Summary:

- AT&T shares have declined significantly, but the company remains undervalued and could be a long-term value play.

- Amazon entering the communications space would be devastating for competitors, but it is unlikely to happen without acquiring a major player.

- AT&T’s Q1 results were disappointing, but the company is confident in generating over $16 billion in free cash flow for 2023.

jetcityimage

It is hard being an AT&T (NYSE:T) shareholder. No matter what AT&T does, it’s never enough. Over the past decade, shares have declined -42.36%, and if that isn’t enough, shareholders have seen Warner Bros. Discovery (WBD) shares drop -55.32% since the spinoff. The latest shoe to drop was the report that Amazon (AMZN) was considering offering mobile service to its Prime customers. AMZN is the last company shareholders of T should want to collide with as they outspend the competition and have a loyal Prime membership base that isn’t leaving. While I feel AMZN entering the communications space would be a disaster for every competitor in the communications space, I think it is unlikely they will embark on that endeavor. The market wasn’t happy with the results from Q1 2023, but if you believe management projections, AT&T looks extremely undervalued. It’s hard to stay bullish, and I am aware that AT&T has been a massive value trap. I am negative on my investment, and I am sure many other shareholders are also. I actually feel dollar cost averaging under $16 is a long-term gift, and if you have time on your side, AT&T may be worth hanging on to.

Why Amazon entering the communications space would be a nightmare for communication companies

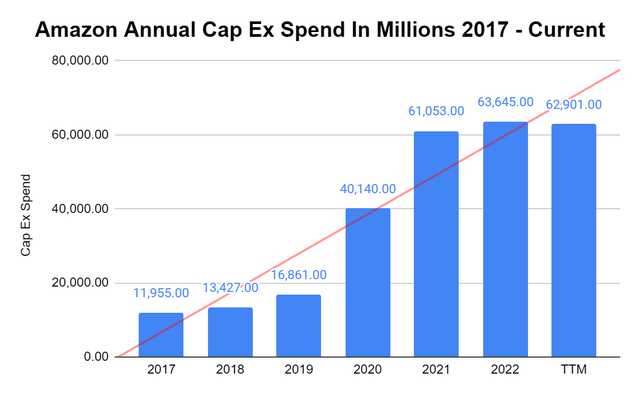

AMZN is willing to spend as much as it takes to win. If AMZN decides to enter the communication space I believe it will be devastating for the current communications companies. In 2020, AMZN’s capital expenditure (CapEx) spending increased from $16.86 billion to $40.14 billion. Then in 2021, the CapEx spend increased to $61.05 billion, and in 2022 AMZN allocated $63.65 billion toward CapEx. This is important because CapEx is the pool of money that a company allocates toward acquiring, upgrading, and maintaining physical assets, which can include property, plants, buildings, technology, or equipment.

Steven Fiorillo, Seeking Alpha

Look at what happened in the retail space. AMZN realized that the consumer was valuing efficiency and how quickly they received products more and more. By building a best-in-class logistical network, AMZN was able to dominate the e-commerce space, and offer same-day delivery in some major cities, while offering next-day shipping to many areas for Prime members. This happened by AMZN outspending its competitors and building the most in-depth logistical network.

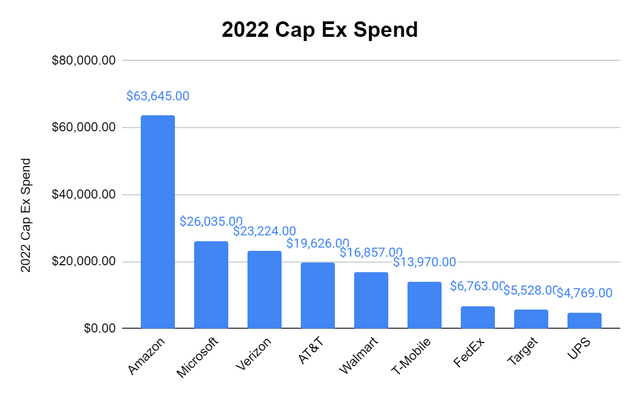

In addition to taking on Microsoft (MSFT) in the cloud space, AMZN decided to control its own destiny and not depend on FedEx (FDX) or United Parcel Service (UPS) for shipping its products when competing in the consumer goods space against Walmart (WMT) and Target (TGT). In 2022 the combination of MSFT, WMT, TGT, FDX, and UPS CapEx was $59.95 billion, and AMZN outspent these 5 entities by $3.69 billion. While AMZN went head-to-head with MSFT, it also went head-to-head with the incumbents in shipping and made Prime the go-to method for many Americans.

Steven Fiorillo, Seeking Alpha

Now the question becomes, if AMZN does enter the communications space, will they spend to win? I think the answer would be yes, but that’s an opinion. In 2022, Verizon (VZ) allocated $23.22 billion toward CapEx, while AT&T spent $19.63 billion, and T-Mobile (TMUS) spent $13.97 billion on CapEx. This is speculation, but after 3 years (2020 – 2022) of AMZN allocating $164.84 billion toward its CapEx, what if it can spend less on maintaining the logistical network as it’s already built? What if AMZN is in a position to cut CapEx by $15-$20 billion and decide instead of saving that capital and increasing its free cash flow [FCF], they are going to enter into the communication space and allocate $15-$20 billion toward building out a communication network? I don’t know what AMZN is going to do, but history shows that AMZN is willing to spend to win, and if they are in a position to keep CapEx at the 2022 levels and reallocate to new projects, they could become a strong competitor in the communication space quickly.

Luckily, there is no hard evidence that AMZN is going to enter the communications space. Right now, AMZN is stating that there are no current plans in place to enter the communications space, and Maggie Sivon, who is a spokesperson for AMZN, said that AMZN does not have plans to add wireless services to Prime currently. TMUS also came out and said that they are not in discussions about including its wireless services into a Prime package, and TMUS is already a Prime partner.

My opinion on whether or not Amazon will enter the communication space

Prior to giving my current opinion, I want to say that I am a shareholder of AMZN, VZ, and AT&T. As of now, I don’t believe AMZN will enter the communication space. I don’t think the upside is there unless AMZN is willing to go all the way. I don’t think a partnership deal makes sense, and it would just be too messy for AMZN to incorporate wireless in its prime package. This would also cannibalize whoever is their direct partner, as it would most likely have a negative impact on the consumer count for the major players.

The only way I see this working is if AMZN was to buy one of the big 3, and AT&T would make the most sense. AT&T has a market cap of $108.74 billion ad an enterprise value of $284.39 billion. By acquiring AT&T and consolidating its debt on AMZN’s balance sheet, they gain an instant 5G network, a large customer base, and $16+ billion of annual FCF. This would allow AMZN to keep packages for non-prime members while creating a Prime package that included wireless for its Prime members. This also would give AMZN a business wireline business that they could include in the AWS offerings. When I think about the verticals, it is actually interesting, but I don’t think the FTC or the Federal Government would allow AMZN to acquire AT&T, TMUS, or VZ.

Ultimately I don’t think it would be a good use of AMZN’s capital or time to enter the communications market, unless they were to buy one of the big three communications companies. I don’t think we will see Prime Wireless, and these reports are just speculation and rumors. I could be wrong, and AMZN may be denying it for now while they work out the details. For now, I am not worried, and while it is possible, I don’t think this is a probable endeavor for AMZN.

Q1 wasn’t what the market wanted, but I am still very bullish on the future

On 4/19/23, shares of AT&T closed at $19.70. Once Q1 earnings were released, AT&T sold off and closed at $17.65 on 4/20/23. Since then, shares continued to decline, closing at $15.67 on 6/6/23. Since 4/19, shares have fallen -20.46%, and they are rapidly approaching the 2022 lows of $14.46. AT&T spooked the market as revenue missed estimates by -$80 million, subscriber growth slowed, and FCF came in at $1 billion, significantly lower than the analyst estimates of $2.6 billion.

I believe that there are many investors who would disagree with me, but I see AT&T as a value play, not a value trap. Just because AT&T hasn’t been able to shake the negative stigma, and it has declined by -42.36% over the past decade, doesn’t mean that it will remain in the doghouse. AT&T was able to add 424,000 postpaid phone adds, which is now 11 consecutive quarters of adding at least 400,000 net adds. AT&T also added 272,000 Fiber net adds, and this was the 13th consecutive quarter of adding at least 200,000 net fiber adds. AT&T is far from a dead company as it generated $30.1 billion in revenue for Q1 2023 and is on track to achieve $6+ billion of run-rate cost savings before 2024.

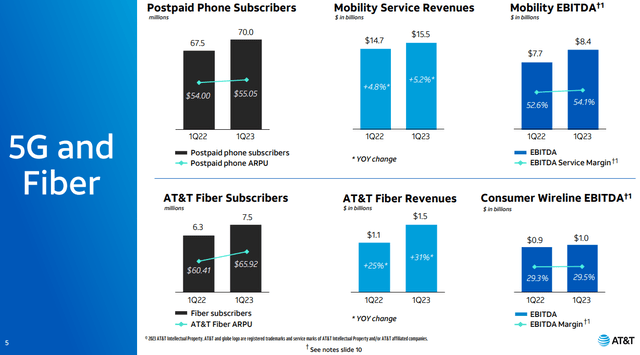

When looking at AT&T’s Q1 2023 metrics on a YoY it’s a mixed bag. AT&T added 2.5 (3.7%) million postpaid phone subscribers YoY. This made its revenue from mobility increase by 5.44% ($800 million) YoY and its EBITDA from mobility increase by 9.09% ($700 million) YoY. On the fiber side, AT&T added 1.2 million subscribers (19.05%) YoY and increased fiber revenue by 36.36% ($400 million) and EBITDA from fiber by 11.11% ($100 million). Overall revenue YoY increased by 1.35% ($400 million), while its adjusted EPS declined -4.76% to $0.60, and its cash generated from operations declined -11.84% (-$900 million) YoY.

The elephant in the room was that AT&T generated $1 billion in FCF rather than the $2.6 billion analysts were looking for. This was addressed on the earnings call, and it still amazes me how quickly people react and that the market doesn’t actually trust that management can deliver. Pascal Desroches (AT&T CFO) specifically addressed AT&T’s FCF and stated that the company is confident in its full-year outlook of generating in excess of $16 billion FCF for 2023. Capital investments were $6.4 billion in the quarter, and AT&T had anticipated that Q1’s FCF would be low due to seasonal and anticipated working capital impacts. The impacts on FCF came from the timing of capital investments, device payments, and incentive compensation, which all peaked in Q1.

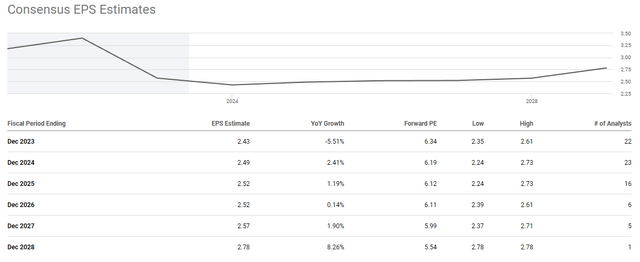

If AT&T does generate $16 billion in FCF, as they are indicating for 2023, it would put their forward price to FCF ratio at 6.79x, which is low. There are 22 analysts who have AT&T’s EPS for 2023 pegged at $2.43, which puts its forward P/E ratio at 6.45. For 2024, there are 23 analysts that have AT&T generating $2.49 in EPS, which puts their 2024 forward P/E at 6.29x, and in 2025 there are 16 analysts that have AT&T generating $2.52 in EPS, putting their forward 2025 P/E at 6.22x.

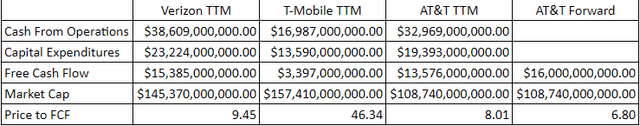

From a valuation standpoint, AT&T is very cheap. Yes, it’s been a value trap over the years, but these are real dollars, and AT&T generates tens of billions in FCF annually. Today, based on the TTM numbers, AT&T trades at 8.01x its TTM FCF, compared to 9.45x for VZ, and 46.34x for TMUS. TMUS generates half the cash from operations, yet its FCF multiple is 4.9x larger than VZ’s and 5.79x larger than AT&T’s. If I look at AT&T from a forward perspective, based on the $16 billion of FCF that management says will be delivered, AT&T trades at a forward price to FCF multiple of 6.8x. From the TTM to the 2023 annualized FCF, AT&T is projecting there will be 17.86% of FCF growth as they add $2.42 billion in FCF over the next nine months. I don’t know how long it will take, but the valuation is too low, and at some point, AT&T’s share price should be vindicated.

Steven Fiorillo, Seeking Alpha

Conclusion

It’s very tough to be a shareholder of AT&T as it just goes down, even WBD just goes down. I think the reaction to the Q1 numbers and the possibility of AMZN entering the communication space are both overdone. AT&T trades at a rock bottom valuation at just 8.01x its current FCF, 6.8x its 2023 projected FCF, and a forward P/E of 6.45 its 2023 EPS. AMZN denies entering the communication space, and the move strategically doesn’t make much sense unless they acquire one of the big three companies, which is unlikely to occur. AT&T’s dividend yield has crossed the 7% level, and now is probably a good time to dollar cost average. I believe that eventually, shares of AT&T will exceed $20.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.