Summary:

- The eligibility of all Tesla, Inc. Model 3 and Model Y variants for the full $7,500 federal tax credit may boost sales, competitiveness, and growth prospects for Tesla in the electric vehicle arena.

- CEO Elon Musk faces allegations of insider trading and cryptocurrency manipulation, potentially leading to legal consequences, reputational damage, and negative impacts on Tesla’s stock.

- Musk stepping down as Twitter CEO to focus on Tesla generates positive sentiment among shareholders, but caution arises regarding potential distractions and shifts in priorities.

- Tesla faces a challenging 2023 due to a global economic downturn, loss of market share, competition, price cuts, and uncertainties in China.

- Tesla may benefit from its scale advantage with the establishment of new factories and increased production capacity. Also, price cuts can stimulate demand in the short term.

solarseven

Investment Thesis

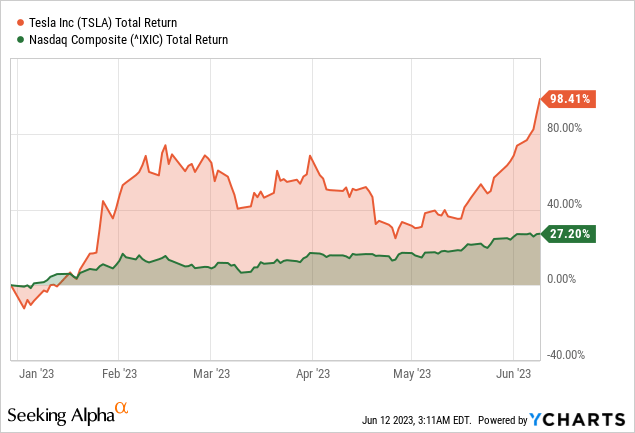

As Tesla, Inc. (NASDAQ:TSLA) embarks on its journey through 2023 with a 98% price return to date, the electric vehicle (“EV”) pioneer finds itself at the intersection of exciting opportunities and daunting obstacles.

On the bullish side, the eligibility of all Tesla Model 3 and Model Y variants for the entire federal tax credit, coupled with the company’s scale advantage and recent price cuts, promises increased sales and competitiveness. However, bearish catalysts loom, including Elon Musk’s legal battles, concerns about divided attention, and the challenges posed by a global economic downturn and intensified competition.

I had avoided Tesla stocks for years due to the unreasonably high valuations resulting from the EV hype. However, following the crash in 2022, TSLA was a no-brainer. Six months down the road, TSLA is one of the top-performing contributors in the Yiazou model portfolio, and I foresee more upside for the stock.

Model-3 EV Tax Qualification

The recent update regarding the eligibility of all Tesla Model 3 and Model Y variants for the full $7,500 federal tax credit for clean cars has significant implications for Tesla and the EV market. The credit may increase demand for Tesla’s Model 3 and Model Y vehicles. With the full tax credit availability, these EVs become more affordable, effectively reducing the purchase price. The affordability factor is crucial to driving consumer adoption of EVs by reducing the financial barrier. It can lead to a boost in sales volume for Tesla, particularly for the entry-level models that have seen a reduction in their post-tax credit prices. The increased demand may contribute to Tesla’s overall market share growth in the EV segment.

In addition to driving sales volume, the expanded eligibility for the federal tax credit strengthens Tesla’s competitive position against other EV manufacturers. Some competitors, like the Hyundai Ioniq 6 and Polestar 2, do not qualify for federal credit due to battery material sourcing and vehicle manufacturing locations. However, Tesla can now offer full credit to all its Model 3 and Model Y variants. This gives Tesla a pricing advantage and enhances its appeal to potential customers.

It is important to consider the evolving landscape of EV incentives and regulations when analyzing the impact of this change. The eligibility criteria for federal tax credits can change, and investors can expect requirements for critical mineral sourcing and battery component manufacturing to become more stringent by 2024. As a major EV player, Tesla will need to adapt its sourcing and manufacturing strategies to maintain eligibility for future tax credits. Compliance with these evolving requirements will be crucial for Tesla’s continued success in maximizing incentives and maintaining competitive pricing.

Furthermore, state-level incentives can further impact the affordability of Tesla vehicles. Customers in states with additional tax credits or incentives may experience even greater price reductions, making Tesla vehicles more attractive and affordable compared to gas-powered alternatives. Understanding these regional variations in incentives is important for evaluating the potential impact on Tesla’s sales and market penetration in different states.

Elon Musk & Insider Trading

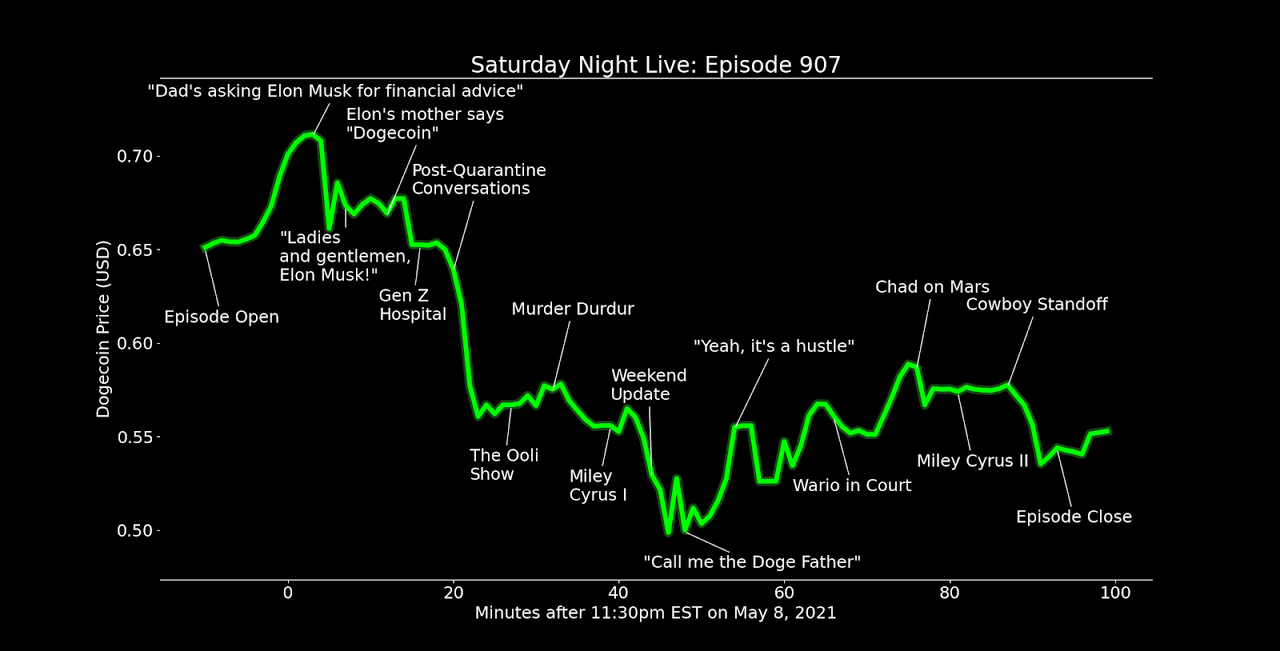

Musk, the CEO of Tesla, is facing allegations of insider trading and manipulating the cryptocurrency Dogecoin. These accusations have significant implications for both Musk and Tesla, potentially leading to legal consequences, reputational damage, and a negative impact on Tesla’s stock performance.

Of course, insider trading is illegal; if proven, Musk could face severe penalties, fines, and even criminal charges. The allegations of market manipulation and fraudulent practices could also harm Musk’s reputation as a prominent figure in the tech and business world, affecting his standing in Tesla and other ventures (such as SpaceX).

From an investor perspective, these accusations could undermine Tesla’s confidence and leadership. Shareholders may become concerned about the company’s governance and ethical practices, leading to a decline in stock value. Additionally, negative sentiment surrounding the allegations might impact Tesla’s ability to attract or retain new investors.

Furthermore, the accusations of insider trading and market manipulation could have long-term impacts on Tesla’s growth. Firstly, legal repercussions and regulatory scrutiny could divert management’s attention and resources from core business operations, hindering product development, innovation, and scaling up production. Also, if Tesla is perceived as being involved in unethical practices, it could lead to a loss of trust, impacting customer loyalty and sales.

Massive activity in Dogecoin during Musk’s appearance on SNL in 2021. (reddit.com)

The Twitter Effect

The recent announcement of Elon Musk stepping down as CEO of Twitter and assuming the role of chief technology officer for the social media platform has generated positive sentiment among Tesla shareholders. This move benefits Tesla’s stock, allowing Musk to devote more attention to his companies, Tesla and SpaceX.

However, Musk’s departure from Twitter may translate into something other than advantages for Tesla. It allows Musk to focus on other ventures, such as his new startup X.AI, potentially diverting his attention from Tesla. There are also speculations regarding Musk’s interest in developing an alternative to OpenAI’s ChatGPT, named “TruthGPT,” which could further shift his focus from Tesla.

Nevertheless, there are data points beyond the Twitter announcement that provide optimism for Tesla shareholders. For instance, lengthy wait times suggest that demand for Tesla vehicles remains robust despite increased competition in the EV market.

Furthermore, Elon Musk’s decision to consider advertising for Tesla marks a significant shift in the company’s strategy. Previously, Musk had dismissed the need for advertising, citing high demand for Tesla vehicles. However, increased competition in the EV space, coupled with rising interest rates, has led to price cuts by Tesla and potential margin pressure. Musk’s willingness to explore advertising demonstrates his recognition of changing market dynamics and the importance of capturing a larger population segment.

Musk’s departure from Twitter, perceived as a “lingering albatross,” may alleviate concerns and distractions, providing investors with a clearer view of Tesla’s performance and potential. The positive sentiment can translate into increased investor confidence and support for Tesla’s growth initiatives. On the other hand, Musk’s focus on other projects and competing with OpenAI’s ChatGPT may divert his attention away from Tesla. This potential shift in priorities could impact Tesla’s growth if Musk significantly veers from the company.

A Challenging 2023

In the face of a global economic downturn and high-interest rates, Tesla is anticipating a challenging year ahead. Musk has acknowledged the impact of the global economic environment on Tesla’s operations and financial performance but remains optimistic about the company’s ability to overcome these difficulties.

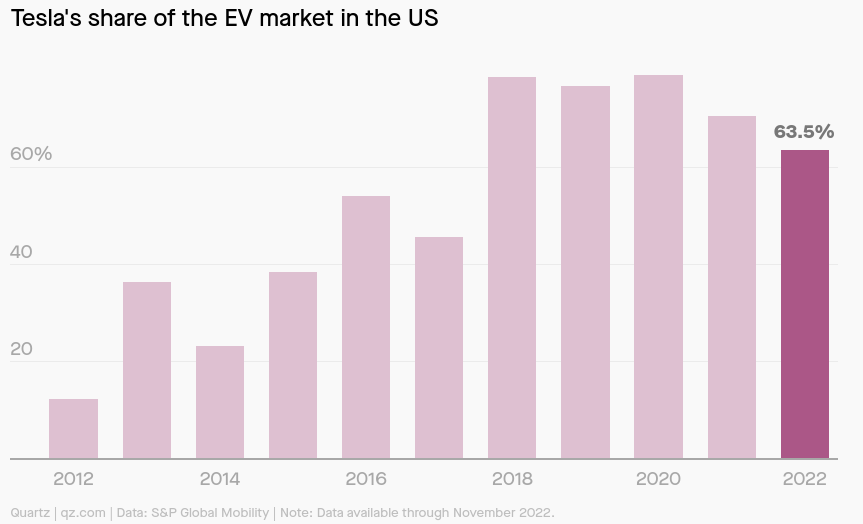

One of the key challenges Tesla is currently experiencing is a loss of market share in the US EV market. As more affordable EV options become available, Tesla’s dominance in the market is gradually diminishing. In 2021, Tesla held a market share of 70.5%, which dropped to 63.5% in 2022. Established automakers such as General Motors (GM), Mercedes-Benz (OTCPK:MBGAF), BMW (OTCPK:BMWYY), and Audi are intensifying their production of EVs, posing increased competition for Tesla. The availability of more affordable options, like the Chevrolet Bolt, is attracting consumers away from Tesla’s higher-priced models.

qz.com

Tesla has implemented significant price cuts on its vehicles worldwide to address this competition. However, concerns arise regarding weakened demand and the need for Tesla to compete in price, which contradicts its previous strategy of rarely offering discounts.

Another significant challenge for Tesla lies in its relationship with China. Elon Musk’s recent visit to China did not result in concrete deals or agreements for expanding Tesla’s Shanghai Gigafactory. This visit occurred amid deteriorating relations between Beijing and the West. While Shanghai officials expressed their support for Tesla’s expansion plans and welcomed new products and technologies, uncertainties persist regarding the regulatory environment and geopolitical tensions that could potentially impact Tesla’s operations in China.

Also, a weak global economy may result in reduced consumer spending, which may compress the demand for EVs, including those manufactured by Tesla. Additionally, higher interest rates can increase borrowing costs for Tesla, potentially influencing its expansion plans and overall profitability.

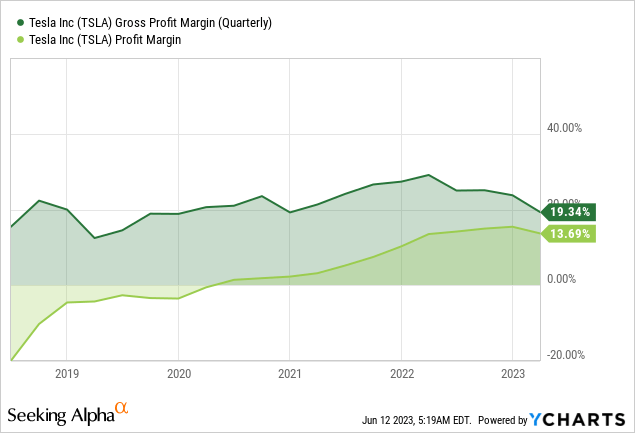

Moreover, Tesla is confronting heightened competition in the EV market. As highlighted in the article, Tesla’s market share in the U.S. has declined as new, more affordable options enter the market. Established automakers are ramping up their production of EVs across various price ranges, offering consumers choices. While price cuts can stimulate demand in the short term, they may also impact profitability. Offering discounts and lowering prices can attract buyers in the short run, but if demand fails to increase significantly, it could squeeze profit margins.

Despite these challenges, Tesla benefits from its scale advantage by establishing new factories and increasing production capacity. Expanding production in different locations may assist Tesla in meeting the growing demand for EVs and lower production costs.

Takeaway

In conclusion, while Tesla, Inc. faces various challenges in 2023, including increased competition, legal battles, and economic uncertainties, there are reasons to maintain a modestly bullish outlook for the company. The expanded eligibility for the federal tax credit enhances Tesla’s competitiveness and growth prospects in the EV market. Elon Musk’s focus on Tesla following his departure from Twitter could lead to more efficient decision-making and strategic planning. Finally, Tesla’s scale advantage, with new factories and increased production capacity, positions the company well to meet growing EV demand.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.