Summary:

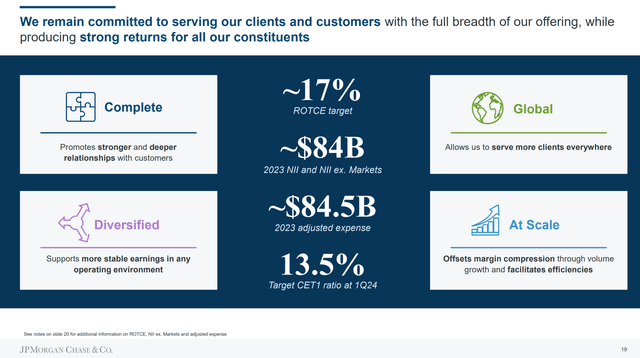

- JPMorgan Chase reaffirmed its ROTCE target of ~17% and CET1 target of ~13.5% while increasing its 2023 NII outlook due to the First Republic Bank acquisition.

- The bank showcased its ‘universal banking model’ with leading positions in CCB, CIB, CB, and AWM, and highlighted opportunities for further growth across its business segments.

- Despite challenges in investment banking and credit, JPMorgan’s strong business moat and attractive P/E ratio make it a good investment, with the author reiterating an Overweight/Buy rating on the stock.

Sundry Photography/iStock Editorial via Getty Images

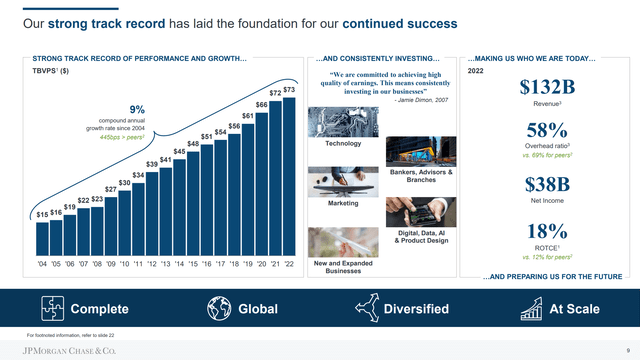

On Monday May 22, JPMorgan Chase & Co (NYSE:JPM) held its annual investor day in NYC and delivered more than 250 slides worth of content covering the bank’s competitive strategy, growth and profitability outlook, as well as challenges. Overall, the key takeaway was very encouraging for investors: JPM reiterated its ROTCE target of ~17% and CET1 target of ~13.5%, while management increased its 2023 NII outlook due to the recently announced FRC acquisition. Accordingly, I continue to argue that JPM is poised to deliver an attractive combination of growth and profitability through at least 2025, leading to an estimated 2023 EPS/TBV ratio ~0.2.

Currently, JPM stock is trading at a price-to-earnings ratio of about ~10x for the bank’ estimated earnings in 2023, which appears exceptionally attractive given the bank’s enormous business moat built on difficult-to-replicate intangible assets such as exceptional human capital, trust, and ‘universal banking’ network effects — with #1 global industry positioning in CCB, CIB, CB.

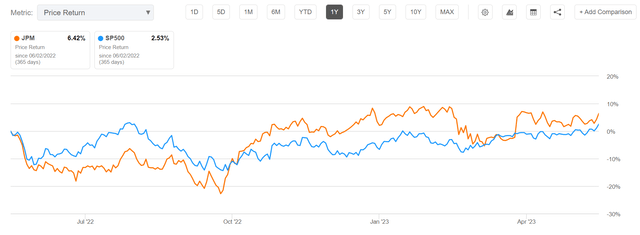

Reflecting on JPM’s investor day insights, I reiterate an Overweight/ Buy rating on JPM stock, and expect the bank’s shares will outperform the S&P 500 (SP500) through 2025 — as the stock has done for the past 12 months.

Seeking Alpha

#1 ‘Universal Banking’ Franchise Poised For Growth

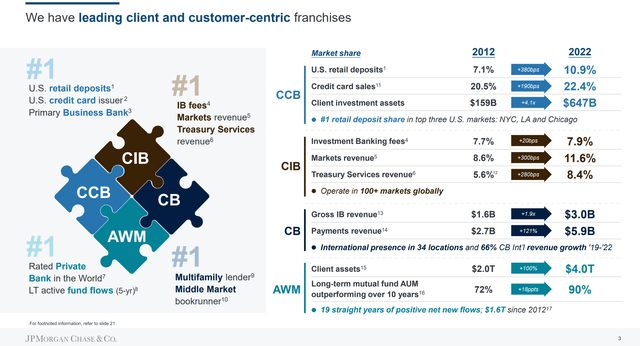

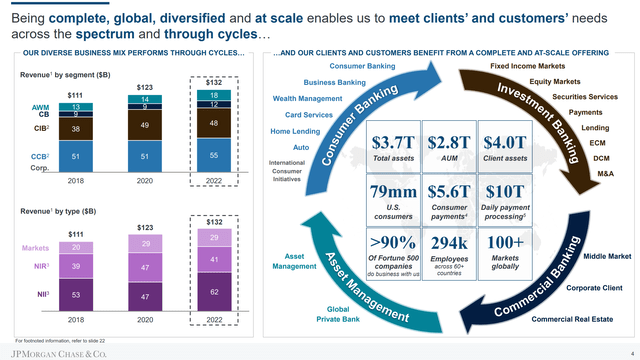

JP Morgan’s investor day showcased the strength of the bank’s ‘universal banking model’, which stands out in a quite fragmented US financial services industry. JPM boasts leading client and customer-centric franchises across its divisions: In Consumer and Community Banking (CCB), the bank holds the top position in US retail deposits and credit card issuance. In Corporate and Investment Banking (CIB), the bank is the leader in investment banking fees, markets, and treasury services. In Commercial Banking (CB), JPM excels in multifamily lending and middle-market bookrunning. Additionally, the bank’s Asset and Wealth Management (AWM) division is highly regarded as the number one rated private bank with robust long-term active flows, competing at a level on par with Morgan Stanley (MS), Goldman Sachs (GS) and UBS (UBS).

JPMorgan Investor Day 2023

JPMorgan Investor Day 2023

With that frame of reference, the investor day demonstrated how JPM can effectively cross-sell across various business segments to maximize the franchise’s potential, highlighting areas of opportunities for further growth despite having a strong market share already (or perhaps because of it).

- In CCB, JPM is pushing to build wealth management advisory, expanding their branch network, hiring professionals, and launching new offerings like “Freedom Rise”. Moreover, the bank is targeting a projected $2 billion in connected commerce revenues by 2025, while enhancing tech-supported business banking services.

- In CIB, JPM is confident to further increase multi-product penetration and expand relationships with financial sponsors, private capital, and international markets. They are also positioning themselves for opportunities in the carbon transition space.

- In CB, JPM will leverage the bank’s intangible assets to attract deposits, and to serve consumers as a first-of-choice name for credit and financing.

JPMorgan Investor Day 2023

FRC Deal Projected To Be NII Accreditive

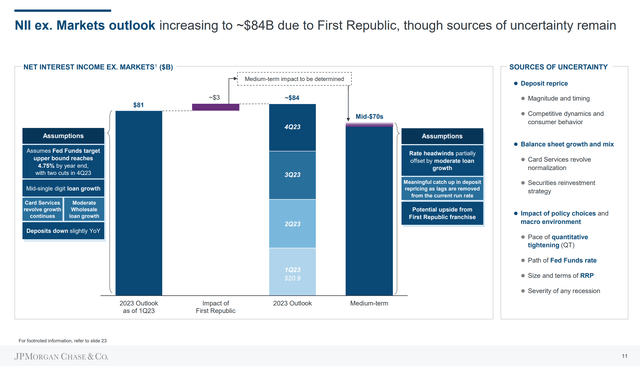

Following the acquisition of First Republic Bank, JPMorgan raised the bank’s projected net interest income guidance for 2023. Previously, the guidance was approximately $81 billion. With the addition of FRC, an increase of approximately $3 billion is expected, resulting in the new guidance of around $84 billion. With that frame of reference, JPM’s guidance anchors on a few key assumptions. First, JPM projects an upper bound of 4.75% for the Federal Funds Rate by the end of 2023, with two rate cuts expected in the fourth quarter. Second, JPM anticipates mid-single digit loan growth, continued revenue growth in Card Services, moderate growth in wholesale loans, and a slight decrease in deposits compared to the previous year. In my opinion, these assumptions are quite reasonable.

JPMorgan Investor Day 2023

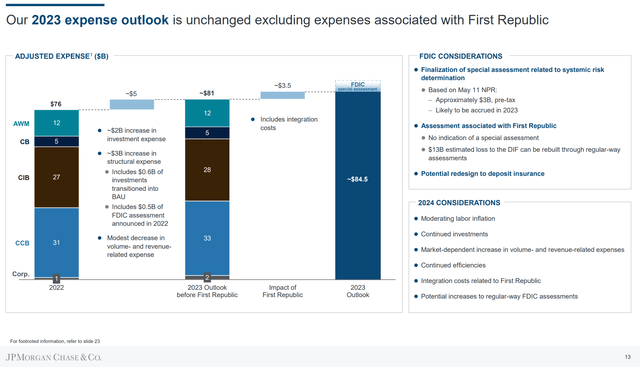

Regarding the expense outlook, JPM pointed out a $3.5 billion cost headwind relating to FRC integration expenses, bringing 2023E costs to about $84.5 billion. Ex-FRC, however, the expense estimates remained unchanged.

JPMorgan Investor Day 2023

A Fair Assessment Of Challenges

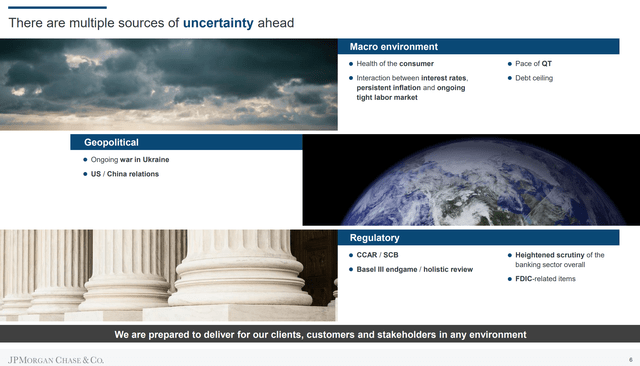

Not everything was painted rosy — JPM also provided a fair assessment of challenges: In addition to multiple sources of uncertainty, such as QT, interest rate hikes/ cuts, post SVB banking turmoil, macro headwinds and US-China relationship strains, I would like to point out more specific commentary relating to investment banking and credit.

JPMorgan Investor Day 2023

Investment Banking

In investment banking, JP Morgan management expects a decrease of approximately 4% YoY in the industry’s markets wallet for fiscal year 2023. Notably, the industry has already declined from about $133 billion in 2021 to $78 billion in 2022. Going forward, it is anticipated that the IB market size will stabilize somewhere between $80 billion and $90 billion, indicating a level in line with 2019/ 2020.

While the second quarter is still ongoing, management suggested that both markets and IB revenues for the Q2 period could decline by approximately 15% YoY -. anchored entirely on a challenging market environment, not on idiosyncratic challenges relating to the JPM IB franchise.

Credit

JPMorgan pointed out that credit trends are normalizing, indicating that the brightest ‘red flags’ are currently seen in real estate, particularly certain office and construction projects. The bank’s balance sheet, however, is well capitalized to absorb any potential losses. As of late May, JPMorgan’s balance sheet has a Total Loss-Absorbing Capacity (TLAC) of approximately $488 billion, which would cover the entire losses and write-downs on financial assets of $460 billion during the Global Financial Crisis.

In general, JPM management also mentioned that consumer spending trends remain solid overall, and there are no changes to JPMorgan’s 2023 estimated Consumer Card Net Charge-Off guidance of approximately 2.6%. Additionally, when it comes to other consumer loss expectations for 2023, the bank anticipates around 0.5% in auto losses, close to 0% in home lending losses, and 0.6% in business banking losses.

Final Words and Conclusion

Balancing tailwinds and headwinds, JPMorgan Chase reaffirmed its ~17% Return on Tangible Common Equity target and raised its 2023 Net Interest Income outlook, highlighting the bank’s exceptionally attractive business model.

JPMorgan Investor Day 2023

Overall, with a strong business moat and #1 positioning in key segments, JPM is well-positioned for future growth and profitability. The stock is currently trading at an attractive P/E ratio of ~10x for 2023 earnings, which I argue undervalues the bank by ~100% if an investor assumes the x20 FWD P/E of the S&P 500 as the benchmark, because in my opinion, JPM has a stronger growth outlook as well as competitive moat than the broad market.

Based on the investor day insights, I reiterate an Overweight/Buy rating on JPM stock, expecting the bank’s stock to outperform the S&P 500 in the coming years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.