Summary:

- I admit to making a bad call on Apple stock due to confirmation bias and ego, but I have now changed my mind, and I’m bullish on the company.

- I emphasize the importance of humility, self-discipline, and mental liquidity in making successful market calls, and warn against fighting the crowd.

- I cite Apple’s strengthening product ecosystem, successful recent product launches, and the potential for diplomatic achievements with China as reasons for my bullish outlook.

Justin Sullivan

Well, you might not expect what is coming. It was Father’s Day when I wrote this, and I have a great Dad who taught me integrity. While many might brag about their good calls, I prefer to let them speak for themselves. You can look at the calls I’ve made, read the analysis, and judge for yourself. Good calls have a way of getting noticed, and people sweep the bad ones under the rug.

Instead of more of that, I will dive into a very bad call I made on Apple (NASDAQ:AAPL) before explaining why I have now changed my mind. I am doing this also because I want to explain my analytical process and how confirmation bias may have affected my call.

By documenting and investigating this, I hope to not only improve my research process and the accuracy of my calls, but I also think calling myself out on confirmation bias can help others identify when it may vex them. As human beings, all of us are susceptible to it – even Einstein.

I want to first off start by saying that I love Apple and its products, so the initial decision to be bearish on the stock was difficult for me. The first article I ever published on SA was a bullish piece on Apple that has aged well. I thought I was overcoming confirmation bias in making the call initially. Still, I see I should have pivoted sooner instead of letting my ego drive the bus. I wanted to be right, and sometimes you have to let that go.

When ANYONE does a good call in markets, there’s always an element of luck. This idea of the market expert is really an illusion. No surfer catches perfect wave after perfect wave and this is an apt metaphor I think. The thing I find most interesting about markets is at the end of the day, pedigree matters, but it can also be a handicap at times of transformational change. We are all ruled by the almighty ask and the boisterous bid. We all have heuristics we use that can cost us a lot of money one day and make us money the next.

We all have blind spots caused by what John Stuart Mill called “the despotism of custom.” This admission is crucial to successfully navigating markets in my opinion. I was into punk rock when I was kid, always have had problems with authority, and probably embrace contrarian positions to a fault sometimes. So, I really relished being right on Apple to my own detriment. You can’t take it personally when the market doesn’t go your way.

I doubled down, and I shouldn’t have. The quicker you cut your losses and change your mind, the better off your returns will likely be.

Folks who are up one year are often down and out the next. Repeated mastery of markets requires self-discipline, humility, and mental liquidity that most folks don’t possess.

As Napoleon Bonaparte wisely once said, “The only one who is wiser than anyone is everyone.” A man usually associated with egotism was actually wholly dependent on teamwork and collaboration, and of course, he knew how to understand and work a crowd. But here, his quote also shows he understood the wisdom of one as well.

Personally, Napoleon often expressed contempt for religion and the Catholic Church and notoriously even imprisoned the Pope. In his youth, he was a dedicated Jacobin. However, perhaps his most successful reform as Emperor was restoring the Catholic Church in France – mental liquidity.

Listen to Professor Price, Don’t Lecture Him

The price itself is a manifestation of what “everyone” thinks. The crowd. The market. And when money is involved, might makes right. So, if institutions like a stock, it often will have more price support. The price is the sum of everyone’s decisions or “votes” on price, in the parlance of Benjamin Graham. I always like to say, listen to Professor Price and don’t lecture him, and here again, I failed.

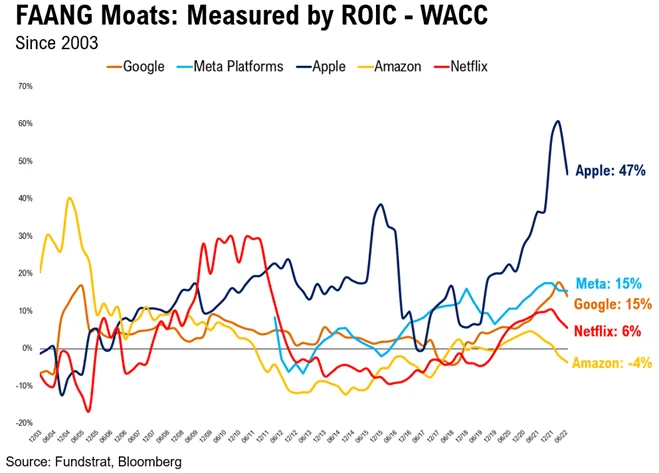

Fundstrat

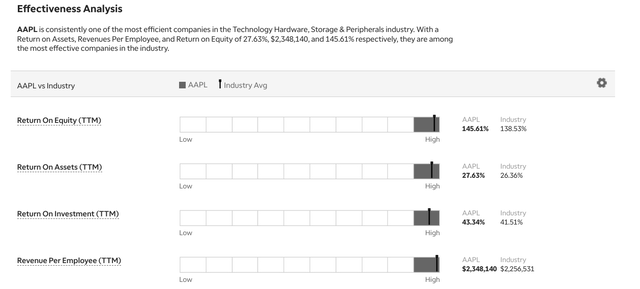

For example, I used this chart and stated that Apple’s ROIC-WACC was declining relative to recent highs. This is a great example of how confirmation bias came into play. I could have just as easily made the conclusion that Apple’s ROIC-WACC was still more than three times higher than the nearest competitor. Remember, to always look at the data both ways regardless what your pre-existing notion is.

Again, I think I stated the bear case on Apple very well, and the analytical process wasn’t a failure. But I started to think my analysis was more important than the price, and that is NEVER true. Especially with the most widely owned stock in the world. This is like playing someone with a high handicap in golf. It might look like they’re playing bad but they still might score way better than their shots look.

In the case of Apple, trying to short it is like playing Tiger Woods in golf and he’s allowed to play with a higher handicap. It’s not for the faint of heart and I knew it, indeed that’s part of what attracted me to it.

I’m proud of the company’s achievements and believe in the mission. It’s worth noting that a very easy smell test of a company is just seeing if its non-monetary mission jives with reality and public perception. Apple’s certainly does, and as a company they’ve put their money where their mouth is.

The events in November surrounding COVID protests and the subsequent waves of illness in the country prompted me to turn bearish on the stock. Here is an excerpt from the first bearish article I wrote on Apple.

War, protectionism, and industrial policy have replaced the openness, cooperation, and free trade that came before it. The latter environment is where Apple flourished. It will struggle in an environment of receding globalization and rising trade barriers. Apple sources components from 43 countries, and it all goes to China to then be assembled. Apple is particularly exposed to domestic political strife in China. Despite recent efforts to diversify the supply chain and a recent announcement to accelerate those efforts, Apple will be unable to untangle its fortunes with that of the Chinese state and its increasingly restless constituents.

So, here’s the thing. I am still convinced those words are correct when I read this now. Indeed, I still look back at these articles (yes, I did more than one) and stand by most of what I wrote in them, even in retrospect with what I knew at the time. Still, I should have done better, and if it provided any of my dear readers’ comfort, I did go down with the ship on the call to my extreme financial detriment.

But still I should have done better, and in retrospect, it is easier to see how particular individual predispositions are unique to me, and my confirmation bias probably affected this call. My first article got picked up by LinkedIn as Apple reached a 52-week low shortly after my first article. I thought I smelled blood in the water incorrectly. I was thoroughly convinced a big earnings miss was near.

Many analysts greater than me had tried to take a shot at the Death Star and failed (as some jokingly call going short Apple on Wall Street, not because of any resemblance to the Sith/Darkside on the part of Cupertino, but because of the perceived futility of the task). I thought I had a unique chance to make a great call as I tried to boost awareness around my name.

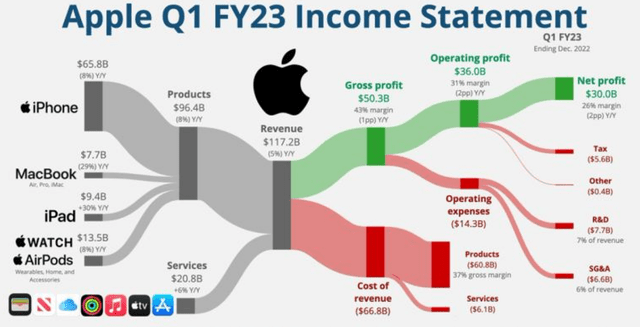

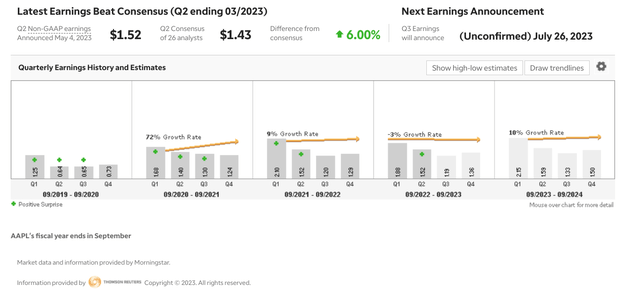

In retrospect, I can see how this might have led me to engage in the “wishful thinking” that we are all susceptible to. I wanted to be John Wayne for a day like we all do. I even got close when Apple had its worst earnings report in 7 years. The stock sold off in market hours, I got a few calls from people I respect congratulating me on the amazing call, and the market bid it up because it narrowly beat expectations on services, which was enough despite missing estimates in every other segment.

I was almost John Wayne for a day, but Tim Cook is considered one of the best CEOs alive for a reason. He righted the ship during an existential threat and navigated it splendidly, he kept the focus on the positive, and he continued delivering in the most trying of circumstances.

Why You Don’t Short Apple

Anyways, suppose you’re really paying attention to the market, and you have the bug, meaning you care about finding the answers as much or more as the money itself. In that case, you’ll realize what you might think about any particular stock is almost entirely irrelevant.

You should be paying attention to what everybody else thinks about it. The Keynesian Beauty Contest is one of the most important fundamental concepts to understand when analyzing investments.

“It is not a case of choosing those [faces] that, to the best of one’s judgment, are really the prettiest, nor even those that average opinion genuinely thinks the prettiest. We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees. -John Maynard Keynes

I’ve always found this to be one of the most important lessons in investing. You’re only trying to find stocks that the crowd will like and when they’ll like it. If you like blondes and the crowd like brunettes, seeking blondes will likely cost you money since the ask and the bid are ultimately functions of how many people want to buy an asset.

I disregarded my lesson and wanted to show what a good analyst I could be. My internal incentives probably slightly corrupted the regular emphasis I try to put on isolating investing truths from the perspective of a dispassionate shareholder that can result in alpha for my readers.

Apple is the most widely owned stock in the world. It has wide institutional ownership, deep derivatives markets, and its management is constantly engaging in aggressive buybacks and other activities to ensure stability of the stock price. I knew these things, but I considered them less than I should have. Don’t fight the crowd ever because you’ll lose. Get ahead of them. Skate to where the puck is going.

Risks and Where I Could Be Wrong

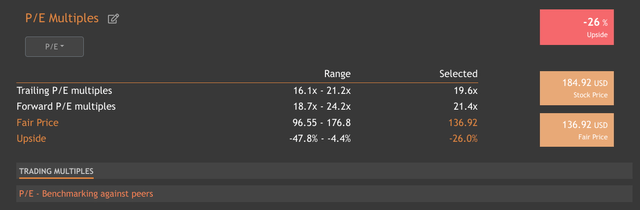

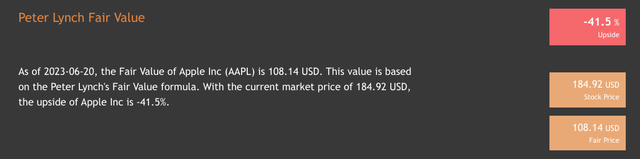

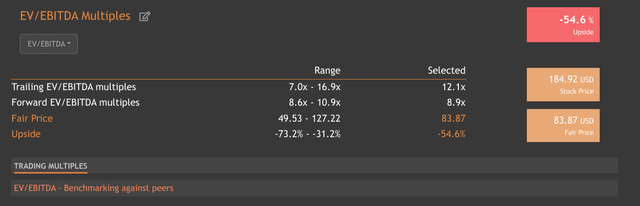

The primary risk to my thesis, given the information I have, is probably just the considerable price risk from having such a large run recently. The stock has recently hit an all-time high and it is definitely overvalued from the perspective of its P/E. I will also state plainly, that I believe we have started a new bull market which will benefit Apple.

Of course, the likelihood of the Fed being done earlier than they have indicated in the dot plot is also a potential upside catalyst for continued gains. If I’m incorrect about inflation coming down next report, and if it spikes for any reason, then I think my call on Apple could end up being like my last one, just in the other direction.

However, as I articulated in a recent article where I introduced a theory for why the VIX is suppressed and I think it goes a long way to explaining why the market has been resilient, and why more nuanced hedging strategies limit the type of cascading sell-offs like those which occurred in 2008.

But even outside of this detailed and technical argument, isn’t it somewhat intuitive that the market would be more equipped to climb a wall of worry after surviving the greatest threat to commerce in modern history?

What risk is there currently, aside from nuclear war, that poses a greater risk to commerce then what we faced in March 2020? People that assume the Fed would break something also assumed financial stability was as fragile as it was in 2008 despite a massive government overhaul.

One of Wall Street’s blind spots is in always thinking the government’s efforts are doomed to failure and idiocy. In this instance, the post-crisis financial reforms appear to have significantly improved the resilience and efficiency of markets. All these things make me think the environment is more bullish for Apple than consensus thinks, even despite their lackluster earnings growth for the year.

Apple might be considered overvalued on many metrics but it also is more financially effective than peers and has the most valuable brand in the world among many other sources of intangible value.

Conclusion: Why I’m Bullish on Apple Now

The original catalyst that led me to be bearish on Apple was the deteriorating geopolitical environment most notably with regard to China. COVID was an acute threat to the prevailing political order of China for a moment. I think the market has priced that in largely, and now efforts by the Biden administration to achieve an effective detente with China’s Xi Jinping are probably underappreciated by the market right now.

It should be remembered that Xi and Biden were both second in command of their nations at the same time and are reported to have a decent working relationship. Biden’s efforts at detente earlier were likely postponed due to “balloon-gate”.

Many may not realize that there are few companies that will benefit more from any diplomatic achievements here than China. Despite all of China’s tough talk against the West since the balloon incident and Taiwan exercises, the Communist Party has guarded its relationship with Apple carefully.

And as run of the mill as my reasons are for being bullish on Apple, certainly not as exciting as my bearish call, I think they reflect the crowd and will be more accurate in terms of price movement.

- The product ecosystem is continuing to strengthen and has positive inertia on securing more revenue through the vital Services segment. I had forecast some potential difficulty in services, but Apple appears to have righted the ship since the issues I brought up were flagged.

- The recent debt ceiling crisis illustrates just how powerful Apple’s balance sheet superiority is. It recently had its debt trading at higher prices than Uncle Sam’s and its juggernaut of a buyback strategy is a formidable obstacle for any prolonged downside price movement given the popularity of its core revenue drivers.

- The iPhone upgrade cycle should be providing benefits in earnest soon. The production interruptions that led to my bearish call seem to have been taken in stride by the company, and the possibility of a recession diminishing iPhone demand did not come to fruition.

- The recent product launch was largely successful, and despite criticisms of the price point I think this product is well suited to capture the initial adopters needed before mass-market adoption of such a high-priced product will be possible. Apple has proven this strategy before.

Apple is overstretched and I wouldn’t buy it hand over fist, but if you have a long time horizon I think you can be nibbling despite the recent highs. If you didn’t buy Apple because it recently hit an all-time high, well you would have been cheating yourself out of a lot of gains over the last few years.

Apple seems quite overvalued on most metrics, but I think you might be surprised that it is still not at the top end of its trailing EV/EBITDA multiples. This says to me, that there’s a lot more melting up that can occur, even if you’re disposed toward being bearish right now. I wouldn’t buy if this multiple gets to the higher end of the trailing and forward ranges.

I know I’ve missed a lot of the upside in this stock, and if I guided you wrong on this name, all I can tell you is that I will try to be better and I suffered the consequences financially for the call as well. I’m back to being an Apple bull and I’d say Cook has more than earned the benefit of the doubt from shareholders and analysts, including myself.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.