Summary:

- Carnival Corporation is up nearly 100% YTD. But do fundamentals justify this run?

- Revenue is back at pre-pandemic level but expenses and debt cancel out revenue strength.

- Be mindful of dilution before asking why a stock shouldn’t go back to its previous highs.

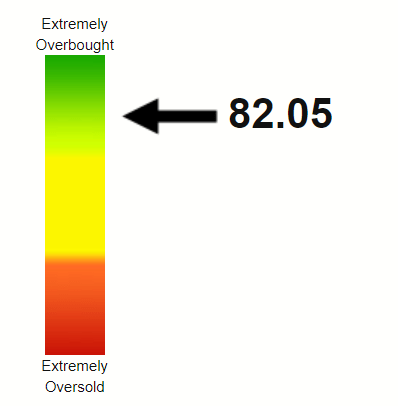

- The stock is technically beyond overbought with a RSI of 82.

Ethan Miller/Getty Images News

Right off the bat, I am not a natural “short seller”. I generally don’t have the stomach to short a stock and watch it go up, worrying how far it will go up. As the saying goes, the market can stay irrational longer than one can stay solvent. Shorting has inherent risks as there is no numerical limit on how high a stock can go while the lowest a stock can go is $0. However, I just shorted the recently high-flying Carnival Corporation & plc (NYSE:CCL) stock. I am presenting 5 reasons for doing so. Let us get into the details.

Monstrous Debt

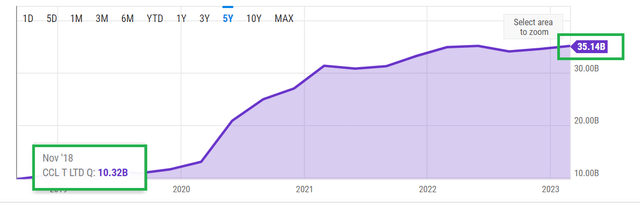

Granted, cruise lines faced what is extremely likely to be a once-in-a-lifetime event with the COVID pandemic. But the fact that Carnival’s debt load has more than tripled in the last five years deserves scrutiny, especially with the current high interest rate environment. As a comparison, Royal Caribbean Group (RCL) has doubled its debt load in the same time period.

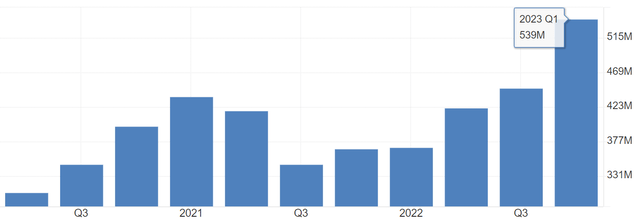

Sometimes, the actual debt level does not matter much if the company is comfortably paying the interest expense. So far, Carnival is paying its debt on time but the interest expense is starting to weigh on as shown below with the most recent quarter incurring about $540 million in just interest expense. Even companies with stronger balance sheets have debt these days. For example, Apple, Inc. (AAPL) paid nearly $1 billion in interest expense in its most recent quarter. However, that number represented 1% of Apple’s quarterly revenue while Carnival consumed 12% of its recent quarterly revenue to just pay interest on debt.

CCL Interest Expense on Debt (tradingeconomics.com)

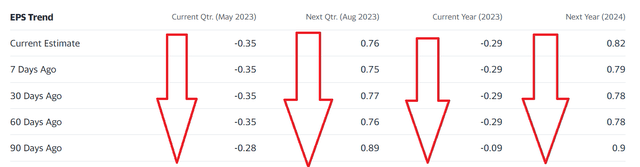

Revisions Are Still Downward

The recent run up in cruise stocks was sparked by a report that booking momentum is not slowing. However, this has not yet translated into EPS estimates as shown below. Despite the stock’s strong momentum, estimates have been falling across the board as shown below. Even if there is an upward revision to, say, $1 in 2024 EPS, a forward multiple of 15 is too high for this business in my view.

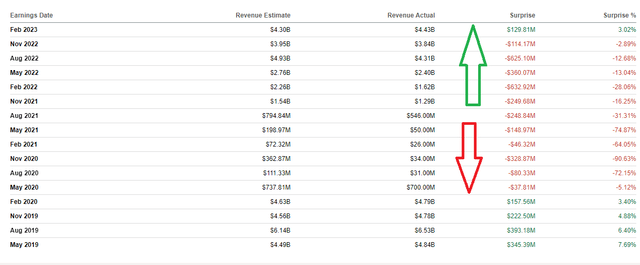

Moving our attention to revenue, Carnival and peers clearly hit rock-bottom during/just after the pandemic. However, Carnival’s revenue is back to pre-pandemic level and I have a hard time believing that the terms “pent up” demand and “COVID tailwinds” apply anymore.

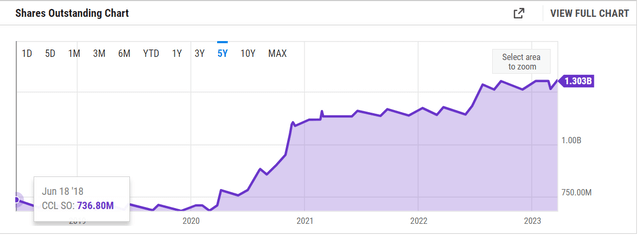

Diluting Away

It is easy but wrong, from my perspective, to look at CCL stock’s 5-year chart and wonder why the stock shouldn’t get back to its 2018 price of $65 if revenue returns to pre-pandemic levels. One word, dilution. Price charts are usually adjusted for splits but not for dilution. Carnival’s shares outstanding has almost doubled in the last 5 years.

CCL Shares Outstanding (YCharts.com)

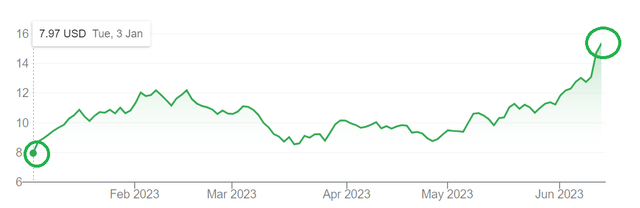

Near 100% Run

Carnival’s stock is up almost 100% YTD, after having a nightmarish 2022. Some of it might be justified as cruise and airline stocks were battered mercilessly during COVID. Hence, by and of itself, this is never a reason to sell a strong stock of a strong company. The $18 billion question is whether Carnival qualifies as a strong company.

Looking at how the company trades at ~1 time 2023’s expected revenue, one might say the company is strong and undervalued. But the debt says another story as established above. Although it is a totally different industry/sector, this reminds me of Exela Technologies, Inc. (XELA), which had about $1 billion revenue in 2022 but has a market cap of $31 million due to enormous debt load. Carnival is a much stronger company but the larger point is that revenue can often be a misleading indicator in high-debt situations. In addition, Carnival’s operating expenses are almost back to pre-pandemic levels with the most recent quarter showing a near 50% jump YoY.

In short, although I completely understand the strong bounce in 2023 after a dismal couple of years, a near 100% run is unjustifiable in my view.

Technically Overbought

As a result of the near 100% YTD run and more to the point the near 20% run in the last 5 days, Carnival stock’s Relative Strength Index (“RSI”) has reached 82, while the textbook overbought level is > 70. The stock undoubtedly has momentum in its favor but such stocks tend to reverse violently as well. Especially when the underlying company is not one of the strongest around, which Carnival is not in my view.

CCL RSI (stockrsi.com)

Conclusion

To recap the 5 reasons above and to highlight how disconnected the market seems to be from reality, let’s do a quick check:

- Debt – Going up, more than tripled in 5 years

- Shares Outstanding – Going up, almost doubled in 5 years

- EPS Estimates – Going down, across the board

- Operating Expenses – Going up

- RSI – Going up, almost 20% above overbought level

Based on the above points, I am having a hard time making sense of the price action as the stock is up nearly 100% YTD and about 20% in the last 5 days.

I am not recommending that you short the stock here. In fact, getting in front of a momentum stock backed by analysts recently is almost never a good idea but I am in this for a quick profit. I will post a “mea culpa” or “told you so” in the comments section below once I close my short position. Please note my intended time frame for this trade is extremely short and I will likely get out very soon due to the number of shares I’ve shorted in this trade if the stock goes down from here (meaning, I don’t need a huge percentage fall to make a decent profit on this trade).

There are many overvalued stocks in this market. For examples, many stocks related to AI have been on a strong run, which is at least understandable as the market likely believes there is more magic on the way. I mean, the number of things automated has only gone up over the years and the trend is very likely to continue. However, I have a hard time conjuring the average consumer taking 5 cruise ships per year as “pent up demand” or just because no new cruise ships are being made. If capacity growth is not expected any time soon, even revenue growth maybe questionable. Last, let’s not forget the looming recession and if it hits in any shape or form, Cruise ships will likely be one of the last things on the people’s minds.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of CCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long AAPL.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.