Summary:

- The operating cash flow-related concerns for AT&T Inc. seem to be misplaced.

- The company is set to post robust financial growth in the quarters ahead.

- This is an opportune time for investors to load up on AT&T stock.

Anne Czichos

AT&T Inc. (NYSE:T) shares have declined 20% from the April highs, as investors have grown wary of the company’s prospects. The biggest concern at hand is the telecom giant’s declining cash flow, which might limit its capital expenditure for growth initiatives and bring along yet another dividend cut.

While this concern sounds legitimate, the ground reality is a little different. In this article, we’ll examine AT&T’s cash flow trends, its dividend sustainability, and I’ll attempt to explain why the stock makes for a good buy at current levels. Let’s take a closer look at it all.

Unwarranted Selloff

Although AT&T’s operating cash flows have remained stable and gradually increased over the years, the metric declined out of the blue in the last quarter. Its management attributed the decline to seasonal factors, but a broad swath of investors wasn’t convinced, as declines of this magnitude weren’t an issue in its prior quarters.

This fueled speculative theories in investing forums — investors began to wonder if this is the “new normal” for AT&T’s operating cash flow, and if it is, then the company will be forced to slash its dividend payouts yet again. Another theory is that AT&T is, perhaps, not doing well operationally and is losing ground to competition. But as I said, the ground reality isn’t all that grim.

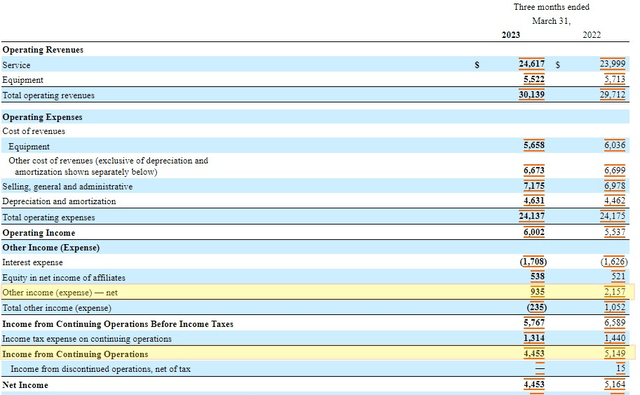

There are a couple of things to note here. First, AT&T’s Q1 results included some fluctuations in what seem to be non-recurring items. Digging into its income statement, we can see that its “other income” declined by $1.22 billion year-over-year, which dragged its net income lower accordingly.

Note how the company’s operating revenue and operating income were higher year-over-year, which dissuades concerns relating to AT&T’s competitiveness and its market positioning. But coming back to the declining “Other Income”, AT&T explained in its 10Q filling that the decline seems exaggerated due to higher base effect of non-recurring items in prior year:

The decrease in the first quarter was primarily driven by the recognition of $1,053 actuarial gain in the first quarter of 2022, with no comparative actuarial remeasurement in the first quarter of 2023. Also contributing to the decrease were lower pension and postretirement benefit credits in 2023, primarily driven by higher interest costs from discount rate increases

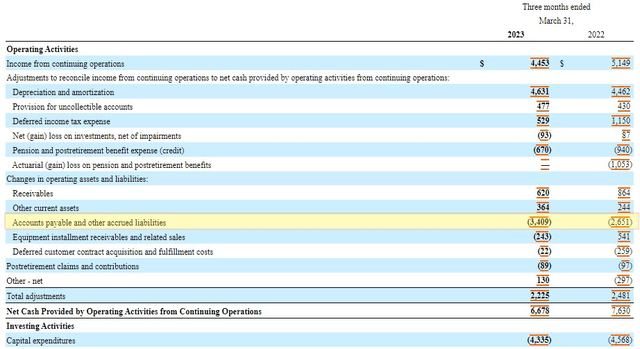

Now, let’s look at AT&T’s cash flow statement. Note how its accounts payables increased by roughly $800 million in Q1 FY23 on a year-over-year basis. The collective impact from declining operating income and rising accounts payables alone, amounts to a near-$2 billion hit to its operating cash flows. But this hit was mitigated by improvements in other areas, and AT&T’s operating cash flow, at the end of the day, declined by less than $1 billion.

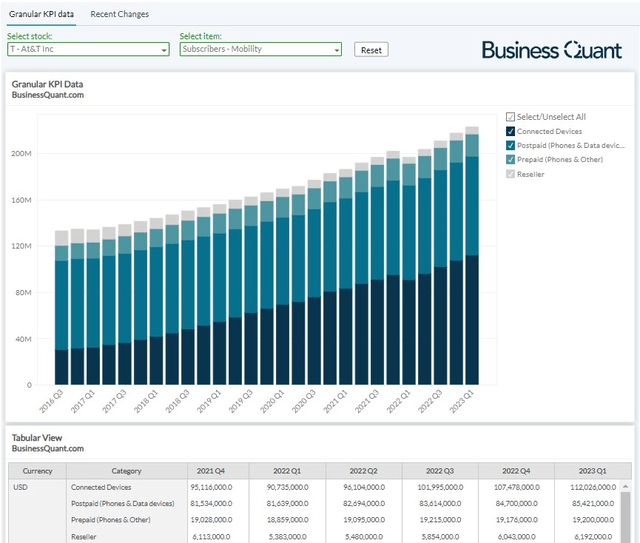

Now consider this – whenever customers purchase wireless connections with AT&T, they don’t have to pay the initial device costs and are charged for the same on their monthly bills. But AT&T, on the other hand, has to bear these costs. Due to strong subscriber additions of late, especially during the holiday season, these device payments rose substantially in Q1. So, the way I view this is, the company has incurred an initial cash outgo to expand its subscriber base, and it’s now ready to reap revenue from this expanded subscriber base.

Per the company’s management, in a conference held yesterday (June 20):

As we think about Q2, we are expecting lower device payments, both sequentially and year-over-year…Device payments are always seasonally the lowest in Q3 and Q4 versus the first half…CapEx — capital investment in Q2 will be fairly healthy, and it will moderate naturally, because in the first half of the year, you will see that we are running ahead of the $24 billion guide.

So, I expect AT&T’s operating and free cash flow to only grow stronger in the coming quarters, which implies that there won’t be any threat to the company’s dividends payouts or its capital expenditure. The selloff in the company’s shares over operating cash flow sustainability seems to be unwarranted, and it gives investors a chance to scoop up AT&T’s shares at discounted levels.

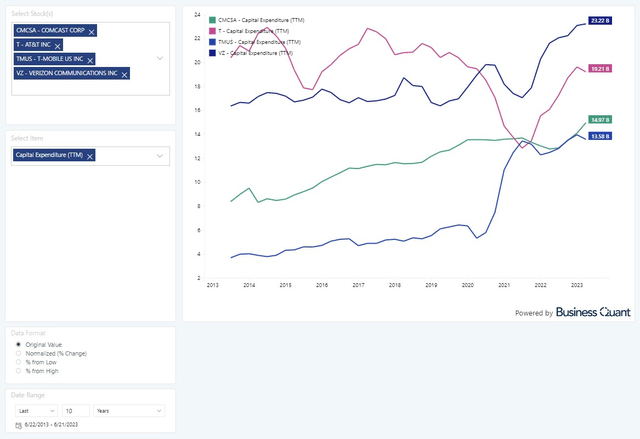

Growing Strong

With that said, AT&T is investing aggressively towards the growth of its mobility business. Its management, as highlighted in the quote above, has earmarked $24 billion in capital expenditure for this year. This will be the highest annual capital expenditure spending in AT&T’s history and will now rival Verizon Communications (VZ), which goes to show that the management is now aggressively looking to reinvigorate their growth momentum.

I believe this elevated level of capital expenditure spend can have three scenarios:

- Improvements in its 5G and fiber coverage will allow it to hike prices, like Verizon did last year, and/or;

- Improvements in its 5G and fiber coverage, without hiking prices, will allow it to nab market share from competition, and/or;

- Improvements in 5G and fiber coverage, with moderate price hikes, will boost its market share as well as ARPU.

I think it’s needless to say that any of the three scenarios will catapult AT&T’s business and are beneficial to its shareholders in the longer run. For the record, AT&T is already seeing strong growth in its subscriber base and its heightened capital expenditure stands to only accelerate its growth momentum.

Final Thoughts

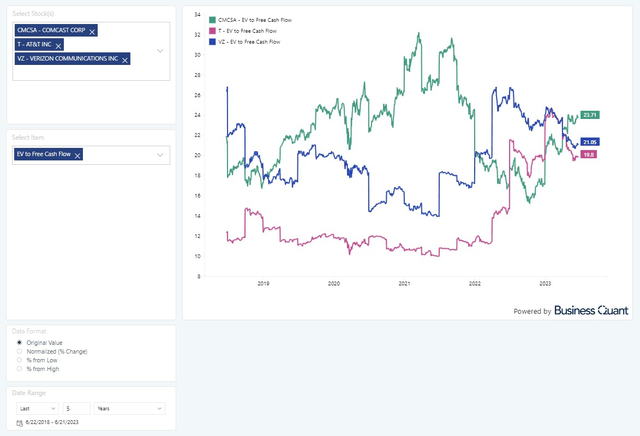

At the time of this writing, AT&T’s shares are trading at an EV-to-Free Cash Flow multiple of roughly 20-times. This may seem high in isolation but it’s actually lower than that of Verizon and Comcast (CMCSA). This suggests AT&T stock is attractively valued when looking at industry peers.

We’ve already seen that AT&T is doing well operationally and that its management is gearing up to accelerate their growth engine in the quarters ahead. This, plus the relative undervaluation, leads me to believe that AT&T’s shares are a good buy at current levels. Its recent selloff was due to misplaced concerns, and investors may want to accumulate AT&T’s shares for the long term, while they’re still discounted. Good Luck!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.