Summary:

- PEP has already completed its downcycle movement from the recent May 2023 top, likely to rebound from the current support level and sustain the upward trend.

- It also demonstrated a robust pricing power through the expansion in topline by +10% YoY, despite the contraction in volume.

- The PEP management’s interest rate hedges have also outperformed, expanding its EPS and sustaining shareholder returns thus far.

- Nonetheless, investors must also pay attention to its accelerating operating expenses and capital expenses, triggering the moderation in its operating and FCF margins.

- Therefore, while PEP’s dividend remain safe, it remains to be seen when we may see a satisfactory deleveraging ahead.

SvetaZi

PEP Is A High Growth & Decent Yield Investment Thesis, Without SPY’s Volatility

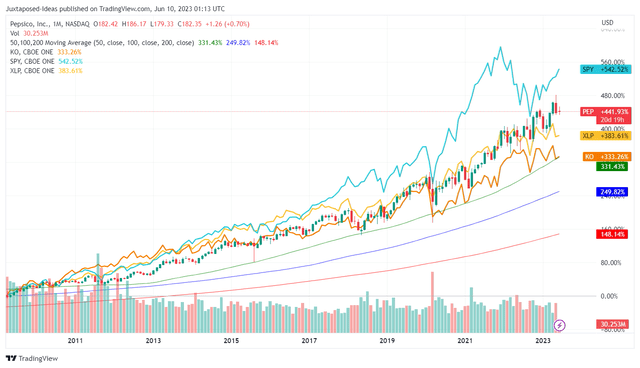

PEP Total Returns Since 2008, Including Dividends

PepsiCo (NASDAQ:PEP) continues to be a core holding in our family’s portfolio, as evidenced by the excellent total returns of +441.93% since 2008, including dividends. The stock has notably outperformed its peers, such as Coca-Cola Company (NYSE:KO) at +333.26% and Consumer Staples Select Sector SPDR ETF (NYSEARCA:XLP) at +383.61%.

While PEP has not performed as well as the SPY has at +542.52% at the same time, we must also highlight that the latter comes with elevated volatility of -28.5% during the worst of the COVID-19 pandemic, compared to the former at -21.7%. The same has been observed between December 2021 and October 2022, with the SPY plunging by -24.5% and PEP only moderating by -2.8%.

This cadence alone solidified PEP’s status as a defensive stock, offering both sustained growth and decent dividends no matter the bull or bear market.

Naturally, much of the optimism is attributed to the company’s stellar financial performance. For example, it recorded FQ1’23 revenues of $17.84B (-36.2% QoQ/ +10.1% YoY) and gross margins of 55.2% (+2.9 points QoQ/ +0.2 YoY) in the latest quarter.

The latter is important since it suggests a return to PEP’s pre-pandemic profitability with gross margins of 55.4% in FY2019, in contrast to the 53.4% reported in FY2020 and 53.3% in FY2021 due to global supply chain issues.

Even if we are to break down the individual segment’s performance, it is evident that the company has been able to command an impressive pricing strategy despite the rising inflationary pressures.

For example, PEP has been able to expand its top-line by +10% YoY by the latest quarter, despite the decline in the Convenient Foods volume by -3% YoY and minimal growth in the Beverage volume by +1% YoY.

Unfortunately, these optimistic developments have been negated by the company’s accelerating operating expenses to $7.06B (-42.1% QoQ/ +17.6% YoY) by the latest quarter, triggering a decline in its operating margins to 15.7% (+7 points QoQ/ -2.2 YoY). Otherwise, it reported an even less satisfactory operating margin of 13.8% (-1.5 points sequentially) over the last twelve months, compared to the FY2019 levels of 16%.

In addition, PEP took on additional long-term debts, growing the sum to $37.48B (+5.1% QoQ/ +8.3% YoY) by the latest quarter. However, with an annualized EBITDA of $13.52B (+4.6% QoQ/ -2.3% YoY), we are not overly worried yet, due to the well-laddered debt schedule through 2060, with only $5.95B due through 2024. This is on top of the interest rate hedges thus far.

The management took advantage of the higher interest rates to effectively increase its gains on cash balances and investments, triggering the moderation in its annualized net interest expenses to $800M by the latest quarter (-26.7% QoQ/ -16.6% YoY). All thanks to the Fed’s sustained hikes thus far.

This cadence has resulted in PEP’s expanding adj. EPS to $1.50 (-10.1% QoQ/ +16.2% YoY), sustaining its stellar dividend payout ratio of between 65% and 70% over the past few years.

Nonetheless, investors must also pay attention to the company’s deteriorating balance sheet by the latest quarter, with cash/ short-term investments of $5.2B (-2.6% QoQ/ -24.6% YoY). In addition, its capital expenditure has accelerated to $5.26B by the last twelve months (+14.3% sequentially), naturally impacting its Free Cash Flow generation to $5.32B (-28.8% sequentially) at the same time.

Therefore, while PEP’s shareholder returns may still be safe, it remains to be seen how the management aims to deleverage in the intermediate term.

So, Is PEP Stock A Buy, Sell, or Hold?

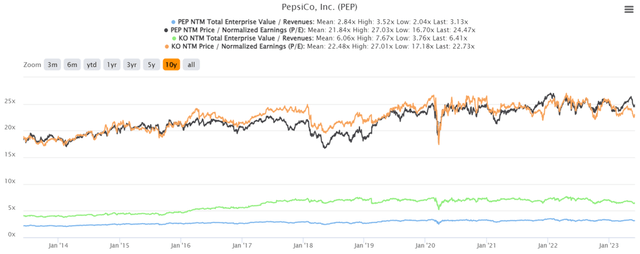

PEP 10Y EV/Revenue and P/E Valuations

As evidenced by the chart above, PEP’s valuations continue to expand, demonstrating its position as a defensive stock over the past few years. In addition, its NTM EV/ Revenue remains stable at 3.13x and NTM P/E at 24.47x, compared to its 5Y mean of 3.12x and 23.37x, respectively. The same has been observed compared to its 1Y mean of 3.19x and 24.81x, respectively.

With the PEP stock trading in line with its peer, KO, the former appears to be more attractive here, due to the stock’s outperformance thus far.

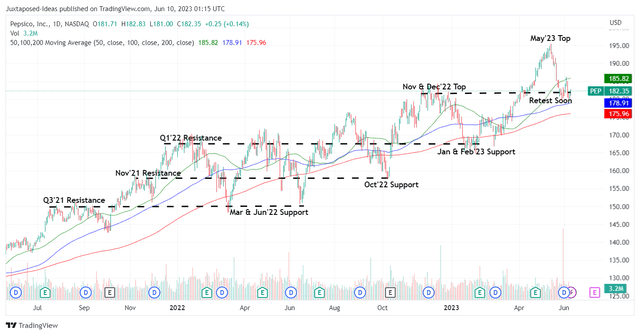

PEP 2Y Stock Price

For now, PEP has already completed its downcycle movement from the recent May 2023 top, likely to rebound from the current support levels and chart new heights over the next few months, sustaining the upward trend for the past few years.

With the peak recessionary fears and the debt ceiling crisis, we suppose Mr. Market may continue supporting the stock’s defensive momentum for the near future, significantly aided by the company’s raised forward guidance. For now, it expects to deliver revenues of $91.57B (+6% YoY) and EPS of $7.27 (+7% YoY) in FY2023, assuming a similar forex impact of -2.5% and -2% in its recent earnings call, respectively.

In addition, PEP sustains its goal of being a shareholder-friendly stock, by guiding a dividend expense of $6.7B (+8.5% YoY) and share repurchases of $1B in FY2023 (-37.5% YoY).

As a result, we continue to rate the stock as a buy here, due to the excellent forward dividend yield of 2.78%, against its 4Y average of 2.73% and sector median of 2.42%.

While some may attempt to time the market, we believe this is the best time to add PEP, given our price target of $209.70 with an upside potential of +14.9%. This is based on the market analysts’ FY2025 EPS projection of $8.57 and its NTM P/E of 24.47x.

There is no point in waiting for a retracement indeed, since the PEP stock may never come cheap.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.