Summary:

- I have been pounding the table stating Exxon Mobil Corporation stock has topped out since the start of the year.

- What’s more, the proof is in the pudding, the stock has gone nowhere for the entire year.

- Even so, I do believe the tide will turn regarding the price of oil in the coming months. This bodes well for energy stocks.

- That is why I took profits on my Exxon Mobil position and with them bought higher-yielding energy stocks with significant upside potential instead.

jetcityimage

What Goes Up Must Come Down

When thinking about Exxon Mobil Corporation (NYSE:XOM) stock’s current status, a famous quote from Sir Isaac Newton comes to mind. Newton famously said, “What goes up must come down.” In the investment world we call this phenomenon Mean Reversion or “reversion to the mean.”

Mean Reversion explained

According to Investopedia the definition of Mean Reversion is as follows:

Reversion to the mean involves retracing a condition back to its long-run average state. The concept assumes that a level that strays far from the long-term norm or trend will again return, reverting to its understood state or secular trend.

This theory has led to many investing strategies that involve the purchase or sale of stocks or other securities whose recent performances have differed greatly from their historical averages. However, a change in returns also could be a sign that a company no longer has the same prospects it once did, in which case it is less likely that mean reversion would occur.”

With Exxon Mobil shares up over 200% in the past couple of years and trading 32.5% above their long-term average state, an argument can be made that XOM stock is due for a major pullback, on the mean reversion thesis alone.

Exxon Mobil Long-Term Chart

Finviz

Nonetheless, there are several other reasons why the stock may have topped out and be primed for a pullback. The primary reason is the fact the stock hasn’t been able to break out of the current range for the better part of a year regardless of how great the news has been about the Guyana discovery, etc.

Exxon Mobil Current Chart

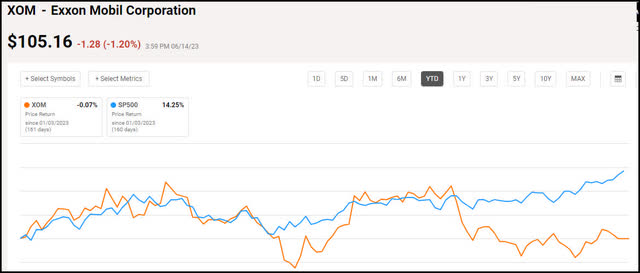

If you review the current chart, it is easy to see Exxon has topped out. Moreover, it’s been unable to break above the current level while first quarter net income more than doubled to $11.43 billion from $5.48B year-over-year, according to Seeking Alpha News. In fact, Exxon Mobil’s stock has vastly underperformed the S&P 500 Index (SP500) for all of 2023.

Exxon Mobil Vs. S&P 500 Chart

The S&P 500 is up 14% while Exxon is flat for the year. One of the issues is the fact that oil prices have not cooperated with the bull case whatsoever this year.

Crude Oil Chart

Back in November of 2022 I penned a public article titled, “Exxon Mobil: Be Fearful When Others Are Greedy.” This article marked the sale of the Exxon Mobil position in my Seeking Alpha Income Investing Group Service. I took a lot of heat from most readers, as a majority of investors were still firmly planted to the bull camp at the time.

The tight supply/demand situation was supposedly due to remain in perpetuity. The China reopening was going to increase demand, OPEC+ cuts were set to decrease supply, and the Biden administration’s policy regarding fossil fuels would put the final nail in U.S. oil production’s coffin.

Well, one thing I’ve learned over my 30 years in the oil patch and market, is when everyone is so sure one outcome is going the happen, usually the exact opposite happens. This time turned out to be no different. Nonetheless, guess what? I am now thinking oil could be on the verge of a comeback! No really! Let me explain.

Oil set for a rebound

At this point in time I believe oil (CL1:COM) may have bottomed. There have been several short term catalysts that have caused oil price to deteriorate in the near-term. Russian, Iranian, and Venezuelan oil has been hitting the market in greater quantities than first expected, increasing supply. Nevertheless, I expect the sanctioned oil hitting the market will soon decrease. They have been off loading current supply, yet, have made little to no invest in infrastructure and will soon see available barrels decrease substantially. This fact coupled with stricter enforcement of sanctioned oil should significantly cut back on the available barrels from these providers.

On top of this, U.S. oil driller underinvestment will soon become more and more of an issue. U.S. big oil majors like Chevron Corporation (CVX) and Exxon have been more focused on returning capital to shareholders than investing in new production. Saudi Arabia and OPEC+ are already producing as much as they possibly can, regardless of what they say concerning production cuts (it’s all smoke and mirrors).

Finally, I do expect demand to make a comeback in the coming years. China’s economy will come back online eventually. The U.S. economy should begin to make a comeback as well once we get past the current rate hike cycle.

So, why not buy Exxon Mobil here, or at least hold on to it? Because the fact of the matter is there are much better opportunities in the oil patch at present.

Current Energy Sector Buying Opportunities

Currently, I have several favorite picks based on either their capital appreciation or income providing potential. My top two upstream oil and gas producer picks are Diamondback Energy, Inc. (FANG), which offers a well-covered 9.3% variable rate dividend yield, and Devon Energy Corporation (DVN), which offers a 6.6% variable rate dividend yield presently. You can read full breakdown of each of these picks posted to my Seeking Alpha Income investing Group by clicking here.

FANG Current Chart

DVN Current Chart

Both FANG and DVN stock offer healthy variable dividends along with the opportunity for capital appreciation due to the current selloff in the stocks. Now let me wrap this article up.

The Wrap-Up

At this point in time, I feel Exxon Mobil stock has topped out. What’s more, the odds of a significant pullback are increasing by the day. I decided to take profits on my position and redeploy the proceeds into companies I believe have a better chance for upside and a higher yield.

If you are a buy-and-hold type, by all means keep holding. I don’t see Exxon Mobil going bankrupt by any means. I just don’t see them substantially increasing the dividend payout. What’s more, I believe odds are XOM stock is due for a reversion to the mean. This means there is a possibility of 32% downside from current levels. There are better opportunities out there presently than Exxon Mobil Corporation stock, in my opinion. Those are my thoughts on the matter, I look forward to reading yours.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DVN, FANG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join the #1 fastest growing new Income Investing Group! Our Portfolios are substantially outperforming the market!

We have opened up an addition 50 Charter memberships at the legacy rate! Memberships are going fast with 30 new members already signed up! We have 28 FIVE STAR reviews in the first few months!

~ Quality High Yield Income – Current Yield – 11.7%

~ SWAN Quality Income – Current Yield – 8.8%

~ High Quality Growth – Current gain – 22%

Join now for top income buys, timely macro insights, and a lively chat room! A portion of the proceeds are donated to the DAV (Disabled American Veterans).