Summary:

- The article focuses on electric vehicle sales in Europe.

- Tesla, Inc. should continue to take market share in Europe and the Model Y is outselling all other models.

- On the flip side, Tesla has become a one-model show.

- Statistics usually focus on sales per model or brand. This hides that Volkswagen AG is outselling Tesla in Europe – and I predict that the gap will widen over the next quarters.

PhonlamaiPhoto

Investment Thesis

The discussion about the electric vehicle (“EV”) transformation is, in my view, too often framed in winning or losing terms. While this makes for entertaining reading, I think it is not necessarily the way things are going to be. I think, at least in Europe, Volkswagen AG (OTCPK:VWAGY) and Tesla, Inc. (NASDAQ:TSLA) will both come out as winners. The definition of winning being: to get or keep a sizeable share of the market and profit.

With its low valuation, Volkswagen is a clear Buy in my view. The core investment thesis is that, once the market agrees that the EV transformation will be a success, an upwards revaluation will take place. There are other strong arguments that Volkswagen is undervalued. There is the sum-of-the-parts argument. The market cap of Volkswagen Group, for example, is less than the value of its stake in Dr. Ing. h.c. F. Porsche AG (OTCPK:DRPRY). I think the new CEO, Oliver Blume, is making the right moves and changing Volkswagen. But both arguments need the evidence that a successful EV transformation will provide.

Tesla is in many ways the opposite of Volkswagen. Volkswagen is a sprawling conglomerate of brands and even businesses (besides manufacturing cars, vans and trucks, it is one of the largest financial services providers in Germany and owns one the largest car rental companies in Europe). While Volkswagen has been undervalued for so long that you could argue this is the normal or right valuation, it is actually Tesla that gets the more-than-a-car-manufacturer treatment, although the largest part of its revenue comes from vehicle sales of just one model.

(Not the commercially most relevant data point I found during my research, but to illustrate the difference in the sentiment – while Tesla’s semi truck is getting a lot of attention, Volkswagen actually delivered more electric trucks in Q1 2023 than Tesla.)

It is next to impossible to call the top on any rally, but after the recent AI- and supercharger-fueled run, Tesla shares seem to need a cool-off, whatever you think of the underlying valuation and growth potential. I would not buy any more.

A look at the European EV market

The headline grabbing news is that the Tesla Model Y has been the top selling electric vehicle in Europe in every month of 2023, and in practically every country.

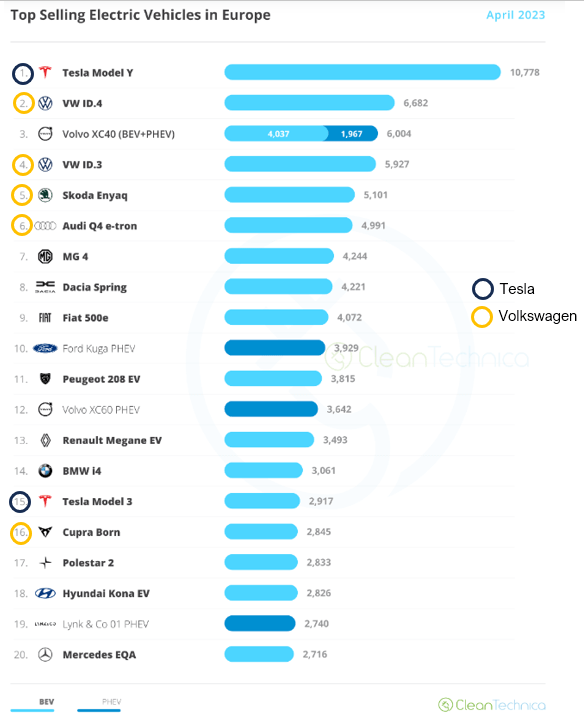

An April sales chart from CleanTechnica captures this remarkable achievement.

Top Selling Electric Vehicles in Europe, April 2023 (Source: Bellasoaa Research, CleanTechnica)

But if you look more closely, Volkswagen is actually the big guy in Europe – as is BYD Company Limited (OTCPK:BYDDF) in China. If you remove the PHEV (Plug-in hybrid electric vehicles) sales for the Volvo XC40 at #3, Volkswagen Group holds all the top spots from #2 to #5.

The Model 3 is only at #15, selling just a few cars more than the CUPRA Born, a brand and car model that a lot of readers probably have never heard about.

According to Electromaps, Volkswagen sold around 349,000 BEVs (battery electric vehicles) in 2022 and Tesla around 232,000. But the Model Y was the best-selling EV model with 137,000 units sold.

Q1 comparison

For 2023, we have detailed number on European EV deliveries from both Volkswagen and Tesla for Q1 only so far, therefore, I will do the comparison based on that period.

Volkswagen Group delivered 141,000 fully electric vehicles (BEVs, I am not including plug-ins here) in Q1 2023. This was a YoY increase of 42.1%. The majority of units sold was in Europe with 98,300 units. Europe was also the overall growth driver with a 68.1% YoY increase.

Sales were split between a variety of models with Volkswagen and Audi being most prominent.

Tesla delivered 422,875 EVs worldwide in Q1 2023, a 36% increase from the same quarter in the previous year – so a lower growth rate than Volkswagen, although obviously from a much higher base.

Tesla does not break out sales across geographies in their reporting, so I used CleanTechnica. According to CleanTechnica, Tesla sold 94,871 Model Y and Model 3 cars in Europe during the quarter. Model S and X sales are not featured in the CleanTechnica numbers as they are obviously very low. Worldwide Model S/X made up just 2.5% of deliveries during the first quarter, and I assume this is also mostly in the U.S.

There are reasons to assume that the gap in Europe between Volkswagen and Tesla will even widen over the next quarters. Volkswagen says that it has a BEV order backlog of 260,000 orders just in Western Europe.

Not all of Tesla’s strengths in the U.S. are applicable in Europe

Tesla is also much better positioned in the U.S. than in Europe, and not all of its strengths in the U.S. apply in Europe. This provides opportunities for a fast moving competitor, which Volkswagen seems to be. The other large manufacturers, especially Renault SA (OTCPK:RNSDF) and Stellantis N.V. (STLA), are still catching up. Elon Musk seems to say more and more that full self-driving (“FSD”) will be the future profit and revenue driver. I take this as an indication that he is aware of that risk.

Tesla clearly dominates charging in the U.S. This is much less so in Europe, although the EV penetration is higher there. Tesla claims to have 45,000+ superchargers worldwide. I could not find out how many of those are in the U.S. and how many are in Europe, but the difference is easy to see if you just look at the map (see link above).

Tesla seems to have a very good chance that its charging plug, which is already conveniently named the North American Charging Standard, will become the de-facto standard in the U.S. It is unlikely, though, in my view, that Europe will follow. In Europe, CCS2 (Combined Charging System 2) is the standard, and Tesla has already opened up a significant number of Supercharger stations across Europe without requiring the need of any adapters. I do not think that the EU will move from the one-standard approach, just look how it forced Apple (AAPL) to use USB-C.

Next is the enormous amount of indirect and direct public subsidies that Tesla is receiving in the U.S. Europe, of course, has subsidies, but they are on average less generous and not so much in favor of Tesla.

Dodging or ignoring regulations is also something that tends not to work so well in Europe, or more specifically in the European Union. The arc of regulatory enforcement is long, but European bureaucracies tend not to forget. We can ridicule that approach, but not adapting to the regulatory environment is not a good business practice, at least in the long run. It creates unnecessary risk.

I think it is likely that Tesla will receive a nine- to ten-figure fine for its recent data privacy violations. The legal process is usually long here, and Tesla can afford good lawyers, so there will be a back and forth over several years, and then Tesla will pay like a third of it. But there will be a lot of bad press on the way.

A few days back, TechCrunch thought it was worthwhile to report that a Waymo robotaxi in San Francisco killed a small dog. With that kind of sentiment, I have a hard time seeing that we will have self-driving Tesla robotaxis swarming the streets of Europe anytime soon, even if the technology should work.

The Volkswagen Buy case

Volkswagen (preferred) shares (OTC:VLKPF) are valued with a P/E ratio of just around 5. The auto manufacturer produces record profits, but the market sees a significant risk that this will not last.

The bear case, which represents the current valuation, is that Volkswagen will invest enormous capital – 180bn euros over the next five years – into the transformation to electric vehicles, and then end up selling fewer cars with reduced profit margins. I think this too pessimistic, and that it creates an opportunity for investors with a long-term view.

It seems to me that the scope and speed of Volkswagen Group’s EV transformation are underappreciated. Certainly not everything is in good order in house Volkswagen. But I think that the new CEO, Oliver Blume, is making the right moves. The clean-up of the software mess in the CARIAD subsidiary was the right thing to do, as is the current focus on cost efficiencies and margin improvements. The benefits could be enormous. The target for the Volume brand group alone (which consists of Škoda, Seat/CUPRA and Volkswagen) is an additional annual profit of 3bn euros (around USD 3.3bn).

It is likely Volkswagen will keep losing market share in China and pivot more towards Europe and North America (with, for example, the revival of the of the Scout brand). Volkswagen has practically acknowledged this, and the company is now saying it just wants to remain the most successful international OEM manufacturer. Before it was overtaken by BYD last year, Volkswagen had been the market leader in China. I think from a risk perspective this is not completely bad, and the first five months of the year were encouraging. From January until May this year unit sales in China grew by just 2% YoY, while sales in Europe were up 20% and North America was up 16%. With 43% of sales Europe was clearly the most important market for Volkswagen. China made up 32% YTD, and North America was a distant third with around 10%.

Looking at Tesla

Tesla certainly was tremendously successful over the last years, but the majority of revenue and profit is now coming from just one car model. Tesla has not launched a new consumer vehicle since the Model Y in 2020.

I am not saying that there is no more sales potential here, but there might not be a limitless supply of customers who want to buy a Tesla Model Y, especially with more and more alternative choices available. More so, at least to some extent the high profit margins seem to be a function of the very small number of models, and we cannot separate those two things.

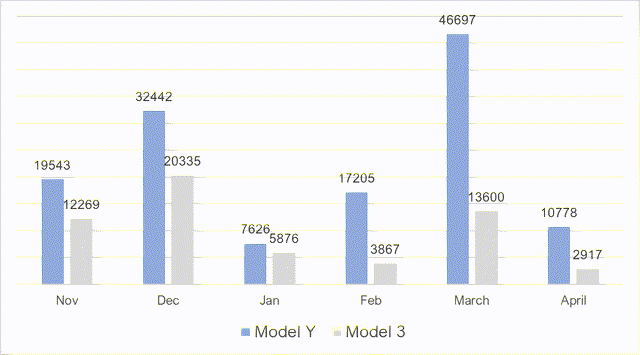

It is hard to recognize a clear pattern from sales in Europe over the last months. Model 3 sales seem be going down, but this is overcompensated by increasing Model Y sales:

Model Y and Model 3 sales in Europe over the last 6 months (Source: Bellasooa Research, CleanTechnica)

Tesla says that it is developing a next-gen platform with a significantly lower cost base and two new models should debut on it. But we have no time frame when this will happen. Volkswagen, for example, has announced a low-cost ID.2 model (below 25,000 euro) for 2025. The new Tesla models probably will arrive in a much more crowded market than the current one.

Conclusion

The transition to electric vehicles is not only unstoppable but accelerating. This development is not market-driven but caused by government policies to mitigate a climate emergency. There will be winners and losers. I think everybody agrees that Tesla will be among the winners – just the extent is unclear and heavily debated.

On the other hand, Tesla has almost doubled its market cap YTD and it added more than 3x Volkswagen’s total market cap of around USD 77bn to its valuation just over the last weeks, while EPS estimates are being reduced. Tesla seems too expensive right now and I would not buy at this share price.

On the other hand the market prices in a significant risk that revenue and profit for Volkswagen will go down with the transition to electric vehicles. I have been long Volkswagen (I own preferred shares) for some time and I am positive in the low double digits only because of the dividends. But I do think Volkswagen is undervalued and too much transition risk is priced into the shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VLKPF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.