Summary:

- Southwest Airlines’ stock price has dropped significantly due to concerns about a pilot strike and other worries, but the company’s troubles may already be priced in, offering a decent margin of safety for investors.

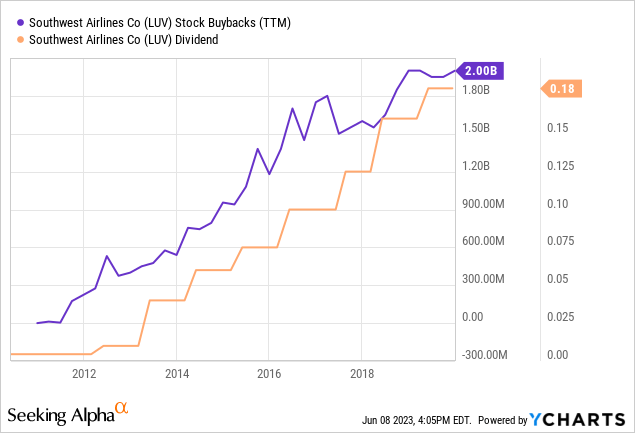

- The airline has a strong history of revenue growth, financial discipline, and cash generation and is expected to return to increasing dividends and buybacks once debt levels become more manageable.

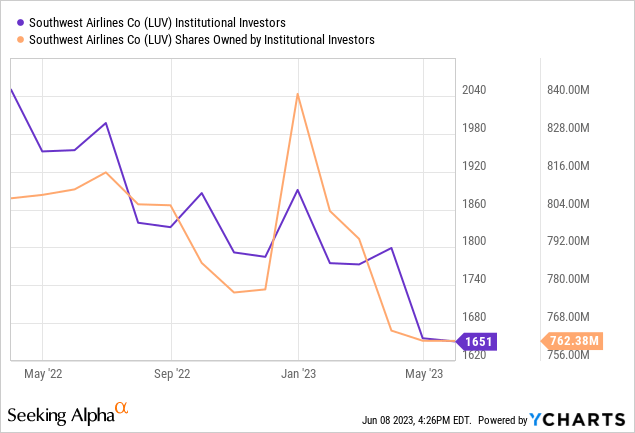

- However, there is still a risk of a pilot strike this summer, which could impact the company’s short-term revenue and profit estimates, and institutional ownership of the stock has dropped significantly in the last year.

- At a forward P/E below 10, this could be a great value for contrarian investors with long-term vision.

kameraworld/iStock Editorial via Getty Images

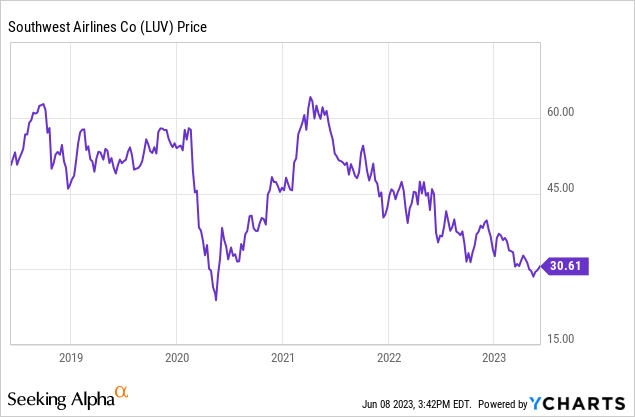

Southwest Airlines (NYSE:LUV) is not your traditional airline company. From the way it sells tickets to the way it operates, this is certainly a unique airliner. Lately the company’s stock price got punished heavily due to concerns about the pilot strike as well as some other worries and the stock is almost back to lows we haven’t seen since the COVID-19 crash which decimated many airline stocks at the time.

I believe most if not all of the company’s troubles are already priced in by now and the current price offers a decent margin of safety for investors to start accumulating a small position in. I will admit that historically airline stocks haven’t been good investments in the long run but this one is definitely worth a look.

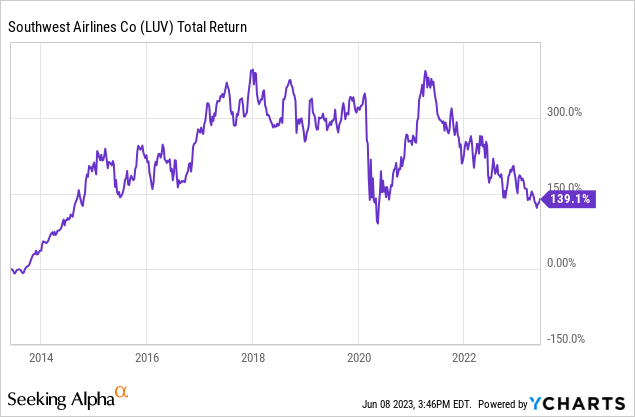

Despite crashing badly twice in the last 5 years, the stock still resulted in a return of 139% in the last decade. Notice from the graph below how the stock’s total return for the past decade was well north of 300% by mid 2021 which is very impressive for an airline company. We could be setting up for good returns again after the stock hit the double-bottom in the 5 year chart.

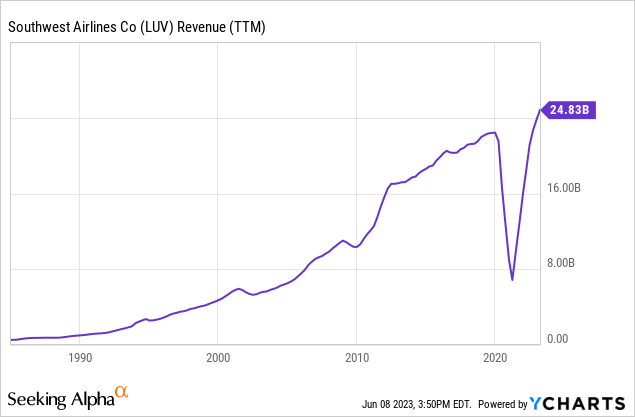

So, why is Southwest Airlines so special? First, let us take a look at the company’s revenue growth chart for the last 30+ years. Notice that if you don’t count 2020 where the company’s revenues dipped for obvious reasons, there is a strong long term growth. It’s very rare to see this kind of growth in airline revenues because the industry is typically commoditized with tons of fierce competition.

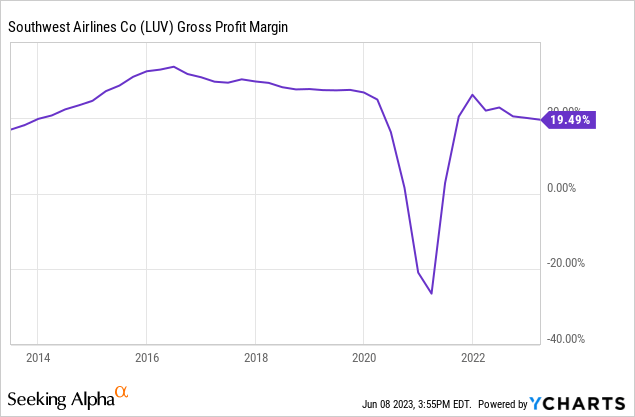

Even though the company is known as a low-cost provider, its gross margins usually came at or above 20% with the exception of 2020. This is because the company is good at managing routes, keeping its costs down and executing well while at the same time providing value to customers. The company’s net profit margin is only around 2-3% but this is actually very common with the airline industry.

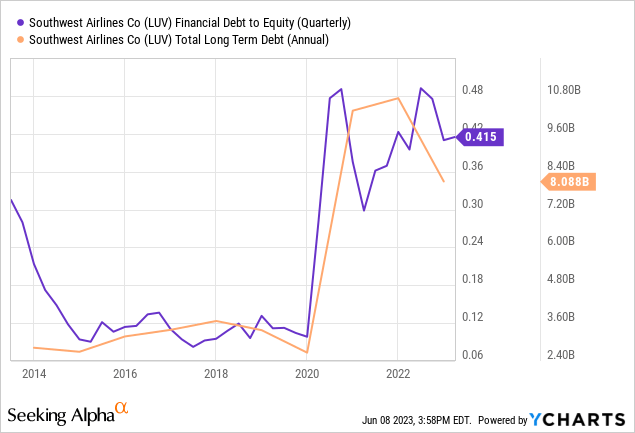

In 2020 the company took out large amounts of debt to survive (so did every other airline company) but even during this time, it’s debt-to-equity level never passes 50%. Currently the company’s debt-to-equity sits at 41.5% which is above its historical average but the company started to pay off its debt in larger chunks starting last year. It’s debt level is already down from $10.8 billion to $8.1 billion in the last year and half.

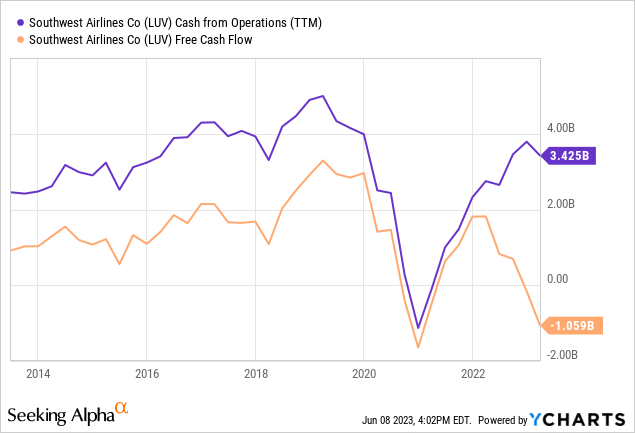

In the last 12 months, the company generated $3.42 billion from its operations but its free cash flow still dropped by $1.05 billion. This is because the company is paying down its debt as I’ve mentioned before. At the current rate Southwest’s debt will become very manageable and the company will be able to return more cash to investors in dividends and buybacks just like it used to do before 2020.

Below is a chart showing how Southwest was returning money to investors with ever-increasing dividends and buybacks prior to COVID-19 lockdowns. I believe that the company will return to this type of returning cash to investors once its debt levels become manageable again.

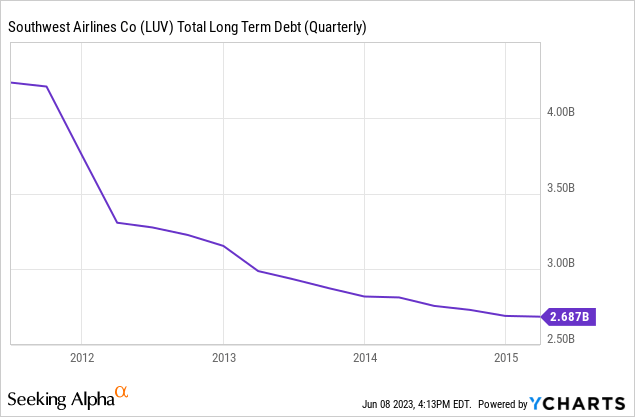

This is not the first time Southwest had to pay off large amounts of debt in a short time either because it happened before. Shortly after the 2009 recession, the company took on some extra debt and it was able pay most of it off within the next few years. This is a company that likes to maintain a low debt level and pay off most of its debt before returning money to investors. Having low levels of debt allows the company to navigate difficult times and become more versatile.

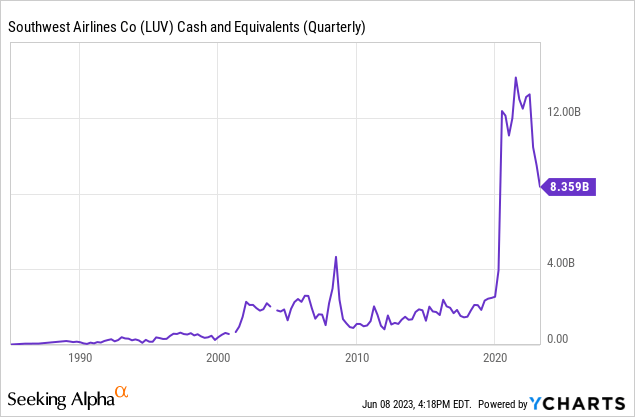

We should also mention that Southwest currently holds $8.36 billion of cash which will allow it to pay off its debt in a comfortable fashion. Between its current cash position and operating cash flow, the company could probably pay off its long term debt entirely within the next couple years but it will probably want to keep some cash in reserve for a rainy day, especially if the global economy enters a recession anytime soon. The company’s large cash position should also tell you that even though it took out a huge loan in 2020, it didn’t need to spend most of this money and it was able to retain much of this money as cash over the years. This also tells me that the company’s management is careful about their money and keeping the company’s balance sheet in check.

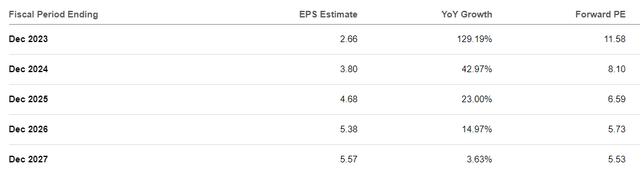

Analysts expect the company to earn $2.66 this year followed by $3.80 in 2024 and $4.68 in 2025. This would indicate that the company is trading for a forward P/E of 12 based on 2023 earnings, a forward P/E of 8 for 2024 earnings and a forward P/E of 6.6 for 2025 earnings which is very cheap even for airline companies. Historically Southwest had a P/E in high 10s or low 20s due to its robust growth and profitability so the stock is selling for a cheap valuation based on its historical valuations.

If I must add a word of caution, institutions haven’t been showing much love for LUV lately. In the last year institutional ownership of this stock dropped significantly. The number of institutions owning this stock dropped from 2050 to 1651 and the amount of stock held by institutions dropped from 810 million to 762 million. Some will say that this is a bearish sign because institutions are exiting their positions but others will say this is a bullish sign because when so many institutions sell a stock and take profits that usually marks the bottom. Keep in mind that this type of behavior isn’t limited to LUV either. During the last year we’ve seen institutions reduce their exposure to many different stocks because of short-term concerns. This movement could simply mean that institutions are moving their money away from stocks to bonds and cash since bond yields are now much higher than before.

I wouldn’t be doing my job if I didn’t mention one big risk factor regarding this company. While it’s currently small, there is still a risk for Southwest pilots going on a strike this summer. I don’t think it will happen in a large scale but if it happens, this could impact the company’s short term revenue and profit estimates significantly. This is probably the part of the reason the stock has sold off recently which could create a buying opportunity for long-term investors.

Conclusion

I think it’s time to show some love for LUV. The company has a strong history of execution, solid cash generation, proven track record of financial discipline, versatility and survival instincts that allowed it to survive even the toughest times. Still, airline stocks tend to be riskier in the long run so if you are initiating a position in this company, make sure it’s a small position in a well-diversified portfolio. You don’t want to put all your eggs in one basket.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LUV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.