Summary:

- Amidst a recovery in the tech sector driven by AI-hype, Affirm has been a surprise beneficiary.

- This comes even as top-line growth slows dramatically due to the tough macro environment.

- Management remains committed to achieving non-GAAP profitability on a sustainable basis.

- The stock remains buyable here, but one mustn’t ignore the rising risk from competition.

Araya Doheny

Affirm (NASDAQ:AFRM) has been an unusual beneficiary of the AI-driven rally in tech stocks. That rally has continued today as the stock is up double-digits on news that Amazon (AMZN) would be including Affirm as a payment option for Amazon Pay. The company continues to see great pressures to growth due to the deteriorating macro environment and competition is heating up in the buy now, pay later market. It is possible that the stock is trading higher alongside other highly-speculative stocks amidst an unsustainable rally. Even so, one must acknowledge the strong balance sheet and management’s commitment to driving improvements in profitability. The valuation remains buyable though investors must question if this is not an opportune time to lighten positions.

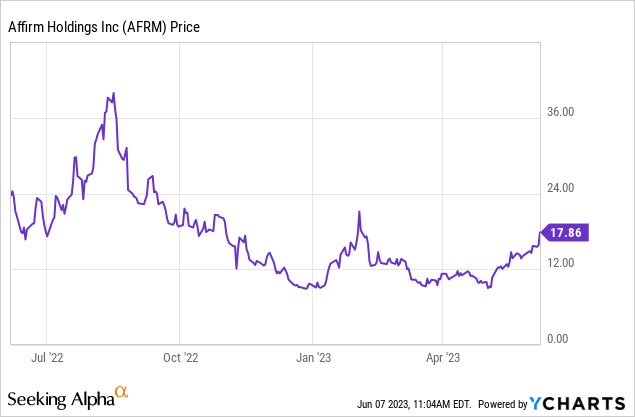

AFRM Stock Price

AFRM has been one of the strongest performers this year, but remains well off its all-time high.

I last covered AFRM in April where I highlighted elevating risks though stood by my bullish rating. The stock is higher since then but I cannot claim much credit as I am not convinced that fundamentals have been driving this latest rally.

AFRM Stock Key Metrics

In its most recent quarter, AFRM generated 18% YOY GMV growth to $4.64 billion, comfortably exceeding guidance for $4.5 billion.

FY23 Q3 Presentation

Given the higher interest rate environment, it is no surprise to see interest-bearing loans forming the vast majority of the company’s portfolio.

FY23 Q3 Presentation

AFRM has managed to sustain some GMV growth in large part due to its ongoing partnership with Amazon (AMZN) and also due to the diversification of its industry categories.

FY23 Q3 Presentation

AFRM saw strong growth in its consumer base, with active consumers growing 26% YOY. This is a promising metric given that buy now, pay later is arguably still a niche form of financing in comparison with traditional credit cards.

FY23 Q3 Presentation

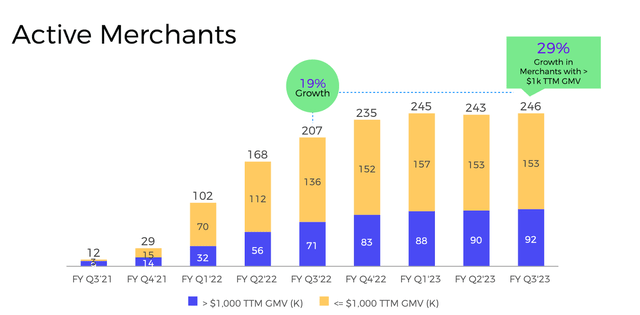

AFRM generated 19% YOY growth in active merchants, again due in large part to its Amazon partnership. It should be noted that active merchant growth has stagnated sequentially for several quarters.

FY23 Q3 Presentation

Despite these strong numbers, revenue grew by only 7% to $381 million, though that did slightly outpace guidance for $380 million.

FY23 Q3 Presentation

Revenue less transaction costs declined 6% YOY due to both higher projected losses from higher interest rates as well as lower take-rates from its partnerships with AMZN and Shopify (SHOP).

FY23 Q3 Presentation

AFRM nonetheless was able to outperform non-GAAP operating margin guidance of negative 7%, generating a negative 2% margin in the quarter.

FY23 Q3 Presentation

During a period in which many fintechs are having trouble with financing, AFRM still retains more than adequate funding capacity at $11.4 billion, which helps complement the short term duration of its loans.

FY23 Q3 Presentation

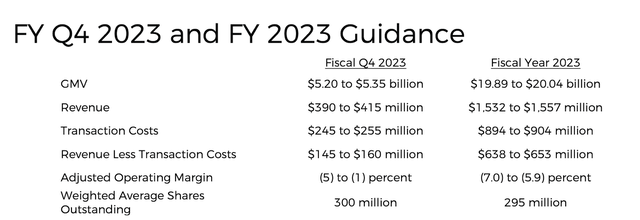

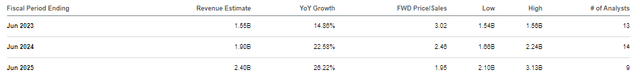

Management slightly increased full year revenue guidance to $1.557 billion (up from $1.55 billion) but materially increased its adjusted operating margin guidance from negative 7.5% to negative 5.9%.

FY23 Q3 Presentation

On the conference call, management noted that roughly half of its customers have agreed to increase the interest rate cap from 30% to 36%, which has helped increase the number of loans approved. Management has repeatedly stressed a focus on profitable underwriting, showing a willingness to sacrifice on growth if needed. AFRM has rolled out Debit+ into the main Affirm app and continues to see solid demand for the product. Management noted that transaction frequency increases by 7x as compared to regular Affirm users after 90 days from activation. Debit+ is one of the levers management hopes will reignite growth. Management also noted their partnership with FICO to enable buy now, pay later loans to factor into credit scores – though it is not immediately clear what kind of impact this will have on consumer demand.

While management did not explicitly discuss their guidance for positive adjusted operating profitability by the end of this fiscal year (the upcoming quarter is the fourth quarter) on the call, in a separate investor event management appeared to imply as much, stating that “that’s we said we’ll do, and we’ve been decent at keeping promises.” In that same call, management noted that the higher interest rate environment may have positive implications for the competitive environment, calling out Klarna and Afterpay as historically “not just pricing it below zero but literally paying merchants to use it.” I retain some doubt regarding this point given both PayPal’s (PYPL) apparent success in growing its own BNPL business as well as Apple’s (AAPL) ongoing ramp there as well.

That said, it was promising to see key partner AMZN announce that AFRM’s Adaptive Checkout would be added to Amazon Pay. Amazon Pay is a checkout button similar to that of PayPal (PYPL) or Apple Pay (AAPL) which can show up outside of the more commonly known Amazon.com marketplace. Yes, the exclusivity deal between the two has ended, allowing other BNPL operators to work with AMZN, but today’s announcement appears to be testament to AFRM’s superior technology and execution relative to peers. I note that it is unlikely for this announcement to materially move the needle in the immediate future, but as Amazon Pay continues to take market share in e-commerce and from checkout incumbents, AFRM stands to benefit long term. With growth slowing down considerably relative to prior years, multiple expansion is likely to be the main driver of forward returns, and positive sentiment can go a long way in this regard.

Is AFRM Stock A Buy, Sell, Or Hold?

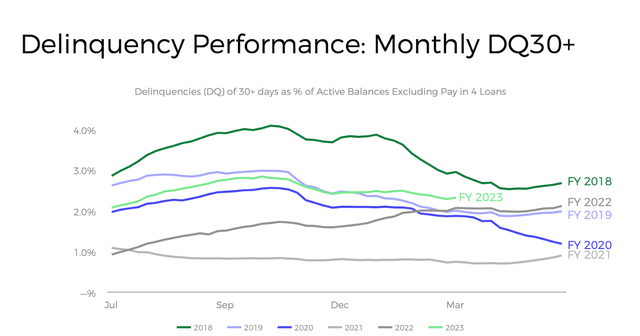

With interest rates sharply higher, investors may be concerned about elevated credit risk. Delinquencies have indeed shot up, but remain below 2018 levels.

FY23 Q3 Presentation

It remains unclear exactly how BNPL loans might perform under even tighter financial conditions, but I maintain my view that AFRM has one of the stronger credit books in the industry.

After the recent rally, AFRM was trading hands at around 3x sales and 7x gross profits.

Seeking Alpha

If one assumes a return to 20% growth, 30% long term net margins (based on gross profits) and a 1.5x price to earnings growth ratio (‘PEG ratio’), then I could see the stock trading at around 9x gross profits, implying some potential upside. But if growth accelerates to only 15% or worse, then that multiple drops to around 6.75x, implying minimal upside, and I note that the 1.5x PEG ratio assumption will likely have to be earned back at this point.

The risks are numerous. It is possible that the BNPL model only worked in the ultra-low interest rate environment. If this proves to be the case, then growth is unlikely to return unless interest rates decline. I also suspect consumers to be highly price sensitive and with so many competitors in the space, there is the risk that AFRM is unable to adequately compete. Sure, AFRM arguably has the most impressive technology but PYPL and AAPL are competitors with deep pockets and can likely better survive any price competition. At these valuations, the stock is offering arguably just modest potential upside and that is assuming a return to robust growth. Yes, the potential upside can be enormous if growth can return to the 30% level previously implied by management, but how can one get confidence that such a result is possible at this point? At the same time, this tough macro environment has forced management to rationalize its cost structure and the company may see long term gains in profit margins coming out of a tough macro. There remains the appeal of CEO Levchin being an outsized shareholder in the company, taking a modest salary while having never sold any stock in the company. It is difficult to view this company with the same “revolutionary” light it may have had during the pandemic, but the risk-reward remains OK for now so long as the balance sheet remains this strong. With today’s announced development with AMZN, one mustn’t ignore the possibility of an eventual takeover, though I am of the view that such an event is unlikely. I reiterate my buy rating for the stock, but note that my position is much smaller than in the past and this is a name which I am likely to discard if management cannot right the ship over the next couple of quarters.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFRM, PYPL, SHOP, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 10 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!