Summary:

- PayPal dip buyers attempted a reversal from its May selloff, but the momentum has stalled.

- PYPL holders might need to get used to a much lower valuation multiple as the market assesses the company’s ability to recover its growth trajectory.

- Management has likely not convinced long-term buyers to return aggressively, as it needs to update its long-term model on its profitability, given the growth in its unbranded business.

- However, with CEO Dan Schulman expected to leave by the end of 2023, such an update might not be likely until 2024 at least.

- Investors are unlikely to return aggressively until they have a clear idea of the new CEO’s strategies. PYPL could be stuck in the doldrums for some time.

Justin Sullivan

I have patiently waited for PayPal Holdings, Inc. (NASDAQ:PYPL) dip buyers to return in full force to reverse the battering it received last month. However, while AI stocks continued their massive run up north, PYPL struggled for upward momentum despite trading at so-called cheap levels.

PayPal holders are likely frustrated, seeing buyers uninterested in returning and helping CEO Dan Schulman and his team reverse a decline that started in earnest since topping out in July 2021.

I’ve also been waiting for a more robust bullish price action reversal to convince me that enough long-term buyers see significant value in its stock. While PYPL seems to be consolidating, it really shouldn’t be trading in a range at the current levels if buyers find the current valuation compelling.

Moreover, a lack of insider buying since Schulman loaded in February 2023 could have deterred more investors from buying the steep pullback aggressively, as PYPL’s valuation fell to 9.4x on forward EBITDA terms.

However, I cautioned investors that Seeking Alpha Quant’s “D” valuation grade suggests PayPal’s valuation isn’t attractive relative to its sector peers. Of course, PayPal Bulls could point out that a sector comparison might not be the most meaningful, as we should consider PayPal more closely with its payments peers.

Unfortunately, S&P Cap IQ’s data comparing PayPal against its diversified financial services peers indicate that its valuation isn’t that cheap. Notably, PYPL’s forward EBITDA of 9.4x is still over its peers’ median of 8.8x.

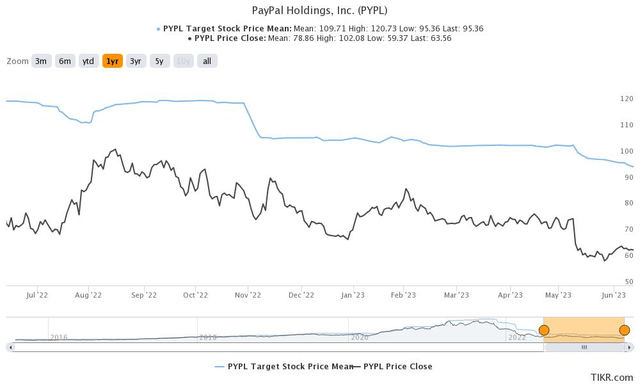

PYPL price Vs. analysts consensus price target (TIKR)

I’ve been deliberating why analysts have gotten their price targets or PTs horribly off the mark over the past year as PYPL continued its downward slide. As seen above, PYPL has not gotten close to the average PT over the past year.

Then, I looked at Morningstar’s fair value estimate of $135, valuing PYPL at “24.1 times [Morningstar’s] projected 2024 adjusted earnings per share.” But, something struck me: 24x earnings is an aggressive multiple. PYPL is priced for growth. But what if the market isn’t confident that PYPL could recover its previous topline growth momentum, much less its ability to maintain its transaction margin as it continued building out its unbranded business?

I shared in my previous update why “investors are likely spooked by the structurally-lower profitability company.” PayPal did well pre-COVID, gaining share and establishing itself as a force to be reckoned with in the e-commerce space. However, that momentum has since worn off, as even Wall Street analysts don’t expect PayPal to be growing that fast over the next few years.

Based on the revised consensus estimates, PayPal’s revenue growth is expected to grow at a CAGR of 8.4% from FY22-25. I think it’s pretty clear that the market isn’t placing too much emphasis on the company’s return to its above-mid-teens growth days, pre-COVID.

While management highlighted that it remains confident of recovering its profitability, buttressed by a robust balance sheet, investors are seemingly unconvinced.

I believe PYPL is at a critical juncture now. As I highlighted earlier, the market has de-rated its valuation downward in line with its peers. It likely isn’t convinced with its pivot toward the unbranded business, leveraging its PayPal Complete Payment, creating a comprehensive payment solution for its SMB merchants. I assessed that investors need more clarity over its transaction margin modeling to determine their long-term structural impacts.

Management held two conferences in late May and early June as it attempted to shed more light on its overarching strategy, including in unbranded. However, Acting CFO Gabrielle Rabinovitch likely didn’t telegraph sufficient confidence in PayPal’s margin evolution, as she articulated:

Closing the gap between branded and unbranded margins is a gradual process. While there will be an improvement in margin performance over time, there may not be convergence between branded and PSP margins due to the continued profitability of the branded business. – PayPal Management Meeting Conference

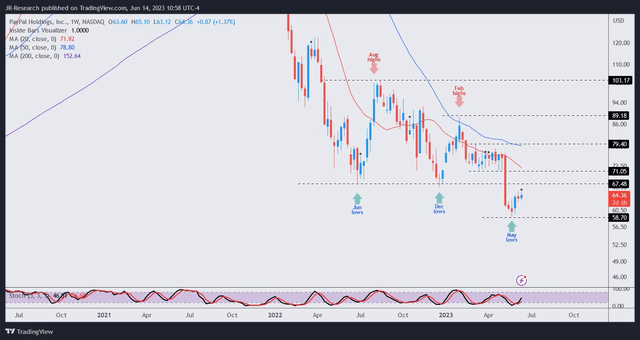

PYPL price chart (weekly) (TradingView)

To be fair, PYPL buyers attempted to help the stock bottom out since May, but the momentum has since stalled. I anticipated a quick reversal to regain control of the $68 to $70 resistance levels, but it didn’t happen. Still, I must emphasize that PYPL could pleasantly surprise me here and attempt a sharp reversal to the upside, given its well-battered valuation. Hence, I’m still willing to hold on to my current positions.

However, I assessed that PYPL could also be stuck in the doldrums for an extended period as the company’s business model undergoes a structural transition in its margin evolution.

Coupled with the expected departure of Schulman by the end of the year (plus possibly a new permanent CFO), investors also likely need to reflect significant uncertainty over PayPal’s execution.

The market is likely determining whether PYPL should be valued as a growth stock (with a higher multiple) or in line with its peers, as discussed previously. As for now, the latter seems to be the verdict that PYPL holders need to accept unless management updates everyone with more conviction about its long-term model.

But with an expected near-term CEO change in the cards, a long-term update would likely remain unlikely until next year.

Considering that, I believe it’s time to look elsewhere for opportunities.

Rating: Hold (Revised from Buy).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!