Summary:

- Meta Platforms has experienced a remarkable rebound in its stock price, outperforming competitors such as Alphabet, Amazon, and Snapchat.

- Key factors contributing to Meta’s success include strong cash flow, robust advertising revenue, regular product updates, advancements in reality labs, potential in Chinese markets, and a focus on efficiency.

- The company’s cash flow growth, advertising revenue, e-commerce initiatives, and product updates.

- Despite positive aspects in Meta’s investment thesis, the stock may be slightly overvalued at its current price, leading to a Hold rating.

- The company faces regulatory challenges and competition in the emerging Metaverse space, which pose risks to its long-term prospects.

Kira-Yan

Introduction

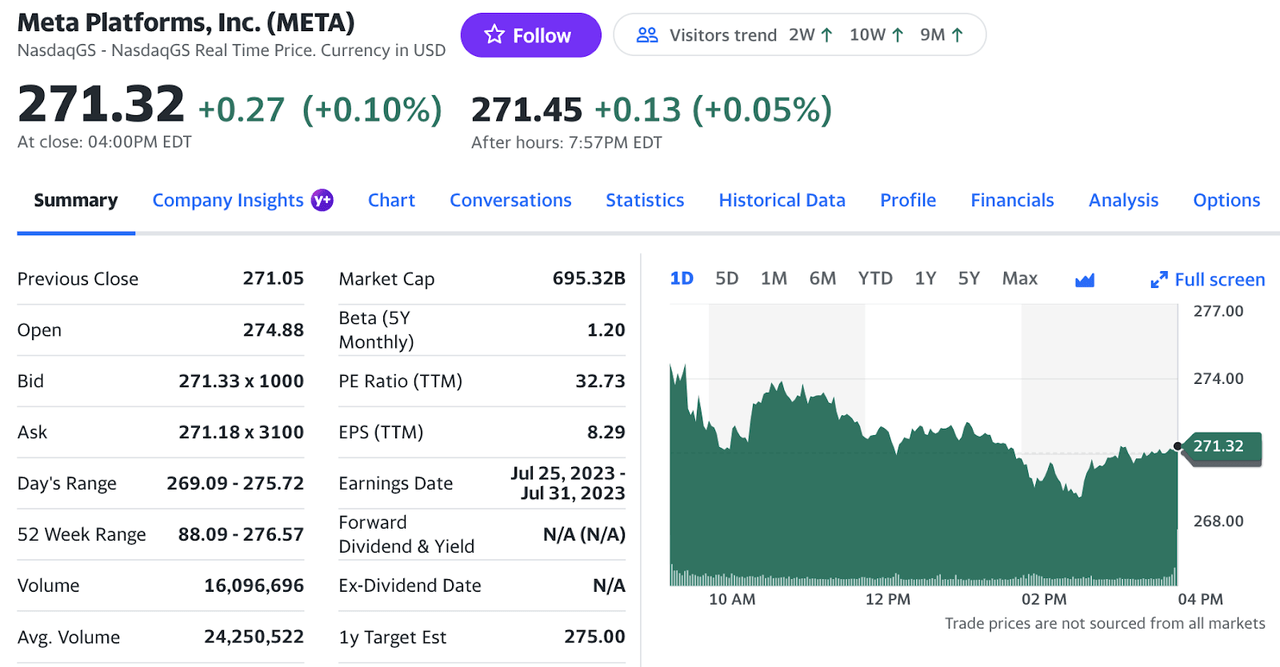

Meta Platforms (NASDAQ:META) experienced a remarkable rebound as its stock price surged from a 52-week low of $88.04 to $264.95. This impressive performance raises the question of how Meta managed not only to outperform the market but also surpass competitors such as Alphabet (GOOG, GOOGL), Amazon (AMZN), and Snapchat (SNAP), whose stock prices plummeted from all-time highs of $83.11 to $10.09. The reasons behind Meta’s success can be attributed to several key factors, including strong cash flow, robust advertising revenue, regular product updates, advancements in reality labs, potential in Chinese markets, and a focus on efficiency. However, despite these positive aspects in Meta’s investment thesis, it is worth noting that, at its current price of nearly $265 and with a P/E ratio of over 30, the stock may be slightly overvalued, as I will discuss further in this article. Therefore, I assign a Hold Rating to META.

Yahoo Finance

Investment Thesis

Over the past 10 years, Meta has consistently exceeded investor expectations by growing its cash flow from $370 million to over $39.1 billion in 2021. Despite a decline to $19 billion in 2022 due to restructuring costs, Meta’s robust cash flow reserves enable the company to focus on three key areas: strategic acquisitions, R&D investments, and balance sheet improvement.

Advertising remains Meta’s primary revenue stream, driven by its Family of Apps, including Instagram, Facebook, and WhatsApp. Meta has also introduced e-commerce advertising options, allowing businesses to sponsor product-related digital catalog listings. Additionally, the company is yet to fully capitalize on Instagram Reels as a growth driver.

Released in March of 2023 (currently available only in the U.S., Australia, and New Zealand), Meta Verified allows users to get verified with a government ID, proactive account protection, access to direct account support, and other exclusive features such as stickers & 100 Stars per month to reward their favorite creators. Meta Verified is available for $14.99 USD/month (iOS/Android) or $11.99 USD/month on web (Facebook only). According to CivicScience’s latest data, 6% of U.S. adults who use either Facebook or Instagram say they’re very likely to sign up for Meta Verified (12% somewhat likely), which could result in at least a $2 Billion increase in Revenue per month.

Meta has streamlined digital retail with the launch of Facebook Marketplace (800 million users) and Instagram Shops. The company’s growth in this area is expected to match or outpace the broader e-commerce market.

To compete with TikTok and leverage its network effect, Meta introduced Instagram and Facebook Reels, offering short, entertaining videos that promote creativity and brand engagement. The platform has also added new features, such as image carousel ads and the ability to target followers directly. With Instagram’s user base projected to grow steadily, Reels is expected to play a vital role in capturing more engagement and driving revenue. Reels played across Facebook, and Instagram has more than doubled over the last year, while the social component of people resharing Reels has grown even faster and has more than doubled on both apps in just the last 6 months.

WhatsApp Direct to Message is crucial to Meta’s growth strategy. By providing a seamless communication channel for businesses to interact with customers, WhatsApp is set to enhance customer engagement and support e-commerce activities. AirFrance started using WhatsApp to share boarding passes and other flight information in 22 countries and in 4 languages. Businesses often tell that more people open their messages and they get better results on WhatsApp than on other channels. As of October 2021, WhatsApp had over 2 billion monthly active users, and the number is projected to grow steadily, reaching over 2.5 billion by the end of 2023.

Automation is Meta’s bet to increase the performance of ads across its ecosystem. In Q4, the company released new ad formats and placements for Facebook, Instagram, and Messenger powered by machine learning. Meta’s use of machine learning and AI, such as Advantage+ shopping campaigns and Advantage Custom Audiences, has streamlined the advertising process on its platforms. By automating ad targeting and utilizing data more effectively, Meta aims to improve ad performance and lessen reliance on manual targeting. The use of AI could eliminate privacy issues and increase versatility in the use of user data.

Meta introduced 4 new ad placements for Instagram, adding another set of monetization: Ads in Explore Home, In-profile ads, Multi-advertiser ads, and Augmented reality (AR) ads.

Instagram is experimenting with an ad revenue-sharing program for select US creators, allowing them to earn revenue from in-profile ads. This program aims to inspire creators to produce more original content, attract new users, especially younger demographics, and sustain platform engagement. Additionally, Instagram has broadened subscription access for eligible US creators and is testing a “Gifts” program for Reels, allowing audiences to send virtual gifts or donations.

Meta’s vast user base and messaging platforms like Facebook Messenger and WhatsApp offer significant potential for click-to-message ads. These ads allow businesses to engage users directly and personally, using Meta’s advanced targeting and rich metadata. By catering to the growing preference for instant communication, click-to-message ads can improve user experience, and conversion rates, and drive revenue growth for Meta in the digital marketing landscape.

With acquisitions like Oculus and substantial investments in R&D, Meta is positioned as a VR industry leader. Meta aims to dominate the VR market, having a projected market value of $87 Billion by 2030, and establish a foundation for the Metaverse. Through its investments and innovations, Meta is shaping the future of virtual reality.

Meta has introduced product enhancements to enhance user experience and content creation. Instagram now allows “Professional” accounts to schedule posts up to 75 days in advance, simplifying account management for brands and creators. Content moderation alerts can be previewed before uploading, reducing the risk of demonetization. Meta is also testing digital collectibles for creators, potentially accelerating VR growth.

Meta’s focus on the Metaverse and VR social media platforms presents an opportunity to re-establish itself in China. Tencent has shown interest in bringing Quest 2 headsets to the Chinese market, which would grant Meta access to one of the world’s largest technology markets. This potential entry into China overcomes challenges faced since Facebook’s ban in 2009.

In its call for a “year of efficiency,” I project Meta’s ongoing layoffs, totaling 21,000 employees, to save the company $6.5-$8 billion in costs. This restructuring improves cash flow, margins, and the balance sheet while allowing continued investment in the Metaverse. Meta’s adaptability and innovation are showcased through these measures.

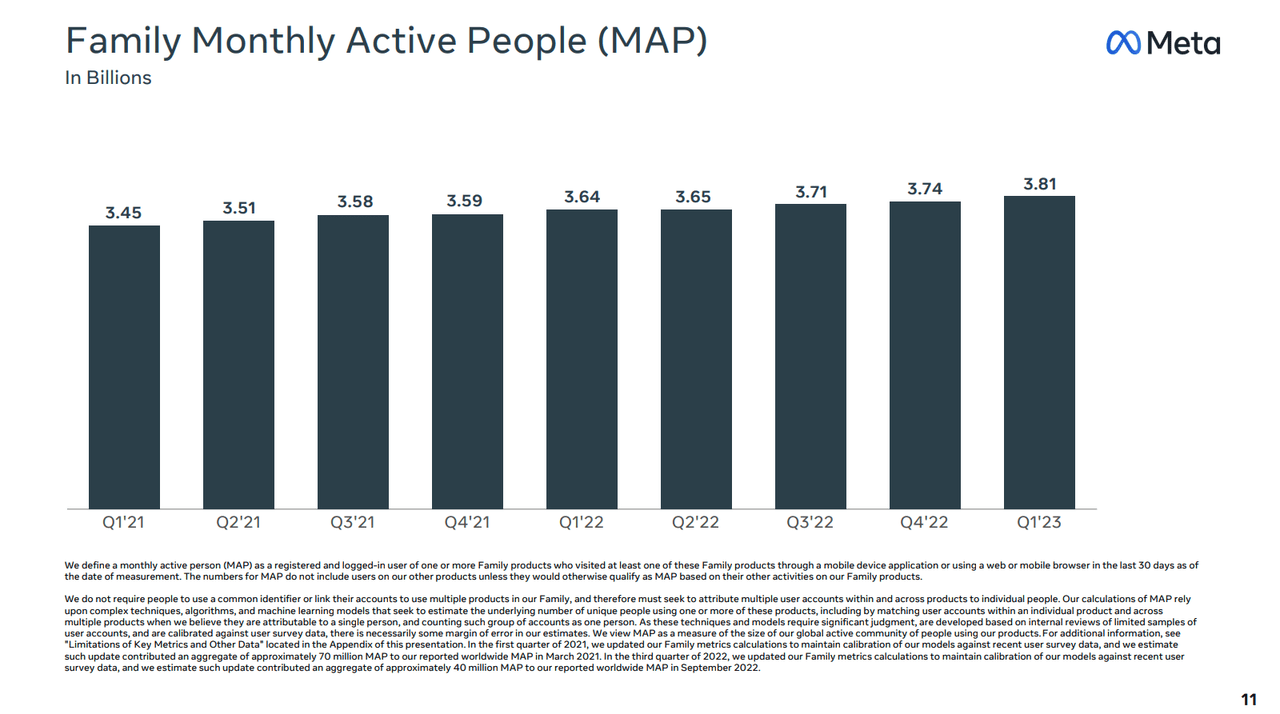

Competitive Advantage

With a user base of approximately 3.81 billion across Meta Platforms, Inc., the company benefits from a strong networking effect. This extensive user base provides ample opportunities for monetization through commercial marketing tools like Facebook Marketplace and Instagram Shop. Meta is recognized as the most-used network for marketing by 93% of social marketers, highlighting its competitive advantage in reaching a wide audience.

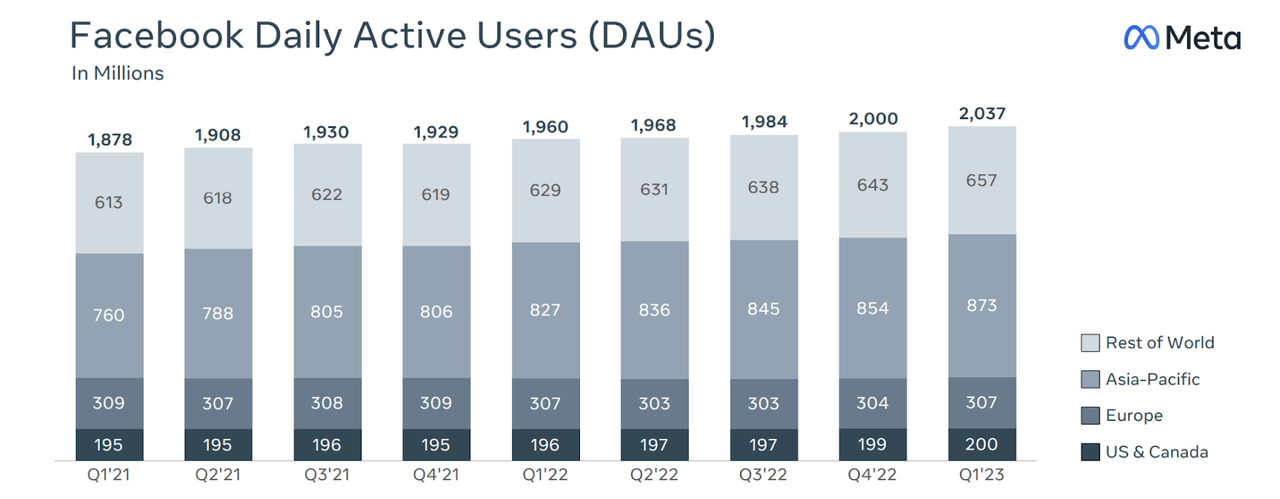

2023 Q1 presentation (Meta)

Meta’s vast collection of metadata across its platforms allows businesses to optimize their outreach ROI. By leveraging user data, Meta enables effective targeting and personalization, resulting in higher revenue generation.

Meta’s strong brands, including FoA (Facebook, Instagram, WhatsApp) and Reality Labs, provide significant prominence in a competitive landscape. These recognizable brands give Meta a competitive advantage, especially in international markets where Facebook is widely known, strengthening its position in emerging markets.

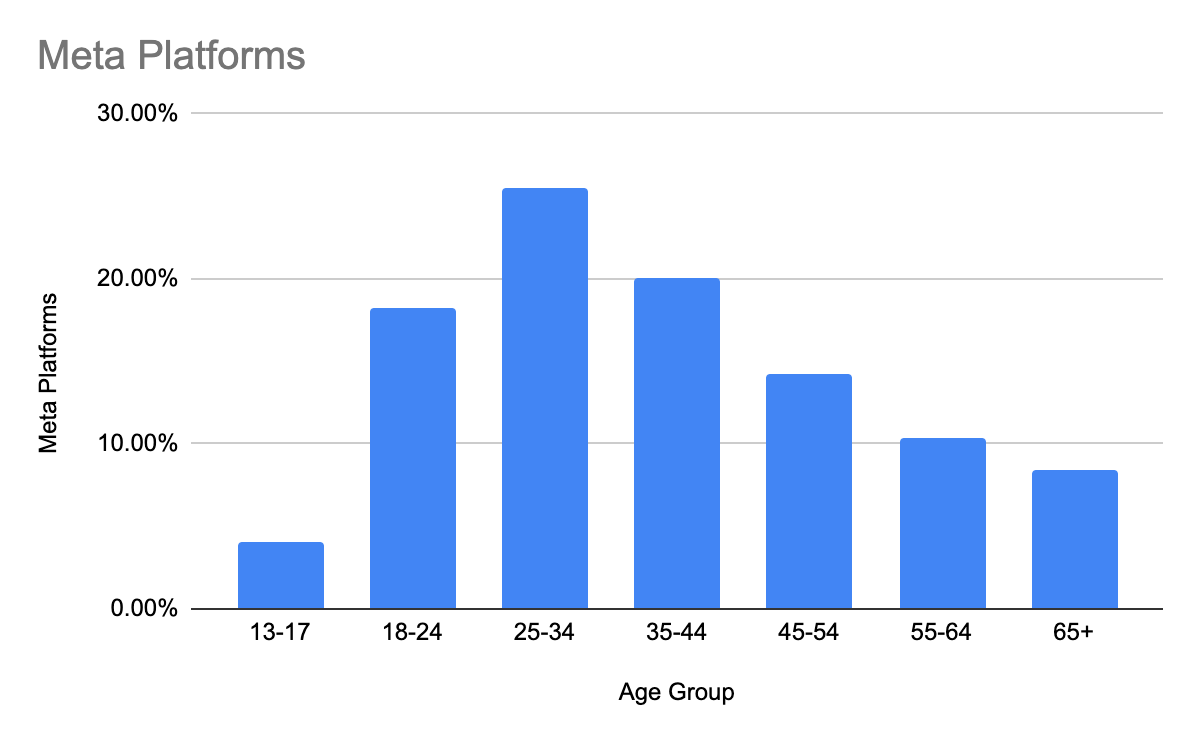

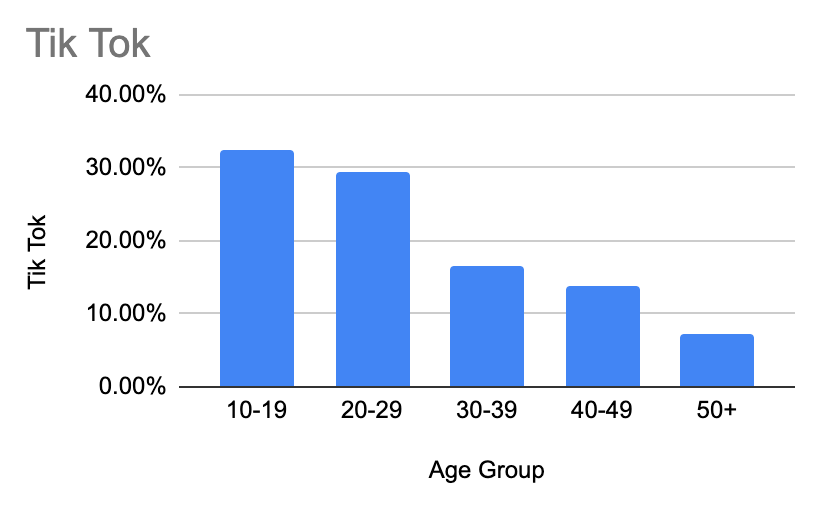

TikTok Versus Reels

TikTok, Meta’s emerging rival, has rapidly gained popularity with over 1 billion monthly active users (MAU). However, Meta Platforms maintains a significant advantage with a total user base of 3.81 billion MAU across its social networks, including Facebook, Instagram, WhatsApp, and Messenger. There is a notable contrast in the targeted audiences and services offered by Meta’s platforms, with Instagram and Facebook appealing to individuals in their late 20s to mid-thirties, while TikTok focuses on the younger generation, particularly those aged 18-24.

Author’s graph (Sheets)

Author’s graph (Sheets)

Recent legislative actions pose a threat to TikTok’s growth in the US market. The introduction of a new bill aims to simplify the process for the US government to restrict access to the platform, potentially eliminating TikTok from the US market. This provides an opportunity for Meta to capture a larger share of the social media landscape. Furthermore, the No TikTok on Government Devices Act, passed in December 2022, requires the removal of the TikTok app from executive branch IT systems. These legislative actions highlight the challenges TikTok faces in the US market and present potential opportunities for Meta to capitalize on the changing dynamics.

Userbase Saturation

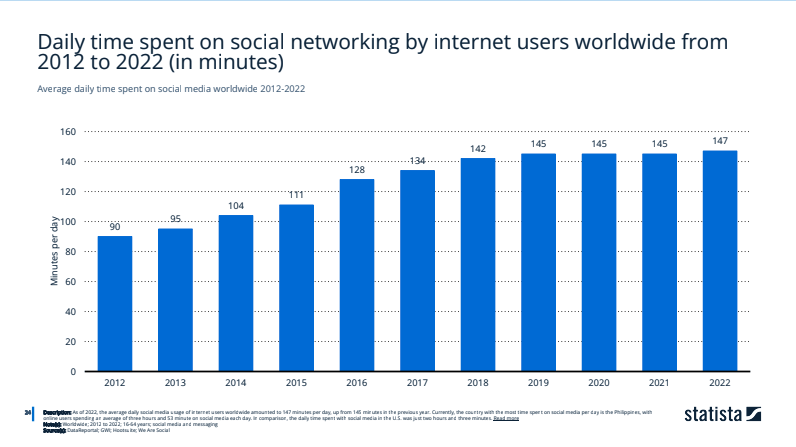

Many have pointed toward a concern toward META’s userbase saturation, but these concerns have yet to realize as the company pushes quarter after quarter with daily active user increases in the tens of millions. This accompanies an increase in daily time spent on social networking platforms.

2023 Q1 Presentation (Meta)

Statistica

Risks

Meta faces regulatory challenges due to its influential digital presence, being the target of anti-trust lawsuits and privacy concerns. Regulations such as Apple’s IOS updates, costing the company an estimated $10 Billion in 2022, and GDPR have restricted user tracking and impacted ad targeting, resulting in potentially negative effects on ad budgets and revenue for Meta.

Meta relies heavily on digital advertising, accounting for 98.5% of its revenue. This dependence exposes the company to market fluctuations and exchange rate volatility, making it susceptible to industry innovation and changes.

The emergence of the Metaverse, a platform for immersive user connection and collaboration, introduces competitive challenges from companies like Microsoft. This poses uncertainty for Meta in terms of long-term production and development, potentially overshadowing its position in the market.

Valuation

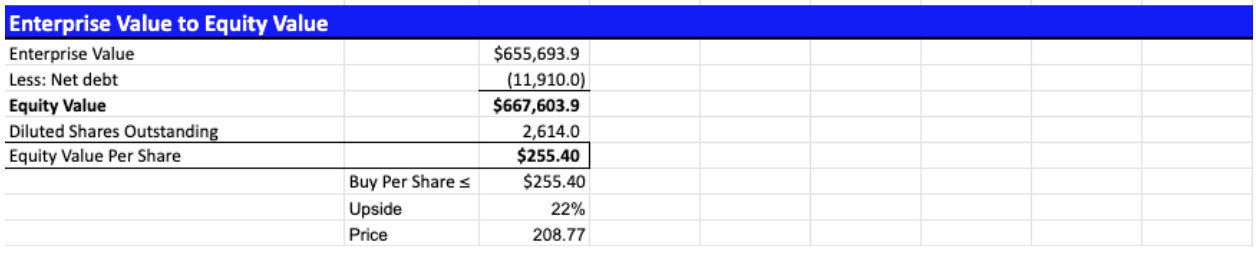

My target price for Meta Platforms represents a $255.40 per share (Base Case Scenario), constituting a -3.6% ROI was evaluated through a foundation on a discounted cash flow *Did not use relative valuation analysis given that many of Meta’s comparable competitors have either lost their status of profitability or have discontinuities in their profitability, meaning their margins have changed likely due to an abnormality not found in past years and likely to not occur in years following. Examples include Amazon, Snapchat, and Pinterest.* I arrived at my target price through the following assumptions:

Assumes consistent net margins of 33.3% (average 5-year) accompanied by 1-5 cash flow CAGR of 19.35% y/y (expected rebound in numbers from the 50% decline last year which were largely due to “restructuring costs”/PPE added to Meta’s “year of efficiency”), and a terminal growth rate of 6% (regulatory pressure saturates digital advertising markets, but is combatted by the rapidly growing VR industry, resulting in a conservative terminal growth rate of 6%) with an 8.3% WACC.

Assumes consistent cash & security levels of ~$30-40 Bn…Used a -2% growth in cash & cash equivalents as Meta takes a heavy investment into VR/Metaverse.

Assumes mid-level dominance within the VR industry as monetization of virtual creativity and market competition with Sony & Microsoft persists accompanying the entrance of Apple.

author’s own calculation (Excel)

Although the company has great fundamentals, at this price, it’s worth waiting. Any price sub- $250 would be a good buy point, but at the current price of $264.95, starting a small position if one has yet to be created or holding for the long term seems a logical plan of action.

Analyst Recommendation by: Mehul Singh

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.