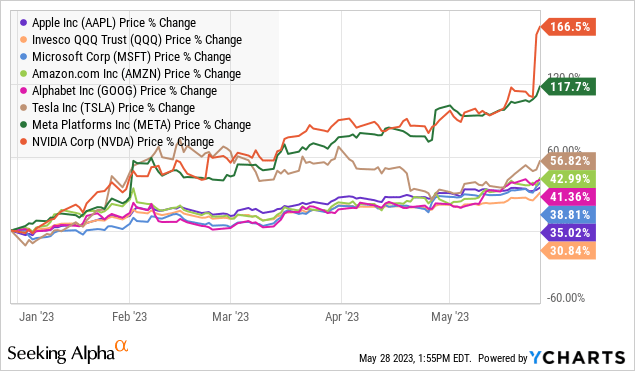

After a challenging 2022, Apple (NASDAQ:AAPL) and its big tech peers have experienced a wild run-up so far in 2023, with investors looking for safety ahead of a potential recession amid multiple bank failures.

In my latest report on AAPL, we reviewed Apple’s FQ2 2023 earnings report, wherein the tech giant reported negative revenue growth and flat earnings despite beating the consensus top and bottom line estimates. Furthermore, we looked into Apple’s valuation and concluded that the company is pretty over-valued in the mid-$170s. Read the full note here:

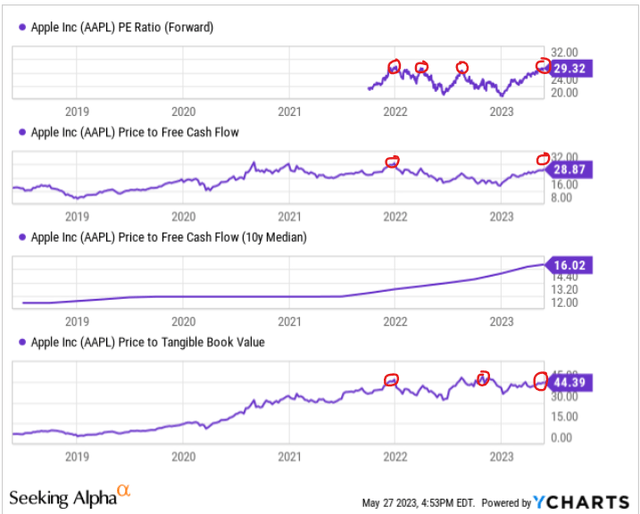

While Apple’s current financial performance and near to medium-term business outlook do not justify its premium valuation (~29x forward P/E) in a 4-5% interest rate environment, the stock is now just a stone’s throw away from its all-time highs!

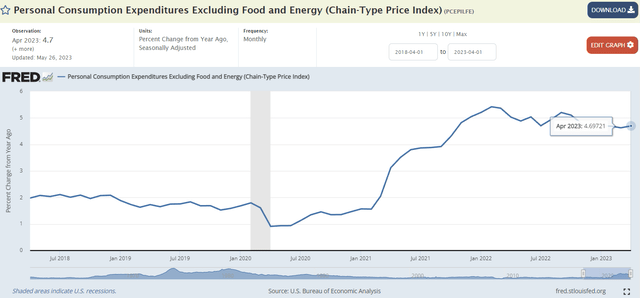

Generative AI breakthroughs have undoubtedly reinvigorated hopes of a growth re-acceleration at large and mega-cap tech firms like Apple; however, in my opinion, the year-to-date rally in Apple and other big tech stocks has been driven in a big way by moderation in inflation & interest rates (improvement in macroeconomic factors) coupled with greater liquidity in global financial markets; and not by fundamental drivers.

With the US debt ceiling issue likely to be resolved this week, a wave of treasury issuance is set to drain liquidity out of the financial markets over the next few weeks. Going into this event, Apple’s stock is showing signs of exhaustion at a key technical resistance zone. And despite the breakout in QQQ last week, there’s a good chance the next big move in AAPL stock is to the downside!

AAPL Stock: A Scary-Looking Technical Setup Complicated By Interest Rate Moves

In the aftermath of Nvidia’s blowout Q1 FY2024 report, we saw a breakout above August highs in the tech-heavy Nasdaq-100 index (NDX) towards the end of last week, with a +5% jump in Invesco QQQ ETF (QQQ) over the last two trading sessions. While AAPL also rose by ~2% in this period, the stock remains stuck in a key resistance zone right below its all-time highs.

Here’s what I wrote on Apple’s stock chart on 8th May 2023:

With this latest jump, AAPL stock appears to have broken out of the bearish megaphone pattern it has traded in over the last year or so. If the stock holds this bounce, we are more than likely to hit new all-time highs within the next few sessions.

However, if this post-earnings bounce turns out to be a false breakout, I can see Apple breaking the rising wedge pattern (marked in purple) to the downside and re-tracing back down to the $145 level. While momentum can carry Apple higher in the near term, I think business fundamentals and valuations do not permit much upside from here. Conversely, the stock could easily lose ~25-50% in the event of a hard landing in the economy. Hence, the risk/reward on AAPL looks highly unfavorable.

Source: Apple Stock: Say No To FOMO

Now, Apple may yet form new all-time highs in upcoming weeks as a rising wedge can resolve to the upside; however, I think the resolution of this wedge will be to the downside. And here’s my rationale for this bearish stance:

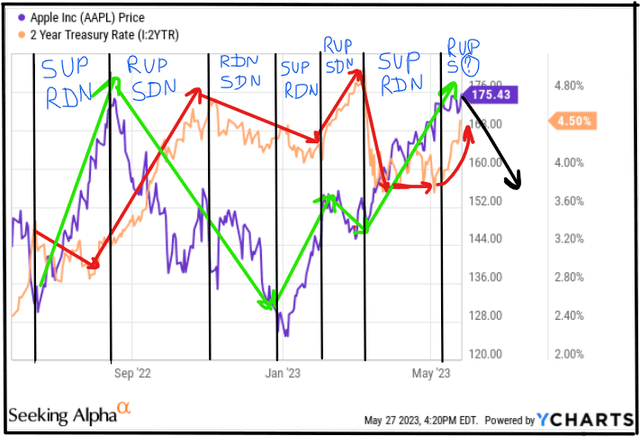

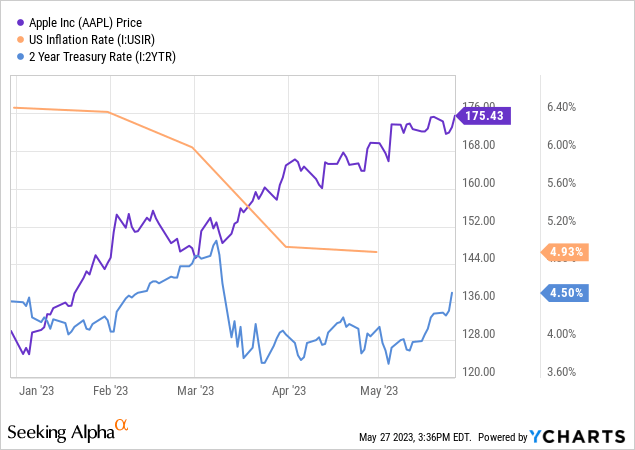

- Over the last year, Apple’s stock has shown a negative correlation with treasury rates (especially the 2-yr treasury). As you can see on the chart below, an increase in the 2-yr treasury rate has led to declines in AAPL stock, and vice versa.

Note: SUP = Stock Up, SDN= Stock Down, RUP = Rate Up, RDN = Rate Down

- Since my last update on Apple (8th May), the 2-yr treasury rate has moved up sharply by ~70 bps from ~3.9% to ~4.6%. This surge in treasury yields is likely to trigger a selloff in AAPL stock in the upcoming weeks if the correlation holds.

- After a ~35% YTD rally, Apple’s stock is as expensive as it was in early-2022 on a forward earnings basis, and you know what followed! (Hint: A big decline throughout last year).

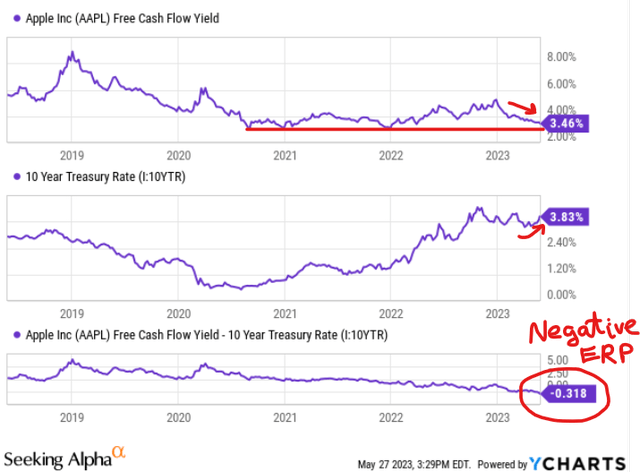

- As we have noted previously, Apple’s revenue and earnings are currently in decline. Hence, the stock trading at historically high trading multiples (not seen outside of a zero-interest rate world) is simply unsustainable. With Apple’s equity risk premium sliding deeper into negative territory over the last three weeks, the violation of the immutable laws of money is getting to an absurd level.

Apple Technical chart (5/27/2023) (YCharts)

- With core PCE inflation (FED’s preferred measure for inflation) proving to be sticky in the 4.5-4.7% area over the last six months, the FED is likely to hike once again at the June meeting. As interest rates climb higher, Apple’s stock is getting even less attractive.

- Furthermore, the full effects of FED’s aggressive monetary policy tightening haven’t been realized yet (nor are the effects of bank credit tightening being instigated by the regional banking crisis); hence, the macro environment for Apple remains uncertain, and its financial performance could get worse in upcoming quarters.

- Given the sheer lack of an equity risk premium, I think Apple stock is likely to get de-rated at some point. At this moment in time, the market narrative is being dominated by AI talk (and hype to some level); however, financial realities (macro and valuations) still do matter, and a day of reckoning is coming for AAPL stock as it remains overloved and overvalued.

Hence, I see a resolution to the downside of Apple’s rising wedge pattern.

Final Thoughts: Is Apple Stock A Buy, Sell, Or Hold As Price Nears All-Time Highs?

With AAPL stock trading at ~$175 per share, investors and traders are getting excited about Apple breaking out to a new all-time high. However, I think the rising wedge formed on Apple’s stock chart is likely to get a resolution to the downside in the not-too-distant future for all the reasons shared above.

According to TQI’s Valuation Model, Apple’s fair value is ~$118.83 per share (or $1.88T). While some of you may disagree with this assessment, I feel the model assumptions are quite generous.

TQI Valuation Model (TQIG.org)

For the modeling period, we have assumed an FCF margin expansion for Apple to 27.5% and a 7.5% CAGR revenue growth rate (higher than consensus analyst estimates).

Apple revenue estimates (SeekingAlpha)

Therefore, I am not a fan of Apple’s current valuation.

Now, predicting where a stock would trade in the short term is impossible; however, over the long run, a stock would track its business fundamentals and obey the immutable laws of money. If the interest rates were to stay depressed, higher equity multiples would be justifiable. However, I work with the assumption that interest rates will eventually track the long-term average of ~5%. Inverting this number, we get a trading multiple of ~20x [P/FCF].

Applying this figure as an exit multiple, I see Apple stock rising to $241.64 by 2027-28 at a CAGR of ~7%. Since Apple’s expected return falls short of my investment hurdle rate of 15%, I am not a buyer here.

TQI Valuation Model (TQIG.org)

With short-duration treasuries offering ~5.5-6%, treasury bills (and notes) offer significantly better risk/reward than Apple’s stock. In the event of a hard landing, I could see Apple re-tracing to its fair value (and maybe, it could probably overshoot to the downside). Hence, I see a downside risk of around ~30% in AAPL stock based on DCF valuation.

In the near term, a downside resolution of Apple’s rising wedge pattern is likely to result in a ~20% decline in AAPL stock (i.e., the $140-145 level), with the stock chart showing clear signs of exhaustion. Given limited near-term upside potential and significant downside risk for Apple stock, I rate Apple stock a “Sell” at current levels.

Now, I am not saying “Short Apple”, but if you own it, this is a good tactical opportunity to reduce exposure. At TQI, we own AAPL within our Buyback-Dividend strategy, and we will be trimming Apple in the mid-$170s this week in favor of near-term treasuries. If (and when) Apple gets back down to the mid-$140s, we will resume slow, staggered accumulation again.

Key Takeaway: I rate Apple a tactical “Sell” in the $175-180 range.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below or DM me.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

At TQI, we own AAPL within our Buyback-Dividend strategy, and we may trim/sell the stock in the next 24-72 hours.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

At The Quantamental Investor, we make investing simple, fun, and profitable. To learn more about our community –> Click Here