Summary:

- Following the latest quarter, it appears that Salesforce’s management is now heading the business in the right direction.

- Most of the red flags that I have outlined before are now being taken care of, but I remain cautious for the time being.

- More importantly, the market continues to react negatively to what was in my view a very good quarter.

Stephen Lam

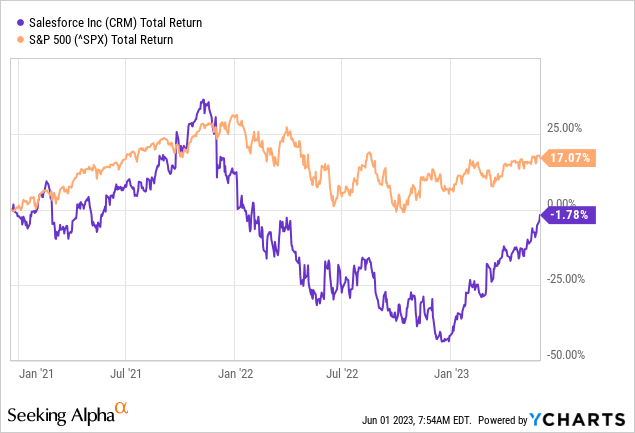

A lot has changed since I first covered Salesforce (NYSE:CRM), back in December of 2020.

Almost two and a half years ago, the company was trading at $225 per share and the optimism was running high. That is why, my bearish thesis was not well received by most readers since the notion of CRM underperforming the market was hard to conceive.

Nevertheless, this is what followed.

A few months ago, however, I turned more neutral on the stock. Not as a result of any efforts to time the market, but rather as a consequence of the rapid pivot in the company’s strategy.

Seeking Alpha

From a business focused entirely on achieving high top line growth through ever larger outside deals, the management was suddenly talking about ‘The Oracle Playbook’ (one of my favourite picks in the tech space). What that meant is that CRM would now be laser focused on achieving high and sustainable profitability, which for someone like me who likes to look at the underlying business model translated into a stronger focus on efficiency and competitive advantages.

With CRM already falling sharply during pre-market hours, it seems that the market is still fixated on the company’s old paradigm – revenue growth no matter the cost.

Seeking Alpha

Although there were some very encouraging signs during the quarter, the ‘conservative revenue forecast’ was in the spotlight.

However, in a similar fashion that the market was missing the forest for the trees back in December of 2020, I now see the same behaviour but in the opposite direction.

Margins and Dilution

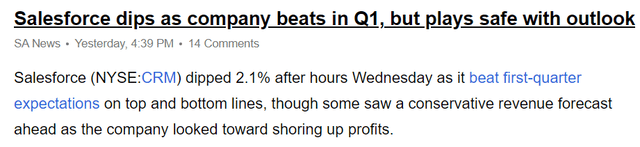

While the revenue forecast for the current fiscal year remained flat to the one provided three months ago, Salesforce’s management has upgraded its guidance across the board on profitability and cash flow metrics.

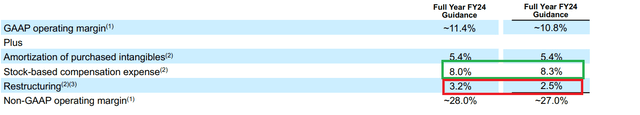

In the graph below, on the left, we have the FY 2024 guidance provided yesterday and the one from three months ago to the right.

Salesforce Earnings Release

In addition to all the profitability metrics noting an improvement over the 3-month period, I have been mostly focused on GAAP operating margin, which noted a slight increase. The reason why this is so important is because capital allocation decisions at Salesforce have prevented the company from achieving high GAAP profitability, in spite of the company’s strong business model.

The issue with large acquisitions is largely a done deal, since there isn’t much that could be done at this time, but the adjustments for stock-based compensation and restructuring for FY 2024 have both changed during the past three months.

The impact on margins of stock-based compensation is now expected to ease, while at the same time restructuring expenses will be higher.

Salesforce Earnings Release

For example, stock-based compensation expense for FY 2024 is expected to drop from $2.88 per share to $2.80 from the prior quarter. The issue of Salesforce’s enormous share-based compensation packages relative to its cash flow has been one of the major red flags that I pointed out all the way back in 2020.

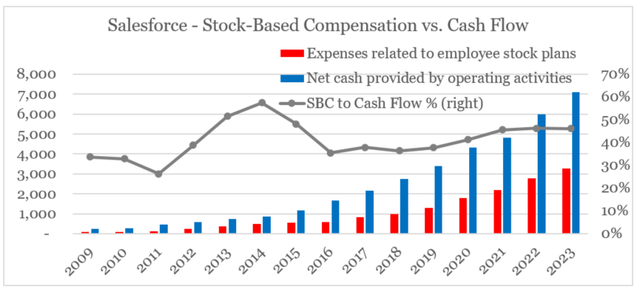

As we see in the graph below, the share of stock-based compensation expense to Salesforce’s cash flow from operations has been above 50% in the past few years which is unsustainable over the long run and could result in problems with expenses and retention of talent.

prepared by the author, using data from SEC Filings

Not only is the trend now reversing, with Salesforce gradually reducing the amount of stock-based compensation, but also management has committed to continuing down that path.

We also remain focused on stock based compensation and continue to expect it to improve this year to below 9% as a percent of revenue.

Source: Salesforce Q1 2024 Earnings Transcript

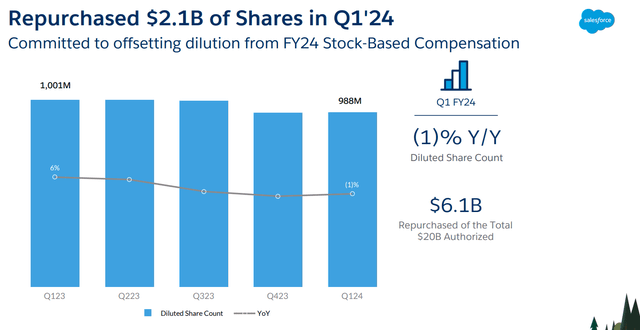

In addition to the reduced stock-based compensation, Salesforce has already repurchased $2.1bn worth of shares which is a major step towards addressing the issue of shareholder dilution.

Salesforce Investor Presentation

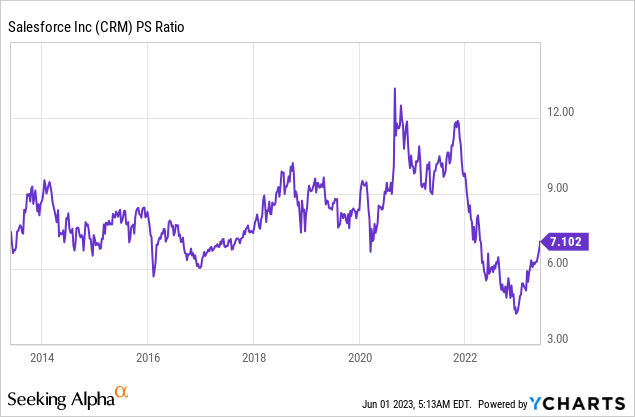

Last but not least, we should note that these repurchases were made at one of the lowest multiples for CRM in recent history.

More Reasons To Be Optimistic

Another area of concern for me over the years has been the bloated fixed cost structure of Salesforce which was yet another obstacle to achieving high and sustainable GAAP profitability.

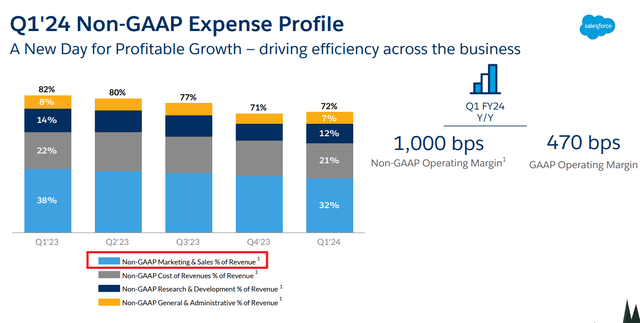

Looking at CRM’s expenses as a share of sales, by far the largest component is the company’s marketing and sales spend. (…)

Being a fixed cost expense, spend on marketing and sales usually declines as a share of revenue as a company grows in size. In CRM’s case, however, this expense has not changed much for the past 11 years.

Source: Seeking Alpha

After outlining the issue during the previous earnings conference call, management seems to be doubling down on its commitment to restructure the business. That is why, restructuring related expenses for fiscal 2024 are now expected to increase from $0.85 per share to $1.11.

We continue to scrutinize every dollar investment, every resource, and every spend and we’re transforming every corner of our company. Our progress over the last 5 months, while it’s very impressive and I cannot be more grateful to our entire team for their leadership.

Source: Salesforce Q1 2024 Earnings Transcript

Namely, marketing & sales expenses are now going down fast as a percentage of revenue which is exactly what I have been looking for.

Salesforce Investor Presentation

The company seems to be capitalizing on its pricing power and stronger focus on larger deals as well as improving productivity to reduce the share of fixed costs relative to sales and so far this strategy is working better than expected.

And one of the things that we’re talking quite a bit about right now is pricing and packaging, bringing together logical products that we can be selling in a single motion versus our go-to-market, which is largely aligned by product., how do we focus on a larger average deal size for every transaction, and so big investments on that front, really a strong focus on productivity as it relates to moving people up market as well.

Source: Salesforce Q1 2024 Earnings Transcript

Investor Takeaway

Overall, the latest quarter of Salesforce was largely encouraging that management is fully committed to its recent U-turn on its strategy. Reported figures and fiscal year guidance only confirm that, and I am now more optimistic about the future of CRM than I was a quarter ago. Nevertheless, the market is having a different opinion, which could once again create a major opportunity for anyone willing to have a different opinion than that of the predominant narrative.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ORCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the technology space?

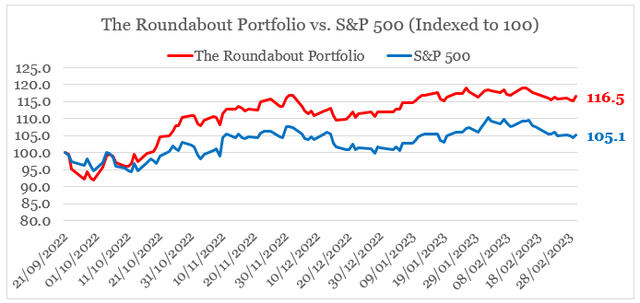

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.