Summary:

- GameStop has struggled over the last several years, but has been improving its financials since Q2 2022.

- As of the most recent quarter, revenue was at $1,237.1M, EBITDA was at -$11M, operating income was at -$24.7M, and net income was at -$50.5M.

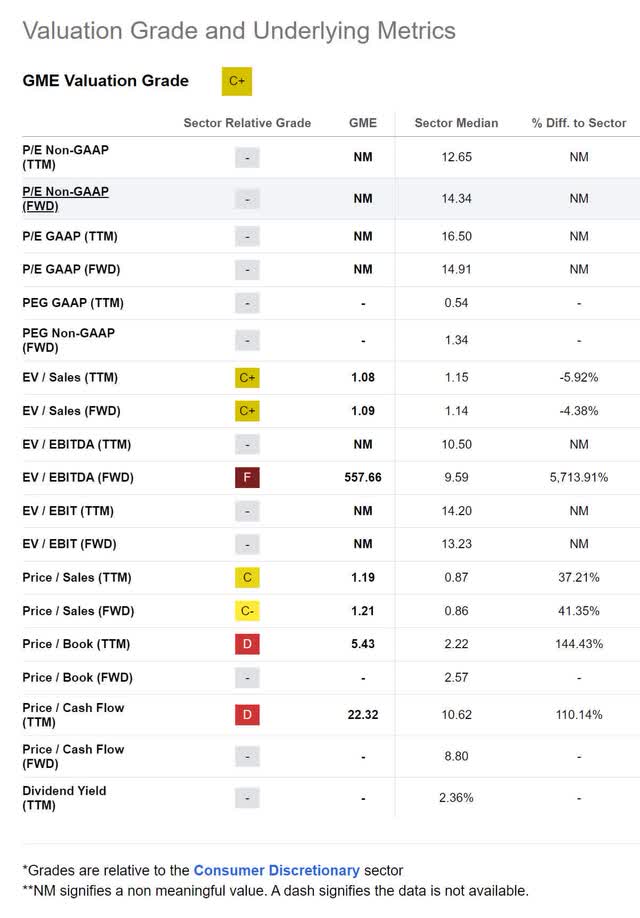

- With a forward EV/EBITDA of 557.66x, a trailing Price/Cash Flow of 22.32x, and a Price/Book of 5.43, I currently view the company as overvalued.

- I currently rate the GameStop as a Hold.

Brandi Lyon Photography

Thesis

GameStop (NYSE:GME) used to be an attractive investment before it fell on hard times. The revenue declines caused by increased competition sent operating income into the negative as many investors labeled the company as walking dead. However, the short squeeze and subsequent capital raise that both occurred in 2021 breathed new life into the company. I occasionally check in on them because I believe they may be able to find profits again. After looking over the present state of their financials, I currently rate the company as a Hold.

Company Background

GameStop is an international video game, consumer electronics, and gaming merchandise retailer. The company operates roughly 4,400 stores in the United States, Canada, Australia, and Europe. They operate under many brands, including GameStop, EB Games, EB Games Australia, Micromania-Zing, ThinkGeek and Zing Pop Culture brands. The company is currently headquartered in Grapevine, Texas and was originally founded in 1984 as Babbage’s. They adopted the GameStop name in 1999.

The company sells video games and gaming consoles. Their business model has them selling used games, they stay stocked by letting customers trade in pre-owned games for either cash or credit. As of their last annual report, the company also has a loyalty program with over 56.7M members called PowerUp Rewards; 5.6M of which pay to be pro members.

Long Term Trends

The global gaming market is projected to have a CAGR of 13.2% through 2028. The global consumer electronics market is estimated to experience a CAGR of 4.62% until 2030. The gaming accessories market has a projected CAGR of 12.2% globally through 2030, and 10.5% within the United States. The global gaming console market is expected to grow at a CAGR of 7.2% through 2028.

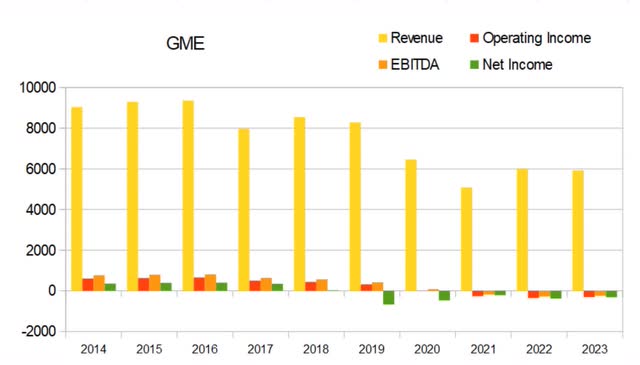

Annual Financials

Before I go into their annual financials, I should note that their annual reports always land at the beginning of the following year. This results in most of the business for a calendar year being labeled as occurring in the following year. This is why 2023 shows up on the charts; it covers operations from January 2022 to January 2023. References within this section are always as the years are labeled and not how they fall on the calendar year.

Annual revenue has been dropping over the last decade. In 2014, it was at $9,039.5M. By the most recent annual report, that had fallen to $5,785.9M. This represents a 35.99% drop in revenue.

GME Annual Revenue (By Author)

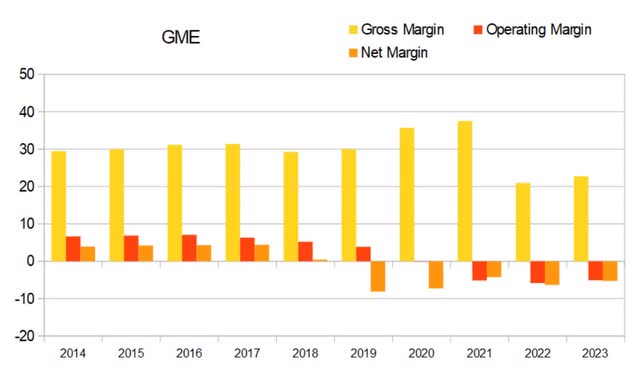

Their margins used to be quite stable but experienced a disruption in 2018. Net margins fell into negative values in 2019 and operating margins joined them a year later in 2020. As of the most recent annual report, gross margins were at 22.74%, operating margins were at -5.09%, and net margins were at -5.28%.

GME Annual Margins (By Author)

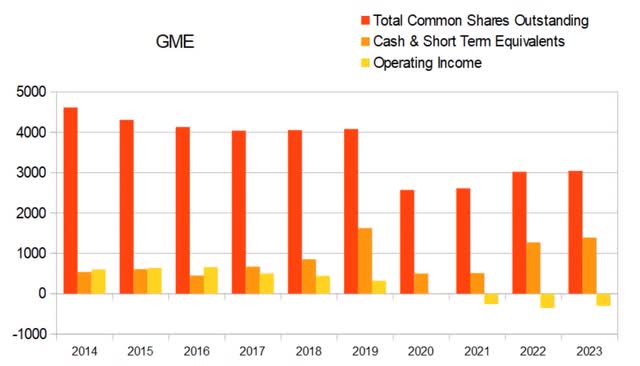

The company has a culture of buying back shares when they find them affordable, and diluting when the shares are overvalued. Raising cash when it would hurt shareholders the least and buying shares back whenever it is convenient, is exactly the type of behavior one wants to see if they are planning on holding long-term. As long a company can deploy their capital effectively, capital raises when the share price is overvalued should be looked at as a positive.

GME Annual Share Count vs. Cash vs. Income (By Author)

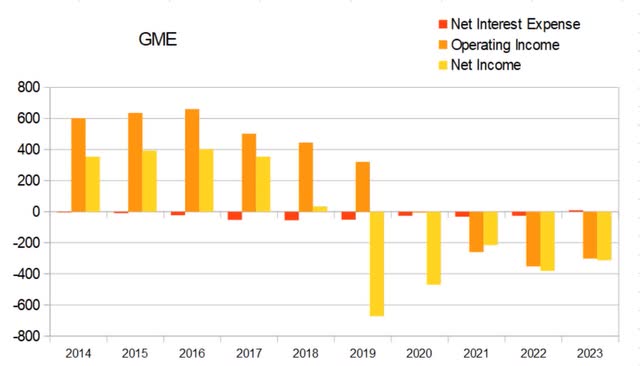

Their net interest expense rose significantly during 2016 and 2017. This has slowly diminished, and even turned positive in 2023. As of the most recent annual report GameStop had $616.6M in total debt, $1,390.6M in cash & equivalents, and an annual operating income of -$301.6M.

GME Annual Net Interest Expense (By Author)

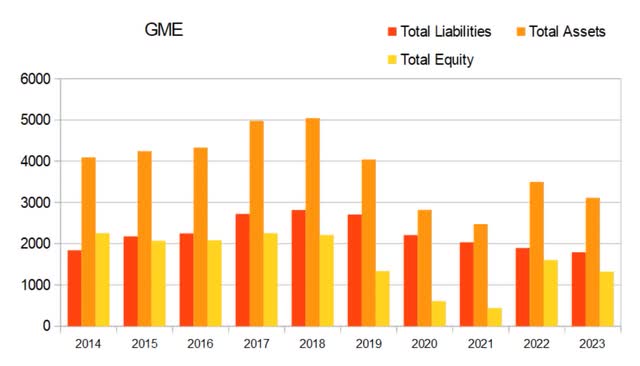

Total equity fell significantly from 2019 through 2021, but rose sharply in 2022. This was the result of the post-squeeze offering which was completed in June 2021.

GME Annual Total Equity (By Author)

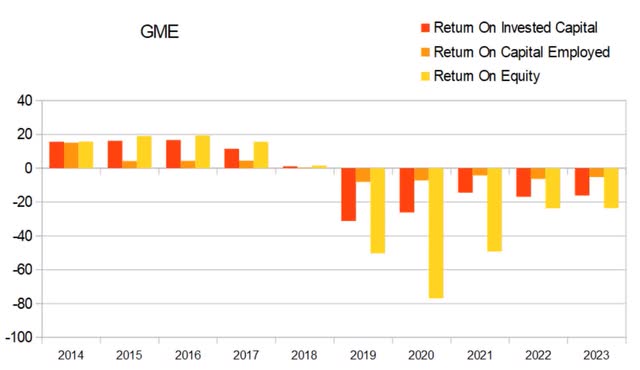

Until their downturn, they were experiencing attractive returns. Returns went negative in 2019 and reached a bottom in 2020. As of the most recent annual report ROIC was at -16.15%, ROCE was at -5.28%, and ROE was at -23.68%.

GME Annual Returns (By Author)

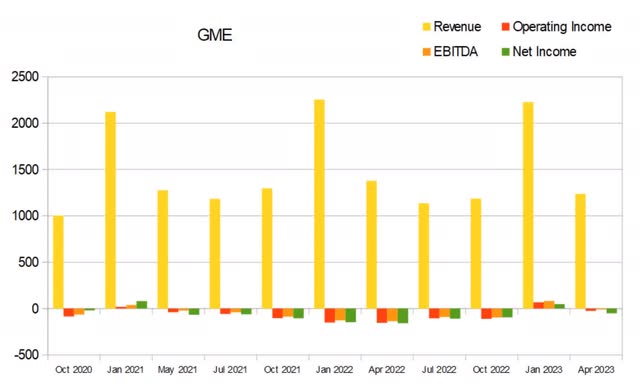

Quarterly Financials

Their quarterly revenues are showing significant variance from seasonality, but are otherwise fairly stable. As of the most recent quarter, revenue was at $1,237.1M, EBITDA was at -$11M, operating income was at -$24.7M, and net income was at -$50.5M.

GME Quarterly Revenue (By Author)

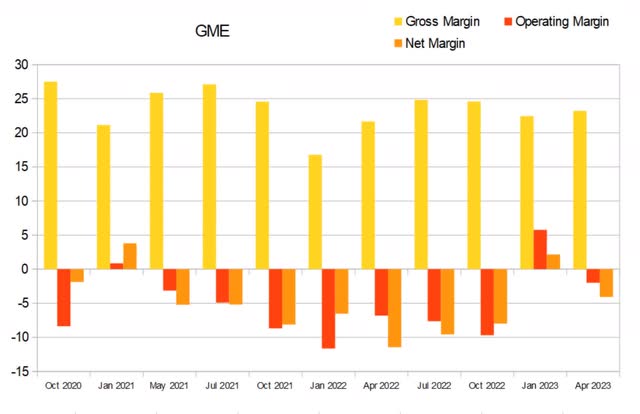

When looking at margins on a quarterly basis, it’s clear that the company has been experiencing significant margin instability. Operating and net margins fell into lows in 2022, but have shown some improvement in 2023. If this trend persists and margins restabilize at a more attractive value, GameStop becomes a far more attractive investment. As of the most recent quarter, gross margins were at 23.22%, operating margins were -1.99%, and net margins were at -4.08%.

GME Quarterly Margins (By Author)

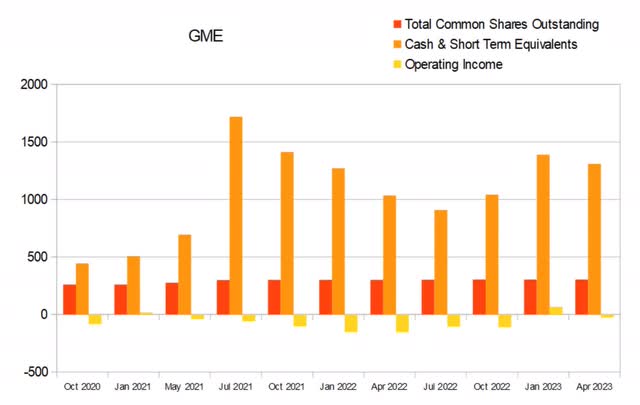

Total common shares outstanding has remained fairly stable since the offering that ended in June of 2021. For the quarter ending October 2021 total common shares outstanding was at 302M. By this most recent quarter that had risen to 304.4M, representing a 0.79% rise. Their cash position rose sharply with the offering, but later dropped until it found a low in July of 2022. As of the most recent quarter, their cash and short term investments were at $1,310.1M.

GME Quarterly Share Count vs. Cash vs. Income (By Author)

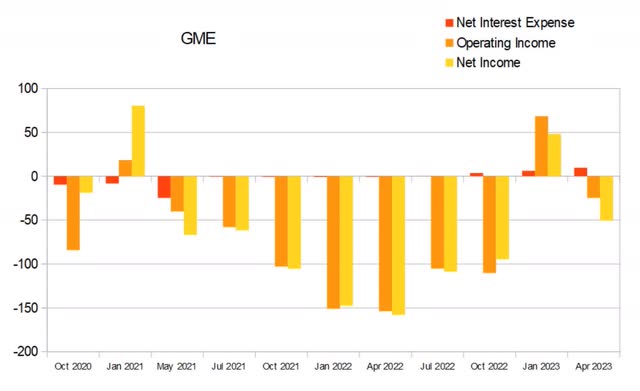

Their net interest expense has been improving. As of the most recent quarterly report, GameStop had $650.5M in total debt, $1,310.1M in cash & equivalents, and a quarterly operating income of -$24.7M.

GME Quarterly Net Interest Expense (By Author)

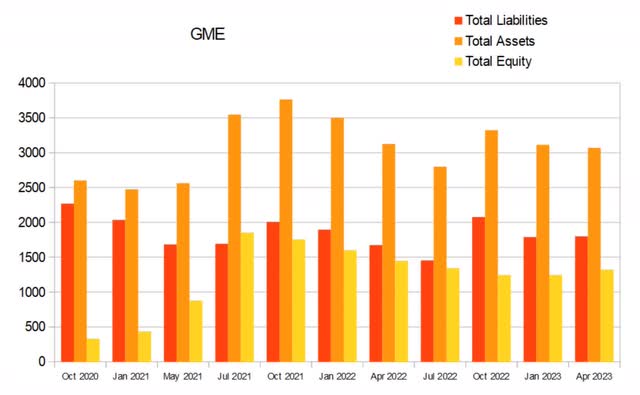

Their total equity rose significantly in 2021, but later fell. It found a new low in October 2022 and has since risen to $1,271.6M.

GME Quarterly Total Equity (By Author)

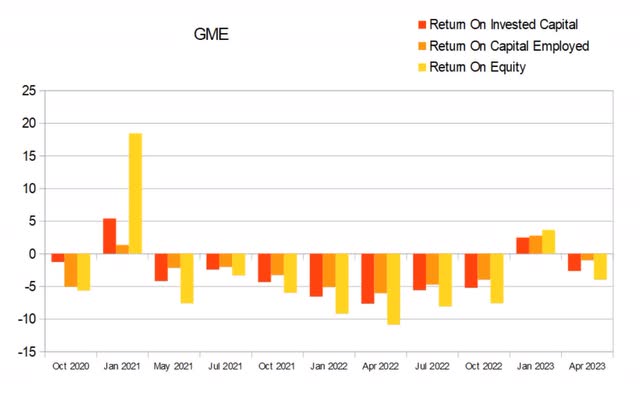

Their quarterly returns chart is the single most attractive aspect of their financials. All three return values found lows in April 2022 and have been trending upward since then. Similar to my comments about their margins, if the values for these returns stabilize into positive values, the company would look far more attractive as an investment. I typically look for annual returns above 10% and quarterly returns above 2.4%. As of the most recent quarter, their ROIC was at -2.63%, ROCE was at -1.01%, and ROE was at -3.97%.

GME Quarterly Returns (By Author)

Valuation

As of June 12th 2023, GameStop had a market capitalization of $6.91B and traded for $424.30 per share. With a forward EV/EBITDA of 557.66x, a trailing Price/Cash Flow of 22.32x, and a Price/Book of 5.43, I currently view the company as overvalued.

GME Valuation (Seeking Alpha)

Risks

Because of its present business model, GameStop has exposed itself to changes in the demand of gaming consoles and their games. The competitive pressures that drew away a significant portion of GameStop’s revenue still exists. I used to play on both consoles and PC. I now exclusively use a PC and have had the same Steam account for over 15 years. With the number of mods that are available on PC’s which aren’t available for console players, and the lack of high-quality strategy games on consoles, I for one, am not switching back. This risk could be mitigated if the company were to successfully launch a viable competitor to Steam.

Catalysts

GameStop is blessed with high brand recognition and has the potential to draw in a large number of investors and traders, so if it manages to improve its financials it is extremely likely to experience a significant rally. If they manage to sustain these potential future strong financials, the post rally cool-off is likely to establish a new higher low and then begin taking on a bullish sentiment and grinding higher.

A significant rise in demand could produce profits without an efficiency increase. With gross margins currently in a stable range between 20% and 25%, a large enough revenue increase has the potential to grow gross income to the point where operating margins are pulled up into positive territory.

Conclusions

Overall, GameStop has not improved their financials enough for me to consider becoming a buyer. However, they are improving to the point that it is clear I need to begin checking in on the company more often. With their quarterly returns significantly better than their corresponding quarter the previous year, it’s clear they have been trending toward positive territory.

With the company currently posting negative operating margins, I would not want to take part in their cash burn rate. As they improve their financial situation, they are likely to become a viable turnaround play. As is, I think their business model faces too many competitors with better margins and easier access to customers. So, I don’t think they are investible long-term without dramatic cost efficiency improvements or some kind of adaptation involving an expansion into new forms of revenue.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.