Summary:

- Eating crow is never fun but owning up is more important to me than my pride.

- Nvidia Corporation stock is fundamentally overvalued. But fundamentals don’t necessarily apply during tectonic shifts.

- Covered Calls offer a middle ground between capping gains early and watching your gains evaporate.

- Nvidia stock is in a great place technically.

Justin Sullivan

As a writer, there is nothing worse than eating crow in public. But as a voracious reader of many news articles and opinion pieces myself, I fully expect authors to own up to their mistakes, just as they take credit for their good calls. So, here is my “mea culpa” on Nvidia Corporation (NASDAQ:NVDA). I wrote this piece ahead of NVDA’s most recent earnings and true to my words, I did sell out completely. In hindsight, I was too early to get out and missed out on about 40% returns since then. But then, on the positive side, I rated the stock a “Hold” for the readers and I wasn’t foolish enough to short this juggernaut.

Does that mean I am back with a position in Nvidia? No. Fundamentally, I still believe the stock is overvalued but I failed to acknowledge the hype “could be” real. This is not hindsight bias alone but just acknowledging that artificial intelligence (“AI”) was and is still fairly unknown when it comes to potential opportunities for these companies. As an example of this potential, the AI market is projected to grow twentyfold from the current $100 billion valuation to $2 trillion by 2030. And no one saw that coming just a few short months ago.

But if you still hold massive gains in NVDA stock, this article is for you. I recently profiled another recent high-flyer, Palantir Technologies (PLTR), and suggested investors sell covered calls to have a chance to (A) exit at a higher price and (B) to collect additional income for doing so, than selling outright. Seeking Alpha readers were very appreciative and receptive to the suggestions in that article. Hence, I am presenting similar thoughts on NVDA. Before that, a few fundamental aspects about Nvidia.

Stock and Macro Fundamentals

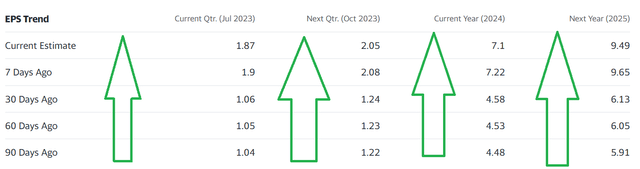

- Soaring AI Expectations: It wasn’t long ago that I recall seeing NVDA with a forward multiple of 80 on Seeking Alpha’s summary page. Despite the stock’s monstrous run, the forward P/E has now fallen to “just” 55. Obviously, this is largely due to NVDA’s unprecedented guidance but also has to do with the fact that we are in infancy when it comes to understanding what the advent and advancement of AI will mean financially for companies like Nvidia. In short, I expect the upward revisions to continue at least until the next earnings report, and that means NVDA stock likely has more room to the upside.

NVDA Estimates (Yahoo Finance)

- Macro #1: With the Fed pausing interest rates for the first time, it appears like the fight against inflation has peaked officially as well. This augurs well for companies like Nvidia that thrive when the other parts of the ecosystem are able to borrow to enhance their data centers and processing capabilities.

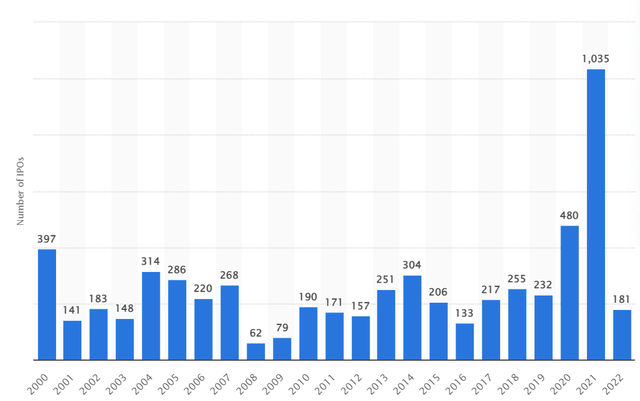

- Macro # 2: There is also now a belief (or hope) that the market is finally ready to welcome new IPOs. We can argue about cause and effect here but a flurry of IPOs and bull markets generally go hand in hand. For example, 2021 saw 1,035 companies going public when the market was going bananas, while 2022 had 181 when the market crashed. When the market crashed in 2008/2009, only 141 companies went public in two years. Nvidia is in a unique situation of being an established company with potentially huge rewards awaiting in the near future as well and is likely to benefit from new money coming into the market.

Enter Covered Calls

If you hold at least 100 shares of NVDA, covered calls allow you to collect premiums for agreeing to sell your shares at a price you pick. While that sounds too good to be true, it indeed is true, as explained below. With covered calls, there are many ways to skin a cat. You can choose a strike price and/or expiration date that best fits your agenda. For example, to net a higher premium, your strike price needs to be closer to the current market price. For safety (to not get called away), you may want a strike price that is further away. And so on.

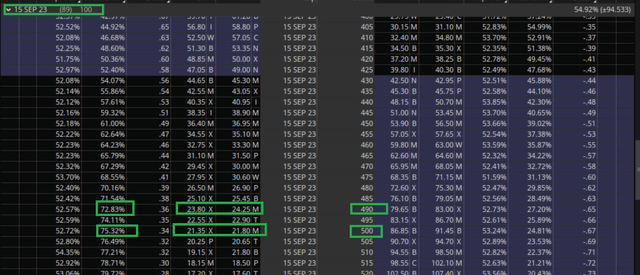

With some expecting NVDA to reach $500 per share, the contrarian in me wants to get out just a little before the crowd. Hence, I am picking the September 15th, 2023 $490 strike price for this exercise.

NVDA $500 Sept 2023 Options Chain (Think or Swim)

Key Data Points of This Trade

- The call seller gets about $2,400 per contract (100 shares) for agreeing to sell NVDA stock at $490 should it reach that price or beyond by the expiration date, September 15th, 2023.

- Returns if NVDA goes above $490 by Expiration: You will be called away, meaning forced to sell your NVDA shares at $490. The number of shares you need to sell depends on the number of contracts (of 100 shares each) you sold as part of the sample transaction above. Based on the current price of $427, the strike price of $490 represents 15% upside from here. Including the premium of $24 per share, the total returns in this scenario is nearly 20% in about 3 months. Bear in mind that NVDA gained 11% just this past week and reaching $490 may not be much of a stretch given that the options chain expires 3 months from now. If this strike price and/or the expiration date appear too close for your liking, please adjust accordingly.

- Returns if NVDA stays below $490 by Expiration: You just added a cool 5.60% to your NVDA returns for agreeing to sell at a higher price. And you retain all your shares.

Why I Believe This Is A Good Trade Technically?

While the specifics may vary a little (such as the probability), this section generally applies irrespective of the strike price and expiration date you pick. I am picking the $490 strike price for this example as the total returns, if called, will be 20% from here including the premium and would place the stock’s forward P/E close to its 5-year average at 63.

- Technical Reason #1: There is a high probability (73%) that NVDA stock will be below $490 by the expiration date and if you believe in the stock’s long-term potential, this works in your favor as you are unlikely to get called-away (aka forced to sell your shares in lots of 100 each).

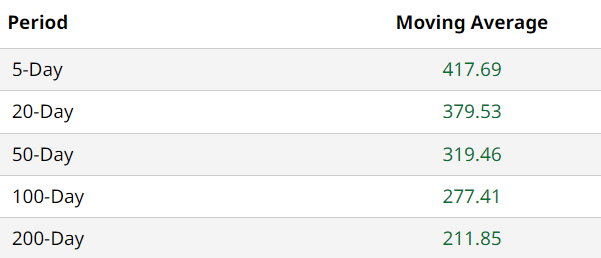

- Technical Reason #2: NVDA stock is currently trading way above the commonly used moving averages. This suggests a stock with strong upward momentum, and selling your shares outright here may cap off your gains.

NVDA Moving Avgs (Barchart.com)

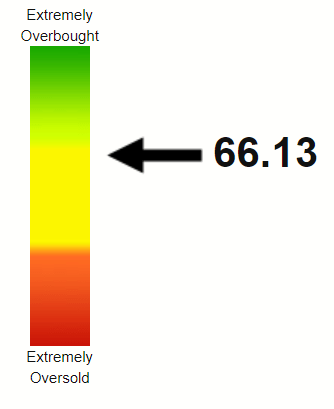

- Technical Reason #3: Despite the 200% run YTD, NVDA stock’s Relative Strength Index (“RSI”) is at a healthy 66 as shown below. I personally like stocks with RSIs between 60 and 75, as it likely means the stock has momentum in its favor but is not over extended. I won’t be surprised if NVDA’s RSI comfortably breaches 85 before starting to cool down.

NVDA RSI (stockrsi.com)

Downside

This has ticked off some of my readers in the past but I still hold the opinion that selling covered calls is the safest strategy out there with no downside. Covered calls allow you to pick a higher price than the current market price and you get paid a premium for doing so. In that sense, you know your expected returns down to the cent, should you get called. The only risk you’d need to be aware of is that you may be foregoing additional gains in the stock if you get called away at your strike price. And this is where the strike price becomes a key personal decision. What is a satisfactory return for you depends on two standpoints: your original investment and the returns from the current price. Answers to those two questions should help you determine your strike price.

Conclusion

I retain my “Hold” rating on Nvidia Corporation stock, but suggest those who hold to milk the cow using covered calls. Again, the strike price and expiration date used in my example above may not be the best for you specifically. But the larger point is to not exit momentum stocks too early and then later have regret (like I did). I cannot pinpoint as to why I sold my Nvidia stock outright instead of using covered calls, but in my defense, I did not get out all at once. I did step-ladder my way out and felt the risk was too much holding into earnings when I already had nearly 200% gains.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.