Summary:

- META’s core advertising business will likely improve as challenges diminish, and cost savings from job cuts are anticipated.

- Meta’s investments in AI and ML are establishing a solid competitive advantage, improving content ranking, user engagement, and ad delivery efficiency.

- Generative AI presents an opportunity for Meta to become a leader in the consumer internet space, driving increased usage and engagement.

- I anticipate an extended bull market for the stock through 2024, and a target price of $350 in the next 12 months.

wildpixel

Investment Thesis

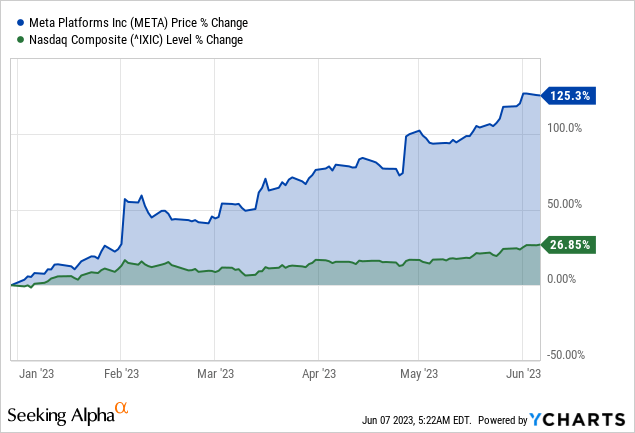

While some investors might be tempted to book profits following Meta Platforms, Inc.’s (NASDAQ:META) outperformance, I anticipate an extended bull market for the stock through 2024, and a target price of $350 in the next 12 months, reaffirming the strong buy rating. META remains the top-performing stock for the Yiazou model portfolio, sitting on a 203% gain, with no plans to sell anytime soon.

Earnings Rebound In 2023

Meta is expected to experience a strong recovery in its operating performance this year. The company’s core advertising business is likely to improve as the impact of various challenges diminishes, and cost savings resulting from significant job cuts are anticipated.

Users’ continued high engagement with Meta’s social media apps has contributed to slightly firming revenue growth in the first quarter. The company’s leadership expresses confidence in further recovery after last year’s weak performance. However, Meta’s efforts to diversify beyond advertising into metaverse-related opportunities have yet to yield positive results and dampen overall performance.

While cost-efficiency measures have affected the Reality Labs division, Meta foresees increased operating losses for this unit. There are rumors that the company’s leadership, particularly CEO and co-founder Mark Zuckerberg, is quietly shifting strategic focus from the metaverse to potential opportunities linked to Artificial Intelligence (AI).

Nonetheless, during the recent earnings call, Zuckerberg refuted these rumors, emphasizing Meta’s continued commitment to the metaverse project and highlighting potential long-term benefits. Undoubtedly, AI can have a more immediate impact on results. Meta has considered AI a strategic priority for years, and recent developments in generative AI, such as OpenAI’s ChatGPT, have attracted significant interest and triggered investments from established firms like Microsoft and startups.

Meta is actively enhancing its efficiency and establishing long-term financial discipline. These efforts involve prioritizing projects, streamlining operations, and reducing headcount through restructuring and layoffs. The company has already undergone two rounds of restructuring this year, with a third round planned for May, resulting in a reduction of approximately 25% in headcount compared to the previous year’s third quarter. Meta aims to increase productivity and improve its processes by implementing these measures.

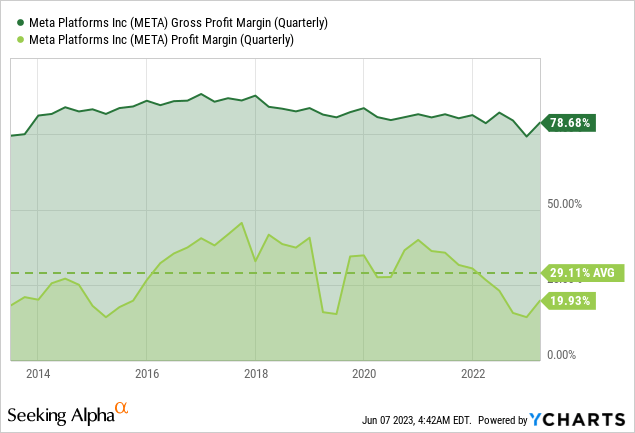

In the first quarter of the current year, Meta’s operating income was $7.2 billion, surpassing the consensus estimate of $7.0 billion. Additionally, Meta has narrowed its expense range for 2023, expecting expenses to fall between $86 billion and $90 billion, including restructuring costs ranging from $3 billion to $5 billion. With accelerating revenue growth and more favorable expense comparisons in the future, Meta will significantly expand its operating margins in the latter half of the year. Thus, the improved efficiency will enable Meta to allocate resources towards two major technological trends: AI and the metaverse.

AI Investments Drive Engagement & Monetization

Meta’s ongoing investments in AI and machine learning (ML) establish a strong competitive advantage for its platforms in the long run. The company’s advancements in AI/ML capabilities are not only enhancing the content ranking and recommendation algorithms for Reels, which drives user engagement but also improving the efficiency of ad delivery, leading to increased monetization of the service.

According to Meta’s reports, approximately 20% of the content on Facebook and Instagram feeds is now recommended by AI. Since the introduction of Reels, AI recommendations have played a significant role in driving overall user engagement. Furthermore, AI/ML will enable automation for easier deployment of advertising campaigns and performance optimization on products like Advantage+, generating higher demand from advertisers across Meta’s other platforms.

An AI-centric approach necessitates increased investment in infrastructure to handle computationally intensive workloads. Meta has allocated $30-33 billion for CapEx in 2023, which likely exceeds half of its operating cash flow. While this raises the capital intensity of the business, significant spending on AI has already demonstrated positive returns. AI contributed to user engagement, evidenced by continued growth in Meta’s user base and increased daily usage of its apps. Additionally, users are showing greater engagement with the short video format Reels, although monetization of Reels remains more challenging compared to mature formats like Stories and Feed.

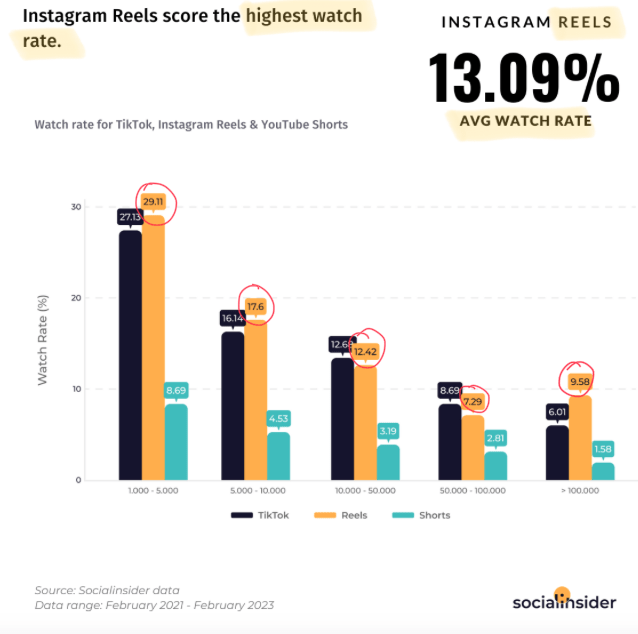

While TikTok is the most effective platform in getting users to interact with the videos produced, statistics shows that Instagram Reels has the greatest average watch rate. Reels have a higher average watch rate than TikTok, which often gets a watch rate of 9.06%. This might be a result of the posting trends, as with fewer Reels submitted, there is less spam, which increases the likelihood that users will find and watch more high-quality, personalized movies, ultimately increasing the number of views per Reel.

Socialinsider.io

Meta has also focused on developing generative AI to create larger models and release them as open source. Recently, the company introduced its LLaMa LLM and three other visual models. While these model developments have required a relatively small investment in headcount, the addition of GPUs for training has contributed to the company’s CapEx costs. As Meta continues to introduce new products utilizing these models, there may be an impact on CapEx in the fiscal year 2024 as inferencing costs scale up.

Lastly, it remains to be seen whether Meta will eventually be the beneficiary of a potential TikTok ban. Even though, the Chinese-originated app has rapidly built a large user base, it still faces concerns regarding privacy and potential bans by US politicians due to fears of spying and the influence of users’ views. Recently, the No TikTok on Government Devices Act’s interim regulation was released by the Department of Defense (DoD), General Services Administration (GSA), and National Aeronautics and Space Administration (NASA), and it will apply to any contract solicitations the organizations release on or after June 2.

Meta Is A Beneficiary Of Generative AI

META can become a leading player in the consumer internet space, benefiting greatly from the upcoming wave of Generative AI applications. While chatbots have received considerable attention, the true breakthrough is expected to be a surge of content generation (videos, images, audio, etc.), similar to the early years of YouTube or Netflix, which significantly increased usage and engagement.

Unlike investments in VR/AR, which aim to immerse users in entirely new environments, Generative AI aligns better with META’s core mobile and desktop business. This technology could become META’s elusive “second act” while longer-term technologies related to the metaverse transition into the third act.

Generative AI can potentially address META’s historical challenges with user engagement. The company operates four major apps: Facebook, Instagram, WhatsApp, and Messenger. Apart from WhatsApp, engagement on these apps has experienced a decline due to reduced user-generated content and adverse network effects. Generative AI unlocks a wealth of curated content that, when distributed on META’s apps, can drive increased engagement, as already evidenced to some extent. Therefore, combining Generative AI with a new content ranking system can solve this problem and restore positive network effects.

Generative AI can also benefit META’s advertising business. The introduction of Apple’s App Tracking Transparency (ATT) has significantly impacted direct response advertising at META, and the company has been actively working to mitigate the effects. However, the worst may be behind, and META has been gradually recovering return on ad spend (ROAS) and monthly ad budgets.

META can further enhance its efforts by leveraging Generative AI alongside increased campaign automation through tools like Advantage+. The conglomerate has been using dynamic creative optimization (DCO) for display and video ads, and Generative AI can take this to another level. With Generative AI, direct response marketers could conduct real-time A/B testing of thousands of ad creatives and personalize ads dynamically. Few companies can incorporate such functionalities into their ad stacks in a brand-safe manner, giving META a competitive advantage in its advertising business in the years to come.

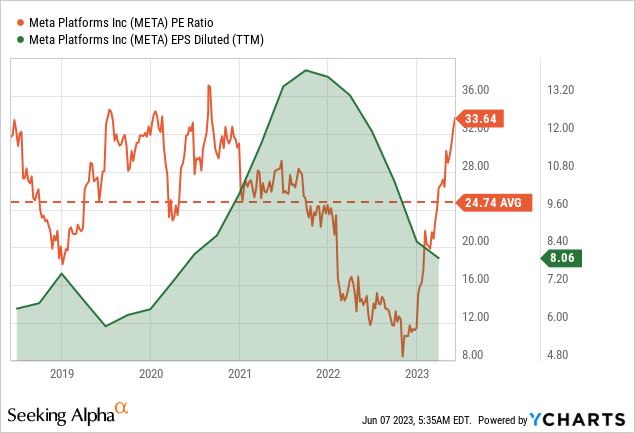

The Valuation Is Still Attractive

Even though META appears to surpass its 5-year P/E multiple averages of around 25x, the restructuring efforts and a recovering ad demand will boost the company’s earnings. With a forecasted DEPS of around $11.5 for 2023 and a slightly lower multiple of 30x, META should trade closer to $345-$350 in the next 12 months.

Takeaway

Meta is heading to the right direction as the efforts towards improving efficiency have started to pay off, which will provide capital to continue share repurchases and reinvest in improving family of apps features powered by AI, while also investing in the metaverse.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.