Summary:

- Tesla’s unit sales in the U.S. rose 52% in the first four months of the year following price reductions and added premiums, with Elon Musk prioritizing market share over profit.

- Tesla’s Model Y crossover was the No. 1 selling passenger vehicle worldwide in Q1, and Musk has hinted at further expansion with potential investment in India.

- Despite increasing competition in the BEV market, Tesla’s financials show sharply increasing profitability, with a net profit margin of 15.4%.

Tesla Shanghai Gigafactory

Xiaolu Chu

To paraphrase Winston Churchill, Elon Musk is a puzzle wrapped in a mystery wrapped in an enigma – often confounding conventional wisdom and expectations.

By one of the U.S. automobile industry’s standards, however, Musk differs little from scores of auto executives before him who learned, sometimes the hard way, that automakers need strong market share more than short-term profits.

None other than Lee Iacocca, Chrysler’s chief, popularized the phrase “buy a car, get a check” when cash discounts seemed the only way to push vehicles into consumers’ hands. Massive capital expenditures needed for tooling and new designs require a steady and stable share of the market: Idle assembly lines and bloated inventory were a prescription for ruin.

Less for more

Tesla, which sells directly to consumers rather through dealers, takes a direct approach to discounts by lowering prices and adding premiums, such as free access to the company’s chargers. In January, following price reductions, Tesla’s unit sales in the U.S. in the first four months of the year rose 52% from a year earlier, said data provider Experian. Musk has declared share more important than profit and said his global goal was to increase unit sales of Tesla models by 50%.

According to Automotive News:

“From January through April, Tesla’s Model Y crossover had a 99% increase in new registrations over last year, while the Model 3 sedan grew by 28%, Experian said. The Model X crossover’s registrations rose 15%, while the Model S sedan’s fell 67%.

“Tesla’s U.S. registrations totaled 211,842 through April, which was good for a 60.8% share of the electric vehicle market, the data showed. That was a slight improvement over its 60.3% share in the first quarter.”

No comment

Websites track the changing prices of Tesla models, which are difficult for media to verify because Musk abolished the company’s media relations office and mostly prohibits contact with reporters.

Tesla’s premium Model X crossover was reduced by $7,500 to $92,880. Last year the Model X cost $122,440 with shipping. Such price reductions have alarmed some investors who view the change as a hit to the company’s profit margins – which is a fair analysis of the moves.

Model 3 discounts varied, according to one website. The discounts in and around San Francisco amounted to about $2,500. The least expensive version cost $39,670 with shipping, a $2,210 discount. Some fancier versions of the sedan carried bigger incentives.

Tesla Model 3 (Tesla)

Shockingly to rival manufacturers, Tesla’s Model Y crossover in the first quarter was the No. 1 selling passenger vehicle worldwide, ahead of Toyota Corolla, which has led in the past. To ensure continued growth, Musk has at times spoke about new manufacturing plants on top of the six factories the automaker already operates worldwide – and one on the drawing boards for Mexico.

The next location for Tesla could be India.

“We don’t want to jump the gun on an announcement but it’s quite likely that there will be a significant investment and relationship with India in the future,” Musk said Tuesday in New York, after meeting with the country’s prime minister.

Though Tesla has dominated the BEV market in the U.S. and has been a significant player overseas, the slew of new BEV models being rolled out by incumbent manufacturers inevitably has reduced Tesla’s share of the BEV market. Yet the overall size of the BEV market has been growing steadily, so a smaller share doesn’t necessarily portend difficulties.

More green

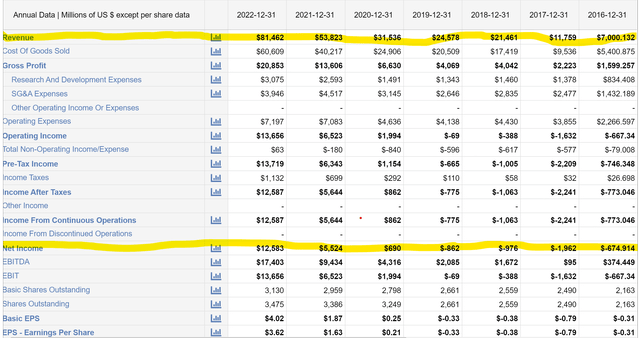

Tesla’s financials, from a fundamental standpoint, show sharply increasing profitability after posting its first annual profit in 2020, $690 million on revenue of $31.5 billion. Just two years later, 2022 net income reached $12.6 billion on revenue of $81.5 billion.

In recent weeks, Ford Motor Co. (F), General Motors Co. (GM) and Rivian Automotive Inc. (RIVN) have agreed to adapt their BEVs to Tesla’s NACS, with other automakers likely to follow suit. Though still too early to forecast an outcome, the possibility exists that Tesla’s Superchargers could evolve into a new profit center, further bolstering the automaker’s balance sheet.

With a net profit margin of 15.4%, Tesla has been generating profit on an annual basis at a rate that’s the envy of incumbent large automakers that struggle to reach an 8% to 10% margin. Naturally, the current P/E ratio for TSLA shares of 76 times earnings will seem excessive to many investors, which is why – in the face of rising competition from rival automakers of new BEV models – some analysts are growing cautious.

Tesla income statements (Macrotrends.net)

On Wednesday, Barclays analyst Dan Levy downgraded Tesla stock to equal weight from overweight. Levy also hiked the firm’s TSLA price target to 260, up from the previous 220.

The Barclays analyst wrote the stock’s recent rally has been “too sharp relative to challenging near-term fundamentals.” Levy told investors questions about margins and demand for Tesla vehicles remain concerns. Net profit margin in the first quarter of the year dropped to 10.8% from 15.4%.

On Wall Street, the ratings scorecard show 16 Buy-equivalent ratings vs. 17 Hold-equivalent ratings and 5 Sell-equivalent ratings.

What Musk has been displaying lately is a willingness to support market share at the expense of near-term profit. Having sustained losses for more than a decade in pursuit of a pioneering position in electric vehicles, Musk is pursuing a course to maintain leadership worldwide. He’s anything but predictable, so whether he continues on this course is anyone’s guess.

As a one-time skeptic, I’ve changed my tune and have viewed TSLA as a HOLD. On Wall Street they used to say “don’t fight the tape.” The momentum of Tesla’s vehicle sales and profitability are reasons why investors should consider – the rising competition and endless delays reaching true full self-driving technology are reasons to avoid. The puzzle, mystery and enigma remain.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.