Summary:

- Eli Lilly reported an 11% decrease in worldwide revenue for Q1 2023, largely due to reduced COVID-19 antibody sales, but saw growth in newer products like Verzenio, Jardiance, and Mounjaro.

- The company continues to invest in R&D, with promising pipeline drugs such as tirzepatide, orforglipron, and mirikizumab, which could drive future revenue diversification and growth.

- Despite high valuation and recent revenue fluctuations, Eli Lilly’s strong product portfolio, robust pipeline, and solid profitability make it a ‘Hold’ recommendation for long-term growth potential.

Caíque de Abreu

Introduction

Eli Lilly and Company (NYSE:LLY), founded in 1876 and incorporated in 1901 in Indiana, stands as a premier entity in the pharmaceutical industry. This company is dedicated to inventing medicines that significantly enhance the quality of life for people globally. The majority of its currently sold products were discovered or developed by Eli Lilly’s own scientists. The company’s longevity and success heavily rely on its ability to continually innovate, acquire, develop, and bring new medicines to the market. Eli Lilly manufactures and distributes its products via facilities within the U.S and seven other countries, reaching a market of approximately 110 countries.

Eli Lilly’s product portfolio includes diabetes treatments such as Basaglar, Humalog, Humulin, Jardiance, Mounjaro, and Trulicity. Its oncology range features Alimta, Cyramza, Erbitux, Jaypirca, Retevmo, Tyvyt, and Verzenio. The immunology sector is represented by Olumiant and Taltz, while neuroscience products include Cymbalta, Emgality, and Zyprexa. Other notable products and therapies include Cialis for erectile dysfunction and benign prostatic hyperplasia, Forteo for osteoporosis, and Bebtelovimab and Bamlanivimab with Etesevimab for COVID-19.

The following article review’s Eli Lilly’s most recent financials and activities.

Q1 2023 Financials

For the quarter ending March 31, 2023, Eli Lilly and Company experienced an 11% decrease in worldwide revenue, amounting to $6.96 billion. This downturn was influenced by lower prices, decreased volume, and unfavorable exchange rates, exacerbated by a significant drop in revenue from COVID-19 antibodies. Despite these factors, the company’s revenue, discounting the COVID-19 antibody aspect, increased by 10%, with an 18% surge in volume.

Specifically, in the U.S., Eli Lilly saw a 14% decline in revenue, attributed to reduced volume and prices. Nonetheless, a 19% revenue increase was achieved when the impact of COVID-19 antibodies was excluded. Internationally, the company faced a 4% revenue dip primarily due to unfavorable exchange rates and lower prices, although volume improved by 7%.

Eli Lilly’s gross margin contracted by 7% to $5.33 billion or 76.6% of revenue. There was a 23% growth in research and development expenses, and a 12% rise in marketing, selling, and administrative costs. The company recognized $105 million in in-process R&D charges during Q1 2023 and had an other income of $35.7 million. The effective tax rate rose to 12.1% from 7.3% in Q1 2022, while net income reached $1.34 billion, translating to an earnings per share [EPS] of $1.49.

Several products showed revenue fluctuations. Trulicity’s revenue expanded by 14%, while Verzenio and Jardiance registered growth rates of 60% and 38% respectively. Mounjaro, a new product for type 2 diabetes, delivered a robust $568.5 million in revenue. Conversely, Humalog and Alimta experienced decreases of 25% and 83% respectively. Notably, revenue from COVID-19 antibodies, which was significant at $1,469.8 million in Q1 2022, plummeted to zero in Q1 2023.

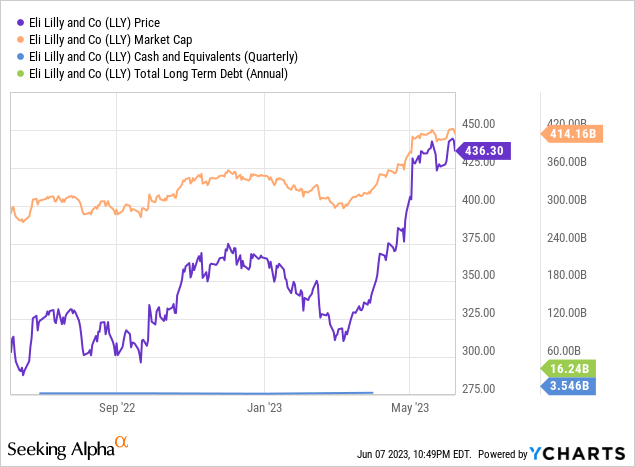

Per Seeking Alpha, LLY stock currently holds a high valuation, with a non-GAAP forward P/E ratio of 51 and a GAAP P/E ratio of 70.45. Its growth is steady, yet subdued, with a 3-year revenue CAGR of 6.25% despite a YoY decline. Profitability remains strong with an impressive gross profit margin of 77.67% and an ROE of 54.79%. These metrics reflect a well-performing stock, but also suggest that it might be overvalued. Indeed, it has been highlighted that Eli Lilly recently surpassed Johnson & Johnson (JNJ) in terms of market capitalization, establishing itself as the leading global pharmaceutical company in terms of value. The negative YoY growth in revenue and EPS indicates some potential concerns, but a strong profitability profile offers reassurance for investors.

Q1 2023 Earnings Call Review

Eli Lilly management expressed enthusiasm about positive results from the SURMOUNT-2 Phase III study for tirzepatide, a promising treatment for obesity and type 2 diabetes. The study achieved significant weight loss outcomes and met all primary and key secondary endpoints. With two successful Phase III trials now completed, they anticipate submitting the findings to the FDA soon.

The SURMOUNT program consists of eight studies with over 5,000 participants, assessing the efficacy and safety of tirzepatide for various populations and conditions. While results are promising, there are differences in weight loss effects between type 2 diabetes and non-diabetes patients, likely due to multiple factors, including the use of weight gain-promoting medications in type 2 diabetes treatment.

Management also discussed several other developments. Orforglipron, an oral GLP-1 non-peptide agonist, has moved into the first Phase III clinical trial. Meanwhile, the IL-23 P19 inhibitor mirikizumab got approval in Japan and a positive opinion from the EMA for ulcerative colitis treatment. However, in the US, it received a Complete Response Letter from the FDA regarding certain manufacturing aspects.

In neuroscience, the company announced that solanezumab, an Alzheimer’s disease drug, failed to meet its primary and secondary endpoints in the A4 study. In contrast, they remain optimistic about other Alzheimer’s drugs like duninimab and rimternatug, which specifically target and clear amyloid plaque. Management expressed eagerness to obtain the results from the upcoming TRAILBLAZER-ALZ 2 trial for donanemab.

Eli Lilly Forms Strategic Partnership with XtalPi

Eli Lilly has entered into a strategic alliance with XtalPi, a China-based tech firm renowned for its AI-driven pharmaceutical solutions. This partnership could yield XtalPi up to $250 million in payments, subject to specific objectives being met. The purpose of this collaboration is to capitalize on XtalPi’s expertise in AI and robotics for the discovery of new drug candidates, with the targeted area of this research still being kept under wraps. XtalPi’s unique platform, ID4Inno, effectively merges artificial intelligence with autonomous labs and specialized knowledge. It’s designed to create and examine a vast chemical space tied to a particular target, enabling swift zeroing in on promising leads.

This partnership is a testament to the pivotal role AI and robotics are starting to play in the drug discovery sector of the pharmaceutical industry. With the potential to expedite the process of identifying viable drug candidates, this new approach could lead to significant cost and time efficiencies. This liaison between Eli Lilly’s pharmaceutical experience and XtalPi’s technological prowess may pave the way for ground-breaking medicines. The undisclosed nature of the target area for this research might indicate a strategic focus on competitive or novel therapies. The substantial payments to XtalPi also hint at a strong belief in the potential of their technology. This move can be seen as a pointer towards a future where advanced technologies like AI play a defining role in the pharma industry.

My Analysis & Recommendation

In conclusion, while Eli Lilly has faced an apparent downturn in revenues, largely driven by a reduction in revenue from COVID-19 antibodies, the outlook for the company is promising when viewed from a long-term perspective. The temporary COVID-related headwinds have impacted the recent revenue figures but should be seen as an exception rather than a trend, as the company continues to diversify its product portfolio beyond pandemic-related offerings.

Eli Lilly’s strategic strength is demonstrated by robust sales growth for its newer products, namely Verzenio, Jardiance, and Mounjaro, which could become significant growth drivers moving forward. Despite the short-term contraction in margins, the company continues to invest heavily in R&D, demonstrating a firm commitment to innovative solutions and long-term growth.

Eli Lilly’s current challenges, including the underperformance of certain key products like Humalog and Alimta, are not unusual in the pharma industry, especially considering the patent cliff and the rise of generics. However, its robust pipeline of novel drugs, such as tirzepatide, orforglipron, and mirikizumab, along with strategic partnerships like the one with XtalPi, offer the potential for future revenue diversification and growth. These factors contribute to Eli Lilly’s resilience and strategic advantage.

Investors’ confidence is reflected in the company’s high P/E ratios, although these valuations also point to potential overpricing risks if the expected near-term earnings growth fails to materialize. Despite this, Eli Lilly’s strong gross profit margin and ROE testify to its sustained profitability and robust financial health.

Eli Lilly’s adaptability to dynamic market conditions, its consistent focus on R&D, and its extensive global presence all serve as key differentiators. However, considering the high valuation coupled with recent revenue fluctuations largely influenced by the cyclic nature of the pandemic, investors might want to adopt a cautious stance in the short term.

With this perspective, the recommendation for Eli Lilly’s stock would be to ‘Hold.’ Despite the recent decline in revenue, largely due to pandemic cyclicality, Eli Lilly’s solid product portfolio, robust pipeline, and strong profitability should provide a platform for long-term growth. While the high valuation warrants careful monitoring, this should not overshadow the company’s potential for future growth, provided that investors remain mindful of the changing landscape of healthcare and the company’s ongoing developments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content only and should not be construed as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. Any predictions made in this article regarding clinical, regulatory, and market outcomes are the author's opinions and are based on probabilities, not certainties. While the information provided aims to be factual, errors may occur, and readers should verify the information for themselves. Investing in biotech is highly volatile, risky, and speculative, so readers should conduct their own research and consider their financial situation before making any investment decisions. The author cannot be held responsible for any financial losses resulting from reliance on the information presented in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.