Summary:

- Opendoor Technologies’ stock has risen over 170% since the start of the year, but the company faces significant challenges due to a depreciating inventory and high levels of debt.

- The company operates as a digital intermediary in the real estate sector, offering a simplified and accelerated experience for home buyers and sellers, but struggles to generate positive cash flows from its core business.

- Opendoor’s survival depends on its ability to manage its debts and sell its real estate portfolio, currently at a loss, over the next 24-36 months.

Dragon Claws/iStock via Getty Images

Shares of Opendoor Technologies (NASDAQ:OPEN) have outperformed with a rise of more than 170% since the start of the year, even though they remain down by over 90% from their 2021 peak. Judging solely on this, one might think that it is just one of many fruits borne from the SPAC frenzy of 2021. However, an examination of the fundamentals of the business model – particularly in the light of today’s macroeconomic context – reveals that it is an intriguing stock. As intriguing as it is, I think you should stay away from it anyway.

The company is operating as an intermediary in the real estate market at a time when sales volumes are depressed. It also grappled over the past year with a stock of homes purchased at inflated prices, which has eroded a significant portion of its book value. Despite showing some improvements in cost optimization in its Q1 2022 quarterly report, a depreciating inventory and a lot of debt give the company few chances of surviving this market cycle.

The Strategy

Opendoor operates as a fully digital intermediary in the real estate sector. It significantly simplifies and accelerates the experience for both home buyers and sellers, while ensuring fair prices for both parties. From this business, it expects to derive a contribution margin of 4-5% for each transaction, in part due to taking on the brokerage service and all the bureaucracy.

The company has successfully resolved one of the main problems encountered by many other SPACs: having a good customer acquisition cost (CAC). It has been able to extensively expand its presence in the United States and has done so with remarkable efficiency. Its marketing strategy involves direct affiliations with real estate agents, advertising portals, and builders.

- 90+ builders directly sell at least a portion of their properties to Opendoor, including 8 of the top 10 largest home builders in the country;

- Thousands of agents, and over 50% of those who make at least one deal with Opendoor, return for at least a second;

- Zillow, Redfin, and Realtor.com, the three largest ad portals in the United States, have partnerships with Opendoor. Zillow, in particular, has an exclusive with Opendoor.

Zillow’s “Sell” page presents the user with the possibility to directly sell a house to Opendoor (Zillow.com)

By directly dividing the revenues with those who bring the business, Opendoor can ensure a marketing approach based directly on performance that costs only as much as it brings in revenues. It also directly controls the CAC based on the offers proposed to partners.

For the end customer, the value proposition is very clear:

- Avoid the brokerage costs of a real estate broker;

- The house is purchased in its current condition, without the need for repairs;

- The processes are digitized, quick, and easy to understand;

- Sellers have the flexibility to adjust the date when they want to leave the property. In summary, the three essential elements for success are there: a functioning business model, an effective way to reach its customers, and a market that can oscillate, but certainly can’t die.

The problem arises when the accounts are examined: the company is heavily in debt and still unable to generate positive cash flows with its core business. In addition, it offers generous stock compensation schemes to employees, which significantly dilute shareholders’ stakes. In Q1, the company managed to repay part of its debts at 46.5% of their face value, demonstrating the market’s expectation that Opendoor is nearing bankruptcy.

The Right Business at the Wrong Time

Opendoor has always promised its shareholders that the target regarding the contribution margin of each house sold would be around 4-6% of its value. Even in the pre-IPO phase, investor presentations historically hammered on this guidance. A guidance that the company has also managed to adhere to at some moments: on the stock of houses bought after Q2 2022, the company registered contribution margins exceeding 8% in the first quarter of 2023.

However, the properties acquired before and during Q2 2022 have prices that are significantly higher than those of the current market. On these, the company had a negative contribution margin, as much as -13.1% in Q1 2023.

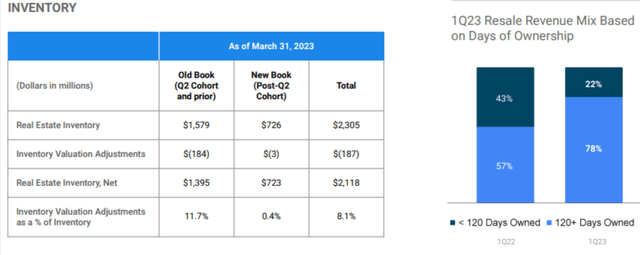

In the company’s real estate portfolio, currently there are:

- $1.579 billion in properties purchased before or during Q2 2022, which have depreciated by $184 million in the last quarter alone. In Q4 2022, they had suffered a further devaluation of $454 million;

- $726 million in properties acquired after Q2 2022, which have more or less maintained their value, depreciating overall by only $3 million.

Opendoor’s real estate inventory as of Q1 2023 (Opendoor’s Letter to Shareholders – Q1 2023)

If Opendoor continues to register the same margins as in Q1 2023 for the rest of the year, that one and a half billion in ‘old’ properties risk seriously damaging Opendoor’s ability to continue operating. Furthermore, the company has little liquidity to invest in ‘new’ properties that can generate profits, as it finds itself battling with expiring debts and inventory turnover times longer than expected.

The Effect of Interest Rates

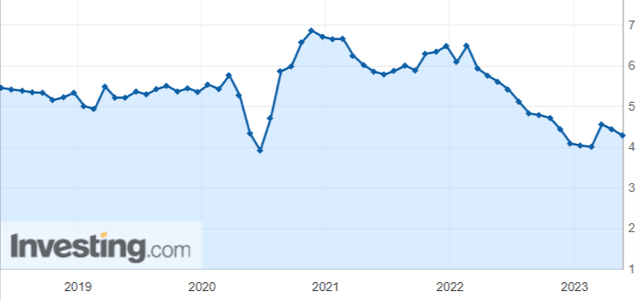

Monetary policy can have an impact on virtually any company, but in the case of Opendoor, the impact is extremely strong. To begin with, sales volumes are depressed because sellers don’t want to give up homes purchased with extremely favorable mortgages during the pandemic. US Existing Home Sales were:

- 4.28 million in April 2023

- 5.57 million in April 2022

- 5.92 million in April 2021

- 5.23 million in April 2019, before the pandemic

U.S. Existing Home Sales (Chart from Investing.com / Data from NAR )

If the market records sales volumes 20-30% lower than in a good year, however, it must be said that Opendoor Technologies in Q1 2023 bought 81% fewer homes compared to 2022, and 68% less compared to 2021. The company contracted significantly more than the market, also due to a halving in marketing spending.

Moreover, inventory costs more if rates are higher. 78% of properties sold in 2023 required more than 120 days to liquidate the initial investment. At the same time, in its latest letter to investors, the company suggested that the expected contribution margin for 2024 will be on average 1%.

Assuming that the company can close its deals on average every 120 days and that the capital can be immediately reinvested after the sale, it means that the company expects to generate a return of 4.06% annually on working capital gross of:

- Interest

- Fixed costs

- Stock-based compensation

- Taxes, although it is likely the company won’t pay any for several years

At the same time, a 3-year ultra-safe bond, issued by the US Treasury, yields 4.37% as I write this article.

Some may argue that Opendoor’s long-term prospects are significantly better and that the period does not do justice to the goodness of the business model and the company’s ability to innovate in the real estate sector. All true, but there is a fundamental problem: the long term is not an argument if a company risks bankruptcy in the next two years.

Too Much Debt, Too Much Stock-Based Compensation

As of March 31, 2023, Opendoor had $1.3 billion in cash and cash equivalents and $459 million invested in properties for sale. This is not an enviable liquidity position for a company that has $4.08 billion in debts and a real estate portfolio to sell, mostly at a loss compared to the purchase price.

There are two pieces of good news that can cheer shareholders, but the situation remains unenviable. The first piece of good news is that the company is renegotiating some of its debts, paying cents on the dollar, because bondholders prefer a smaller but sure payment to a missed one. This nevertheless denotes a lack of confidence in Opendoor’s future prospects.

The second piece of good news is that short-term debts, at least those due by Q1 2024, are only $362 million. Opendoor is not threatened in its very short-term survival, even once the balance sheet loss is taken into account. The next 12-18 months will be the ones in which the company will have to demonstrate a real turnaround in its numbers, in order to convince investors to inject liquidity to keep the company alive while waiting for better times.

The company also issues a significant amount of shares to compensate its employees, including those in non-executive positions. In 2022, $171 million was paid in stock-based compensation, which currently represents about 8.9% of the company’s market capitalization. Opendoor is already issuing significant amounts of new shares, and it’s hard to believe the stock won’t plummet if it decides to face debts by issuing even more shares.

In addition to all of this, if things were to really get better, Opendoor’s creditors would no longer be willing to renegotiate their debts with such significant discounts. That’s why it will be very difficult for Opendoor to manage its debts over the next 2-3 years.

Conclusions and Final Thoughts

Opendoor is a company capable of offering real added value and at the same time operating in an economically efficient way. The reason for my bearish view is that management was not cautious enough in times of zero interest rates, buying large amounts of inventory at prices that later proved to be inconvenient. At the same time, the real estate market has seen a significant reduction in transaction volumes, leaving Opendoor with a mountain of debts to pay and a portfolio to sell overall at a loss.

In my opinion, the company’s indebtedness is such that it compromises Opendoor’s ability to meet payments over the next 24-36 months. This is unless a rare mix of conditions occurs, including economic policy and GDP growth, which leads to a strong resurgence of the real estate market with prices at least equal to those recorded in 2021. A very unlikely situation, at least at the moment.

If the company didn’t have such a large exposure to properties purchased before June 30, 2022, or didn’t have so many debts to deal with, the soundness of its business model would, in my opinion, be able to generate confidence in investors and support the company through this period of difficulty. Having both of these problems at the same time, however, Opendoor’s struggle for survival faces really challenging hurdles to overcome. As interesting as the long-term prospects may be, if a “long term” doesn’t exist, my view remains that investors should avoid this stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.