Summary:

- After a 43% gain since April, I am closing out my position in Tesla, Inc. stock.

- Recent partnerships with Ford and GM, as well as encouraging data from the China Passenger Car Association, have led to upside momentum in Tesla’s shares.

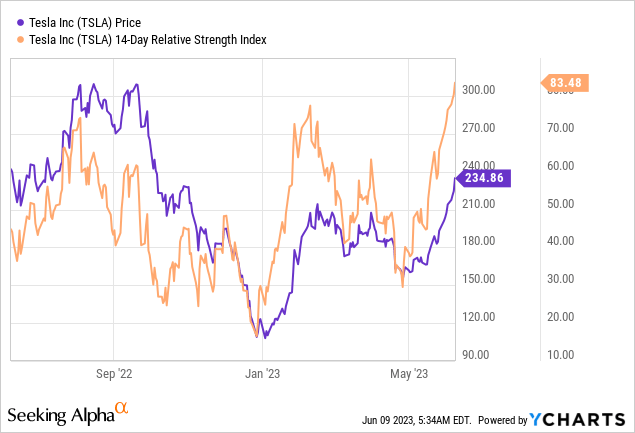

- Tesla’s shares are now overbought, based off of RSI, and expensive based off of P/S and P/E.

jetcityimage/iStock Editorial via Getty Images

Tesla, Inc. (NASDAQ:TSLA)’s shares have crossed into overbought territory recently, and investor sentiment has profoundly improved since I bought the fear during Tesla’s large valuation draw-down in April. Most recently, Tesla has reported a couple of wins, including a partnership that will see Ford Motor Company (F) and General Motors Company (GM) join its Supercharger network. Additionally, data from the China Passenger Car Association indicates that Tesla is seeing an improving sales picture in China.

Since shares of Tesla have benefitted enormously from changing investor sentiment since April, and are now heavily overbought based off of RSI and are leaning towards being expensive, I believe it is a great time to sell into the strength again and capitalize on investors’ overly bullish sentiment!

Tesla effectively establishes NACS as the EV industry’s charging standard, potentially accelerating EV adoption in the U.S.

Tesla reported a couple of positive headlines recently. One stand-out news item was that Ford and Tesla entered into an EV-charging partnership that will allow drivers of a Ford electric vehicle to access Tesla’s Supercharger network. Ford also said that it was adopting Tesla’s North American Charging Standard charge port which is going to make it easier for Ford EV owners to charge their electric vehicles going forward.

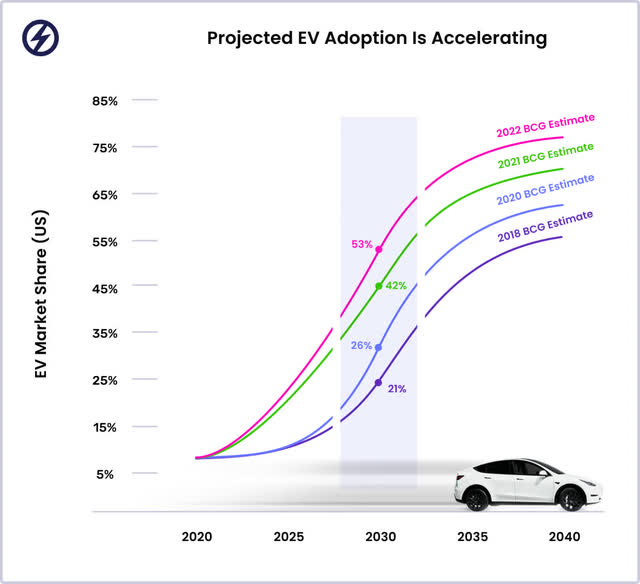

Additionally, General Motors agreed this week to join Tesla’s Supercharger network as well. The EV-charging partnerships between Tesla and Ford/GM are set to establish Tesla’s North American Charging Standard as the dominant industry standard which could boost electric vehicle adoption in the U.S. as buyers of a Ford or GM electric vehicle will now be able to access Tesla’s vast fast-charger network. According to the Boston Consulting Group, EV adoption is expected to soar until 2030 with estimates calling for electric vehicles to grow to a more than 50% market share by the end of the decade.

In other good news, the U.S. government confirmed this week that all of Tesla’s Model 3 sedans now quality for a full EV tax credit in the amount of $7,500, which will likely boost demand for Tesla’s EVs as well.

Tesla’s delivery rebound, promising data from China Passenger Car Association

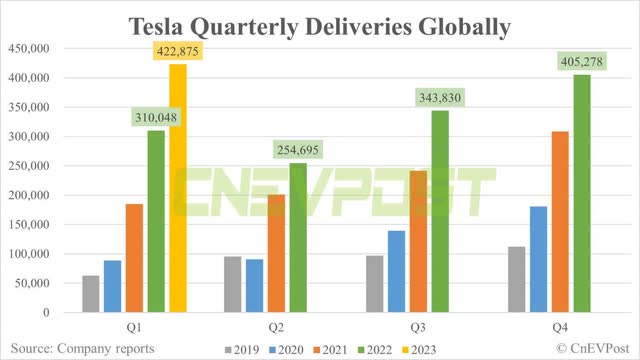

After a challenging year in 2022, which saw the shutdown of its Tesla Gigafactory in Shanghai, Tesla has managed to drive a strong rebound in production and deliveries… resulting in a record delivery volume of 422,875 electric vehicles in the first-quarter, showing more than 36% year-over-year growth.

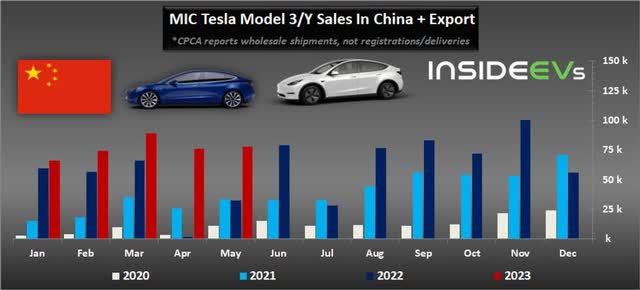

Production and delivery data from the China Passenger Car Association for the month of May indicates that Tesla could see a record second quarter as well. According to the CPCA, Tesla’s wholesale delivery volume (Model 3 and Model Y) amounted to 77,695 units in May, showing 142% year over year growth. Delivery volumes also increased month over month, by 2%, indicating growing demand in China. The strong Y/Y growth figure is due to the fact that Tesla’s delivery volume was compressed in the year-earlier period due to COVID-19 related factory shutdowns. The rebound in deliveries in Q1’23 is likely one reason why Tesla’s shares have soared since the EV maker reported Q1’23 earnings.

Tesla is now overbought and the valuation is rich

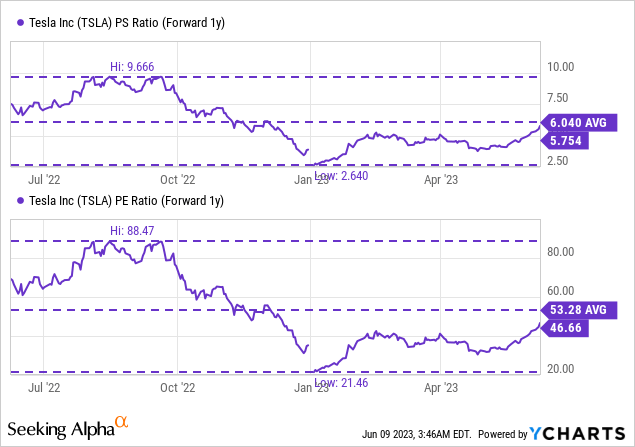

Since I last submitted my work to Seeking Alpha about Tesla in April — Buy The Fear — Tesla shares have seen a sharp revaluation to the upside (+43%). However, Tesla is now highly valued at a price-to-revenue ratio of 5.7X compared to 4.0X in April. Tesla’s P/S valuation is now also approaching the 1-year average P/S ratio of 6.0X.

Tesla is now trading at a P/E ratio of 46.7X, which is also close to the firm’s 1-year average P/E ratio of 53.3X. I believe Tesla’s delivery and revenue growth potential (23% in FY 2023 and 29% in FY 2024) is now fully reflected in the company’s valuation.

Additionally, Tesla is now also massively overbought based off of RSI (83.5), as the EV partnerships with Ford and General Motors as well as encouraging data from the China Passenger Car Association have improved market sentiment towards Tesla greatly.

Risks with Tesla

The biggest risk for EV manufacturers right now is the potentially erosion of vehicle and operating margins, as companies are facing an increasingly tough price war in the electric vehicle industry. Tesla has been a leader of recent price cuts in 2023, lowering prices of key models to spur demand. Tesla has cut prices for its EV models six times, and in the last round of price cuts, in April, Tesla lowered the price of its Model 3 by $2,000 and the price of its Model Y by $3,000. Given the recent price cuts for Tesla and other EV manufacturers also lowering their prices in a bid to stay competitive, especially in China, there is a considerable risk that revenue growth will come at the expense of Tesla’s profitability going forward.

Final thoughts

I aggressively recommended Tesla, Inc. stock on the drop in April, but I now believe that the strong revaluation to the upside that has taken place in the last two months makes Tesla a sell right now. This is from a variety of perspectives: shares are now leaning on the expensive side and are trading near their 1-year average P/S and P/E ratios, shares are overbought technically (raising the risk of a correction), and investor sentiment has drastically improved as well after Tesla entered into EV-charging partnerships with Ford and GM. While I continue to see delivery upside, especially in China, in FY 2023, I believe massively improved investor sentiment and a reset valuation are reasons to consider selling Tesla, Inc. stock into the strength!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.