Summary:

- In 2022, I likened Meta to the Washington Post, led by Katharine Graham, circa 1973-1974.

- From the nature of the stock decline to Meta’s CFO’s execution of a healthy leveraged recapitalization in late 2022, the similarities have been worth considering.

- In this note, we will mostly focus on Meta’s most recent quarter, as well as the simply superb work performed by Meta’s CFO over the last 6 months or thereabouts.

- I provide links to “The Modern Day Washington Post” parts I and II and share a link to an exercise I performed in which I estimated the impact of digital ads on our economic system. Zuckerberg mentioned a study in this vein on Meta’s recent earnings call.

- To concisely state my thesis for Meta: Onward to 5B Family of App users and beyond.

panida wijitpanya

Thesis Housekeeping

In the links below, you’ll find a variety of perspectives for Beating The Market’s Meta (NASDAQ:META) thesis.

From assessing the impacts of digital ads on global GDP to analogizing (a dangerous act at times; reasoning via first principles is preferable) Meta to the Washington Post circa 1973-1974 to analyzing Meta’s virtual reality ambitions long before they entered public collective consciousness, we’ve fairly comprehensively detailed the business of Meta over the last 3 or so years:

- Facebook: The Washington Post Of Our Time.

- Meta: The Modern Day Washington Post Part II.

- Facebook: Conviction Buy Despite Regulatory Fears.

- Facebook: Introducing President Mark Zuckerberg.

With these ideas as our foundation, let’s begin our review of Meta’s most recent quarter to assess whether the company has continued to satisfy our expectations related to the KPIs core to our thesis.

Onward To 5B Users Globally

In past work on Meta, we boiled our thesis down to the idea that it would one day have 5B+ users on its Family of Apps. Simply put, in reaching 5B+ users over the next 10-20 years, we’ve (including the spirit of Mr. Jared Simons in this pronoun, a former analyst within Beating The Market) believed that Meta would be worth substantially more than $500B to $800B in market cap, within which range it has traded over the last 18 months or so.

And we continue to make progress on this front:

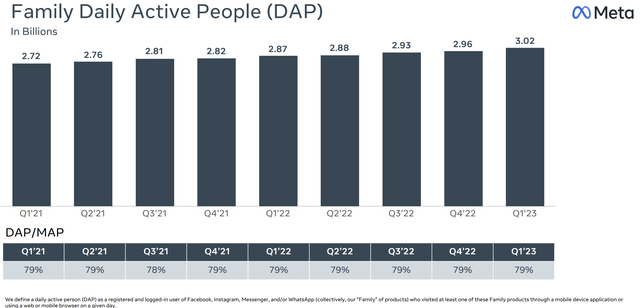

Humans That Used One Meta Product Once Per Day, Q1 2023

Meta Q1 2023 Earnings Presentation

In Q1 2023, Meta grew its Daily Active People beyond 3B for the first time.

I recall writing ~2.7B in 2021, and, in just a couple of years, we’ve now eclipsed 3B, adding 300M in just two years.

With continued global population growth alongside technology such as Starlink (the payments for which are powered by Shift4 (FOUR)), I believe Meta’s TAM is all of humanity on earth, sans CCP-governed China, in which all external social media apps, e.g., YouTube (GOOGL) (GOOG) or WhatsApp (META), have been banned.

So we have a very long runway, suggesting that we could somewhat easily reach 5B and beyond, and this runway extends with each passing day in which the whole of human population grows.

(As an aside, our thesis for Shift4 could be summarized by stating “Onward to 1B Starlink subscribers!”)

Turning to Meta’s Family Monthly Active People…

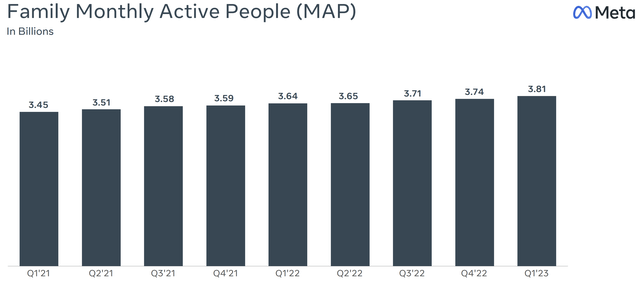

Humans That Used One Meta Product Once Per Month, Q1 2023

Meta Q1 2023 Earnings Presentation

As the above chart illustrates, monthly active people continue to inch closer to 4B, and, in Q1 2023, we experienced our largest sequential add in years.

I say again: We experienced our largest sequential addition of users to Meta’s Family of Apps in years!

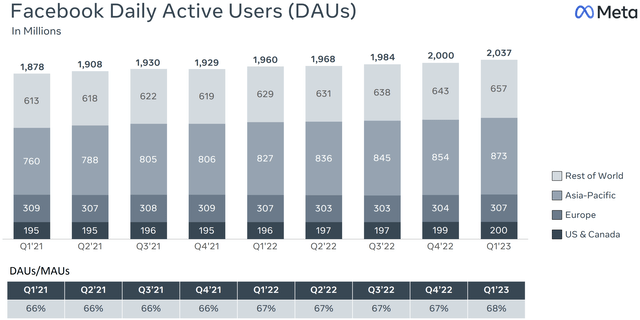

Humans That Used Facebook Once Per Day, Q1 2023

Meta Q1 2023 Earnings Presentation

While the same cannot be said for Facebook, we did experience a healthy addition of daily active users in Q1 2023.

And the same could be said for Facebook (Meta’s flagship, ol’ blue app) in Q1 2023.

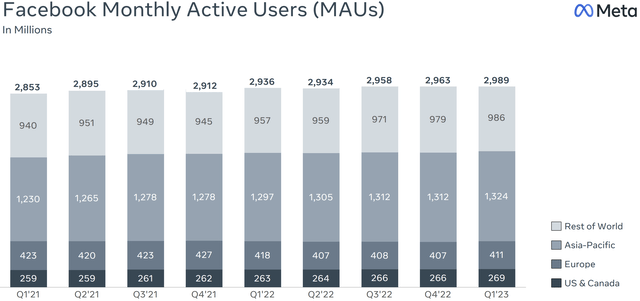

Humans That Used Facebook Once Per Month, Q1 2023

Meta Q1 2023 Earnings Presentation

In short, Meta continues to grow users as we’ve hoped it would, and our thesis remains very much on track and intact.

In short, onward to 5B users and beyond!

Meta’s Moats

In past works on Meta, which I linked earlier for you in this note, we’ve delineated the moats we believe the business to have.

I believe that two of Meta’s principal moats, as of today, are ironically begotten by exogenous entities, such as regulators around the world and Apple’s (AAPL) privacy changes (known colloquially as ATT).

To be sure, I do not take issue with Apple, and I’ve always believed Apple to be a fantastic DGI investment.

That said, objectively, I believe Apple’s privacy changes, which were seen as negatives for Meta when first enacted, have effectively served to guarantee core Facebook’s virtually insurmountable moat.

As I remarked in the Beating The Market chats,

So Facebook was already one of a kind prior to ATT/Apple privacy. Now it takes tens of billions, if not hundreds of billions, in data center infrastructure and AI development to rival Facebook’s ROI for advertisers.

Apple [has been] helping us out big time here it would seem.

Source: Beating The Market Chats.

WhatsApp Monetization

While we cannot be exactly sure how much revenue WhatsApp generates for Meta presently, it is certainly a platform that’s worth monitoring. In November 2022, there were some whispers of Meta’s monetization of WhatsApp in India, where Zuck has positioned WhatsApp as effectively the WeChat of India.

It is certainly worth noting for our U.S. audience that WhatsApp is exceptionally popular internationally; not just for occasional communication, as is the case for Americans and their relationship to WhatsApp.

Within Europe and Latin America and SE Asia, WhatsApp reigns supreme; hence, it boasts billions of users globally.

As a daily destination for billions of humans globally, I think it’s entirely conceivable that WhatsApp continues to evolve into a business that generates billions, then tens of billions in revenue for Meta; potentially more over the very long run.

I believe that Zuck is being smart here in essentially not monetizing WhatsApp whatsoever.

I think he followed the same playbook with Facebook throughout the 2000s, in that he and his team waited as long as they could to monetize the platform, which created the embedding, brand, and network effect moats Facebook came to possess; the fruits of which we continue to harvest to this day.

I believe Zuck should wait for as long as possible to monetize WhatsApp. He should give away services that are objectively valuable and worth compensation for free for a decade+, if not longer, whereby he locks in as many of earth’s citizens as is possible into the ecosystem.

With Facebook’s moats being solidified by crisp execution and via a little help from Apple and regulators, we’re not hurting for gross profits or free cash flow. We can continue to give valuable services away to as many citizens of Earth as possible, whereby we create the embedding, network effects, and brand moats that will allow us to produce robust free cash flow in the 2030s and beyond.

Considering Zuck is arguably the most competent capitalist in the U.S. at present (Mr. Jared Simons’ ideas; not mine), in response to which we’ve had to use the U.S.’s monopoly on violence through the FTC to hamstring his ability to continue to accumulate assets, such as WhatsApp or Instagram, which he acquired in the 2010s, I think he sees the above realities and is evolving Meta accordingly.

I have faith in his business mind, and I humbly ask the U.S. or universe to allow him to allocate capital once again.

If we’re going to allow Microsoft (MSFT), which has a perfect monopoly on PC gaming to buy a $69B oligopoly (ATVI) in 2023 after buying a $7.5B duopoly (GitHub) in 2018, I think it’s time we unshackle Zuck’s arms and legs and allow him to compete with the other tech giants fairly.

Incredible Execution By Meta’s CFO

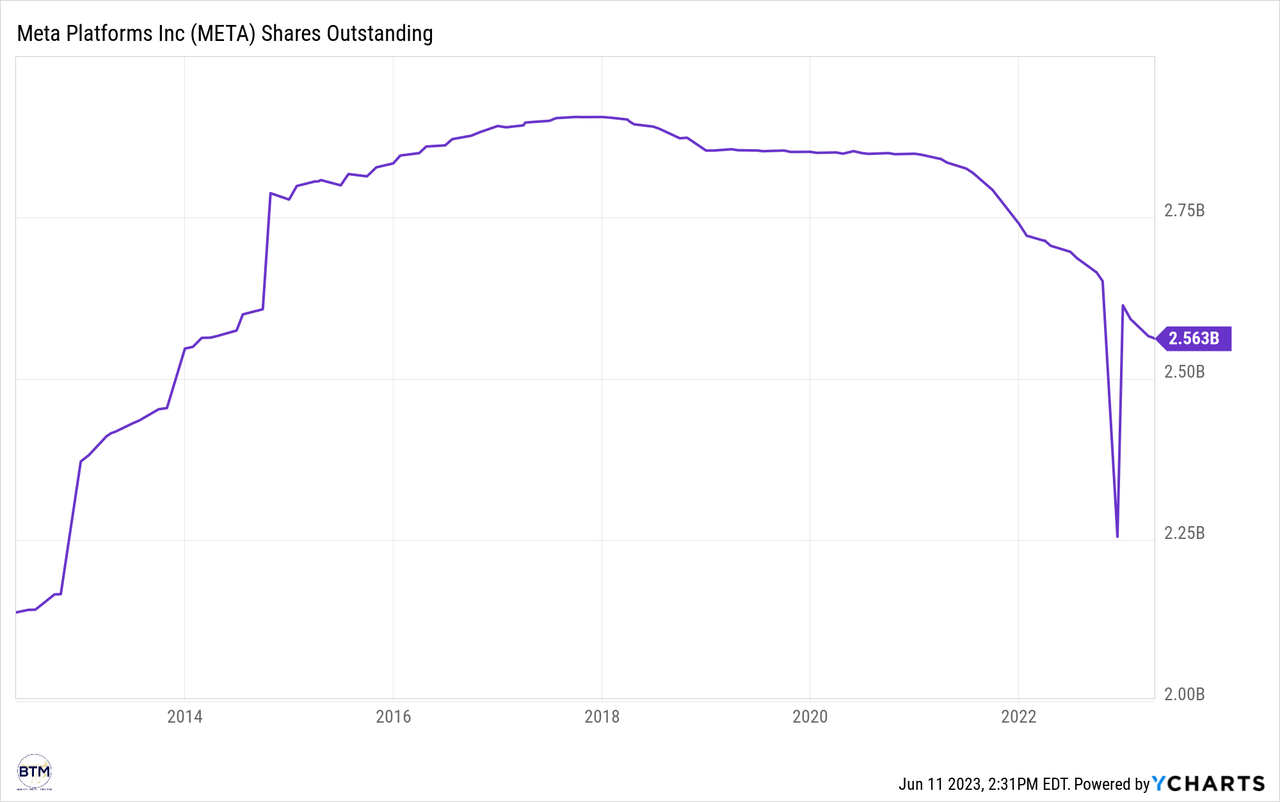

Turning to Meta’s buyback activities, I’d not checked on Meta’s shares outstanding in a while, but I was pleasantly surprised when I did recently:

Meta Continues To Buy Back And Eliminate Shares Outstanding, Reducing The Shares In The Equation Fcf/Share, Thereby Accelerating The Quotient Of The Equation Fcf/Share

YCharts

And, recently, Meta has been using debt to repurchase even more shares.

As I remarked in the Beating The Market chats on this subject,

Little leveraged recapitalization maximizing shareholder value.

Great CFO work here!!

Wow! I didn’t even have to write a note this time! Alphabet’s Cash Hoard Is Destroying Shareholder Value (I know I reference it often, but it’s foundational knowledge for investing).

Reels gaining share. Facebook monopoly solidified thanks to Apple. WhatsApp is the Visa of communications globally. Huge embedding moats in India and LatAm. TT getting banned in various jurisdictions. Fate loves irony!

To reiterate, Meta uses the debt and the associated interest expense to reduce its tax burden, reduce share count, and adjust WACC, all of which lends to maximizing shareholder value.

And the CFO’s leveraged recapitalization was done when Meta was very attractively priced. This truly constitutes legendary work by Meta’s CFO, and I have seen nary a peep about it publicly, though perhaps I am not looking hard enough.

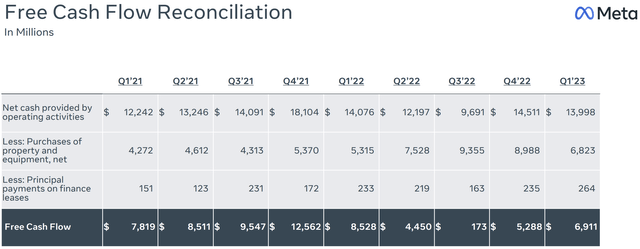

I believe Meta will continue to execute sustained share repurchases via its robust free cash flow, depicted below:

Meta Q1 2023 Earnings Presentation

Concluding Thoughts: In The Dog House With Zuck

As we’ve been sharing often over the last 6-12 months within the Beating The Market chats, Zuck is a dog.

And, as we know, “All Dogs Go To Heaven.” Why do all dogs go to heaven? They do so because they are loyal, persistent, tenacious, loving, and willing to protect.

When they tire or experience setbacks, in service of a goal, they do not quit. They continue to persist.

It’s been a hard day’s night, and I’ve been working like a dog.

I believe Zuck is a business leader who is a dog.

I also believe he is largely just trying to make his dad proud via serving a consistent product to, as of today, all of humanity.

I think the evidence of this can be found in his dad’s offer to him when he was 18: Harvard tuition or a McDonald’s (MCD) Franchise.

I think this indicates that Zuck’s father, and he has always had the mindset of “serve the customer through business and a consistent product, while also acting as a capitalist.”

Of course, Zuck chose Harvard and built Meta, but I believe the same psychology continues to permeate his brain: Build a business. Serve customers with high quality, consistently. Work like a dog to do so.

In closing, I am happy to be partnered with Zuck with a “hopefully forever” mindset.

As always, thank you for allowing Beating The Market to serve you in building your business of owning businesses!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, FOUR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.