Summary:

- Investors often struggle when they wish to invest in a leading company but find that its stock consistently trades at a high valuation multiple.

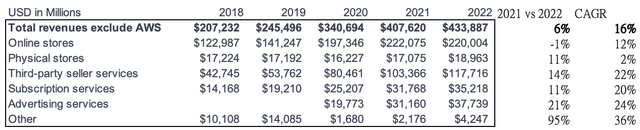

- Despite a significant drop from its past five-year average of 190 times earnings, Amazon’s forward P/E ratio is still high at 81 times earnings.

- This article provides a framework for long-term investors to develop an investment strategy for expensive yet fundamentally strong stocks.

BraunS/E+ via Getty Images

A tough nut to crack

Many investors are unsure of how to correctly value Amazon. At a glance, Amazon’s valuation multiples are high compared to the sector median. Despite a significant drop from its past five-year average of 190 times earnings, Amazon’s forward P/E ratio is still high at 81 times earnings.

Valuation multiple (Seeking Alpha)

This is a common dilemma that investors face when they desire to invest in a market-leading company but discover that its stock consistently trades at an exorbitant multiple. This article aims to alleviate your concerns by providing a framework for developing an investment strategy for expensive yet fundamentally strong stocks.

Valuing Amazon Like a Pro

When it comes to valuing stocks like Amazon, adopting a sum-of-the-parts approach proves to be the most effective strategy. This approach not only enhances your understanding of the company’s performance but also enables you to make informed investment decisions with greater confidence.

Below, we will evaluate Amazon’s retail and AWS segments separately.

Retail Segment

Investors worry about Low Margins

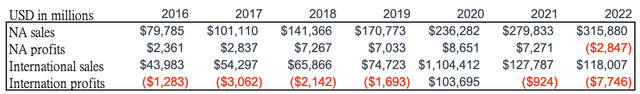

Many investors have the belief that Amazon’s retail business is not profitable, as the tables below demonstrate how its North American retail section has been operated at extremely low margins and its foreign division has periodically been at a loss from 2016 to 2022. Hence, investors find it challenging to value Amazon’s retail business.

Revenues and profits by segments (AMZN)

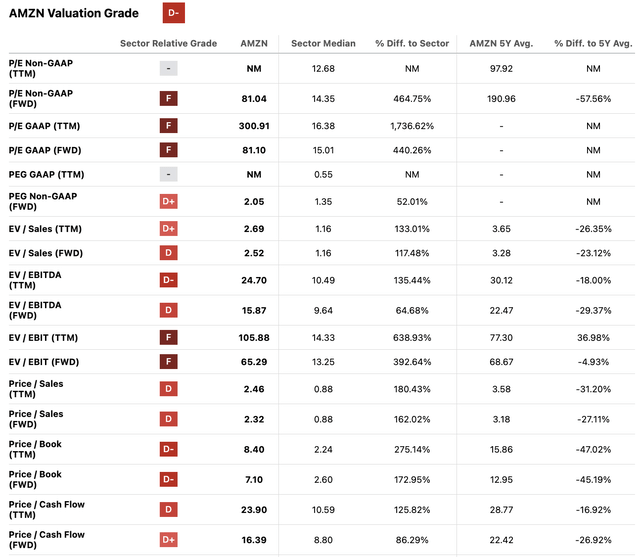

Amazon’s Retail Revenue Breakdown

However, we would have a better understanding of Amazon’s performance if we had examined its retail operation in terms of revenue sources.

Its retail business revenues include sales from various sources, such as:

- Online store

- Physical store

- Third-party seller service

- Subscription service

- Advertising service

Despite a slight 1% dip in online store sales in 2022, Amazon experienced a notable 6% growth in its overall retail sales. Over the past five years, the company’s retail business has consistently expanded with a strong CAGR of 16%.

This suggests that Amazon’s retail division is still expanding quickly. The business consistently invests in cutting-edge technologies and new offerings. Therefore, higher expenses do not necessarily indicate that its retail segment is unprofitable.

Investment in the Pharmacy Market

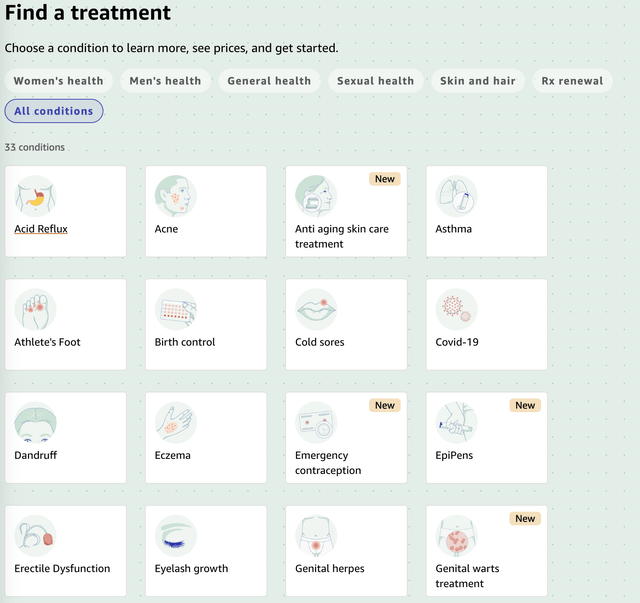

Amazon’s retail empire has expanded far beyond consumer goods, as the company now sets its sights on disrupting traditional service sectors.

For example, in Q4 2022, Amazon introduced Amazon Clinic, a virtual health service offering personalized and affordable care for various conditions. Amazon Clinic makes its debut on the front page of Amazon.com. Customers can choose from a network of telehealth providers without an appointment. Additionally, Amazon Pharmacy’s RxPass provides unlimited prescription medications for $5 per month. Amazon’s transparent pricing approach may disrupt the market.

One Medical is another example of Amazon’s expansion in the healthcare sector. Amazon completed the acquisition of One Medical in Q1 2023. It is a primary care organization offering both 24/7 virtual care services and in-office visits across the U.S. for preventive and everyday health, chronic care management, pediatric care, and mental health services.

By leveraging its established infrastructure and its Prime membership base, Amazon has the potential to streamline processes, reduce costs, and bring unprecedented convenience to the healthcare and pharmacy industries.

Assessing the High-Growth Business with the DCF Model

Therefore, to value a high-growth business, the DCF model and long-term margin assumptions accurately evaluate the retail segment’s worth in the overall business.

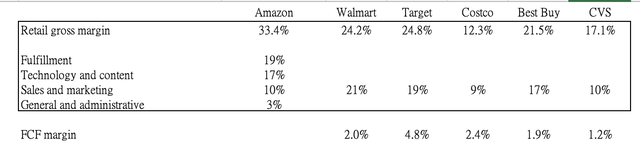

While Amazon has expanded beyond traditional retail products, its focus remains on targeting retail consumers. Therefore, we will examine the profitability of its competitors, including Walmart (WMT), Target (TGT), Costco (COST), Best Buy (BBY), and CVS (CVS), in order to establish a reasonable long-term assumption for Amazon’s free cash flow margin.

Peers margin (Companies filings)

*Target’s free cash flow margin was calculated using financial data from 2021

Amazon Has a Higher Gross Margin

When comparing Amazon to its traditional retail counterparts, it becomes evident that Amazon enjoys a considerably higher gross margin. This is largely attributed to the additional services it offers, such as Prime membership, seller services, and advertising.

Amazon Has a competitive Costs Structure

Although Amazon does not provide a detailed breakdown of SG&A costs between its Amazon Web Services (AWS) and retail segments, it is important to note that Amazon has a higher gross margin than its traditional retail rivals thanks to additional services like Prime membership and advertising. Even without a detailed SG&A breakdown, Amazon’s costs represent only 13% (10% of sales and marketing expenses plus 3% of advertising expenses) of retail revenues, which is comparable to competitors Costco and CVS when AWS-related costs are excluded.

As a result, we hold the belief that Amazon can achieve a higher free cash flow margin compared to its retail counterparts in the long term.

When applying the DCF model, we have calculated the equity value of Amazon’s retail business to be $3,189 billion based on the following assumptions:

- Free cash flow margin: 5%

- WACC: 10%

- No growth in 2023

- Terminal growth rate: 3%

- Net debt:-2876 million (Q1 2023 data)

- Shares outstanding: 10.17 billion (Q1 2023 data)

Some investors choose to disregard Amazon’s retail business entirely when conducting their valuation analysis, given its low operating margin. However, we advise against taking that approach, as the inclusion of AWS in supporting its $1.25 trillion market capitalization can significantly complicate investors’ decision-making processes.

AWS segment valuation

Now, let’s turn our attention to assessing Amazon’s AWS business.

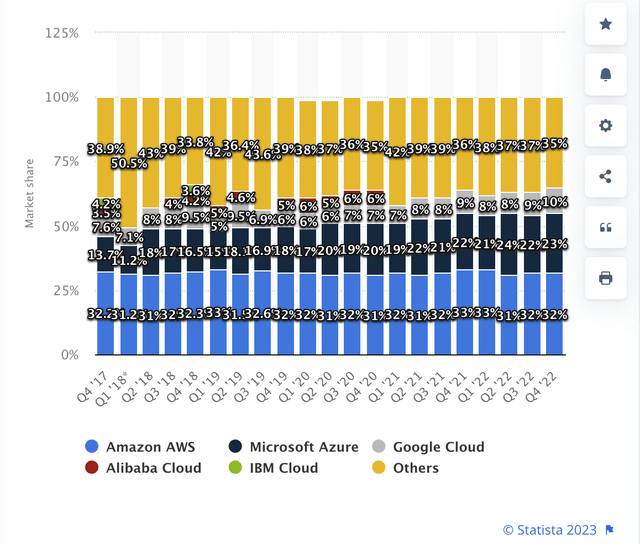

Over the past few years, AWS has maintained a consistent market share. This can be attributed to its cost advantage in the Infrastructure as a Service (“IAAS”) sector and its diverse range of offerings in the Platform as a Service (“PAAS”) arena.

AWS market share in cloud infrastructure (Statista)

AWS Benefited from Cloud Shift

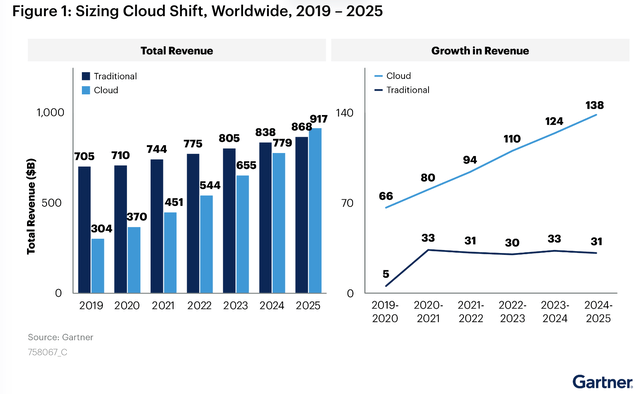

Gartner predicts a shift towards public cloud computing in enterprise IT spending, surpassing traditional IT spending by 2025. This “cloud shift” includes categories like application software, infrastructure software, business process services, and system infrastructure markets, all suitable for cloud migration.

By 2025, it is estimated that 51% of IT spending in these categories will have transitioned from traditional solutions to the public cloud, compared to 41% in 2022.

As a result, we anticipate that AWS will maintain its market share and expand alongside the industry due to the cloud shift trend. Additionally, we project a long-term free cash margin of around 15% and determined the equity value of AWS using a DCF model to be $9602 billion.

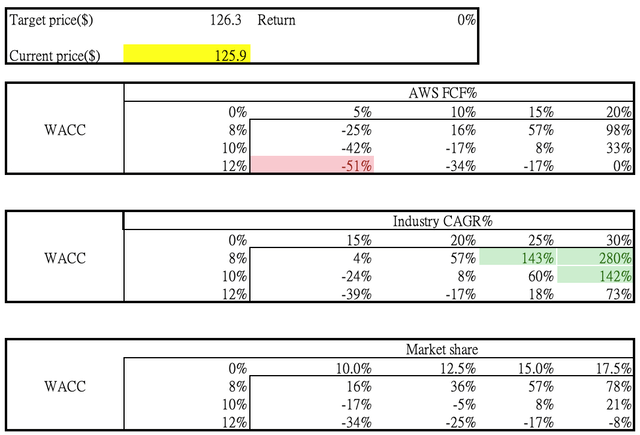

Leveraging the sensitivity test: Guide investment decisions and maximize returns

When summing up the valuations of the retail ($3,189 billion) and AWS ($9,602 billion) segments, the overall valuation is approximately $13 trillion ($126.3 per share), which is roughly equivalent to the current price.

Does this imply that investors cannot profit from the current price? Absolutely not. The model does not account for numerous potential trends and catalysts.

Sensitivity analysis (LEL Investment)

Untapped Potential: The Influence of AI on AWS’s Valuation

The growing popularity of ChatGPT and similar conversational AI technologies has the potential to boost cloud service providers.

These AI models require significant computational resources and storage capacity to function effectively. As more organizations and developers adopt conversational AI solutions, the demand for cloud services is likely to rise, benefiting cloud service providers by driving increased utilization of their resources and generating additional revenue streams.

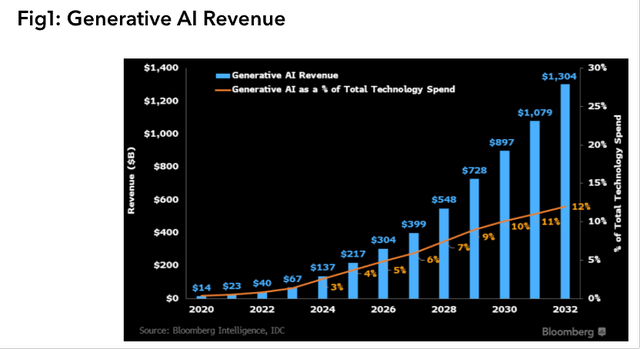

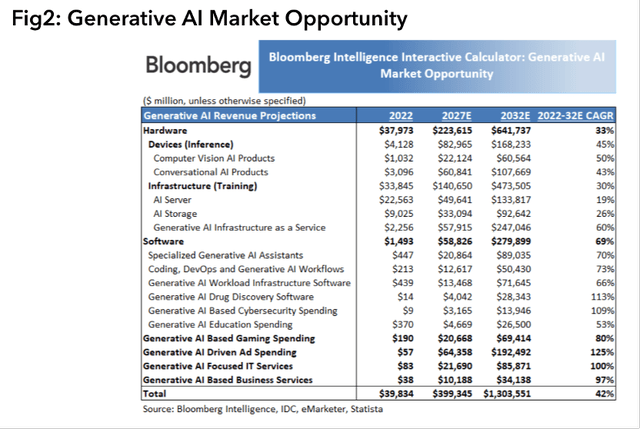

According to Bloomberg, the major beneficiaries of this trend are expected to be Amazon Web Services, Microsoft, Google, and Nvidia as more businesses migrate their workloads to the public cloud. Bloomberg forecasted that the generative AI market is projected to reach $1.3 trillion by 2032, with a remarkable CAGR of 42% over the next decade.

Generative AI Revenue (Bloomberg)

Generative AI Market Opportunity (Bloomberg)

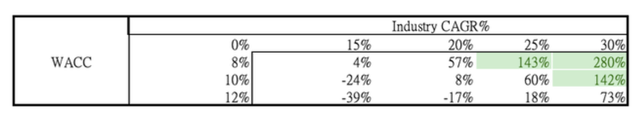

Our valuation model did not incorporate the potential impact of AI on AWS. However, if AWS were to experience accelerated growth exceeding 30%, this could result in significant upside in stock valuation, potentially reaching as high as 142%, as indicated in the sensitivity test table mentioned below.

Sensitivity test (LEL Investment)

Downside risk by segments

There are evident downside risks in the market too. Both segments face potential headwinds moving forward.

Weak AWS segment may cause a 42% stock price decline

The cloud rivalry intensified as Amazon revealed that enterprises were continuing to be cautious in their spending in this uncertain time.

In Q1 2023, Amazon’s AWS experienced a slowdown in revenue growth to 16% and a decline in margin of 1000 basis points.

In contrast, its cloud competitor, Oracle, achieved a 77% increase in cloud IAAS revenues during the same period, driven by its cutting-edge products catering to users interested in utilizing generative AI on the cloud.

“Oracle’s Gen2 Cloud has quickly become the number 1 choice for running Generative AI workloads,” said Oracle Chairman and CTO, Larry Ellison. “Why? Because Oracle has the highest performance, lowest cost GPU cluster technology in the world. NVIDIA themselves are using our clusters, including one with more than 4,000 GPUs, for their AI infrastructure. Our GPU clusters are built using the highest-bandwidth and lowest-latency RDMA network—and scale up to 32,000 GPUs. As a result, cutting edge companies doing LLM development such as Mosaic ML, Adept AI, Cohere plus 30 other AI development companies have recently signed contracts to purchase more than $2 billion of capacity in Oracle’s Gen2 Cloud.”

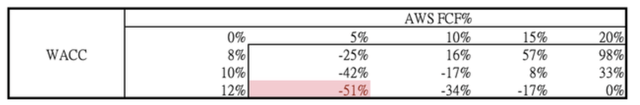

Investors should be aware that AWS may consequently experience short-term difficulties. According to our methodology, a 5% reduction in the industry’s CAGR assumption causes a 16% drop in stock price. Similar to the previous example, a 1000 basis point drop in long-term free cash flow margin results in a 42% drop.

Sensitivity test (LEL Investment)

Retail segment exposed to macro and competition risks

There are two risks that we believe Amazon’s retail business is currently facing.

Macro risk

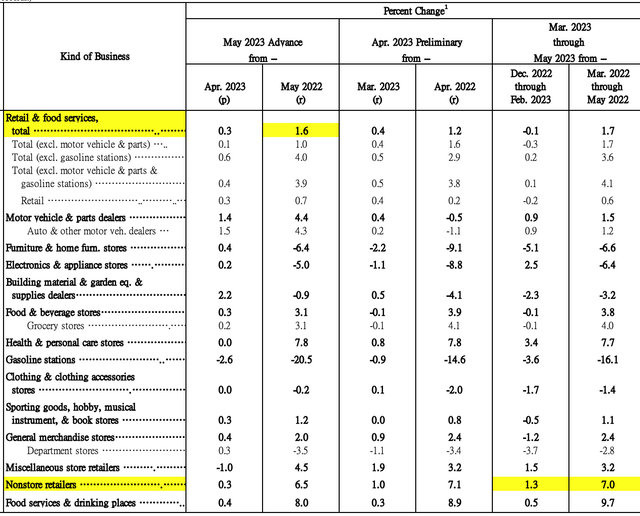

Amazon’s product sales are at higher risk due to several macroeconomic factors. The latest data from the U.S. Census Bureau reveals a weak year-on-year growth of only 1.6% in U.S. retail sales, indicating a slow demand environment. This reflects the ongoing pressure on discretionary spending, which is crucial for Amazon’s retail sales.

It’s important to note that discretionary spending accounts for approximately 95% of Amazon’s retail sales, making the company more susceptible to fluctuations in consumer purchasing behavior and economic conditions.

US Retail sales (US Census Bureau)

Competition risk

Amazon is likely losing market share in the retail space. According to the data above, U.S. non-store retailers experienced growth of 7%, while Amazon’s online store grew by only 3%.

Competitors like Walmart and Temu pose challenges to Amazon. Walmart demonstrated remarkable performance in Q1 2023, with an impressive 27% growth in its U.S. e-commerce sales. This outstanding achievement can be attributed to Walmart’s strong foothold in the grocery sector, where it has capitalized on consumer demand for online grocery shopping.

Despite Amazon’s efforts to attract traffic and increase consumer footfall in Whole Foods stores through its return policy, the higher price point of Whole Foods products has hindered the conversion of this traffic into actual sales.

Moreover, Temu, a company owned by PDD Holdings, has made aggressive inroads into the U.S. market, and heavily promoted its products to directly compete with Amazon. For instance, Temu offered a similar CarPlay product at 40% less compared to Amazon’s offering.

Wireless Carplay (Temu) Wireless Carplay (Amazon)

Conclusion

The method described above can be used to evaluate the value of high-valuation multiple stocks. In our view, the DCF model provides investors with a quantitative method to evaluate risks and rewards more effectively than the multiple method.

Based on our analysis, our model suggests that if AWS can effectively capitalize on the AI boom and achieve a growth rate surpassing 30% in 2023–2024, its stock could experience a substantial increase of up to 142%. However, it is crucial to acknowledge that AWS may encounter short-term challenges as it navigates the competitive landscape.

Conversely, there is also the potential for a 42% decline in stock value due to competition risks. Taking into account the risk-reward profile, we have decided to maintain a “Neutral” rating and adopt a cautious approach, opting to observe the developments before making any conclusive judgments.

We will keep a close eye on market dynamics and examine how the competitive environment is changing in order to adjust our rating as necessary.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.