Summary:

- Lucid investors want to believe that the Saudi PIF is their friend.

- I urge these holders to be realistic as the PIF has its interests to safeguard. It even managed to get a decent discount for its stock offering.

- Lucid’s financing challenges are not over, as the runway is extended by another year. The PIF is smart enough not to undertake significant moral hazard risks.

- Without a substantial discount on its valuation, I don’t expect Lucid to be taken private by the PIF. Why should they, even if they can?

- With LCID still priced at a steep premium, the pain likely isn’t over.

hapabapa

Lucid Group (NASDAQ:LCID) “diamond hands” suffered another setback this week, as the company announced a new $3B stock offering, including $1.8B from its cornerstone investor, the Saudi PIF sovereign wealth fund or SWF.

LCID fell nearly 17% to close yesterday’s session, reflecting the dilution from the stock offering. Accordingly, LCID had a market cap of about $14.2B before yesterday’s session. As such, the stock offering would have led to a 21% dilution to equity holders.

LCID closed May 31’s session at $7.76. Barron’s reported that the Saudi PIF received pricing of “about $6.77 per share,” while the rest of the stock offering was priced at $6.91 per share. As such, the SWF was offered a discount of nearly 13% against May 31’s closing price.

In my previous update, I cautioned investors that “Lucid’s dwindling liquidity balance suggests additional funding could be necessary.” With Lucid’s liquidity expected to last through Q2’24, the company must tap more funding early to bolster investors’ confidence as it ramps production.

Based on the funding boost, Lucid is expected to have sufficient liquidity through mid-2025, extending its runway for about another year. However, it’s also crucial for investors to note that the company’s cash burn in Q1 was much worse than expected as it struggled with ramping production.

The revised analysts’ estimates indicate that Lucid could burn through $9.37B by the end of 2025. As such, investors should be prepared that the recent financing will unlikely be the last over the next two years. Moreover, investors will need to brace for more pain if the production ramp is worse than expected (worsened by Lucid’s underperformance record).

One of the critical questions investors have is whether the PIF would be keen to take Lucid private. Lucid is an essential pillar in the PIF’s “Vision 2030,” as Saudi Arabia seeks to diversify its reliance on fossil fuels. With the PIF as the anchor investor for Lucid, I don’t expect the company to “run out of money” theoretically.

However, I believe the PIF is also not keen to instill moral hazard risks by being the sole shareholder of Lucid by taking it private. Does it make sense? Consider Lucid’s latest stock offering of $3B. The PIF could easily subsume the entire stock offering but didn’t. With assets under management of over $600B, I believe it’s easily within reach.

Therefore, having other financiers on board helps the PIF diversify some of the financing and moral hazard risks and retain its majority stake in the company. Hence, while Lucid investors view the PIF as a benefactor, the SWF is not “stupid.” It even managed to get a reasonable discount for the offering.

However, if the production situation at Lucid worsens further, it could lead to more selling pressure, as short-sellers anticipate another massive round of financing could be necessary. Moving forward, I expect the PIF to negotiate even better terms for itself, which will likely put LCID’s holders under more pressure, as seen by yesterday’s selloff.

No, the Saudi PIF is not your friend.

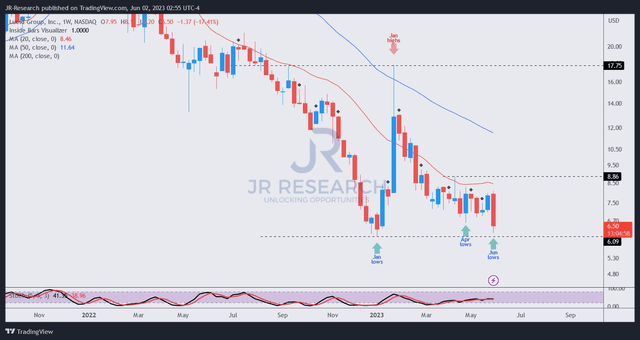

LCID price chart (weekly) (TradingView)

LCID dip buyers who bought its April lows were likely taken out by the force of the selldown yesterday.

I anticipate that dip buyers could return to help bolster the stock, assessing that the dilution has largely been reflected.

However, while the EV market remains in a secular growth phase, LCID’s “D-” valuation grade by Seeking Alpha Quant suggests that the stock has not yet been priced for extreme disappointment.

What does that mean? If Lucid continues to disappoint, holders must expect even more pain. Even if the PIF continued to finance, the discount could widen further to reflect increasing risks to their shareholding.

Rating: Hold (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!