Summary:

- Comcast’s core business is in decline, with subscriber growth falling in many leading segments and the company resorting to discounted pricing and promotions to compete.

- The company’s net margins are at a ten-year low, and analysts predict only low-single-digit revenue growth over the next several years.

- Despite attempts to offset slowing revenue growth with aggressive share buybacks, Comcast’s management has no plan to fix the struggling core broadband and cable businesses.

Justin Sullivan

Warren Buffett once famously said that there weren’t any horse carriage companies who successfully made the transition to automobile corporations. Change is inevitable, but sometimes there are structural transformations put companies in very tough spots.

One leading company that operates in a number of industries going through significant change right now is Comcast (NASDAQ:CMCSA). Comcast is a $163 billion dollar media and technology company that functions through Residential Connectivity and Platforms, Business Services connectivity, media, studios, and the operation of theme parks.

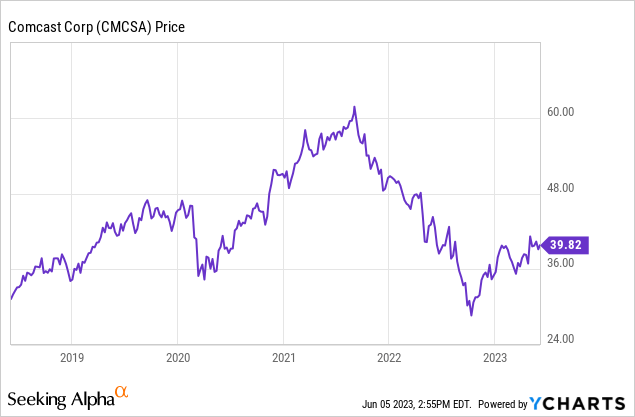

Comcast’s stock has gone nowhere for three years. The company’s total returns since the middle of 2020 are 1.23%, while the S&P 500 (SPY) has risen 45.40% during this same time period.

Today I rate Comcast a sell. The company’s core business is in decline with subscriber growth falling in many of the cable provider’s leading segments. Comcast is also being forced to use discounted pricing and offer significant promotions to compete in industries such as the cable market. The company’s net margins are also at historic lows, the stock looks overvalued at the current multiple this industry leader trades at.

Comcast recently reported for the first quarter that the company has just over 32.1 million broadband customers and nearly 15.53 million video customers in 2022. The company also had nearly 9 million voice customers and nearly 5.66 million wireless lines. Comcast also owns Sky Europe and operates three theme parks that are in China, Japan, and California. The company got nearly 19% of revenues from Sky Europe in 2022. Comcast’s revenues from the theme parks made up 29% of the company’s earnings in 2022.

The most important metric for gauging Comcast’s business is subscriber growth. Comcast can’t rely on price increases in most of the very competitive industries the company operates in, the cable operator has to be able to add new customers without comprising margins through promotions to drive earnings growth. Comcast’s last two earnings reports make clear that the company is still both losing subscribers in key segments of the corporation’s business and also that management is still using heavy discounts in other areas to add new customers and offset market share losses.

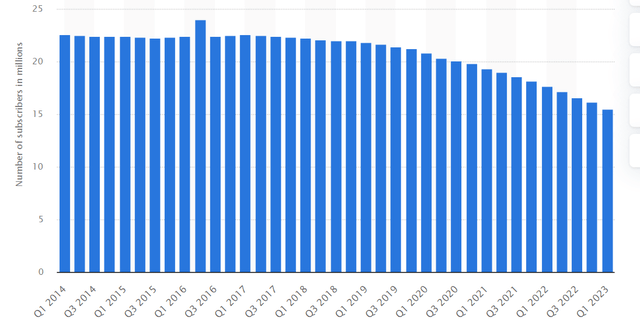

Comcast also recently reported in the first quarter of this year that the company lost 561,000 video subscribers in the past quarter alone, and this continues the long trend of sequential decline in the cable provider’s subscriber numbers. Even though the company’s new paid streaming network, Peacock, saw a 60% increase in customers, adding 2 million new customers to get to 22 million, this new service also lost $7 million a day in the first quarter of 2023 alone. Peacock’s losses are expected to be nearly $3 billion for the full year. Many people are increasingly finding ways to stream for fee, and most people also don’t watch more than a couple cable channels, so these individuals are often switching to new stream services such as YouTube TV and Hulu.

A chart of Comcast’s cable subscribers (Statista)

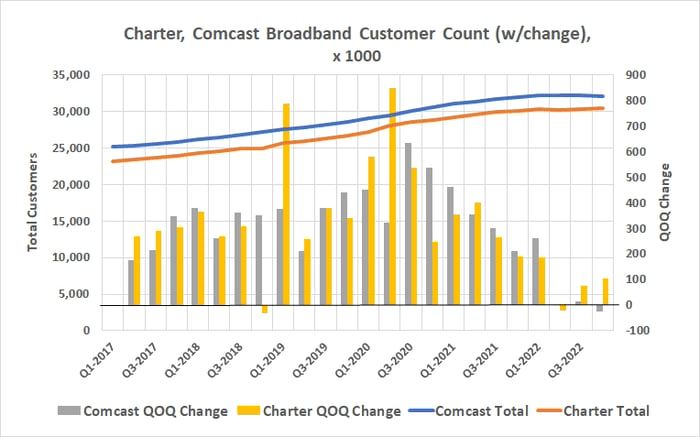

Comcast also added only 3,000 new broad brand customers in the first quarter of this year. While this number beat analyst expectations for a loss of 27,000, the company is still seeing a continued trend of slower subscriber growth in this core segment. Comcast added 300,000 new broad band subscribers in the third quarter of 2021 alone just 2 years ago.

A chart of Comcast’s broad band subscribers (Nasdaq)

Comcast has been seeing increasingly slower subscriber growth in the company’s core broad band segment since the end of 2020 as well. Even though management saw a minor increase in average revenue per broad band user of 4.5%, this division is struggling.

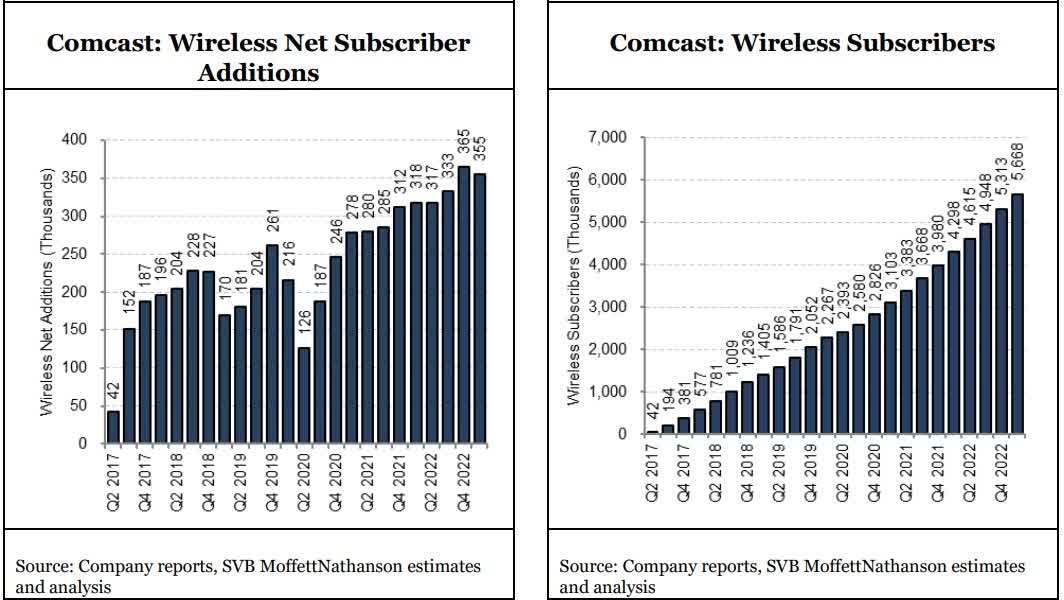

The only part of Comcast’s core business that continues to see solid subscriber growth is in the wireless and mobile division. The company reported an increase of 355,000 new lines in the first quarter, which helped Comcast grow revenues in this segment by 26.7% to $858 million in early 2023.

A chart of Comcast’s wireless customer subscriber growth (SVB MoffettNathanson estimates and analysis)

Still, even in the much smaller mobile division, Comcast’s subscriber growth rates appear to be flatlining, with the fourth quarter of 2022 seeing increases that were lower than the third quarter of last year.

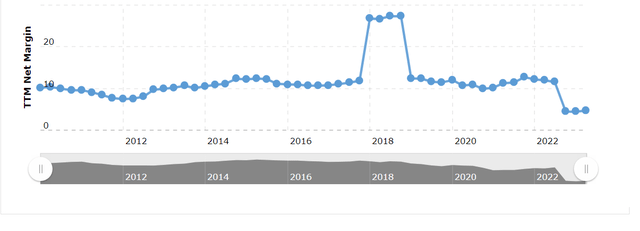

This is why Comcast’s falling margins should concern investors. Management is being forced to discount heavily and use promotions in the company’s core broad band and cable divisions to offset customers leaving and slower subscriber growth. The company’s margins are currently at a ten-year low.

A chart of Comcast’s Net Margin (Statista)

Comcast’s reported first quarter net margin of 4.71% is nearly the lowest this cable operator has seen in over a decade, and this negative trend shows how the company is being forced to use significant discounts to drive subscriber growth and stop customers from leaving areas such as the cable business.

Comcast also looks overvalued using several metrics. Even though Comcast currently trades at 11.46x likely forward earnings, analysts are projecting the company to grow revenues at just 1-2% per year over the next five years. The company also trades at 1.4x forecasted forward sales and 1.99x trailing book value. The sector average is 1.15x projected forward sales, and 1.58x trailing book value. The company is increasingly relying on share buybacks that are often being financed with debt to grow earnings per share, since management isn’t able to drive meaningful organic revenue growth.

Comcast announced an increased share buyback of $20 billion in September of 2022, and the company is on pace to purchase $14 billion in shares in 2023 alone. The company has taken on nearly $100 billion in mostly long-term debt in part to finance these aggressive buybacks. While most of Comcast’s bonds are trading low interest rates since the company has over $250 billion in equity, these buybacks are likely being done in significant part because the company is not able consistently drive consistent earnings growth. Interest rates also are likely to continue to remain at higher levels moving forward, with inflation levels still running while above the Fed’s stated 2% goal. The cost to finance future buybacks should be more expensive moving forward.

Comcast had operated for a long-time across fairly non-competitive industries, but the cable industry is being forced to compete with a number of online stream services now, and the company’s core broad band business is also seeing increasingly slow subscriber growth as well. Comcast’s stock has stagnated since the core broad band division began to see significantly slower growth starting in late 2020. While Comcast is trying to offset the company’s slower revenue growth with aggressive share buybacks, management still has no plan to fix the company struggling core businesses.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.