Summary:

- PayPal may be one of the cheapest high-quality tech stocks available now.

- While many tech stocks have skyrocketed recently, PayPal’s stock has been stuck in the mud and may have bottomed after an 80% peak-to-trough decline.

- At around 10-12 times forward EPS estimates, PayPal’s stock is exceptionally cheap.

- Furthermore, the company could beat the lowballed consensus estimates in future quarters and years.

- PayPal has significant revenue growth prospects and earnings growth potential, enabling its stock price to appreciate considerably in the coming years.

Justin Sullivan

I recently increased my PayPal (NASDAQ:PYPL) position again, bringing my average price paid per share to approximately $66. At more than 3% of my All-Weather Portfolio holdings, PayPal is one of my most significant positions now. PayPal had one of the most spectacular crashes during the recent bear market phase, dropping by about 80% from its peak in 2021.

However, PayPal remains in a favorable market position and should continue growing sales and EPS as we advance. Moreover, it seems likely that many analysts have become too pessimistic regarding PayPal’s prospects, and its consensus estimates are probably lowballed right now. PayPal remains the online payment services sector leader, and its technical image is screaming, “Buy me now.”

Furthermore, the indiscriminate selling lowered PayPal’s valuation to an exceptionally undervalued level. PayPal trades at only around 12 times 2024 consensus EPS estimates, and if we use higher-end forecasts, the stock is closer to 10-11 times forward EPS. The stock is selling at about 2.5 times forward sales estimates, making the company’s valuation appear dirt cheap. As the market and the economy recover, PayPal could continue beating consensus analysts’ figures, leading to multiple expansion, and a much higher stock price in the coming years.

The Crash is Over – Now It’s Time to Recover

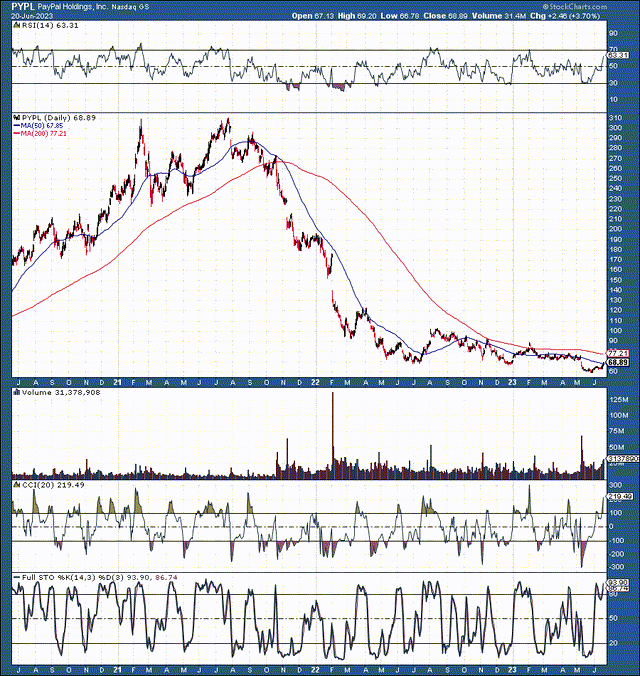

PYPL (StockCharts.com)

PayPal’s stock crashed, culminating in a recent slide to the $60 level, approximately a six-year low for the company’s stock. PayPal’s bear market has been long and brutal, lasting about two years and taking roughly 80% of the company’s value away. However, the last year has been mostly sideways, and we can view this as a consolidation phase. Recently, the technical image became more bullish, with a possible bowl-shaped bottom forming here. Also, we’ve seen improvements in the RSI and other technical gauges. Next, we want to see the 50-day MA move above the 200-day MA. The increasing bullish technical characteristics should increase the buying interest in the company’s shares. However, aside from the improving technical setup, there are plenty of fundamental reasons to own PayPal.

PayPal – Still Leading in Payment Services

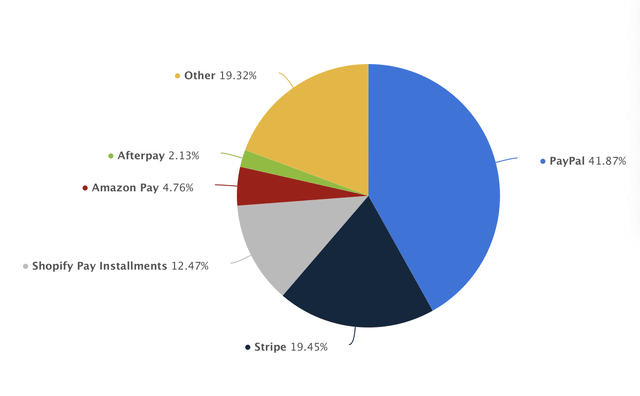

Market share of online payment processing software (Statista.com)

PayPal isn’t only the leader in online payment processing software. PayPal is a household name. PayPal remains well ahead of its competition, with its market share accounting for about 42% in the payment services sector.

Here are several other facts you may find interesting about PayPal:

- As of 2023, PayPal has a staggering 435 million active accounts.

- In 2022, PayPal had 22.3 billion payment transactions, a 16% YoY increase.

- In 2022, PayPal generated $27.5B in revenue, an 8% YoY increase.

- As of 2023, there are approximately 29 million merchant accounts on PayPal.

- PayPal is truly global, as more than 200 countries and regions worldwide use PayPal.

PayPal generates remarkable numbers, and the stock became significantly oversold recently, driving PayPal’s valuation down to ridiculous levels. PayPal’s market cap cratered from a high of about $360B to less than $70B in the recent declines. Now PayPal trades at only about 2.5 times this year’s sales estimates. This P/S valuation is relatively inexpensive, provided PayPal’s revenue and earnings growth potential in the coming years.

PayPal – Likely to Beat Earnings Estimates

Last quarter PayPal reported non-GAAP EPS of $1.17, beating the consensus estimate by seven cents. Moreover, PayPal reported revenues of $7.04B, a $50M beat over the consensus estimate and an 8.3% YoY gain. Total payment volume increased considerably to $355B from $323B a year ago. Total transactions grew by 13% to 5.8B YoY. Furthermore, PayPal provided excellent guidance of non-GAAP EPS growth of 24-26% YoY for Q2, and full-year EPS is now expected to grow by 20% YoY to $4.95 (up from prior guidance of 18% YoY growth of $4.87).

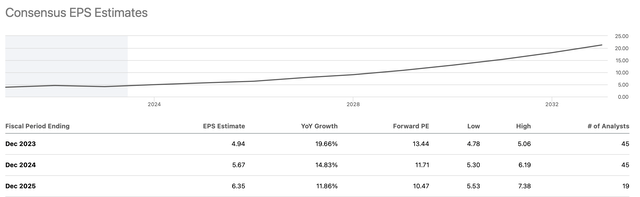

In Q2, PayPal should deliver around $1.16 in EPS (consensus estimate). Also, double-digit EPS growth should continue as the company advances in future quarters. Moreover, PayPal should report around $4.95 in EPS this year, and the company’s consensus estimate is for $5.67 in EPS in 2024, approximately 15% YoY growth. Additionally, PayPal’s earnings estimates were lowered significantly, and PayPal could report better-than-expected revenues and EPS, leading to upward EPS estimate revisions, multiple expansion, and a much higher stock price as we advance.

EPS Estimates – PayPal Likely to Outperform

EPS estimates (SeekingAlpha.com )

With the stock still bouncing around the recent bottom PayPal is still dirt cheap. At approximately $68 a share and EPS of roughly $6 next year (my estimate), PayPal’s stock is only trading around 11 times forward EPS estimates. This valuation is remarkably cheap for a company set to provide robust revenue and EPS growth in the coming years.

What the Wall St. Crowd Thinks

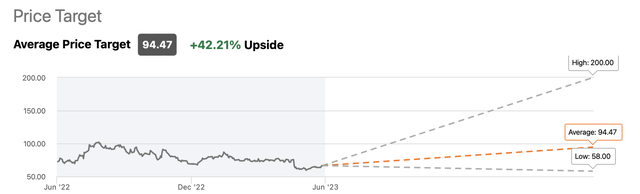

Price estimates (SeekingAlpha.com )

The average price target on the street is around $95, roughly 42% above PayPal’s recent price. Moreover, the lowest price target is slightly below $60, implying that the downside is likely limited now. On the other hand, the higher-end price targets go up to around $200, suggesting the company’s shares could appreciate by 100% or more over the next 12 months.

Where PayPal’s stock could be in future years:

| The year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 |

| Revenue Bs | $30 | $33.8 | $38 | $42.7 | $47 | $52.5 | $58 |

| Revenue growth | 8% | 13% | 12% | 12% | 11% | 11% | 10% |

| EPS | $5 | $6 | $7.14 | $8.50 | $10 | $11.80 | 13.85 |

| EPS growth | 20% | 20% | 19% | 19% | 18% | 18% | 17% |

| Forward P/E | 11 | 17 | 20 | 22 | 21 | 20 | 19 |

| Stock price | $68 | $121 | $170 | $220 | $248 | $277 | $325 |

Source: The Financial Prophet

To remain modest, I use relatively low revenue and EPS growth estimates. PayPal’s sales could accelerate faster than my model implies, and the company could experience more significant EPS growth than the table suggests. Furthermore, we may see higher multiple expansion as the market comes to its senses. Therefore, my 2029 price target of $325 is modest, and PayPal may achieve this range sooner than expected if the company executes and performs well in the coming years.

Risks to PayPal

Of course, as with almost any investment, there are risks involved. PayPal Holdings, Inc. may face more significant margin compression. This dynamic will make achieving the projected EPS and revenue growth figures more difficult. Moreover, macroeconomic factors, completion, and other elements may weigh on the stock price for some time. Additionally, PayPal’s multiple may not expand as envisioned, and its stock price could stay depressed or appreciate less than anticipated as we advance.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!