Summary:

- Thermo Fisher Scientific has experienced significant growth over the past 20 years, with a 14% CAGR in revenue and a 17% CAGR in adjusted EPS.

- Despite headwinds from the COVID-19 pandemic and inflation, the company maintains strong guidance for 2023, with a focus on rewarding shareholders through dividends and buybacks.

- TMO stock is currently trading at a premium but for good reasons. Today’s price is still a good entry point but I would recommend to add only on weakness.

JHVEPhoto

Thermo Fisher Scientific Inc. (NYSE:TMO) has been a quiet winner for many decades now, with the stock returning about 2,800% in the last 20 years, compounding revenue and profits like crazy and growing into the $200 billion behemoth of today.

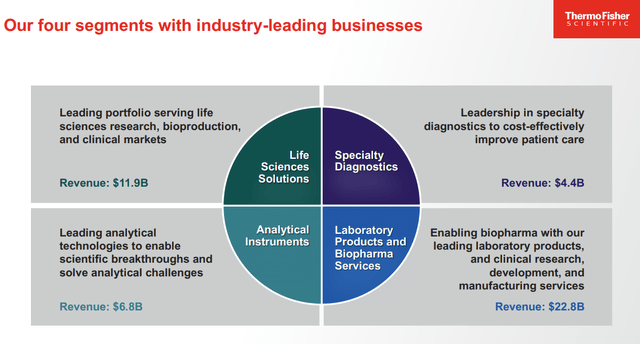

Thermo Fisher Investor Day May 2023

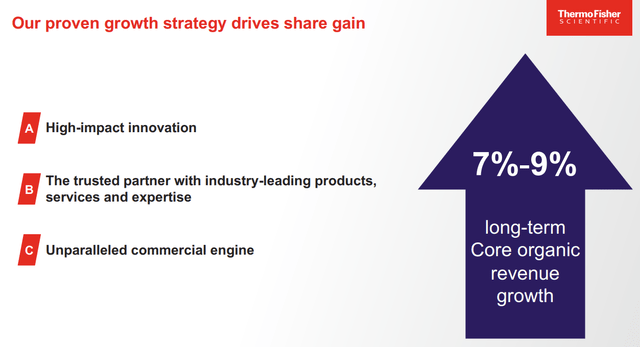

The company we know today came into existence in 2006 when Thermo Electron and Fisher Scientific merged together. Since then, the company experienced a relentless growth bumped by a constant stream of tuck-in acquisitions; the result is a beast that in the past 10 years grew Revenue at 14% CAGR, Adjusted EPS at 17% CAGR and Free Cash Flow at 15% CAGR. On top of that, it has always been a shareholder friendly company as a lot of capital has traditionally been spent on a combination of buybacks and dividends.

Good recent performance despite headwinds

The latest quarter saw the first impact of the expected slowdown in revenue due to the waning of pandemic effects. Thermo Fisher was a big beneficiary of the COVID pandemic and saw its Revenue (including acquisitions) exploding from $25.5 billion in 2019 to $44.9 billion in 2022. During the last quarter revenue came in at $10.7 billion, down 9.38% compared to a year ago.

What is fascinating is that management has acknowledged that the macro environment has become more challenging on top of the revenue headwind attributable to COVID, nevertheless the full year guidance of $45.3 billion in revenue (about flat from the 2022 peak) has been reiterated. The remainder of the year is therefore expected to be more positive overall than what was experienced in Q1.

Adding to the slowdown in revenue, COVID headwinds as well as inflation also meant a marked deterioration of margins: Adjusted Gross Margin came in at 40.3% (down 720 bps YoY) and Adjusted Operating Margin was 21.8% (down 740 bps YoY). Cash from operations was $730 million with Free Cash Flow coming in at $280 million, both figures much lower even compared to the years before the pandemic but I could not personally find an explanation as management did not provide details on this. Nevertheless, management has still guided for $6.9 billion in Free Cash Flow for the year which is once again basically flat YoY. Overall the guidance is assuming that despite the COVID headwinds the company is not expecting any big impact to its financial performance.

Thermo Fisher Investor Day May 2023

On top of upbeat commentary during the earnings call, despite the slowdown management kept pressing hard on rewarding shareholders: during the quarter the dividend was raised 17% (although the current yield is hardly attractive at about 0.28%) and $3 billion was spent to buy back shares. In addition, another acquisition was completed during the quarter with The Binding Site being acquired for $2.7 billion in cash and integrated into the Specialty Diagnostics business. The UK-based company should add about £200 million to Thermo Fisher’s topline this year.

A lot of debt might impact future growth

Thermo Fisher Q1 2023 Reconciliation of Financial Information

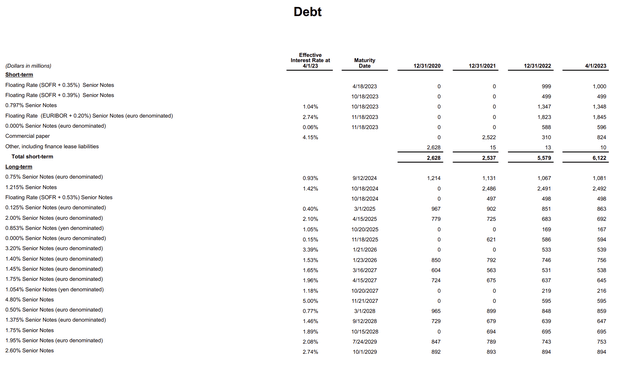

Thermo Fisher unfortunately has a slightly problematic balance sheet with $3.5 billion of cash and a big pile of debt, $35.3 billion as per the last report.

About $5.2 billion in debt will mature before the end of 2023 and the company will need to refinance it. Next year will also be a busy year from a financing point of view as about $4 billion debt will mature and will also need to be refinanced. However, after that for a good while the debt profile seems much more manageable as between 2025 and 2030 TMO has only an average of $1.8 billion maturing every year.

Nevertheless, the cost of refinancing all these maturities will not be painless. The latest round of financing was done in November 2022, when TMO priced an offering for a total of $1.2 billion: $600 million came from Senior Notes maturing in 2027 at 4.8% interest while the other $600 million came from Notes maturing in 2032 at 4.95% interest. At the same time TMO issued euro-denominated Notes due in 2026 and 2034 at lower interest (3.2% and 3.6%). As evident, the cost of debt is tremendously higher compared with the Notes that will soon mature, most of which bear an interest rate under 2%.

One good aspect is that in conjunction with US denominated debt, TMO is also able to raise funds at a lower cost by issuing debt in other currencies (euro, yen). Nevertheless, that will expose the company to FX risk and will not completely offset the global phenomenon of higher interest rates.

Expensive stock for good reasons

The stock is now trading at a market cap of about $194 billion, for a P/S of 4.6 and GAAP P/E of 34. Some growth is implied for next year and thus the forward ratios are respectively 4.45 and 29.6. That is clearly not cheap, and for good reason: Thermo Fisher is a fantastic business that enjoys a leadership position in a growing, recession-proof market. Nevertheless, as always investors need to take into consideration the current valuation as a lot of risks are implied. Moreover, management has admitted that the company is navigating an increasingly challenging environment and one cannot exclude that some missteps will happen.

The question is: what kind of growth the market is implying in order to justify today’s valuation? I built a reversed Discounted Free Cash Flow model and took as a starting point the $6.9 billion that management is guiding for FY2023 FCF. With a 10% discount rate and a terminal P/FCF value of 20 (below the average of 27 recorded in the past 10 years), the market is implying a growth of about 12% per year for the next 10 years. A hard goal to achieve, but TMO in the last 10 years was actually able to grow FCF by an even greater CAGR of 15% per year.

Conclusion

Thermo Fisher is an amazing business, and I am not the first person to notice that. As a result, the stock has always traded for a premium and that is still true today, despite some short-term headwinds. The high valuation, as always, implies a higher risk for investors but generally quality deserves a premium. I rate the stock as a cautious buy at these prices: if the company continues to grow as it did for the past 15 years or so, it is probably well positioned for market-beating returns. Nevertheless, I would not personally recommend building a big position as near-term challenges could send the stock lower, but I would definitely add on weakness. In addition, the debt position is in my opinion a bit worrying as a higher cost of debt could potentially impact the FCF growth that is needed to justify today’s price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TMO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.