Summary:

- Amazon.com, Inc. is not a growth company anymore but is still priced as a growth story.

- While artificial intelligence has potential benefits for ecommerce companies, it is uncertain how it will impact Amazon’s future, and the hype surrounding AI should be examined critically.

- Investors are overly optimistic about Amazon’s AI prospects, overlooking crucial aspects such as declining growth rates, and the challenge of finding a significant revenue stream in AI.

- Valuation is a crucial factor, and at more than 45x its 2024 EPS, Amazon’s stock appears overpriced considering its growth rate.

- Success in investing lies in buying stocks below intrinsic value, a criterion that Amazon doesn’t meet right now.

fabioderby

Investment Thesis

I argue that investors should not chase Amazon.com, Inc. (NASDAQ:AMZN).

In this analysis, I lay out 3 reasons, with 3 arguments in each section, as to why Amazon is not likely to benefit from the AI hype.

At the core of my argument is the fact that Amazon is not a growth company any longer and that it’s still priced as a growth story.

This doesn’t provide investors with the right setup to benefit from this investment at the current valuation – even if the share price is rallying hard on the back of Wall Street’s AI-fever.

AI is A Game Changer

Here are three aspects where AI will benefit commerce companies:

- Companies can deploy AI to analyze vast amounts of customer data to personalize recommendations.

- AI can automate repetitive tasks and streamline supply chain operations.

- AI can optimize inventory management and reduce operational costs by providing real-time customer support (think chatbots).

How will AI impact Amazon? As Niels Bohr said, it is difficult to make predictions, especially about the future.

For now, there’s just so much excitement about AI. But let’s attempt to move beyond the hype and the alluring narrative, to look into Amazon’s fundamentals.

Why Investors Are Getting Too Bullish on Amazon’s AI Prospects

Here are three crucial aspects of why investors are getting too bullish on Amazon’s AI prospects.

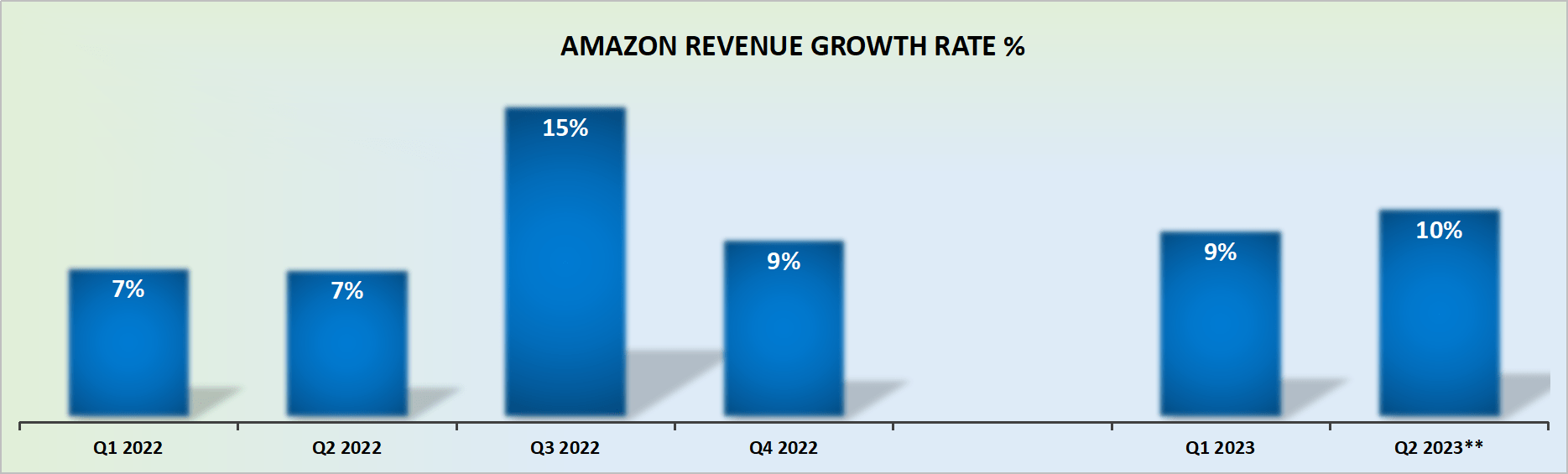

AMZN revenue growth rates

In the first instance, it’s important to keep in mind that Amazon’s growth rates are now reporting meaningfully less than 20% CAGR. In fact, the guidance for Q2 2023 is up against relatively easy comparables, and at the high end Amazon is guided for around 10%. Even if Amazon ends up growing by 12% CAGR, I believe that in H2 2023 its growth rates will not move higher than 12% CAGR.

Secondly, by the end of 2023, Amazon’s retail operations will generate $500 billion in revenues. That comes from selling merchandise. To find a needle-moving revenue stream in AI that will be significant enough to meaningfully change the direction of its core business will be quite a stretch.

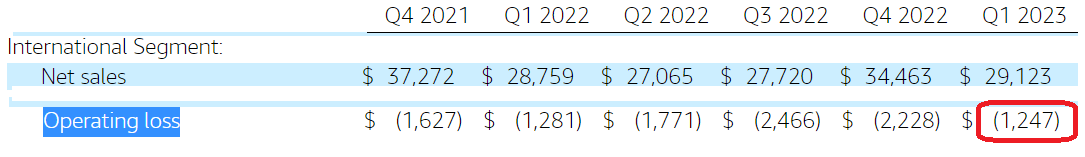

AMZN Q1 2023

Particularly, when we consider that even today Amazon’s International segment is still a money-losing operation. Meaning that outside of North America, after years upon years of investing in its International segment, Amazon still hasn’t figured out a way to be profitable.

And thirdly, Amazon succeeded with Amazon Web Services, or AWS, because it was years ahead of anyone else in figuring out the need for storage. Indeed, I’m confident that I don’t need to remind anyone of Warren Buffett’s quote on AWS. Can the objective Amazon shareholder say that the same applies here? I believe that Amazon was caught just as flatfooted on AI as Alphabet Inc. (GOOGL, GOOG) aka Google. Or perhaps even more flatfooted.

Valuation Still Matters

Here are 3 quick summaries of bubbles that happened in the past 10 years:

- The housing bubble of the early 2000s. Home prices soared driven by speculation on the belief that housing prices would continue to rise indefinitely.

- 3D printing of 2013-2014 (although this one repeats every so many years)

- The cannabis bubble, as the legalization of cannabis gained momentum drew significant investor attention.

I’ve not included cryptocurrency because that’s more nuanced. Even though most cryptocurrencies have died OUT, some are still thriving. My point here is that on every occurrence, investors honestly believed that this time was different. It always starts off with a half-truth. And as they say, a half-truth is more dangerous than a lie.

As we look out to 2024, investors are being asked to pay more than 45x forward EPS. And I know the refrain very well, that Amazon isn’t priced on earnings, because its investing for growth.

However, on that basis, I question, where’s the growth? Because from what I see, the stock is growing at less than 15% CAGR.

The Bottom Line

The only thing we know about the future is that it will be different. (Peter Drucker.)

The reason why Warren Buffett succeeds in investing is not because he is able to predict the future better than anyone. Making predictions about the future is not the way to compound wealth. The way to compound wealth is to buy stocks that are selling for less than intrinsic value.

I don’t believe that Amazon.com, Inc. stock is being priced for less than intrinsic value. And even if right now the share price appears to be smiling away, we both know from a look back to 2022 that the Amazon.com, Inc. share price is not immune to selling off.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.