Summary:

- Adobe has recovered nearly 70% from its September 2022 lows, leveraging the recent AI hype.

- However, Adobe is a dominant market leader that’s more than ready to defend its position against the hype from the AI image generation startups.

- Adobe has been innovating rapidly and is well-poised to continue its leadership. The company’s AI strategy could keep its customers “commercially safe” from potential copyright infringements.

- Despite the sharp recovery, ADBE’s valuation is still below its 10Y averages. Hence, I assessed that adding at the current levels is still reasonable.

Sundry Photography

Adobe Inc. (NASDAQ:ADBE) has staged a remarkable recovery since my update last year, as it also latched on to the AI hype train. Given Adobe’s wide-moat business model, I believe it’s justified that the leading creative software company is well-positioned to lead the generative AI revolution for the creative industry.

While there are doubts about whether leading image-generating AI startups could pose a significant threat to its market leadership, I believe the fears are overblown.

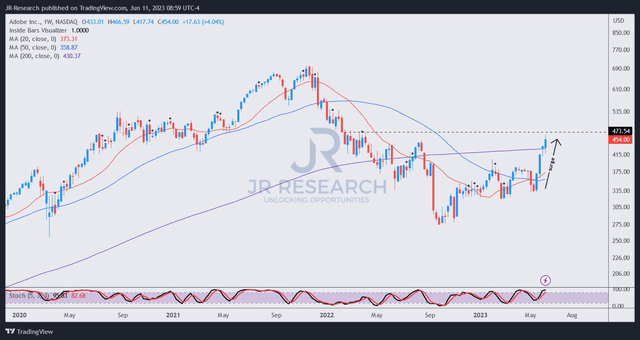

Moreover, market operators remain unfazed by the threats, given Adobe’s solid business fundamentals and well-entrenched ecosystem among creatives. As such, ADBE has recovered nearly 70% from its September 2022 lows through its recent June highs.

Despite that, I assessed that ADBE remains attractively valued relative to its 10Y averages, suggesting that the current levels remain constructive. However, I think it’s essential to address the elephant in the room, whether Adobe could fend off the challenges from AI startups.

Keen Adobe investors should recall that the company has announced its generative AI integration, including Adobe Firefly, into its ecosystem. While it has yet to be monetized, I believe the company needs to demonstrate that it’s good enough to maintain its moat first. As such, it needs to secure buy-in from its current users before it can work out an effective monetization model.

Moreover, big tech companies like Adobe are expected to leverage their leadership qualities to capitalize on generative AI. In a recent commentary, Goldman Sachs (GS) noted that “in the AI sector, a ‘winner-take-more’ scenario is likely, where the largest companies become increasingly dominant.” These companies are expected to lean on “their resources and established industry relationships” to stretch their dominance.

Given Adobe’s substantial profitability and robust balance sheet, I believe startups like Midjourney and Stability AI aren’t going to have a free run against Adobe. Adobe’s quick pivot into the generative AI space demonstrates that the Shantanu Narayen-led company hasn’t fallen behind on the transition.

In a mid-May conference before the official launch of the company’s generative AI integrations, Adobe Chief Strategy Officer Scott Belsky accentuated the company’s AI progress. He articulated that the company has been making advancements in the field of AI “for years,” as he added:

The core foundational models for generative AI were built in-house by a team of hundreds of PhDs and AI experts. Adobe has been planning and laying the groundwork for leveraging these models in their products and marketing pipeline for years. Firefly is launching at the right time, following a period of progression and feedback, and Adobe is prepared to open the floodgates for wider use. – MoffettNathanson’s Inaugural Technology, Media, and Telecom Conference

Moreover, Peter Yang, a product lead at Roblox (RBLX), also highlighted that “incumbents like Microsoft (MSFT), Google (GOOGL) (GOOG), and Adobe have moved incredibly fast on AI. [So,] startups that overlap with core incumbent use cases might struggle.”

Sure, Adobe needs to maintain its competitive edge in the rapidly evolving generative AI space. However, AI startups might find it highly challenging to disrupt Adobe’s business model, ecosystem, scale, and relationship with their customers.

Adobe’s pitch to its enterprise and corporate customers is that its generative AI tools will not lead to copyright infringements. The company believes that such a “commercially safe” requirement is critical for corporate customers. Also, the company continues to stress that its tools are equitable to creators, ensuring that its customers need not worry about legal ramifications that could result from using other tools from AI startups.

However, Adobe was also cognizant of the comparison with these startups as it discussed Firefly’s strengths in an “Adobe Firely vs. Midjourney” article:

For Adobe, it was essential to build generative AI models that reflect Adobe’s creator-first commitment. To do so, the first model of Firefly trained on Adobe Stock imagery in accordance with the Stock Contributor License agreement, openly licensed content, and public domain content with an expired copyright. The goal of training Firefly like this is to avoid creating anything that infringes on the copyright of artists, photographers, and hard-working creators. In short, everything created in Firefly is designed to be commercially safe. – Adobe

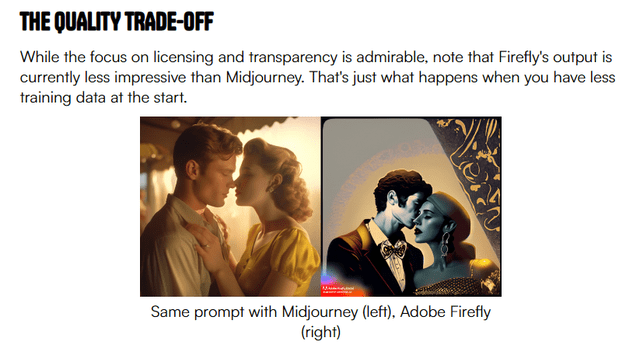

However, there are concerns with the level of quality in Adobe’s tools compared to the very high standards in the current versions of Stability AI and Midjourney.

Well-followed LinkedIn AI influencer Pete Huang shared in a late May post that Firefly’s output was “less impressive” than Midjourney’s output with the same prompt.

Adobe Firefly Vs. Midjourney image comparison (The Neuron )

However, Huang also highlighted that Firefly “can get better.” Therefore, it’s premature for Adobe naysayers to suggest that it’s an “old dinosaur” which could see its tools commoditized by the advents of image generation AI startups keen to take share rapidly.

Still, these concerns need to be observed. In a late May article, the Wall Street Journal WSJ highlighted that small business owners and individual professionals have been using image-generation AI tools to “boost their income.” Midjourney’s tool was highlighted in the article.

I think it’s reasonable to suggest that image-generation AI should help democratize creation for non-professional users. However, it’s too early to suggest that it could commoditize Adobe’s business model.

Adobe CTO Ely Greenfield argued that while it “might make photo editing more accessible,” professional creators are still expected to create more value with their exceptional storytelling. He added:

I can make really pretty images with it, but frankly, I still make boring images. When I look at the content that artists create when you put this in their hands versus what I create, their stuff is so much more interesting because they know how to tell a story. – NYT

Therefore, while the threats from new challengers are real, Adobe’s incredible innovation pack, leadership, and focus on being commercially safe should help it fend off these attacks to maintain its market dominance.

Moreover, ADBE’s valuation is still reasonable.

ADBE price chart (weekly) (TradingView)

If you have not added ADBE yet, I assessed that the stock would not likely revisit its lows in September 2022. However, the current price action is not ideal unless you typically buy into breakouts.

Dip buyers will likely wait for a pullback before adding more exposure. Therefore, if you prefer a more attractive risk/reward entry, consider waiting for a retracement first.

Despite that, ADBE’s forward EBITDA multiple of 21.1x is still below its 10Y average of 23.7x. As such, I think the opportunity is still reasonable, even though investors should consider layering in their purchases to take advantage of a possible dip after its recent sharp surge.

Rating: Buy.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ADBE, MSFT, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!