Summary:

- Intel is in the middle of a challenging turnaround.

- Investors are expecting a recovery in the next 4 or 5 years.

- The new strategy IDM 2.0 will require substantial changes in the capital allocation.

- We believe Intel should stop its buyback program as a standard policy to set a solid base for long-term growth.

Chip Somodevilla

We rate Intel (NASDAQ:INTC) as a Buy as the company is working to recover its market position in its different business segments, focusing on foundry services as a strategic business segment of its long-term strategy IDM 2.0. In this article, we will explore why Intel has the odds in its favor for a successful turnaround that would benefit long-term investors if they buy at the current stock price. We will focus on what might be Intel’s future capital allocation, which is a critical factor for long-term sustainability, looking first into its past practices and comparing them with those of its main competitor in the foundry segment Taiwan Semiconductor (TSM). Reviewing the roadmap for Intel, CEO Pat Gelsinger’s past performance at VMware (VMW), and the company’s past capital allocation, we will try to determine if it is on the right track for a successful turnaround that finally rewards long-term investors.

Roadmap

In July 2020, Bob Swan, the former CEO, announced that the 7-nm node would be delayed, meaning a real problem for the company as it was losing competitiveness against TSM. This delay was critical as Intel was delaying the production of 5-nm and 3-nm process nodes as well, while TSM was announcing the start of its 3-nm production in December 2022.

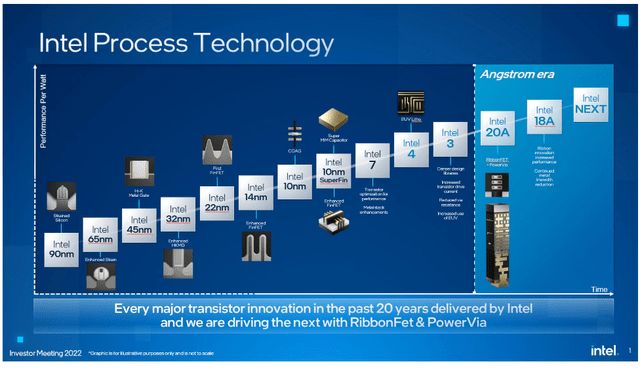

In a seemingly desperate move, Intel named Pat Gelsinger as its new CEO in January 2021 to start a turnaround that he would call IDM 2.0 (integrated device manufacturing 2.0). Looking at the chart below, we may notice that Intel has made a lot of efforts to reduce the gap with TSM by launching the Intel 10-nm SuperFin in order to compete with the 7-nm process node of TSM.

Then, the Intel 7 is not a 7-nm process node yet; it is still a 10-nm process but an enhanced version of the 10-nm SuperFin; and finally, the Intel 4, which is the 7-nm process node in which, for the first time, Intel is already using the EUV lithography equipment provided by ASML (ASML).

In the call for the last Q1 2023, Pat Gelsinger said:

Relative to five nodes in four years, notably, two out of these five nodes, Intel 7 and Intel 4, are now essentially done. Intel 7 is in high-volume manufacturing, and Meteor Lake on Intel 4 is ramping production wafer starts today for a second-half product launch.

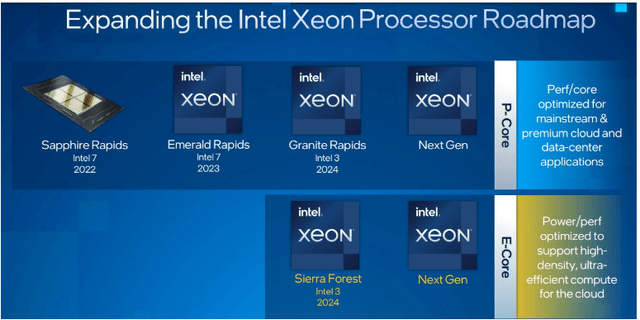

We are quickly mastering EUV technology with Intel 4 as our first EUV node. As we focus on the next three nodes, Intel 3 is on track and we highlighted in our recent DCAI webinar, Sierra Forest will begin shipping in the first half of ’24, with Granite Rapids shortly thereafter, both on Intel 3.

It’s clear that Pat Gelsinger is showing important advances in the roadmap related to Intel 7 and Intel 4, and now Intel is planning the next milestones for Intel 20A and 18A, according to his statements in the same last call:

We also have significant milestones planned in Q2 for Intel 3, Intel 20A and Intel 18A, and look forward to providing more details as we execute. Overall, we are squarely on track to deliver five nodes in four years. We understand that our foundry ambitions will not be realized overnight, building a vibrant foundry ecosystem will take time. But we also understand our foundry success is vitally important to establishing a geographically diverse and secure supply of semiconductors.

The ambitious plan can be seen in the Intel 3’s launch in 2024 through Granite Rapids and Sierra Forest with P-core and E-core processors, respectively:

Intel is working on improving the products’ performance in its different business segments, such as client computing, data center and AI, network and edge, mobile, and IFS, as the company has faced a global demand slowdown in the last few quarters.

Shareholders are expecting that Pat Gelsinger’s turnaround will establish a solid base for the company’s future value generation. In this sense, Intel is performing in a very hard and challenging sector like the semiconductor industry, where all the players, particularly those who offer foundry services, need to reinvest significant resources only to reinforce their competitiveness and keep their respective market positions.

Apparently, Intel has not invested enough money in its core businesses in the last 10 years; thus, the result is a turnaround that might cost around $100 billion for the company. Nevertheless, it’s important to notice that Congress passed the CHIPS Act in 2022 to give support to the American semiconductor industry, which strengthens the bullish case for this company.

Capital Allocation

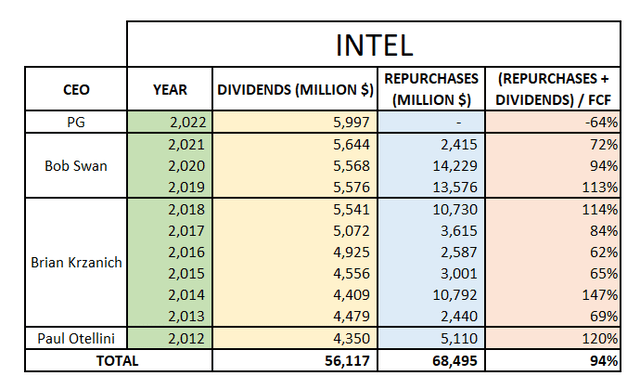

In the last 10 years, before Pat Gelsinger’s tenure, Intel used around $68 billion in share buybacks, and all that money could have been used in reinvesting into its core business to follow the technological advances of Taiwan Semiconductor; instead, the share buybacks policy failed to reward a significant capital appreciation to the shareholders while the company lost competitiveness in all those years. On the contrary, TSM stock delivered better capital appreciation than Intel in the same period without the need for a share buyback program in all those years and with a similar dividend yield.

Given the high capital requirements of companies that offer foundry services, these companies need to continuously reinvest in their own businesses to maintain their market position over time. As such, TSM has continuously reinvested in its core business, keeping its leadership holding a sustainable level of debt with dividend payments and without share buybacks. It seems that Intel is looking to follow this way of capital allocation, probably reducing its share buyback program (but not entirely) while making dividend payments as in the past without compromising its competitiveness.

Share buybacks and dividends

In the last 10 years, by paying a 3% annual dividend yield, Intel wanted to enchant dividend investors, who are usually attracted to companies that are in mature markets where there is not much more room to grow revenues. Nonetheless, the semiconductor industry is not a mature market since it actually requires industry players to push their own limits to keep advancing continuously. In the last 10 years, Intel has not only allocated a significant amount of money for dividend payments but also used a lot of its liquidity for share buybacks.

In the table above, we may see that from 2012 to 2021, Intel spent $56 billion in dividend payments and $68 billion in share buybacks, for a total of $124 billion combining both policies in that period.

It would have been truly beneficial for long-term investors if the company had used most of the money allocated for share buybacks in the last decade to reinvest more into the business; as a result, that more conservative policy would have reinforced Intel’s market position over the years without the need for a turnaround right now. Indeed, on average, 94% of the total free cash flow (FCF) generated by Intel in the last decade was used for dividend payments and share buybacks, so only 6% of the remaining FCF was used to invest in its own business. We are not surprised that Intel has needed to raise its total debt in the last decade from $13.4 billion in 2012 to $42 billion in 2022 to offset the lack of liquidity for adequate reinvestments.

Author, Annual Reports

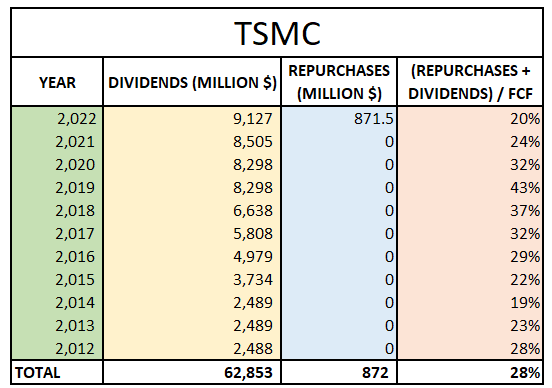

In the table above, we may see how TSM allocated its liquidity to maintain its market position over the last 10 years. In all this decade, TSM has not bought back its own shares except in 2022, at a relatively small amount of its FCF. In all these years, the company pleased its shareholders with dividend payments and used only an average of 28% of its FCF for that purpose. This meant that there was 72% of its FCF, on average, to reinvest into its core businesses, while its relatively low total debt increased barely from $1.1 billion in 2012 to $1.7 billion in 2022.

Without allocating money for share buybacks, TSM did not suffer any delays and could fulfill its own roadmap without major obstacles with a clear goal of being the most competitive in its sector, delivering, in the last 10 years, a total capital appreciation for its shareholders of 667% despite a dividend yield of around 2%, whereas Intel only delivered a total capital appreciation of 12.99% with a dividend yield of around 3% in the same period. TSM did not need a share buyback policy to deliver very good capital appreciation in its stock in the last decade. We think that Intel would end up following this path, not entirely cutting its repurchases, because it makes more sense in a very competitive sector like the semiconductor industry.

Buyback programs work differently at each company

Being well known for its strong share buybacks, Apple (AAPL) has allocated, on average, 80% of its FCF in share buybacks in the last decade, delivering 2,300% of capital appreciation for its shareholders in that period. So we need to find out what was wrong with Intel when the company used a similar proportion of its FCF for share buybacks.

Apple’s moat is not so much compromised by the technological advances of its counterparts, although Apple has been staying ahead of its competitors in innovation. Coupled with the lower capital requirements to remain competitive, Apple has very strong pricing power, which ends up generating more FCF for its share buyback programs without jeopardizing the company’s competitive advantages. On the contrary, Intel does not have Apple’s competitive advantage but still has a moat that is less based on the brand and more based on the performance and technological advances of its products. One example of the latter was when Apple stopped using Intel’s processors to reinforce its relationship with the more advanced processors of TSM.

According to the Q1 2023 report, Intel has not allocated money for share buybacks, which might be a sign that Pat Gelsinger has noticed how important it is to focus on what really creates long-term value for its shareholders in the industry where Intel is operating. In addition, the company slashed dividends by 65% in Q1 2023, given its higher capital requirements. We would expect that in the long run, Intel would allocate less money for share buybacks while allocating more money to reinforce its market position, which would be a more similar capital allocation to TSM’s.

The capital allocation by Pat Gelsinger at VMware seems to indicate we’re on the right track

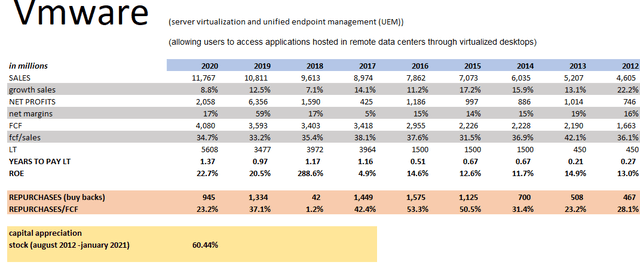

We will need to look into Pat Gelsinger’s past performance with VMware to see what to expect about the future capital allocation of Intel. When Pat Gelsinger was VMware’s CEO from 2012 to 2021, he used part of the FCF for share buybacks while he did not pay any dividends in all the years he conducted the company, except in 2019, when he paid a special dividend as a one-off policy:

As you may notice, using its FCF for share buybacks without dividend payments, the company was using between 20% and 50% of the FCF for that purpose, while there was remaining cash between 80% and 50% of that FCF to reinvest in its business. In this way, Pat Gelsinger kept the financial leverage of the company at very healthy levels during his tenure at VMware, delivering 60% of capital appreciation for the shareholders in nine years without counting the special dividend in 2019. It’s interesting to see that Pat Gelsinger delivered sustainable revenue growth with healthy profitability at VMware.

This might be additional evidence that Pat Gelsinger understands what is needed by these kinds of businesses, VMware and Intel, to remain competitive in their respective industries, such as more capital to be reinvested into the business with less capital allocated to share buyback programs or less dividend payments, as it was in VMware, as a way to have more liquidity to be reinvested into the business to secure their market position while facing intense and fierce competition.

Valuation

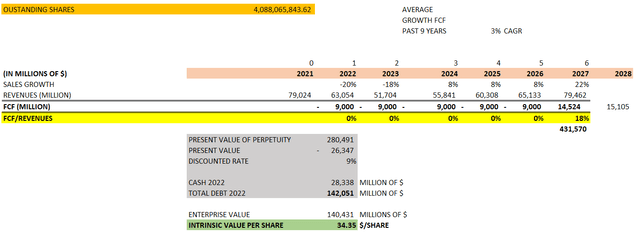

Using the discounted cash flow (DCF) method, we assume the following:

- Outstanding number of shares in 2022: 4,088,065,843

- Revenue growth forecast: 2023: -18%, 2024: 8% (Consensus estimate: -18% in 2023 and 13% in 2024)

- FCF margin revenues: 0% until 2026; 18% in 2027 onward (FCF margin of 19% on average in the last 10 years except in 2022, which was negative)

- Growth of FCF for perpetuity: 5.5% CAGR (last 9 years: 3.3% CAGR)

- Discounted rate of 9%

- In 2027, Intel completes its turnaround, returning a positive FCF

- In 2027, Intel will, at least, generate the revenues it did in 2021 (it might happen earlier as well)

- We added $100 billion of the turnaround investment to the current total debt of the company as of December 2022

- FCF in 2023, 2024, 2025, 2026: -$9 billion (as it was in 2022, but Intel might get better FCF in those years)

- FCF 2027 is calculated by multiplying our revenue projection for 2027 by the FCF margin of 18%

Note: Perpetuity is a critical value in our DCF, which is calculated with the formula:

Perpetuity: FCF2027*(1+g)/(discounted rate -g)

where g= growth of FCF

Perpetuity is the present value of future FCFs from 2027 onward. That present value is 431,570 in 2027, but we are in the year 2023, so we calculate the present value of the perpetuity again to bring it back to 2023:

Present value of Perpetuity: 431,570/(1+discounted rate)^5 = 280,491

In other words, we are assuming that Pat Gelsinger will complete the turnaround in 2027, when the business will reach the same revenues as in 2021, assuming an FCF margin of 18%.

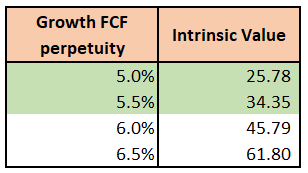

Working in some sensitivity analysis and changing the future growth of FCF, we get several intrinsic values. The scenarios shaded green might represent what the market is assuming with respect to the future growth of FCF. In this sense, the market might be expecting a growth of FCF greater than 5%:

Author

According to the sensitivity analysis, the higher the growth in future FCF, the greater the intrinsic value. We think that the result of this turnaround would be higher future growth for FCF, which might open up higher future valuations for the company. Even when, in the last nine years, the growth in FCF was only 3% CAGR, as the company was losing competitiveness, we think that if the turnaround is fulfilled as expected, the company would have different avenues for growth, such as developing products with better technological performance and building more fabs to strengthen its foundry business unit.

Currently, Intel is making good progress as one new fab in Arizona started production in 2020; there are a couple of additional fabs in the same state that will start production in 2024; and there are other fabs in Ireland and Malaysia that are planned to start production in 2023 and 2024, respectively. In addition, there are two more fabs, in Germany and Italy, that are planned to start operations between 2025 and 2027. Furthermore, Intel started the construction of its mega-fab in Ohio in May 2023, which might be the world’s largest chip plant; we would expect that this fab might be finished in 4 years.

The support of the CHIPS Act from the U.S. government to the American semiconductor industry and the European Chips Act, which might enable Intel to expand its operations in Europe, could support a growth in FCF equal to or greater than 5%, which is why we rate INTC stock as a buy at the current range of $26-$33 per share. The vision of this investment should be that we are investing in a company with a long history and market position that is experiencing a temporary setback, or “temporal problem”. Once the problem is solved, the market will be willing to pay higher multiples for the stock. The catalyst in this particular case would be the turnaround led by Pat Gelsinger.

Dividend yields

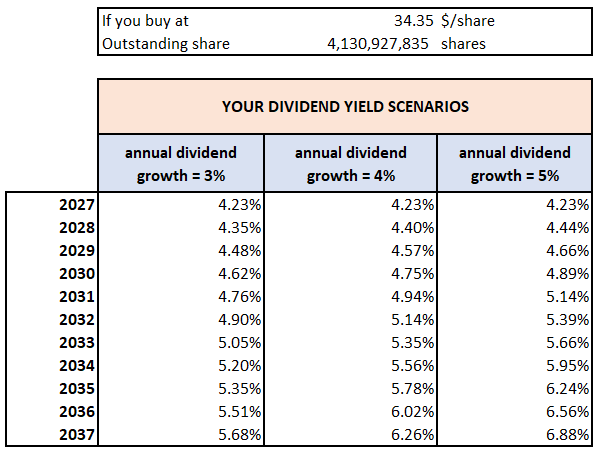

Buying at a price around $34.35 per share or at any price close to that intrinsic value could give dividend investors very good long-term dividend yields. We want to make a simple exercise assuming that in 2027, after the turnaround, Intel would start paying the same amount paid in 2022, and then we assume an annual growth in dividend payments of 3% as it was in the last 10 years until 2022:

Author

The dividend yields might be better if the company increases the annual growth of dividend payments as a result of higher FCF and revenue growth after the turnaround. The yields would be even better if investors bought the stock at a price lower than $34.35 per share. With a long-term horizon, the stock might not only deliver capital appreciation but also higher dividend yields.

It is true that other ways to increase the dividend yields could be made through repurchases, but our thesis is based more on the fact that the company, in general, would allocate less money from its FCF for share buybacks since most of that money would be used for reinvestments and dividends. These reinvestments would support Intel’s competitive advantages and generate even more FCF, which, in turn, would be used for further reinvestments and more dividends. As such, in our assumptions, the dividend yields would be generated by an organic value creation process rather than by increasing the share buybacks.

Risks

The main risk is that Pat Gelsinger does not fulfill Intel’s roadmap, which might generate a loss of trust from the market. Also, it is possible that Pat Gelsinger keeps using liquidity for strong share buyback programs without being aware of the importance of using that money to reinforce Intel’s market position while increasing future debt requirements and jeopardizing its long-term sustainability.

However, the probability of that scenario is low, as we noticed from his past performance at VMware that Pat Gelsinger likes to apply very conservative measures to secure revenue growth, adequate profitability, and conservative capital allocation. On the other hand, this stock should be seen with a long-term horizon.

Final thoughts

Intel is in the middle of a challenging turnaround in which the CEO, Pat Gelsinger, wants to recover the market position of the company to compete with TSM under the strategy IDM 2.0. In this sense, it matters not only the quality of the management execution to fulfill the roadmap but also the expertise in the capital allocation to reinforce the business model after the turnaround, making it more sustainable in the long term.

We’ve got evidence that Pat Gelsinger is aware of the importance of capital allocation, according to his past performance at VMware. Adding to the fact that Intel will receive more support from the U.S. government to strengthen the American semiconductor industry, coupled with the European Union Chips Act, the odds are in Intel’s favor. Currently, the stock is dismissed by the market, but these are the best times to invest in companies that have certain competitive advantages but are facing a temporary setback. By investing with a long-term horizon, a patient investor could buy at a low stock price while waiting for a successful turnaround, resulting in long-term capital appreciation and higher dividend yields over time.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.