Summary:

- I am downgrading Netflix from a buy to a hold, due to overvaluation and potential challenges from its password-sharing crackdown and members trading down to the cheaper ad-supported tier.

- Netflix’s high average revenue per user (ARPU) and improving free cash flow per share are highlighted as distinguishing factors to competitors.

- I remain bullish on the company’s long-term prospects; however, I am instating a hold rating for the remainder of 2023.

- Netflix has had a sustained rally from its July ’22 lows, moving up more than 120%, which I see drying up soon due to its lofty valuation and overbought RSI.

Manuel Velasquez/Getty Images Entertainment

Investment Thesis

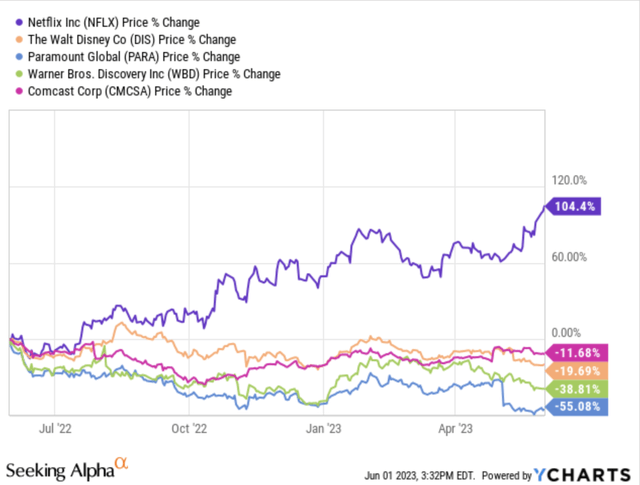

Overall, for the past year or so, I have been bullish on Netflix (NASDAQ:NFLX) and have seen satisfactory gains compared to sector and industry returns and broader market moves. Since July of 2022, I have written two articles covering Netflix, both with bullish targets at price points of roughly $170-180/share and $290/share, respectively. Now that it has surpassed to $400/share mark, it is a great time to take profits and lock in these returns. Netflix has seen handsome returns YoY; from a technical perspective, it has been overbought and is due for some leveling off or retrace. Below is a snapshot of Netflix’s astonishing recovery compared to some of its peers.

1-Year Media & Entertainment Stock Returns (YCharts)

While I still am very bullish on Netflix and its business model in the long run, I think its run has gotten a bit stretched to the upside, and there is still a ton of valuable data that we will be waiting to see in the next few quarters. Because of these reasons, I am starting a hold on Netflix and downgrading it from a buy. I feel Netflix will be trading in the $350-400 range for the back half of 2023 unless it reports surprise beats in its ad-supported tier and avoids heavy churn from its password-sharing crackdown. I believe that Netflix will remain an industry leader moving forward and will continue to outperform its unprofitable peers in the streaming space. Investors should stay overweight or at least equal weight in the name.

Important Points And Netflix’s Valuation

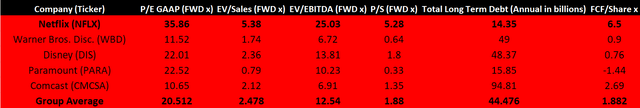

With Netflix’s more than doubled stock price since its July ’22 bottom, its comparable valuation has gotten inflated. This is something that was never the leading reason for my bull case in Netflix, as it has always traded at a pretty pricey valuation; however, because it is the only pure-play, fully profitable streamer in the business for an established amount of time, I feel Netflix still deserves respect as the current industry leader. While its valuation continues to worsen due to its sustained rally, this is the main reason for my downgrade. A comparable metric analysis shows that forward EV/EBITDA of roughly 25.2x and forward GAAP P/E of 35.5x trade significantly higher than sector medians of 8.4x and 18.1x, respectively. Below is a table showing Netflix stock’s current valuation metrics concerning some of its relevant peers.

Streaming Comparable Valuations (Seeking Alpha & YCharts)

As you can see, on a comparable company basis, NFLX is relatively overpriced when compared to names like Warner Bros. Discovery (WBD), Disney (DIS), Paramount (PARA), and Comcast (CMCSA). The only significant metric that Netflix stands out in compared to the group is its free cash flow per share, which the company has been significantly improving over the past decade. These are all relevant peers in the streaming space, with Disney owning Disney+, ESPN+, and a majority stake in Hulu. Warner Bros. Discovery owns the prevalent HBO MAX/or now known as MAX and Discovery+, Comcast owns Peacock and a minority stake (~33%) in Hulu, and Paramount owns Paramount+. Most of the companies listed above have other ventures outside of streaming, which distinguished Netflix as a pure-play streamer. Companies like Comcast can be considered a multinational conglomerate with business segments spanning from streaming to cable/broadband, studios, and even theme parks worldwide. With Netflix focusing all of its efforts on its streaming and improving its original content slate, it has been able to boast best-in-class operating profits and industry-leading ARPU (average revenue per user).

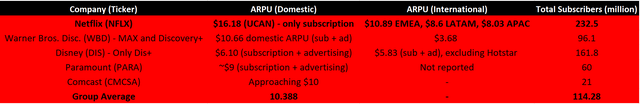

The one thing that stood out to me the most around a year ago when Netflix was beaten down was its ARPU. This metric is a significant benchmark used in the media & entertainment space to differentiate a company’s products from one another. Netflix’s streaming product reflects an average revenue per user much higher than its respective peers; however, it has started to wane a bit and lost its dominance, another reason for this downgrade. Even though its ARPU has yet to be able to grow much more through its price hikes, Netflix has been able to report domestic and international ARPU numbers that are monumentally higher than its peers. Below is an ARPU matrix highlighting the ARPU across various regions for the streamers and total subscribership.

Streaming Comparable ARPU and Subscribership (Streaming Media Blog)

As you can see above, this is the most impressive and distinguishing factor Netflix has over its competitors. Not only is its domestic ARPU significantly higher (even though membership costs are slightly higher), but it can also translate this profitability over to growing regions and areas where other companies are failing to turn a profit. Netflix is also back over 230 million subs while streaming giants like Disney with Disney+ are finally seeing the effects of this macroeconomic environment and seeing subscriber churn last quarter. This, along with Netflix’s content, is the reason why I remain bullish in the long-term and neutral rather than bearish in the short term.

Although NFLX is pricey using most valuation metrics, they still continue to deliver a profitable streaming service month in and month out, which is something, only a couple of other companies can confidently say.

Why I Believe Netflix Has Hit Its Short-Term Peak?

From a fundamental and technical perspective, there are several reasons why Netflix has hit a short-term ceiling for now, right at around $400-405/share. For one, Netflix has seen a lot of backlash from US consumers after announcing its strategy to move its password crackdown into the domestic region. This was a strategy Netflix has been testing in the LatAm region for the past quarter or so before moving it to the US, UK, and Australia. I always had thought that adding an extra account outside of your household would be around $2.99/month; however, I have seen that it is now $7.99/month to add one extra member to use the service. Given that the standard streaming option is $15.49/month, this is roughly an additional half a subscription on top. This is where investors must predict if the churn of people who share passwords will be more significant than acquiring new customers through this crackdown strategy.

Some might be wondering how this will all work. You now have to define a set household for where your Netflix account will stream shows/movies. Once this household is defined, the software will be able to utilize IP addresses to make sure no suspicious account activity is occurring outside of this “defined address.” The UK is charging £4.99/month for extra member slots. Those who pay for the premium Netflix package with 4k streaming can add two additional subscribers, though at the same $7.99/month price point.

In my eyes, if I am paying $15.49/month for shows that I love and watch almost every day, I would have no problem paying the extra $7.99/month if I used someone else’s password, as that is fair from Netflix’s standpoint. Netflix has found a way to monetize this potentially massive market of a projected 100+ million households who share passwords daily. As long as Netflix acquires two or more “sub-accounts” for every one standard account churn, they will, in theory, be profiting in the long run from this strategy. However, Netflix and management believe that this will be much more successful and have yet to see much churn in the early release.

Netflix is doing the right thing here, but not at an ideal time. We are inevitably moving closer to a recession and an environment where inflation has hit consumers’ pockets hard for the past year or two, and the cost of living has skyrocketed for many. I see a lot more people canceling their subscriptions because of this internationally than in the US, as Netflix has seen its UCAN consumers be more sticky to price hikes in the past. With UCAN only accounting for about 35-40% of NFLX’s revenue mix by region, investors can anticipate some top and bottom-line pressure if this hits the international markets harder. We can also expect the average subscription length to drop from its estimated 48 months.

Netflix’s Current Pricing Plans

- Standard with ads: $6.99/month

- Basic: $9.99/month

- Standard: $15.49/month (extra member slots** can be added for $7.99 each/month)

- Premium: $19.99/month (extra member slots** can be added for $7.99 each/month)

All in all, there are a lot of uncertain things investors must uncover in the coming quarter or two, with a slow content slate coming up, the fast growth of the ad tier, and the full rollout of the password crackdown strategies. We have seen some rampant growth in the ad tier after Netflix shared that it had reached 5 million global subs in under six months at its 2023 Upfront presentation. This is another place where, so far, Netflix has seen great results and can also double down and bring in ad revenue; however, they can also see subscribers trading down from the standard $15.49/month tier to the low price of $6.99/month. Rapid trading down has not been seen or anticipated, but in a global economy where consumers are spending less on discretionary expenditures, we may see more people turn to the ad tier moving forward.

From a more technical standpoint, Netflix has been overbought using a 14-period RSI – which is a momentum indicator that measures the magnitude of recent price changes to analyze overbought or oversold conditions, using 14 periods to calculate values on a 0-100 basis. In terms of Netflix stock, it is overbought, sitting at an RSI of 73. This mainly means that Netflix has been relatively overbought in recent trading and that its rally has likely overextended. This is another reason why we will see headwinds for Netflix’s share price in the back half of 2023.

Key Takeaways And Risk Factors To My Thesis

Overall, I still remain bullish on the name for the long run, but I am downgrading NFLX as a hold from a buy in the short run. Netflix has a lot of critical data that will be coming out in the future quarters that will be crucial for the corporation’s future. 2024 will be a huge time for Netflix as they will be releasing huge original fan hits like Squid Games Season 2, which was an international phenom, and the fifth and final season of Stranger Things. Along with some significant content releases, we will see the widespread impacts of the password crackdown and the full implementation of its ad-supported tier.

Of course, NFLX can continue its run and even make new highs as they have been able to rebound in terms of subscriber count and deliver on the ad-tier stage. Suppose Netflix continues its success in the ad tier. In that case, the company will be able to get more companies willing to place ads on Netflix’s streaming product, thus generating more potential ad revenue, which management estimates will be around $560 million for this year and over $1 billion for 2024. While I am downgrading Netflix, it will continue to withstand macroeconomic pressures, a saturated/competitive streaming market, high-interest rates, and F/X headwinds, making it a great long-term hold if you are in the name. It is also a solid point to lock in profits and look to reinvest at potentially lower levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is purely my opinion, and prospective investors should conduct further research to make a conclusive decision.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.