Summary:

- PayPal has seen its stock fall below pre-Covid levels despite the company continuing to generate solid growth rates.

- The market doesn’t appreciate the level of innovation taking place at the digital payment company with a massive TAM.

- PYPL stock trades at a massive discount at only 12x forward EPS estimates due to oddly low investor confidence.

bennymarty

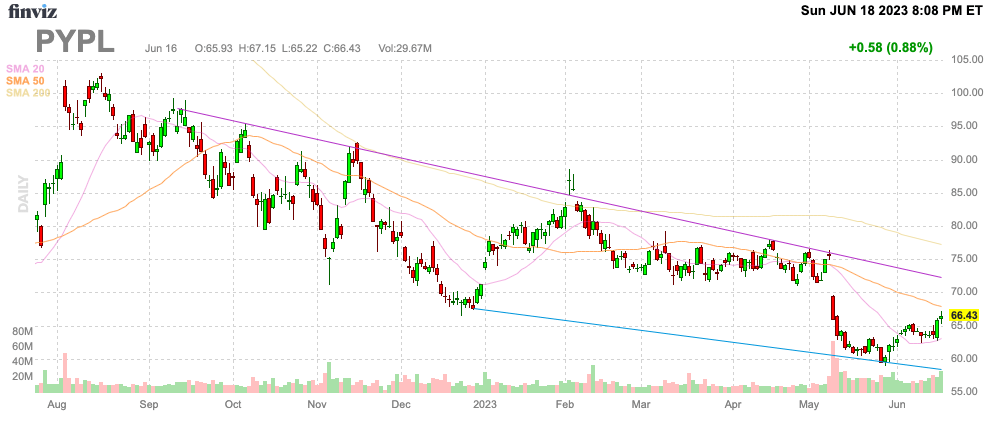

The market can be a perplexing place due to valuations being highly subjective and driven mainly by confounding financial metrics. A prime example of this issue is the depressed value of PayPal Holdings (NASDAQ:PYPL) despite knowledge of tough Covid era comps while some tech giants have limited growth and off the charts investor confidence. My investment thesis is ultra Bullish on the stock of the digital payments company trading below pre-Covid levels.

Source: Finviz

Below Pre-Covid Levels

PayPal focuses on digital payments, so investors need to factor in financial results based on a giant pull forward in demand. The company entered the year expecting e-commerce sales to be flat for the year and now the guidance is for a slight single digit increase in sales in a sign of the limited tailwinds.

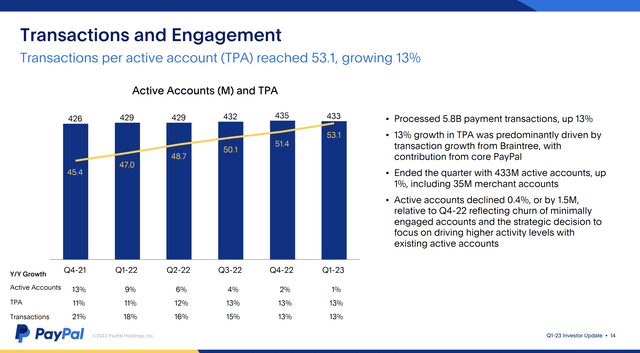

A prime example of where PayPal hit a wall due to Covid pull-forwards were the active account totals. The company hit 305 million active accounts at the end of 2019 and the figure has soared to 433 million now.

Source: PayPal Q1’23 presentation

The market is concerned due to the lack of current active account growth, but a lot of users had to sign up for accounts to make digital payments during Covid lockdowns. The company has to absorb all this growth before taking the next step forward.

What will ultimately matter is the increase in total transactions and the transactions per active account, or TPA. PayPay entered 2020 with only 40.6 TPAs and the company ended Q1’23 with 53.1 transactions. The digital payments company was growing at a 10% clip and the growth rate has actually accelerated to 13% in the current quarter even with e-commerce sales generally flat.

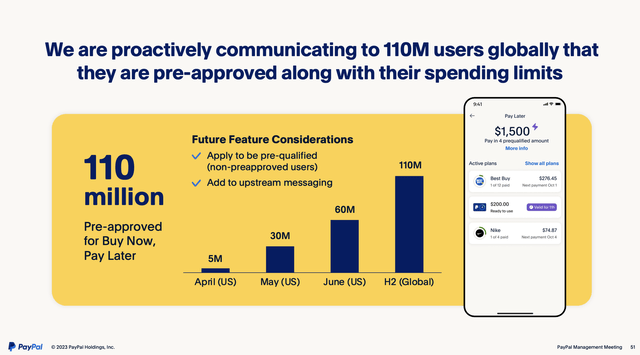

PayPal continues adding more utility with improved checkout functions along with a focus on unbranded transactions. The company is regularly innovating including turning the Buy Now, Pay Later product into a market leader with proactive communication to 110 million global users tied into existing account spending limits.

Source: PayPal Q1’23 presentation

Investors don’t really have a reasonable reason to expect PayPal to see growth slow here with most accounts still not using PayPal as a primary payment tool. The company is turning back into a fintech with the amount of experiments on the platform doubling in the last few months leading to a major increase in new cohort numbers as follows per the CEO on the Q1’23 earnings call:

…our March cohort of new accounts had 24% higher TPA and 40% higher ARPA than in March of last year. These results strongly reinforce our decision to focus our resources on engagement and driving high-value accounts.

Low Investor Confidence

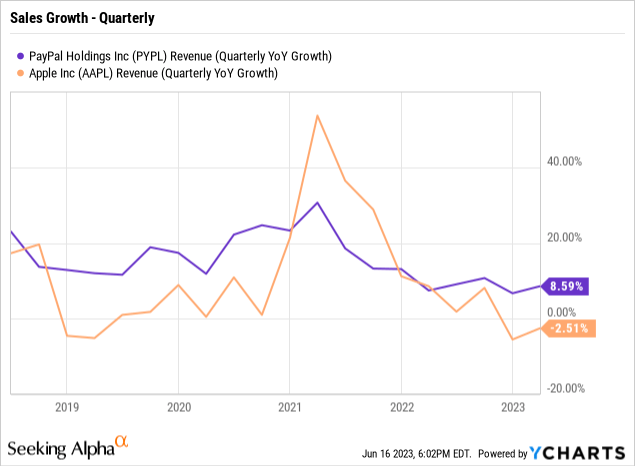

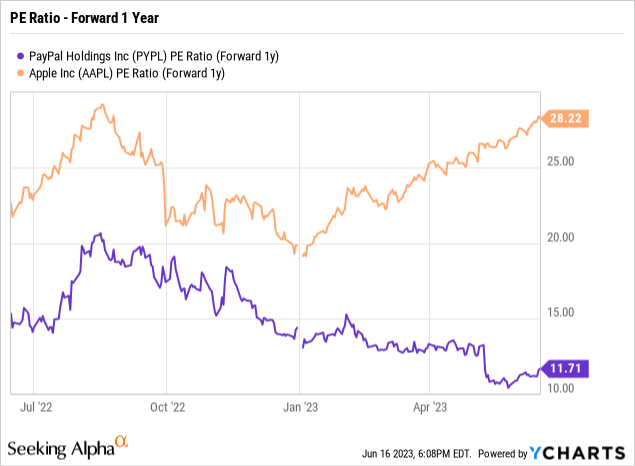

The prime issue facing PayPal is low investor confidence. The company just guided to a $5 EPS for the year and investors aren’t sure they want the stock in the $60s. In comparison, Apple (AAPL) is forecast to earn a $6 EPS this year and investors are willing to pay over $180 for the stock.

Sure, the tech giant has strong brand awareness, but PayPal is very strong in digital payments. Both companies saw Covid boost revenues leading to current weakness, but PayPal has far better growth rates.

The amazing difference here is that PayPal benefits from far more consistent growth rates. The payments company is forecast to maintain growth rates of nearly 10%.

Apple hasn’t been so lucky. The company forecasts sales to dip again in the June quarter with sales dipping up to 2% again.

The main question investors have to ask is why PayPal obtains far less investor confidence. Going into Covid and coming out of it, the digital payments company has generated far better growth rates than the tech giant.

While Apple probably warrants a premium valuation for their growth rates, the tech giant shouldn’t trade at a premium multiple to PayPal. At these stock prices, Apple actually trades at far in excess of double the forward PE multiple of 12x for PayPal.

In essence, investors have to construe that Apple actually far outgrows PayPal over the next few years to justify this valuation discrepancy. The tech giant has a potential promising new AR/VR product in the Vision Pro headset, but the item is unlikely to drive sales until FY25, if at all.

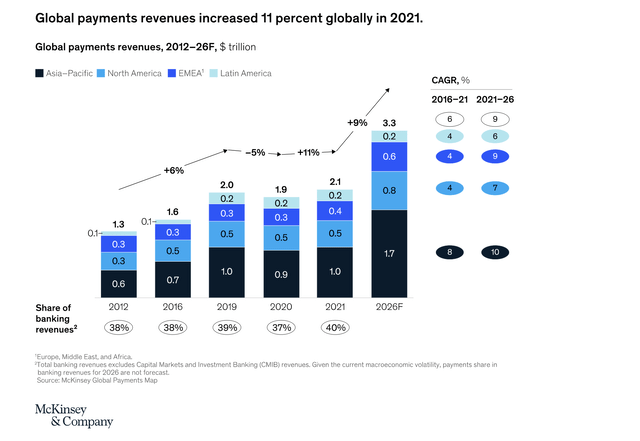

PayPal is now doing $355 billion in quarterly payment volume leading to ~$7 billion in quarterly revenues. McKinsey estimates global payment revenue alone would reach $3 trillion by 2026 while PayPal only produces $30 billion in annual revenue now.

Source: McKinsey & Company

PayPal is only forecast to capture ~1.3% of global payment revenue by 2026 with revenue targets just below $40 billion. Analysts forecast CAGR rates closer to 9%, which fails to gain much in the way of market share over this period.

Takeaway

The key investor takeaway is that PayPal is far too cheap here. Investor confidence has fallen too low providing a great opportunity to buy a premium digital payments brand at a discount.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PYPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.