Summary:

- Despite zero growth on Google’s core advertising segment, the introduction of advanced AI capabilities like PaLM 2 has the potential to revolutionize the search experience and attract more advertisers.

- While Google’s cloud segment holds growth potential, it may not have a significant impact on the company’s overall financial performance.

- To avoid falling into a value trap, Google needs to optimize its AI-related businesses without compromising revenue growth.

- Given the forward-looking nature of the stock market and the 37% YTD rally driven by AI optimism, I maintain a neutral stance on the stock.

stockcam

Investment Thesis

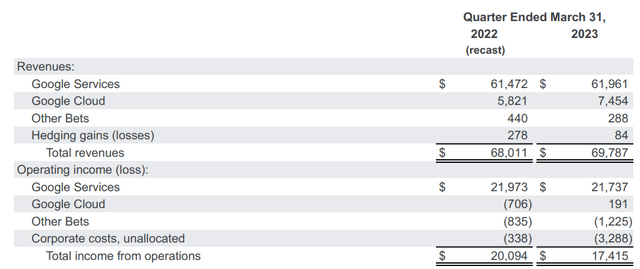

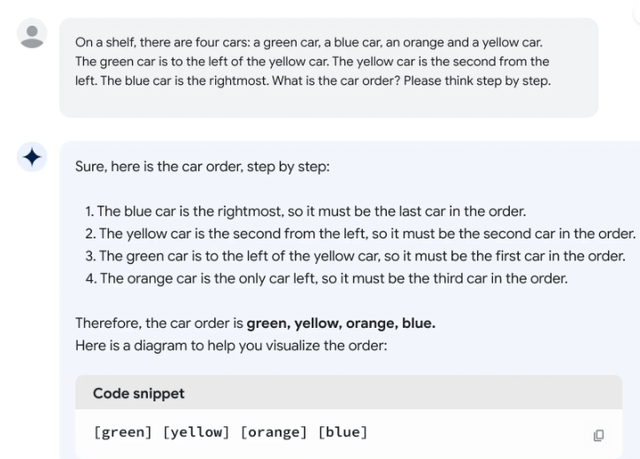

With the rollout of Google Bard, Alphabet Inc. (NASDAQ:GOOG),(NASDAQ:GOOGL) is positioned to build a Generative Artificial Intelligent (GAI)-driven ecosystem. I believe this is right time for Google to make a change, as its core business segment, Google Services (accounting for 89% of total revenue), experienced flat YoY growth in the last quarter, suggesting a deterioration in its advertising business.

By implementing more advanced AI-features to the company’s products, Google can not only enhance customers’ shopping experiences but also empower merchants to effectively target their customers. Particularly, in the last month, the company announced PaLM 2, a more powerful AI language model that will serve as the foundation for its future AI products. Another good news is that Google Cloud segment has eventually achieved breakeven on its operating margin. The stock is currently trading at 22.9x P/E FY 2023, which is higher than the S&P 500’s 18x.

While the company’s focus on AI has potentials to significantly improve its financial profile in the long run, which will expand its valuation multiple. However, it will take time, and I don’t see an inflection point based on the past earnings results. Given a 37% rally YTD, I’m neutral on the stock.

“0” Advertising Revenue Growth

Google’s advertising business has been under pressure due to a cyclical demand slowdown and intense competition. The advertising segment has three parts, including Google Search (74% of total adv revenue), YouTube Ads (12.3% of total adv revenue), and Google Network (13.7% of total adv revenue). Before we discuss more details about its core business, we should keep in mind that although Google’s Cloud business has strong growth potential, it only contributes 10.7% weight to Google’s total revenue in 1Q FY2023. Therefore, Google can’t solely rely on the Cloud business to drive a meaningful growth for the entire company.

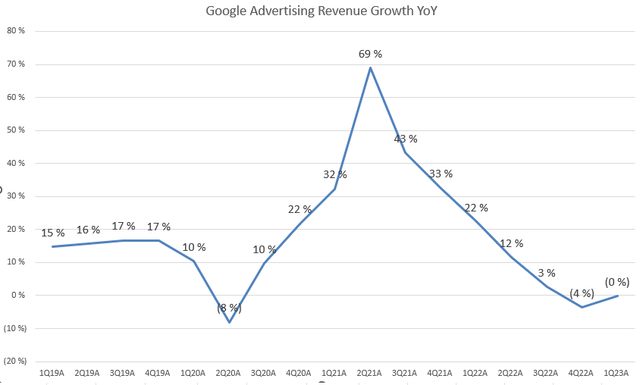

It’s worrisome to see the Google’s advertising revenue growth has been deteriorating dramatically over the past quarters. The growth rate was negative in 4Q FY2022 and flat in 1Q FY2023, indicating that the company’s advertising business is currently facing significant headwinds.

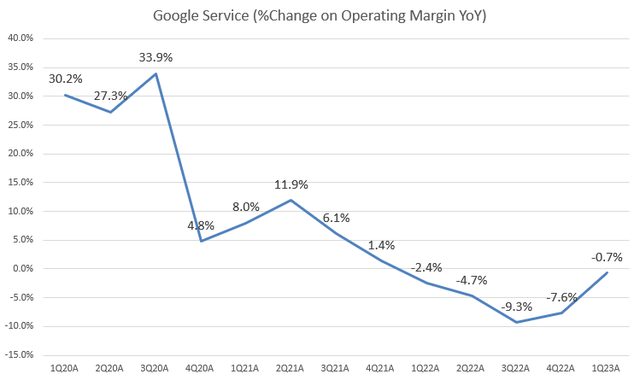

Let’s take a closer look at the margin of Google Service segment, which includes Google Advertising and other core products and platforms such as ads, Android, Chrome, hardware, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube, as stated in the company’s 10K FY2022. This segment represents 89% of Google’s total revenue, which means any growth slowdown in this segment can significantly impact Google’s overall growth and profitability. Looking at the chart, we can see that the operating margin has been deteriorating YoY since 1Q FY2022.

I know this chart looks a little confusing, so let me provide an example to clarify. The operating margin was 35.1% in 1Q FY2023 and 35.7% in 1Q FY2022. This indicates a decrease of 0.7% based on the YoY percentage change of the operating margin. Therefore, we should know that Google is not only experiencing a growth slowdown in the advertising segment but also a series of margin contractions. These deteriorations can further add significant pressure on the company’s valuation.

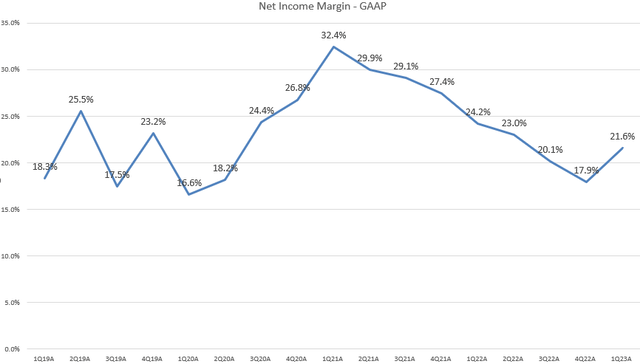

Flat Net Income Margin

Due to a sluggish growth on its core business segment, the company had experienced net profit margin contractions for 7 consecutive quarters. The prolonged contraction in net income margin across multiple periods indicates that even a substantial operating margin expansion in the Google Cloud segment is unlikely to have a substantial impact on improving the company’s overall bottom line. However, in 1Q FY2023, we saw the margin rebounded to 21.6% from 17.9% in 4Q F2022, which is a positive sign. I believe it’s crucial for the company to initiate a turnaround strategy to sustain its leading market share in the advertising industry. This strategy should include leveraging new AI-related features to reshape the company’s long-term growth trajectory.

AI Products Powered by PaLM 2

On May 10th, Google formally announced PaLM 2 during its I/O keynote presentation. This new version significantly improves the performance in logical reasoning and reduced serving costs, making it a direct competitor to Microsoft’s GPT-4, owned by Microsoft (MSFT). PaLM 2 currently powers 225 products and features. Particularly, I’m very excited to see that Bard is now fully running on PaLM 2 and has expanded its availability to 180 countries.

Additionally, Google’s management addressed the importance of AI as a strategic focus for the company. They highlighted how AI is playing a leading role across various parts of the business, such as Google Search, YouTube, and Cloud. During 1Q FY2024 earnings call, the CEO further elaborated:

“We’re actively helping more advertisers pair together with Performance Max. Advertisers who use PMax are, on average, achieving over 18% more conversions at a similar CPA. This is up 5 points in just 14 months, thanks to advances in the AI underlying bidding, creatives, search query matching and new formats like YouTube Shorts.”

Given PaLM 2’s impressive capabilities, I’m confident that it has the potential to revolutionize the search experience for users. Despite intensified competition from Microsoft’s Bing, Bard, powered by PaLM 2, can be a major upside catalyst for the stock. The new model has the potential to significantly improve Google’s advertising business, as those features offered by PaLM 2 have the ability to enhance user engagement and drive increased advertising opportunities. However, so far, those positive impacts haven’t been materially reflected in the company’s financial results yet. Therefore, the company’s valuation multiple has been expanding in the last few months.

Valuation

Google is currently trading at 22.9x P/E FY2023, which is higher than 18x of S&P 500 index and almost in-line with 23x of Meta’s (META) P/E FY2023. Considering the discounted growth expectations in Google’s advertising business and a 37% rally YTD, I don’t think the stock is undervalued at the moment. However, investors should closely monitor the impact of the new AI-related features on revenue growth as they have the potential to boost the company’s valuation and make the stock cheaper.

In the near term, the cloud segment may not have a significant influence on the company’s financial performance, as anticipated by investors. It’s important for Google to optimize its business operations without compromising revenue growth. Otherwise, there is a risk of the company falling into a value trap, leading to a lower valuation.

Conclusion

In sum, although Google is currently facing challenges in its core advertising segment, with stagnant growth and margin contractions, the introduction of PaLM 2, along with other advanced AI features, have the potentials to revolutionize the search experience and attract more advertisers. This can be a primary catalyst to reaccelerate the growth. While Google’s cloud segment holds strong growth potential, it may not have a significant impact on the company’s overall financial performance, which explains the company’s lower valuation compared to other mega cap companies. Lastly, to avoid falling into a value trap, Google needs to optimize its AI-related businesses without compromising revenue growth. We should closely monitor how the new AI-related features play out and their impact on revenue growth. Given the stock market’s forward-looking nature and a significant rally of 37% YTD driven by the optimism surrounding the AI initiatives, I’m neutral on the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.