Summary:

- The healthcare sector is attractive for investors focusing on dividend growth stocks due to recession fears and a potential decrease in private consumption.

- Thermo Fisher Scientific, a company selling services and products to healthcare companies, is less likely to suffer from lower sales and can be a good investment opportunity.

- I analyzed the company using my methodology and found that despite solid fundamentals and growth opportunities, the valuation is not compelling and leaves investors with no margin of safety.

JHVEPhoto

Introduction

As an investor focusing on dividend growth stocks, I always seek new opportunities to invest in income-producing assets, mainly stocks. I usually add to my existing positions when I find them attractive. I also use market volatility to my advantage by starting new positions to diversify my holdings and increase my dividend income for less capital.

The healthcare sector is attractive nowadays as there are still fears of recession. Investors are concerned that we may see less private consumption. Therefore, companies like Thermo Fisher Scientific (NYSE:TMO) can be interesting. These companies sell services and products to healthcare companies and therefore are less likely to suffer from lower sales.

I will analyze Thermo Fisher Scientific using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

Thermo Fisher Scientific Inc. provides life sciences solutions, analytical instruments, specialty diagnostics, laboratory products, and biopharma services in the United States and internationally. The company’s Life Sciences Solutions segment offers reagents, tools, and consumables for biological and medical research, discovery and production of drugs and vaccines, and diagnosis of infections and diseases. Its Analytical Instruments segment provides instruments, consumables, software, and services for use in laboratories, on the production line, and in the pharmaceutical, biotechnology, academic, government, environmental, and other research and industrial markets, as well as clinical laboratories. The company’s Specialty Diagnostics segment offers liquid, ready-to-use, and lyophilized immunodiagnostic reagent kits, calibrators, controls, and calibration verification fluids. Its Laboratory Products and Biopharma Services segment provides laboratory products, laboratory chemicals, research, safety market channel, pharma services, and clinical research.

Fundamentals

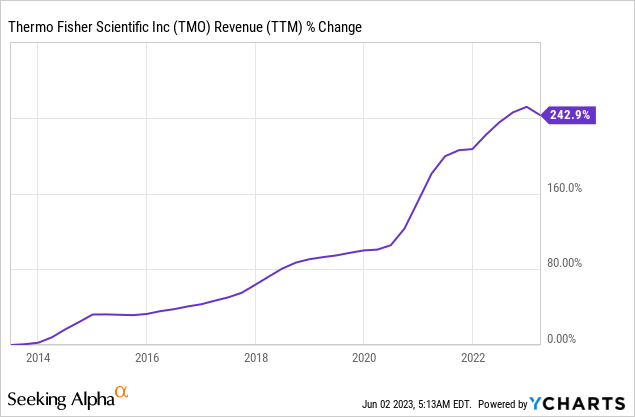

The revenues of Thermo Fisher Scientific have increased by 243% over the last decade. The company has grown by increasing sales, raising prices, and growing through acquisitions. The company makes relatively small acquisitions that supplement its clients’ value proposition. Since 2020, it has enjoyed a significant bump in sales due to the pandemic. In the future, as seen on Seeking Alpha, the analyst consensus expects Thermo Fisher Scientific to keep growing sales at an annual rate of ~3% in the medium term.

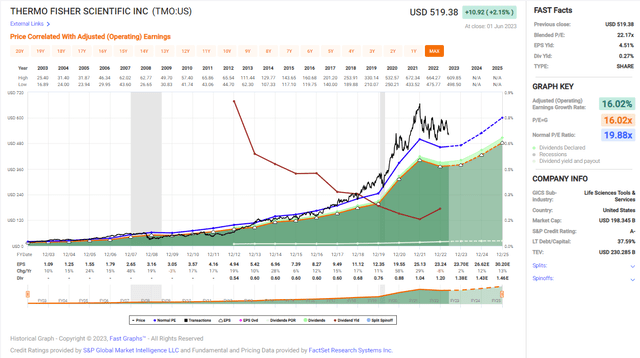

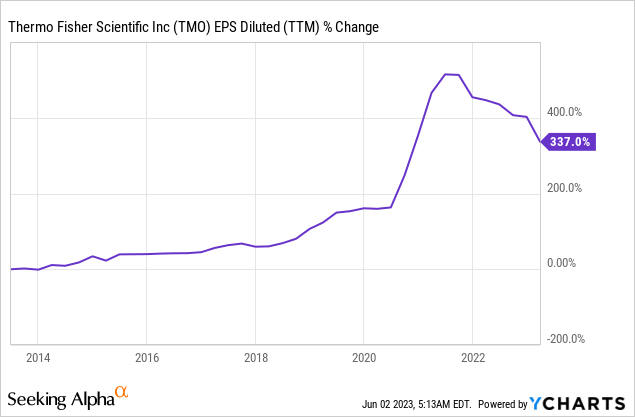

The EPS (earnings per share) has grown much faster. EPS has grown by 337% over the past decade, despite a significant drop since the peak during the pandemic. The company’s EPS growth was achieved despite the increase in shares due to a combination of higher sales with higher margins as the company raised prices with lower expenses. In the future, as seen on Seeking Alpha, the analyst consensus expects Thermo Fisher Scientific to keep growing EPS at an annual rate of ~9% in the medium term.

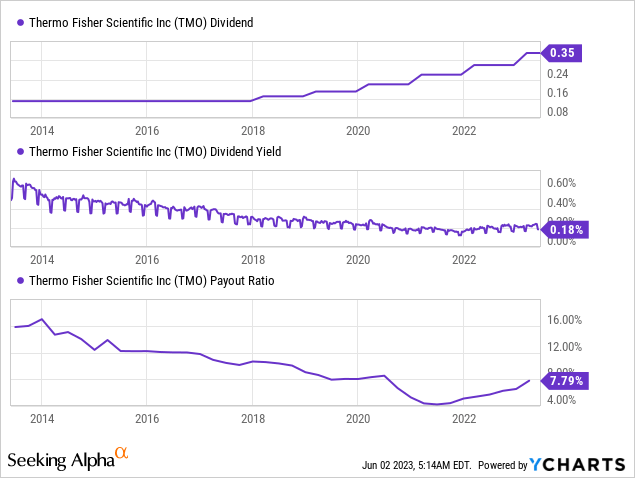

Thermo Fisher Scientific has been paying a consistent dividend over the last decade. It has never reduced it and raised it annually over the past five years. The annual growth rate of the dividend was 15% during that time. Investors should consider that while the payout seems exceptionally safe with a payout ratio below 10%, the current yield is not attractive at 0.2%. However, there is plenty of room to grow the dividend, and therefore, it may be suitable for long-term dividend growth investors who don’t seek income now.

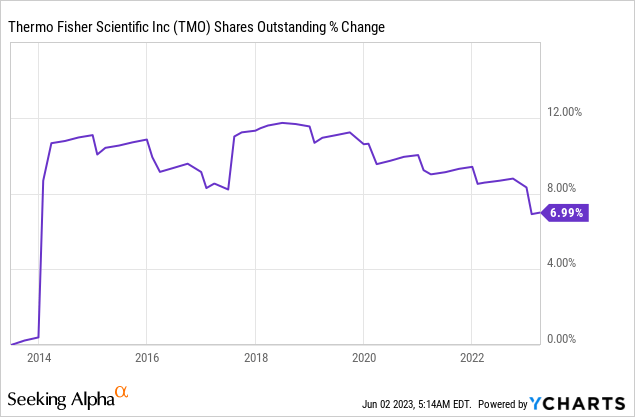

In addition to dividends, companies return capital to shareholders via buybacks. These shares repurchase plans to reduce the number of shares outstanding and support EPS growth. The company saw its share count increase by 7% over the last decade. Shares are used to acquire companies and compensate employees. Since the increase in the share count peaked in 2019, the number of shares reduced by 5%. Buybacks are extremely useful when the valuation is low.

Valuation

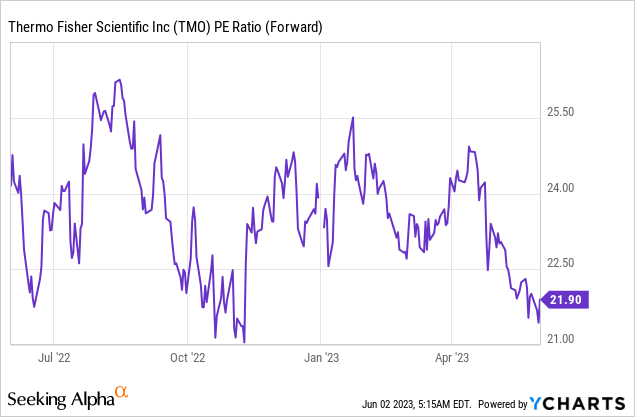

The P/E (price to earnings) ratio stands at 22 when using the EPS estimates for 2023. This is almost the lowest valuation we have seen for the company over the last twelve months. However, paying 22 times earnings in today’s interest rate environment for a company that grows at a high single digits rate seems a bit hard. Of course, this is not a bubble, yet it looks like a slight premium.

The graph below from Fast Graphs shows very nicely why I believe Thermo Fisher Scientific shares are not attractively valued. Over the last two decades, the company has shown an annual average growth rate of 16% and an average P/E ratio of 20. At the moment, analysts expect a lower growth rate while the valuation is higher than average. Therefore, I believe the shares are trading for a slight premium with little margin of safety.

Opportunities

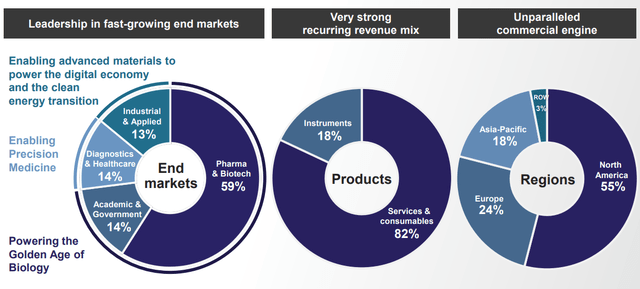

Diversification will support growth in the future. The company has businesses globally, with only 55% of its sales coming from North America. In addition, it is also diversified in the segment it serves. While most of the business is with the pharma and biotech markets, it has significant business with the government and other healthcare and industrial players.

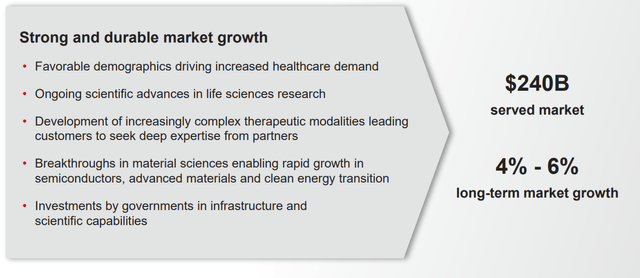

Another catalyst for growth is that Thermo Fisher Scientific is active in a large and growing market. The combination of demographics globally, more people internationally gaining access to healthcare, and the constant need to develop new tools to treat people will drive Thermo Fisher Scientific’s market. Its ability to excel in a growing market will be a long-term growth opportunity.

The company is using a hands-on approach that is beneficial in two ways. It helps it shift revenues from one-time sales to recurring as it incorporates services with the product. It also helps the company protect itself from competition as the services make the products more sticky. The ability to engage with the clients on their sites and practically participate in their usage of products creates added value for clients and makes it harder for them to shift providers.

Risks

The competition is another risk. The company sells products while it relies heavily on its track record, its ability to support and ensure its customers’ success, and the quality of its products. However, investors should remember that it is not the only player in the field, and the barrier to entry is relatively low. Adding inflation to that equation, we have a competitive field with limited ability to raise prices while expenses increase.

The end of the Covid pandemic bump is another short to medium-term risk for Thermo Fisher Scientific. The company has enjoyed a significant increase in sales due to the need for laboratory services and other products and services it provides. It may be harder to replace these sales as the pandemic is behind us. We see companies like Abbott Laboratories (ABT) and Pfizer (PFE) suffering from lower sales, which can also be a setback for the company’s growth as analysts expect no sales growth in 2023.

I believe the narrow margin of safety is the most significant risk. The company has dealt with competition well and is in a decent position to keep doing so. It will also replace sales from the Covid bump eventually. However, the margin of safety can hurt investors in the long term. Buying a company that trades for a valuation that is too high may result in a bad investment even if the company keeps performing well. Investors who bought great companies during the dot com bubble took years to recover despite the businesses performing well. The premium here is not that high, yet I prefer some margin before I buy.

Conclusions

To conclude, Thermo Fisher Scientific is a blue-chip company offering decent growth despite its size. The company has solid fundamentals that lead to a growing dividend over the long term. The company also has the scale and the diversification to keep growing in the massive market it takes part in. It also evolved a hands-on approach, making it stickier and harder to replace.

Despite that, there are some risks to the investment thesis in Thermo Fisher Scientific. The competition in the field, the end of the pandemic, the lower demand it may bring with it, and above all, there is the lack of margin of safety. The company’s valuation is too high for me, leaving no room for execution challenges. Therefore, I believe the company is a HOLD, and investors should wait for a better entry point when the P/E ratio is around 17-18.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.