Summary:

- Following the bankruptcies of SVB and First Republic, many have voiced their disdain for bank stocks ~ I believe bankruptcies spell opportunity.

- Bank of America struggled mightily following the 2008 financial crisis. But Brian Moynihan and Dodd-Frank are game changers.

- The risks need to be analyzed: Unrealized losses, fleeing deposits, and rising defaults.

- In the decade ahead, I project returns of 12% per annum.

Drew Angerer/Getty Images News

The Bull Thesis

Over the past few months, many have voiced their disdain for bank stocks. Instead, investors have piled into technology, in my opinion, at the wrong time. I believe Americans are largely underweight financials. Over the past five years, banking has been one of the worst performing industries.

Cyclical stocks are especially unloved because a recession is so widely expected in 2023. The problem is defensive sectors look overvalued. And, bank valuations are down far more than earnings, prompting the question, “Have we hit bottom?”

Enter Bank of America (NYSE:BAC), Warren Buffett’s second-largest stock position:

Berkshire Q1 2023 – Top Holdings (Dataroma)

Despite having sold-off alongside regional banks, BofA is in much better shape. The bank is well capitalized thanks to Dodd-Frank regulation and has a terrific deposit base.

A Troubled History

To understand where Bank of America is going, we need to understand where it has been. A troubled history has loomed over BofA’s valuation for quite some time. This is thanks to the bank’s handling of the Great Financial Crisis. I believe poorly-timed acquisitions were the main culprit. BofA’s former CEO had the company purchase Countrywide Financial (In ’08) and Merrill Lynch (In ’09). Let’s just say, Bank of America didn’t pay troubled prices for these troubled assets. Some described the Countrywide acquisition as:

“Quite simply the worst deal in the history of the financial services industry.”

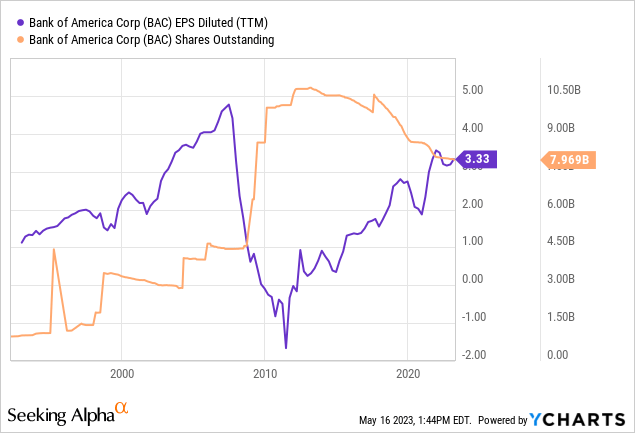

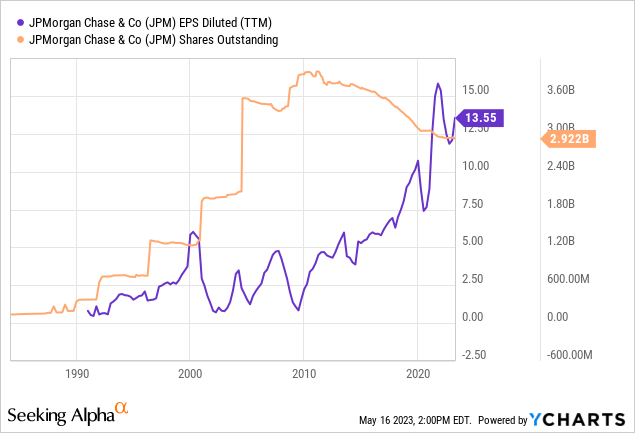

These acquisitions led to years of lawsuits and losses that kept Bank of America’s earnings depressed. The worst part was, Bank of America diluted shareholders to make these acquisitions, causing EPS to plummet:

Brian Moynihan took the reins in 2010 and has largely turned the ship around. As I’ll explain later, the next recession may be nothing but a blip in BofA’s upward trend. This was the case for Jamie Dimon’s JPMorgan Chase (JPM) in 2008:

In the above image, you can see the shift that has occurred in the industry. Since 2010, there have been fewer acquisitions and more share buybacks. The result: Greater EPS growth.

Comparative Valuations And BofA’s Premium

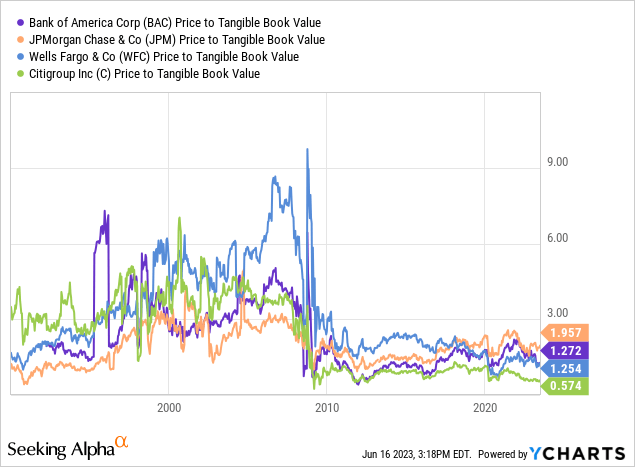

Price to tangible book of America’s four largest banks:

In my mind, Bank of America, Wells Fargo (WFC), JPMorgan Chase, and Citigroup (C) are all quite cheap. Looking at the above chart, you can see how the valuation of these banks has changed over time. You could argue that U.S. banks were more expensive in the late 90’s and early 00’s because there was less regulatory oversight. But I would counter that because of regulatory oversight, these banks have far less risk now than they did before.

Bank of America trades at a price to tangible book premium but deserves this premium. It earns more on assets and equity than Citi and Wells Fargo. BofA has a strong position in consumer banking with its thousands of retail locations, robust credit card offerings, and investment products (Merrill Lynch and BofA Securities).

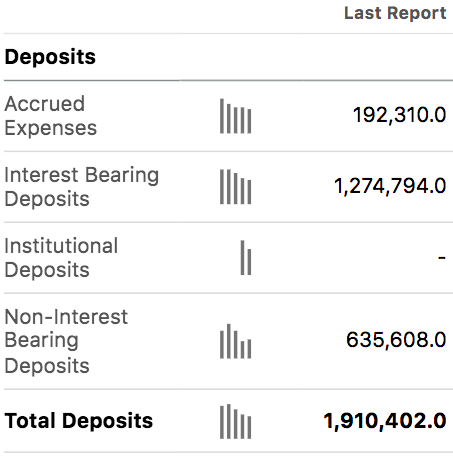

In addition, Bank of America has a very low cost of funds, as evidenced by its trove of non-interest bearing deposits:

Bank of America Deposits (Seeking Alpha)

Seeing as Bank of America pays zero interest on so many deposits, net interest margins naturally increase as interest rates rise.

Dodd-Frank

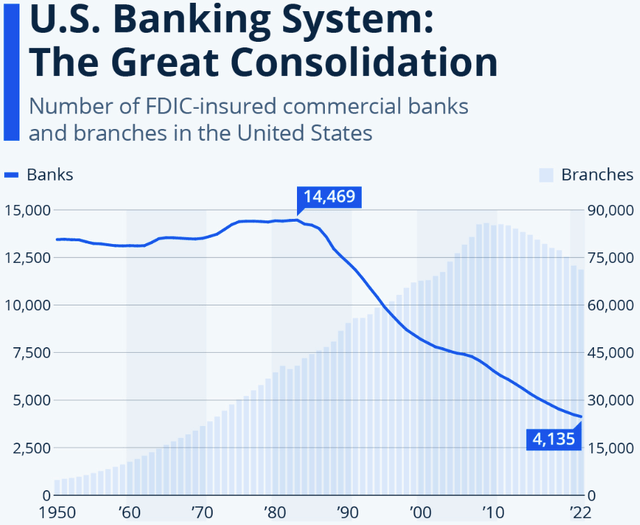

The Dodd-Frank Act has done wonders for America’s largest banks, which sailed smoothly through the COVID-19 lockdowns of 2020. Unfortunately, Dodd-Frank was rolled-back in 2018 for America’s smaller banks, those with less than $250 billion in assets. It should come as no surprise that some regional banks have declared bankruptcy in recent months, as interest rates rise. In my estimation, the likes of Bank of America, JPMorgan Chase, Wells Fargo, and Citigroup are likely exempt from this outcome, and their market share should benefit as the industry consolidates. This continues a long-standing trend that began in the 1980’s:

Banking Consolidation (Statista)

Regulation should, no doubt, increase for regional banks (Those with $100-250 billion in assets). Many of these banks are not well capitalized, with Silicon Valley Bank and First Republic being the poster children.

There Are Risks

Loan Losses

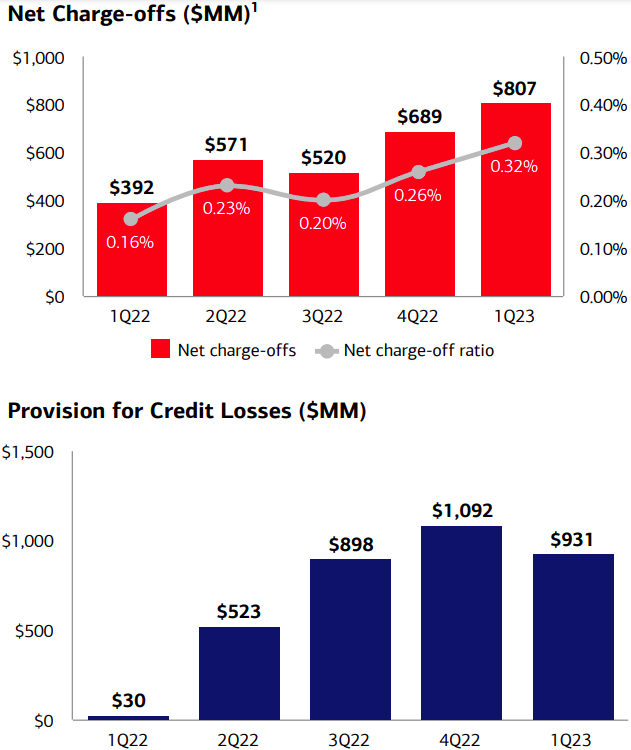

Bank Of America has been building allowances for loan losses, and actual loan losses are on the rise as evidenced by BofA’s net charge-offs:

Financial Information (BofA Q1, 2023 Presentation)

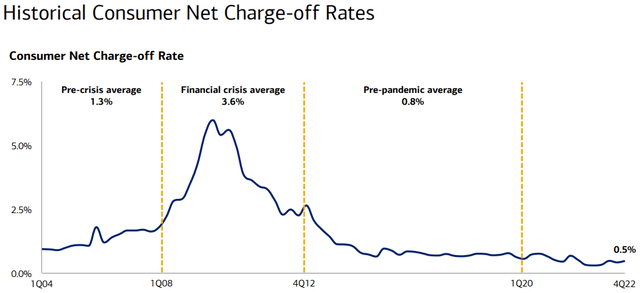

The problem here is, actual loan defaults at BofA are still near all-time lows:

Historical Net Charge-Offs At BofA (BofA Q4, 2022 Presentation)

Some explanation of the above terms: Provision for credit losses means you’re accounting for losses you expect in the future. Net charge-offs means you’ve actually determined a “debt is unlikely to be collected.” A.K.A., the customer is defaulting on their loan.

Now, maybe defaults are lower than they were in the past due to increased regulation, and maybe Bank Of America is making outstanding loans. But, I think low unemployment rates in the United States play a role. I expect a reversion to the mean; loan losses and unemployment rates should increase in the years ahead.

Parallels To Silicon Valley Bank

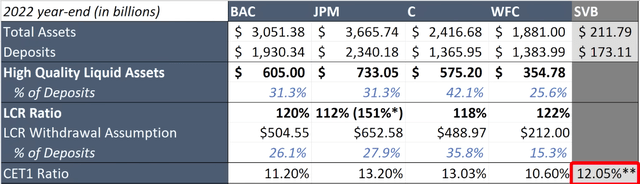

Now let’s compare America’s largest banks to, now bankrupt, Silicon Valley Bank:

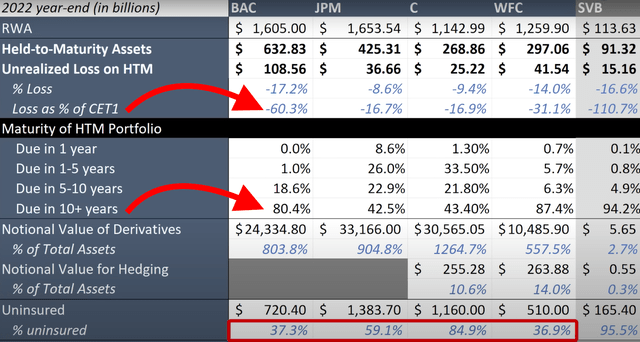

Data, Year-end 2022 (The Plain Bagel)

Note that SVB had a higher CET1 ratio than Bank of America. The issue was that SVB’s losses on held-to-maturity [HTM] bonds effectively wiped out its CET1 capital. Meanwhile, SVB had a concentrated deposit base and did not hedge against interest rate risk.

Data, Year-end 2022 (The Plain Bagel – Altered By Author)

Bank of America also has significant unrealized losses on held-to-maturity bonds, representing 60.3% of its CET1 capital at the end of 2022. This was the result of a capital allocation blunder, buying long-duration bonds in a historic bond bubble. Of Bank of America’s HTM bonds, 80.4% have a maturity of 10 years or more. Note that competitors JPMorgan Chase and Citigroup avoided this outcome.

The good news is, Bank of America shouldn’t have to sell these bonds to service deposit withdrawals. Therefore, it should only lose money in real, inflation-adjusted terms. The reason: Bank of America has a terrific deposit base, with just 37% of its deposits being uninsured.

In my opinion, a run on deposits at BofA is highly unlikely. Insured depositors have no reason to flee. Even if a bank run did occur, America’s largest banks all have tons of liquid assets, as well as good leverage ratios and CET1 capital (See above images). Also, Bank of America has way more hedges in place than SVB did (As evidenced by its derivatives as a percentage of assets).

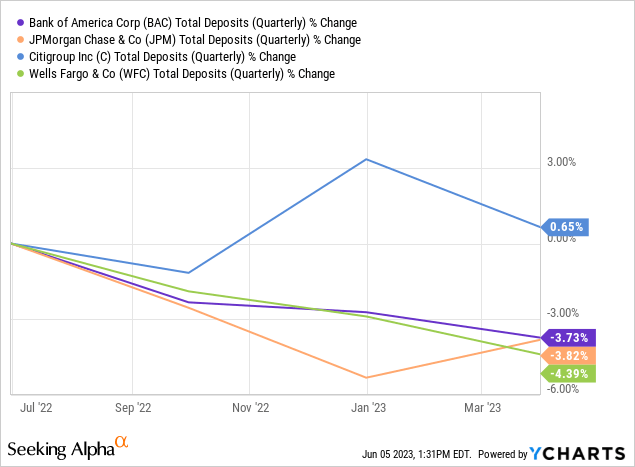

With all that said, it should be noted that Bank of America’s deposits have decreased slightly over the past year:

According to Brian Moynihan, some customers have moved their money to money market funds, chasing higher interest rates. Also, deposits have organically decreased as consumers burn off the stimulus cash injected in 2020 and 2021. Moynihan expects this trend to reverse if interest rates fall.

In the meantime, Bank of America may have to pay higher interest rates on roughly two-thirds of its deposits. At the same time, the bank can also lend out money and buy assets yielding higher rates, partially or fully offsetting this expense.

Temporary Fluctuations, Fundamental Growth

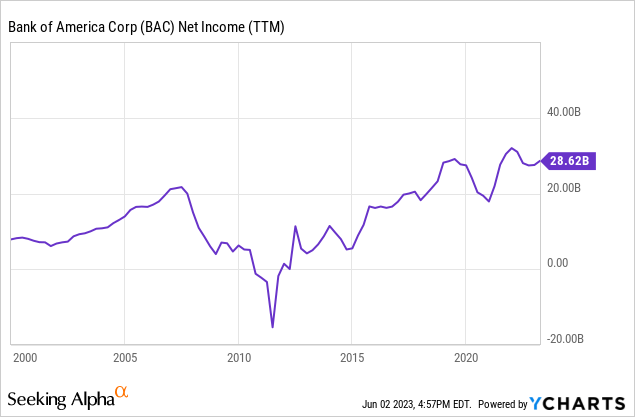

If you are a true business owner, you shouldn’t be too worried about fluctuations in Bank Of America’s earnings. When you own a bank, you understand that there will be some good years, and there will be some bad years. If we look at the history of BofA’s net income this is pretty clear:

Over the past 20 years, Bank Of America’s averaged a net income figure of about $14 billion. But, in the past 20 years, Bank Of America’s made huge strides in improving its online banking, cutting costs in an enormous way. The money supply has also grown tremendously. This, along with the presence of share buybacks means the long-term trend for EPS is overwhelmingly likely to be up.

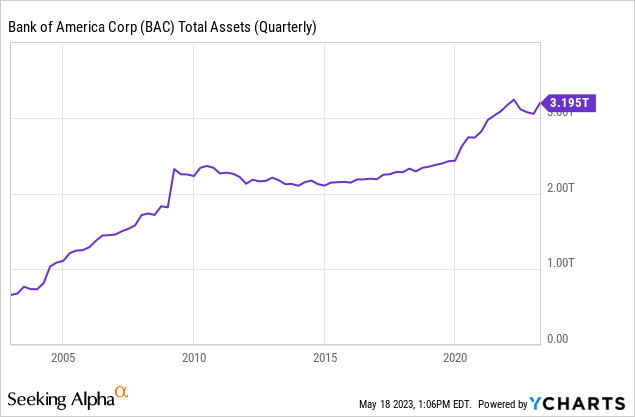

Bank of America has significantly more assets than it did 20 years ago:

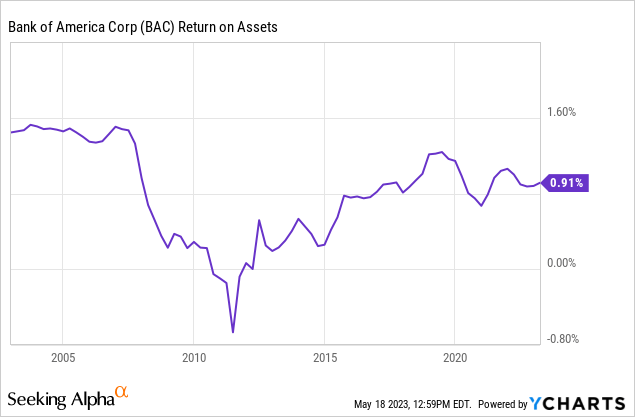

Normalized Earnings

Because of its much larger asset base and fundamental improvements, I estimate the bank’s normalized earnings are around $24.5 billion ($3.10 per share). This is the result of looking at the bank’s average return on assets over the past 20 years. This figure is after preferred dividends and gives BAC a normalized PE of 9.5x.

Long-term Returns

In the decade ahead, I estimate returns of 12% per annum for Bank of America:

| Current EPS | $3.33 |

| Current Dividend | $0.88 |

| Compound Annual Growth Rate | 5% |

| Year 10 EPS | $5.40 |

| Terminal Multiple | 13.5x |

| Year 10 Share Price | $73 |

| Annualized Return (Dividends Reinvested) | 12% |

Note: This is a base-case estimate.

In Conclusion

America’s largest banks look like steady ships in troubled waters. I believe Dodd-Frank regulation has Bank of America in an enviable position as regional banks falter. BofA has a massive, low-cost deposit base and is well capitalized. Brian Moynihan looks unlikely to repeat the mistakes of his predecessor. In the decade ahead, I project returns of 12% per annum for BAC stock and maintain a “Buy” rating on the shares. We opened a small position below $28/share.

Until next time, happy investing!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of C, BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.