Summary:

- T stock prices have been recently hammered by the AMZN market rumors, triggering highly attractive entry points for income-seeking investors.

- AMZN may eventually introduce a MVNO strategy at a break-even price of $10, similar to other asset-light players such as Mint Telecom and Consumer Cellular.

- While no one knows what will happen in the far future, it is unlikely that the e-commerce giant will enter this space for now, with representatives already debunking the speculation.

- However, T may continue their underperformance ahead, due to their elevated capex and long-term debts.

- Therefore, while we rate both T & VZ stocks as great buys at these depressed levels, investors that dollar cost average here must also adjust expectations accordingly.

Liudmila Chernetska/iStock via Getty Images

We have previously covered AT&T Inc. (NYSE:T) in April 2023 here. At that time, the stock has been wrongfully sold-off, since its free cash flow generation has always been lumpy, depending on the timing of cash distributions, capital expenditures, and cash paid for vendor financing.

Given the optimistic signs of operating cost optimization and improved profitability, we believe the telecom may potentially achieve its ambitious FCF generation of $16B in 2023. With the stock already overly sold off due to the Amazon (AMZN) rumor, we are cautiously rerating the T stock as a Buy here.

The Income Investment Thesis Looks More Attractive Here

T and Verizon Communications (VZ) have been recently hammered by the rumors that AMZN may be entering the telecom space in the near future. This development is not surprising indeed, since the latter has previously displayed bottomless ambitions in multiple markets.

This includes being a cloud provider through Amazon Web Services since 2000, groceries through Amazon Fresh since 2007, unlimited streaming through Prime Instant Video since 2011, primary healthcare through Amazon Care since 2019, the pharmacy service since 2020, and most recently, the movie industry through the acquisition of MGM in 2021.

Most notably, we suppose this piece of rumor may be a continuation of those discussed since 2019, with AMZN supposedly interested in buying prepaid cellphone wireless service, Boost Mobile, from T-Mobile (TMUS) then. Either way, with AMZN and TMUS already debunking the rumors, the coast has been all cleared for the rebound of T and VZ’s stock prices.

However, it appears TMUS is still suffering from the baseless market rumor, with the stock still down by -6.1% since June 02, 2023. The pessimism embedded in its stock prices is surprising indeed, given its outperformance thus far.

Perhaps this is due to Mr. Market’s conviction that AMZN may eventually enter the telecom market, putting great competition against the existing telecom players, thanks to its 148.6M Prime members in the US. However, we suppose that speculative event may only occur by the second half of the decade. This is why.

AMZN has been struggling to trim its operating expenses and return to profitability, due to the overly aggressive expansion in its footprints and headcounts during the hyper-pandemic period. Even in the latest quarter, the e-commerce giant only reported 3.9% in operating income margins, dramatically impacted compared to the hyper-pandemic heights of 5.9% in FY2020 and 5.2% in FY2019.

We suppose there is minimal likelihood that AMZN may enter the telecom market now, where competition is intense, margins are thin, and capex is elevated. However, in the long term, it is not overly speculative to imagine the giant eventually taking on the MVNO strategy, buying the telecoms’ spare capacity at wholesale prices, once the macroeconomic outlook normalizes.

This strategy has been employed by smaller telecom players as well, such as Mint Mobile offering monthly mobile plans from $15 and Consumer Cellular from $20 onwards. While it is uncertain if the latter two are profitable, the venture may potentially boost AMZN’s Prime memberships, due to the highly competitive prices of $10.

It is already well-known that the e-commerce business operates at razor-thin margins, with the pure profit play embedded in its Prime memberships, significantly aided by the AWS segment. This is a similar strategy that we have observed with Costco (COST).

We suppose part of the pessimism is also attributed to T’s lumpy free cash flow at $1B (-83.6% QoQ/ +42.8% YoY) and elevated long-term debts of $137.5B (+1.1% QoQ and -33.7% YoY), despite the robust annualized adj. EBITDA of $42.32B (+3.8% YoY).

Meanwhile, VZ is no better with a free cash flow of $2.33B (+37% QoQ/ +133% YoY) and long-term debts of $140.77B (inline QoQ/ +0.5% YoY), with stagnant FY2023 adj EBITDA guidance of $47.75B at the midpoint (inline YoY).

Much of the impacted cash flow is attributed to T’s elevated capital expenditure of $19.39B (+17.7% sequentially) and sustained dividend payout of $15.05B (-46.04% sequentially) over the last twelve months, leaving little for debt repayment.

The same has been reported by VZ at capital expenditures of $23.22B (+7.5% sequentially) and a dividend payout of $10.89B (+4% sequentially) over the last twelve months. While TMUS does not pay out dividends, it is apparent that the telecom business is capex intensive, with the latter similarly reporting $13.59B (+8.6% sequentially) of capital expenditures over the last twelve months.

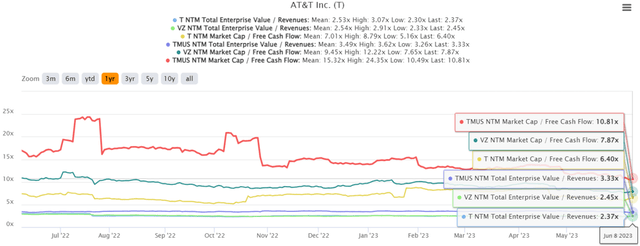

T, VZ, & TMUS 5Y EV/Revenue and NTM Market Cap/FCF

This cadence may be why their stocks’ valuations have been moderated thus far, with T trading at NTM Market Cap/ Free Cash Flow of 6.40x, VZ at 7.87x, and TMUS at 10.81x, compared to their 5Y mean of 8.44x, 11.87x, and 23.29x, respectively. Their NTM EV/ Revenues remains stagnant over the past five years as well, suggesting their sluggish top-line growth ahead.

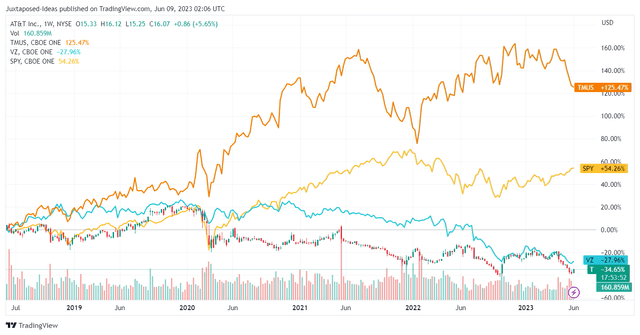

T, VZ, & TMUS 5Y Stock Price

However, if investors are looking for high-growth telecom stock, they may look at TMUS instead, due to the impressive 5Y returns at +125.47%. While past performance may not be indicative of forward returns, the T and VZ stock has also underperformed against the wider market, even if we are to include their dividends.

Then again, we continue to rate both T and VZ stocks as buys here, due to their oversold levels, with T trading at its 2008 lows and VZ similarly at its 2011 lows.

The market rumor has triggered much more attractive entry points for income-seeking investors, in our view, with T now offering an excellent forward dividend yield of 6.89% and VZ at 7.40%, compared to their 4Y average yields of 6.94% and 4.94%, respectively.

Naturally, investors must also adjust their expectations accordingly, since these two stocks may continue their underperformance for the foreseeable future, with their only merit being the rich dividend yields. Even then, assuming that AMZN really enters the foray, we may see the legacy telecoms’ EBITDA negatively impacted, potentially triggering a dividend cut then.

Only time may tell.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.