Summary:

- Exxon Mobil offers ample capital appreciation upside, aided by the news that OPEC+ intends to keep a lid on global oil supplies.

- The company is on track to achieve $9.0 billion in annualized cost reductions by the end of this year.

- Exxon Mobil’s robust cash flow generation and upstream production growth upside in Guyana and the Permian Basin support its fair value estimate of ~$122 per share.

JHVEPhoto

In light of the news that the oil cartel OPEC+ intends to continue keeping a lid on global oil supplies for the foreseeable future, aided by additional voluntary reductions from Saudi Arabia, investors would be wise to consider Exxon Mobil Corporation (NYSE:XOM) as a top tier capital appreciation opportunity. The company’s upstream production base, the side of its business that extracts raw energy resources from the ground, has shown decent growth of late while its downstream operations (focused on refineries and petrochemical plants) are benefiting from recent growth initiatives and corporate consolidation efforts.

Cost Cuts and Growth

Exxon Mobil is well on its way to achieving $9.0 billion in annualized cost reductions this year versus 2019 levels. Reductions in the size of its workforce have been part of this process, alongside corporate consolidation efforts. Last year, Exxon Mobil combined its petrochemicals and downstream operations into one unit known as ExxonMobil Product Solutions.

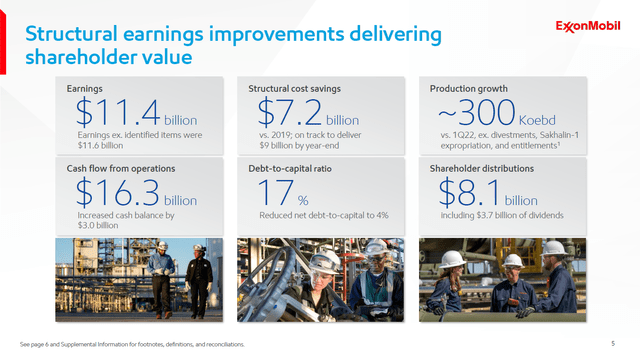

Productivity improvements are being utilized to enable Exxon Mobil to do more with less. When Exxon Mobil published its first quarter of 2023 earnings update in April, management noted that the firm had achieved $7.2 billion of its cost reduction target so far and that Exxon Mobil remained on track to achieve its remaining cost reduction goals by the end of this year.

When excluding the impact of the company exiting the Russian market, Exxon Mobil’s upstream production base has been going in the right direction of late. In the first quarter of this year, the firm pumped out 3.8 million net barrels of oil equivalent per day, up 4% year-over-year. Exxon Mobil is investing heavily in developing its position in Guyana and the Permian Basin (in West Texas and Southeastern New Mexico) to boost its crude oil production. These investments are paying off handsomely, and there is room for further upside here. Additionally, Exxon Mobil recently finished expanding its Beaumont refinery in Texas, adding roughly 250,000 barrels per day of crude throughput capacity to its operations.

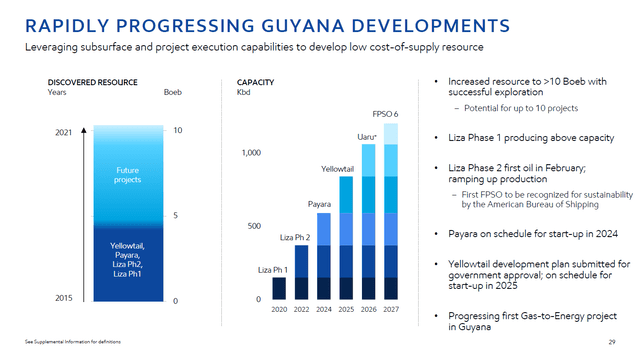

By 2027, Exxon Mobil aims to have ~1.2 million barrels of gross daily crude production capacity in Guyana, up from just under 0.4 million barrels per day currently. Developing new floating production storage and offloading (‘FPSO’) assets is how Exxon Mobil intends to achieve its goals in Guyana. Exxon Mobil owns a 45% stake in the offshore upstream venture developing immense crude oil resources in Guyana, making its position in the area needle-moving. The next FPSO development expected to come online is the Payara asset, with first-oil targeted by next year.

Exxon Mobil’s upstream position in Guyana represents a major growth driver for the firm over the long haul. (Exxon Mobil – 2022 Investor Day Presentation)

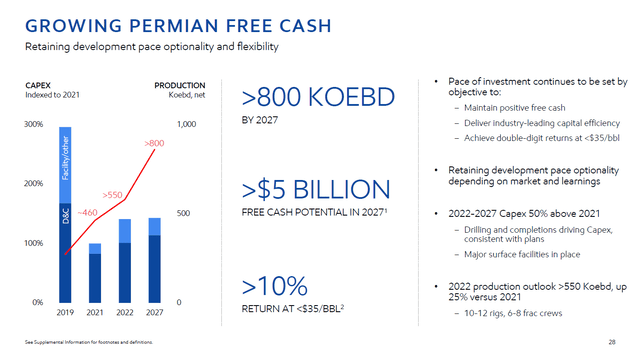

In the Permian Basin, Exxon Mobil is taking advantage of its immense scale in the region to economically grow its liquids-rich upstream production base. By 2027, the company aims to pump out over 800,000 net barrels of oil equivalent per day from its Permian Basin position, with substantial capital investments required to make that possible.

Exxon Mobil’s scale in the Permian Basin is impressive. (Exxon Mobil – 2022 Investor Day Presentation)

Equity Valuation

The value of a company’s equity is determined by its future forecasted free cash flow, defining free cash flow as net operating cash flow less capital expenditures. Additionally, a net cash position increases the fair value estimate of a company’s equity and a net debt position decreases its fair value estimate. Due to each individual investor having a different view of a company’s future financial performance, share prices fluctuate as new information rolls in, such as earnings reports or changes in raw energy resources pricing. However, over the long haul, share prices tend to converge with their fair value estimates as it becomes increasingly clear what direction the firm’s future free cash flows are going.

In the case of Exxon Mobil, the company is a cash flow generating powerhouse with an asset-heavy business model, meaning substantial capital expenditures are required on a continuous basis. Exxon Mobil’s financial performance is highly sensitive to changes in crude oil and natural gas prices. The company’s large downstream operations act as a natural hedge against declines in raw energy resources pricing in the sense that its downstream business tends to benefit from reduced cost inputs while its upstream unit benefits from elevated crude oil and natural gas prices. Keeping that in mind, Exxon Mobil’s financial performance is significantly stronger during periods of elevated raw energy resources pricing for obvious reasons.

From 2020 to 2022, Exxon Mobil generated ~$30.6 billion in annual free cash flow on average, and that includes a period when raw energy resources pricing was subdued (in 2020 due to the COVID-19 pandemic) and a period when raw energy resources pricing was elevated (in 2022 due to the Russian invasion of Ukraine). I’m going to use that average annual free cash flow figure to obtain a fair value estimate for Exxon Mobil’s common equity through the enterprise cash flow analysis process.

Using the $30.6 billion figure as Exxon Mobil’s “normalized” annual free cash flow, I’m going to divide that figure by 0.06 (a 10% discount rate less the assumption that the company’s free cash flow will grow by 4% into perpetuity). A combination of the global population and economic growth, ongoing cost-cutting efforts at Exxon Mobil, and the company’s robust capital investment program justifies the 4% perpetual growth rate I’m using in this scenario in my opinion.

Dividing $30.6 billion by 0.06 gets you $510.0 billion. Now I need to factor in Exxon Mobil’s net debt load. At the end of March 2023, the firm had an $8.8 billion net debt load on the books (inclusive of short-term debt, exclusive of restricted cash), which I subtract from the $510.0 billion figure to arrive at a total $501.2 billion equity value for Exxon Mobil. During the first quarter of 2023, Exxon Mobil had a weighted average diluted share count of 4.1 million. Now I divide the $501.2 billion figure by 4.1 million to get a fair value estimate of ~$122 per share of Exxon Mobil, comfortably above where shares of XOM are trading as of this writing ($105-$106 per share).

This process is far from perfect, and fair value estimates can vary wildly alongside changes in the assumptions used within the enterprise cash flow (or discounted free cash flow) analysis process. However, obtaining a rough fair value estimate is incredibly useful when determining whether a company is undervalued, fairly valued, or overvalued.

Exxon Mobil’s operational and financial performance has been trending in the right direction in recent quarters. (Exxon Mobil – First Quarter of 2023 IR Earnings Presentation)

Downside Risks

Investors should be aware that there are material downside risks when it comes to Exxon Mobil. As the company remains highly levered to changes in volatile raw energy resources pricing, a sharp and sustained downturn in crude oil prices can have an incredibly detrimental impact on Exxon Mobil’s financial position. The company has an asset-heavy business model and material capital expenditure requirements, which can become difficult to manage should its net operating cash flows dwindle. Additionally, Exxon Mobil has a moderate net debt position to be aware of, as that limits its financial flexibility during difficult times.

With these downside risks in mind, ongoing cost structure improvements, asset base growth, and its ample cash on hand ($32.7 billion at the end of March 2023) should enable Exxon Mobil to stay on top of its various financial obligations going forward. Furthermore, while Exxon Mobil’s dividend obligations are material as its run-rate payout obligations stood at $15.2 billion at the end of 2022 (including cash dividend to common shareholders and cash dividends to noncontrolling interests), its “normalized” free cash flow of $30.6 billion easily covers those payouts. In 2022, Exxon Mobil generated $58.4 billion in free cash flow. Beyond returning cash to investors via dividends, Exxon Mobil has also been repurchasing sizable amounts of its stock, including $4.3 billion last quarter.

Concluding Thoughts

Exxon Mobil is a stellar enterprise that’s delivering on its growth ambitions and cost reduction efforts. The company should remain a cash flow generating powerhouse in the current raw energy resource pricing environment, and as such, investors would be wise to consider gaining exposure to Exxon Mobil’s ample capital appreciation upside. Shares of XOM yield a nice ~3.4% as of this writing, and its dividend growth upside complements its ample capital appreciation potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.