Summary:

- PayPal has faced challenges such as slowing growth, increased competition, and management turmoil, leading to an 80% decline in stock value since 2021.

- The company’s core services are in decline, and a shift in focus to engagement over user growth has raised questions about its growth trajectory.

- Despite these issues, PayPal remains a strong company with competitive advantages, and a potential turnaround could occur with the right catalyst.

Justin Sullivan

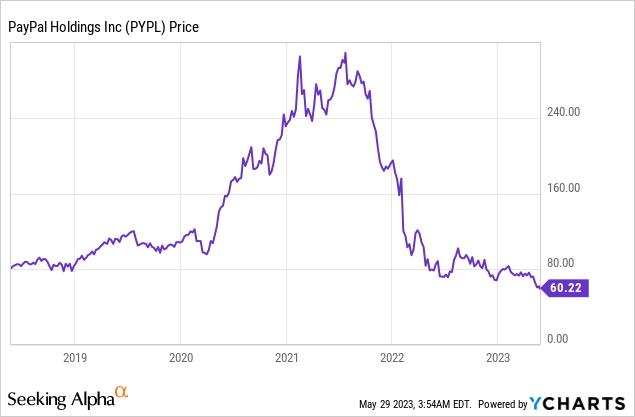

For the majority of its existence, PayPal (NASDAQ:PYPL) has been riding the wave of increasing online payments, with shareholders profiting greatly as the stock seemed to only go one way – up. However, in the recent past, PayPal has struggled, which is more than visible in the stock chart:

PayPal provides payment solutions and financial services to individuals, businesses, and merchants. This includes online payments, peer-to-peer, mobile, international transactions, payment processing for businesses, etc. The business model centers around providing convenient, secure, and reliable payment solutions and the company generates revenues primarily through transaction fees charged as a percentage of the payment amount.

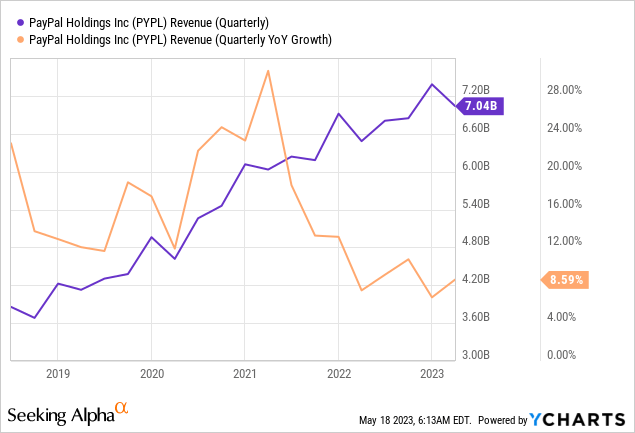

For a long time, PayPal was conceived as the top dog and leader in online payments. It was also a big beneficiary of COVID-19, when physical contact was restricted all around the world, and consumers shifted more towards e-commerce and online payments. However, since mid-2021 the company started to struggle. Since then, the stock has been on a continuous ride down. Investors have been vocal about the low valuation of the stock for some time now – yet, the stock cannot catch a break, it seems. PayPal is caught in a whirlwind of COVID normalization, a toughening macro environment, increasing competition, slowing growth, gross margin erosion, and management turmoil. It looks like a perfect example of a leading business, whose stock has been unfairly punished by the market, and which could lead to big profits for investors who are willing to bet on a turn-around. At the same time, the actual data that we are getting from the company is getting worse and worse – key business metrics like revenue growth, total payment volume growth, and active user growth have been decelerating for many quarters. Worse yet, there are no signs of a turnaround at this point.

Whether PayPal is a good investment or not for the long term, boils down to the question if PayPal’s established market power, secular tailwinds, and low valuation can compensate for the current challenges to the business.

Chronology Of A Downturn

If you go through the recent earnings history you will see things really turned south around Q2 2021 for PayPal when the company missed revenue estimates and gave soft guidance for Q3. After riding the wave of booming e-commerce during the COVID-years some early cracks started to show in the numbers. If you listened to the earnings conference call for Q2 2021 you would not have noticed these problems, though. Management talked about having “some of the best performance in our history on both an absolute and a relative basis”. Even in Q3 2021, when it became obvious that the company will go through more challenging times and analysts pushed back on management’s optimism, the CEO reiterated his confidence:

But if I look at the strength of the core business every single metric is way above, even our forecast is way above our medium-term guidance, and that’s kind of like what gives us just a ton of confidence, and we are obviously being, I think appropriately cautious and conservative as we look forward at this time, but I feel like if I look at the what the real part of our business is every metric is trending pretty strongly right now.

Daniel Schulman, CEO, Earnings Call Q3 2021

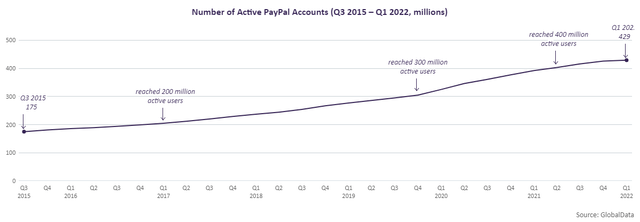

What was that medium-term guidance? If you go back to the February 2021 Investor Day 2021, management gave a target of growing their (at the time) 377 million active accounts to 750 million in five years. The company guided to add 50 million new users in 2021, which meant that they believed at the time to average just over 80 million per year from 2022 to 2025. Considering the pace of user growth up until that point, the guidance, especially for the latter years, seemed outrageously optimistic.

Number of active accounts PayPal (globaldata.com)

You didn’t have to wait long for reality to kick in, though:

In Q4 2021, less than one year after setting these ambitious goals, PayPal announced that they would not meet their 750 million user target and estimated to grow accounts by only 15 to 20 million in 2022.

Furthermore, they would “evolve their customer acquisition and engagement strategy”. In essence, the strategy shift meant the company would deemphasize user growth and focus more on the engagement of the most active accounts to boost efficiency. While their user growth strategies yielded strong results in generating accounts, these customers had a lower engagement, a higher propensity to churn, and did not match the required level of return. Management made it clear that this was a choice. They could increase their spending and accelerate their net new active trajectory, but they believed there were better ways to achieve their financial results. As management alluded to in a later earnings call (Q2 2022), almost 80% of PayPal’s volume was driven by 30% of its active accounts. However, considering that management, only one year before, put out an aggressive customer acquisition target, that clearly was based on a strategy to strengthen the network effect for PayPal, it would seem overly generous to look over this strategic shift in a positive way.

Was it also a choice to only add 9 million users in the whole FY 2022, instead of 15 to 20 million as estimated by management, not even to mention the 80 million adds guided to in 2021? And what about the 2 million accounts lost in Q1 2023? While it may make sense to focus on engagement for efficiency and profitability reasons, it also puts the growth trajectory of the company completely in question. And with the company struggling to meet its decreasing user growth targets, management itself has been called into question by Wall Street.

It didn’t help that just one quarter later, in Q1 2022, the company completely pulled its medium-term guidance. That included growing revenue at 20% compounded through FY 2025 (to over $50 billion), and $10 billion in free cash flow. This was now off the table.

On top of that, the company announced in Q1 2022 that its CFO John Rainey would step down, after seven years at PayPal. One quarter later Mark Britto, the CPO, announced his retirement from PayPal at the end of the year. Not much later, the newly appointed CFO, Blake Jorgensen, had to step away from his duties for unspecified medical reasons just weeks after he was appointed in August 2022 – he would eventually step down permanently in March 2023. And, finally, at the start of 2023, during the absence of the CFO, Dan Schulman, long-time CEO of PayPal, announced his retirement at the end of 2023.

If you sum that up, the company has reported increasingly negative news in its earnings reports in the last six quarters. If you add to that a heavily inflated stock price at the outset of 2021 and a radically changing investment landscape in 2022, it puts the stock decline of 80% since the 2021 highs into perspective.

Digging Deeper

There are many reasons to blame for the bad performance of PayPal, which, to be fair, management also acknowledged in the past: For example, the impact of global supply chain shortages, weakening consumer confidence, the absence of stimulus payments, and the reopening of the economy. Also, the termination of the operating agreement with eBay (EBAY) as well as tough comparables were counted as company-specific reasons. At the beginning of 2022, the Ukraine war also had an impact, as well as inflation, which disproportionately affects PayPal’s customer base that skews more towards discretionary spending.

What management did not acknowledge, though, were any fundamental problems with the business. And here it gets a bit more interesting in my view.

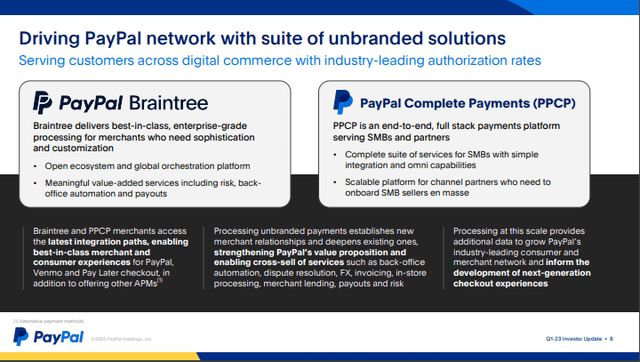

One issue facing PayPal is that, although overall revenue and TPV are still slightly growing, the core PayPal products and services have been in decline for some time. According to the recent 10-Q TPV growth was primarily driven by Braintree, which is often referred to as “unbranded” payment services provided by PayPal. This is problematic because PayPal’s core services carry higher margins than unbranded services.

PayPal Q1-23 Investor Update

Not only do PayPal’s core services thwart overall revenue growth, but the increased weight of unbranded services also has a negative impact on gross margins: Since FY 2018 gross margins were 46.5%, 44.9%, 46.6%, 46.9%, 42.3%, and 41.7% for the TTM. In other words, stable until 2021 but most recently gross margins have dropped off sharply.

Management has focused more on improving profitability, recently, despite the growth and gross margin headwinds. In Q2 2022 they announced approximately $900 million of cost savings in 2022 across operating and transaction expenses, with savings potential of at least $1.3 billion through FY 2023.

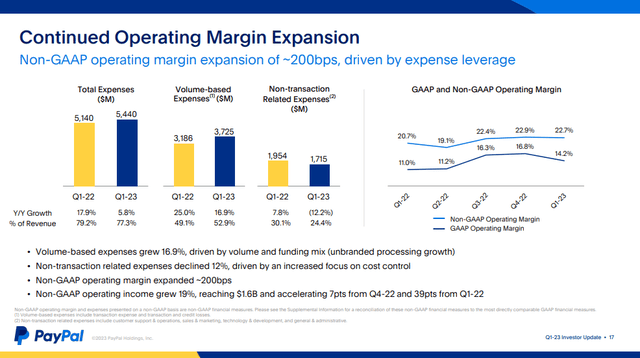

Operating Margin Expansion (PayPal Q1-23 Investor Update)

But the truth is that operating margins have not really moved since 2019 (operating margin was 15.87% TTM vs. 15.74% in FY 2019), which is no wonder considering the contraction in gross margins.

The bigger issue, though, is that these dynamics do not bode well for the PayPal brand, which has to be seen as one of the major assets of the company. Since PayPal’s key task is to provide convenient, secure, and reliable online payments, its brand perception is essential for the business.

It doesn’t help here that PayPal has been making quite a few unforced errors lately considering the management of their brand. One of the bigger mistakes in recent memory was when the company announced a new policy making it possible to fine users to pay $2,500 in damages for “promoting misinformation”. After a huge public outroar the company backpaddled, saying it “was never intended to be inserted”. Unfortunately, for investors, PayPal has a history of controversial decisions on its platform, often confusing its business with politics:

For example, in July 2021, PayPal announced a plan to collaborate with the Anti-Defamation League’s Center on Extremism, “to fight extremism and hate through the financial industry and across at-risk communities” in the “latest effort by PayPal in combating racism, hate and extremism across its platforms and the industry.” This was after the company banned radio host Alex Jones and his website Infowars, because of hateful and discriminatory content. In September 2022, PayPal shut down the accounts of the British social commentator Toby Young, and two connected organizations because of misinformation – a few days later PayPal reversed the decision. Interestingly, PayPal has also blocked accounts of organizations in the past where you would think they would be in line with their political stance: In 2015, PayPal blocked the account of the London-based human rights group Justice for Iran. A bit later that year PayPal blocked an account intended to raise money for the distribution of Boris Nemtsov’s report “Putin. War”.

The bottom line is that PayPal has been active politically through its business. No matter how you stand on these issues politically, PayPal’s involvement is arguably not good for its business because it alienates potential users and tarnishes its brand trust.

It’s Not All Bad, Though

For all its problems, PayPal is still a very strong and well-positioned company: It has strong competitive advantages from its two-sided platform in the form of network effects, scale advantages, and brand power. It has 433 million active user accounts and serves 35 million merchants worldwide. In the last twelve months, it processed $1.39 trillion of payments, had $28 billion in revenue, and earned $5.1 billion in free cash flow. PayPal should also be benefitting from secular tailwinds from the digitization of payments and e-commerce growth. PayPal has its hands on the future owning one of the leading digital wallets Venmo, and planning to develop the next “super app”.

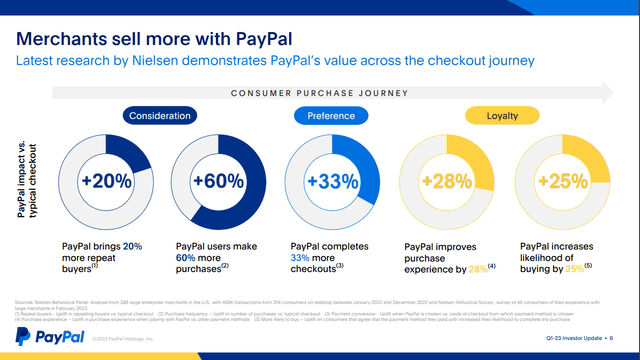

According to consumer surveys, 60% of consumers pick PayPal as their number one choice to do an online transaction. The next closest digital wallet is 8%. PayPal’s customers are two times more likely to shop when they see a PayPal button. PayPal significantly increases purchases, repeat buying, and checkout completions, making it still one of the most important payment partners for online merchants.

Merchants sell more with PayPal (PayPal Q1-23 Investor Update)

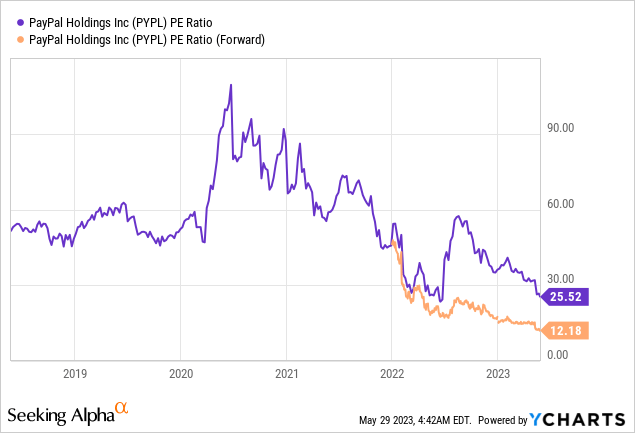

PayPal’s management is also saying that it is committed to maximizing long-term value for shareholders. In Q2 2022, the PayPal Board of Directors authorized an additional $15 billion share repurchase plan. In Q1 2023 they announced that they already returned $4.1B to stockholders on a trailing 12-month basis. On top of that, PayPal looks quite cheap on a PE basis, with a forward PE of just above 12.

Consensus estimates call for revenue growth of 7.5% and 9%, and EPS growth of 19.7% and 15% in FY 2023 and 2024, respectively. While some market participants are fearing a slow decay of PayPal, the truth is that the company is still projected to grow its top- and bottom-line going forward – maybe not at the same growth rate as its competition, but PayPal also has to grow from a much higher base than its competition.

Finishing Thoughts

If you put it all together you can clearly see that potential PayPal investors are in a bit of a conundrum. You have a still strong business – which I outlined briefly – but also many concerns – which I tried to delve into a bit deeper. Of course, great fortunes can be made when the market is at its most pessimistic, and it turns out things are not as bad as everyone thought, but actually quite good.

What I did not discuss in more detail, though, and what probably is a big part of the investment thesis for PayPal, are the technological developments underlying online payments, and the question of whether PayPal is still at the forefront of these developments. This is a big part of the question of whether things are “actually quite good”, which, unfortunately, I cannot answer with my limited technological knowledge. The problem here obviously is that PayPal does not live in a vacuum anymore. With companies like Stripe, Adyen (OTCPK:ADYEY), Block (SQ), Apple (AAPL), Google (GOOG), and many others offering alternative payment solutions, consumers can change payment providers at a moment’s notice. PayPal was the dominant online payment company, and arguably it still is, but its market dominance is seriously challenged if it does not execute.

My view is that in this business of providing convenient, secure, and reliable payment solutions, brand trust and scale, which PayPal still has in droves, are critically important to succeeding in the long term. And this is an advantage that is not eroded that quickly in my opinion. Yes, Wall Street commentators may talk about PayPal being at risk to become a declining tech giant like IBM, or that its services are being commoditized.

But the truth is that PayPal is a golden asset, maybe just waiting to be managed a bit more carefully again. And, on top of that, it’s currently trading at a deep discount, providing at least some downside protection for shareholders.

What PayPal’s stock needs for a successful turn-around is a catalyst – may it be in the form of a positive management change, reacceleration of growth, improving profitability, or simply things turning out a bit less bad than expected. At this point, it has to be acknowledged, though, that there is no real catalyst in sight.

Could PayPal, nevertheless, become a turn-around tech stock like Meta (META) or Netflix (NFLX), recently? I think the basic ingredients are definitely there for PayPal, but investing in it now requires a leap of faith.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, AAPL, GOOG, NFLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.