Summary:

- Bank of America has delivered exceptional results over the last decade.

- BAC stock has been caught up in the banking malaise and has lost almost 50% from the peak.

- We tell you how you can make the case for investing in the stock and why it is still irrational.

tupungato/iStock Editorial via Getty Images

If you love value based equities, it is hard not to love the banking sector. The sector has been creamed in 2023 and nowhere else we see this valuation gap more than in Bank of America Corporation (NYSE:BAC). The stock has given up all its gains from the post COVID-19 melt up and is now trading at levels it first saw in late 2017.

When we last covered it, we took the sidelines approach as we expected all stocks to get cheaper.

BAC is unequivocally cheap but markets rarely follow logic when chaos strikes. We think the Federal Reserve hikes from 2022 are still working through the system and all stocks will become cheaper in 2023.

Source: Busted Preferreds Stand Out For Their Yield

Today we want to take a look at the Q1-2023 results and tell you why you can hold your nose and buy with a decade long outlook, and also why it is actually irrational to invest here.

Q1-2023

There was not much that you could find wrong with the Q1-2023 results. GAAP EPS delivered a very solid beat of 11 cents and the bank surprised on the upside with revenues as well. If we had to nitpick here, it would be the increase in non-interest expense that investors should worry about.

Bank of America Presentation Q1-2023

That $16.2 billion was up sharply from Q4-2022 and from a year ago. Bank of America has been rapidly expanding its branches (both for itself and Merrill Lynch) and it is showing up in the cost structure. So far it has not dented the net income but it will likely hurt down the line. On the other hand, capital keeps fleeing into the bank as checking accounts keep increasing. Well it appears that way based on the slide below at least.

Bank of America Presentation Q1-2023

Why It Is Irrational Not To Buy

The best investment setups are characterized by solid fundamentals alongside big valuation compression. They grow and grow and the market gives them less and less credit. This causes further capitulation from long standing bulls disgusted with their decisions. That is the best point to buy. This is better than the “all the bad news is priced in”. The former setup is far lower risk while the latter often has the odd company going to zero and that spoils your return profile. On our favorite metric BAC has done just that. Price to tangible book value is now at 1.25X, fairly reasonable for ultra-large, ultra-conservative bank.

Also notable here is where this stands relative to JPMorgan Chase (JPM). We have calculated the spread in price to tangible book values for the two stocks and one thing appears rather clear. BAC is at least extremely cheap relative to JPM.

While there are quite a few other banks in the “mega-bank” category, these two are most comparable in our opinion in terms of quality of balance sheet and risk management. So this spread looks rather unwarranted.

Finally, Bank of America’s stock price relative to the S&P 500 ETF (SPY) is reaching a very strong support zone.

If you want equities, you could do worse than Bank of America.

Why You Need Everyone Else To Be Irrational To Make The Long Case

Ok, so that was the long pitch and we are really sold on it. But there is still a problem. That problem lies in the fact that for Bank of America to work in the medium term at least, you have to expect the population or at least the population banking with Bank of America, to be irrational. What do we mean by that? We mean that all three major segments of Bank of America’s deposit franchise need to be content with those stupidly low interest rates.

Bank of America Presentation Q1-2023

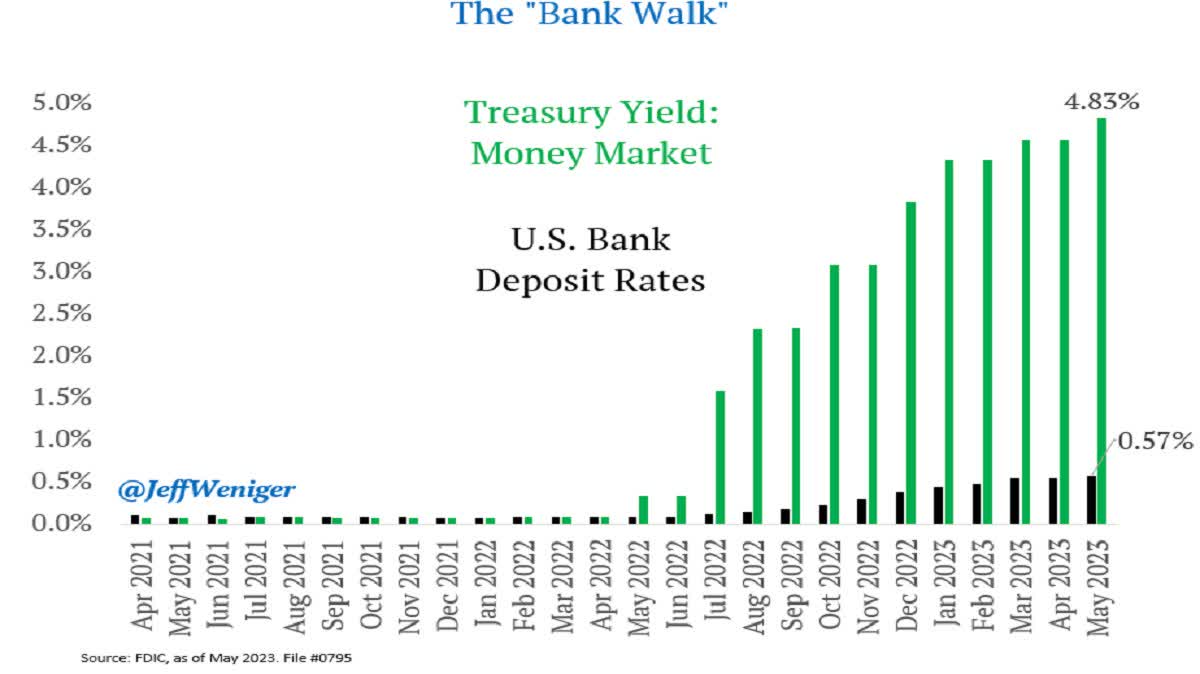

Yes, those rates are going up but they are exceptionally low relative to what risk-free Treasuries yield. Investors have access to money market funds where the liquidity is just as good and the yields are way higher averaging close to 5% today. Of course we are not remotely implying that Bank of America is unique here. Almost all banks are in the same boat and offering to next to nothing vs what the average customer can get. Jeff Weniger, who might be the first to coin the term “bank walk” (as opposed to the unmitigated disaster known as the “bank run”) had this graph at the end of May.

Jeff Weinger-Twitter

This kind of penny pinching by the banks was fine in June 2022 but we think something is going to break here if they persist with such differentials. Some banks like PacWest Bancorp (PACW) are already fighting for deposits and it won’t be long till the siren call is heard everywhere.

PacWest Bank

Bank of America has seen checking accounts increase but deposits have on the whole declined.

Bank of America Presentation Q1-2023

We would watch this carefully in the months to come.

Verdict

Bank of America is a great long term bet, we will give the bulls that. You could definitely do worse over here. But the current setup, despite attractive valuations is not risk-free. We have a massively inverted yield curve, and if it persists, banks will make less lending than paying for deposits. This is combined with banks basically tightening their books as they see the recession coming.

So if you believe the collective public will act irrationally, indefinitely, then go long and be strong. If not, wait for it or sell defensive cash secured puts to create ring fence around your capital.

Bank of America Corporation 7.25% CNV PFD L (NYSE:BAC.PL)

In our previous article, we had identified BAC.PL as a great choice for income investors. At the time it was trading at $1,131.82 and offered a generous, virtually non-callable, 6.41% yield. Interestingly enough, BAC.PL has outperformed the common shares marginally with a 5.82% total return including the dividend. We had rated it a “buy” at the previous price. While that remains a strong income option, this is not something that is likely to have a very huge price range in a normal year. At the current price, we would rate it a “hold”. None of the other preferred shares for Bank of America are attractive enough for a buy rating either.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

We may initiate a Long BAC/Short JPM trade.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.