Summary:

- PayPal has agreed to sell up to $44 billion of its European BNPL loan portfolio to global investment firm KKR.

- The deal aims to raise immediate cash for PayPal and reduce its exposure to the riskier BNPL loans.

- PayPal will use $1 billion of the proceeds for additional share buybacks, increasing its buyback plan by 25% to $5 billion.

hapabapa

A rather interesting development was announced on June 20th regarding payment processing giant PayPal Holdings (NASDAQ:PYPL). According to a press release issued by management, the company reached an agreement with KKR (KKR), a leading global investment firm, whereby it will sell to KKR ‘substantially all’ of its European BNPL (Buy Now, Pay Later) loan portfolio in an effort to raise some immediate cash and to reduce its exposure to those types of loans. Although management did not provide a comprehensive look at how this will impact the company in the long run, I do generally believe that this is a wise move, especially considering current economic circumstances and the risk I believe these types of loans to carry.

A look at the deal

Based on the press release that PayPal issued, KKR has agreed to acquire up to €40 billion, which translates to roughly $44 billion, of the BNPL loans that are on the books of the payment processing giant. These loans only cover the company’s operations in Europe, which really boils down to France, Germany, Italy, Spain, and the UK. This will take place over multiple years using a €3 billion replenishing loan commitment and will involve not only the loans that are currently on the company’s books, but also those that it continues to originate throughout Europe. On top of originating new loans, PayPal will also be responsible for loan servicing.

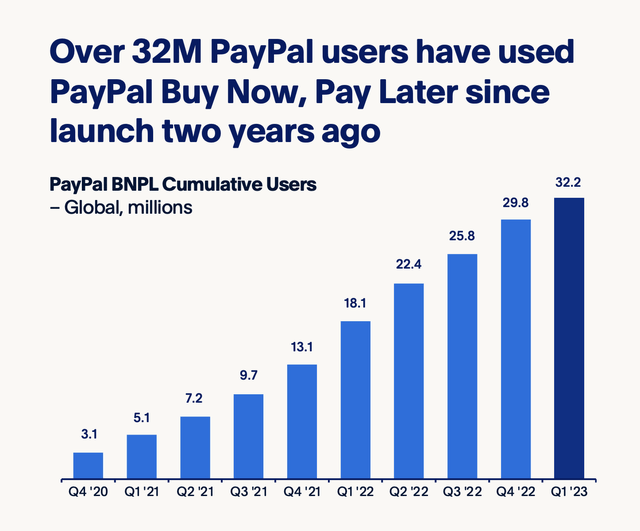

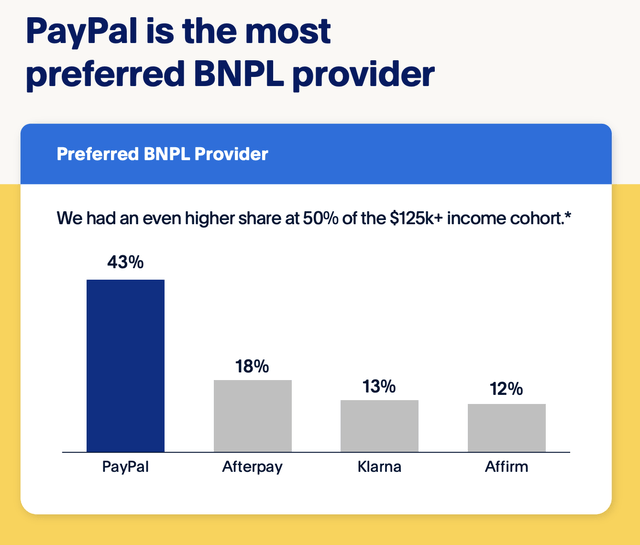

Before we get into further details about this transaction, it would be helpful to dig into PayPal’s BNPL business. Globally, the company has provided this type of loan opportunity to roughly 32.2 million of its users over the roughly two years that the service has been available. This has been spread across seven different countries, which include the European nations I mentioned, as well as the US and Australia. The company’s ecosystem has been instrumental in empowering 2.7 million merchants to accept BNPL transactions and over 300,000 merchants to provide BNPL offerings on their shopping pages. PayPal is so popular, in fact, then it boasts a 43% market share over the BNPL space, with the next largest competitor having only an 18% slice of the pie.

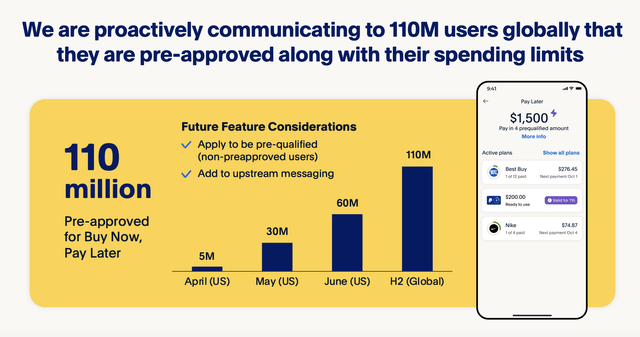

What’s really exciting for investors is that PayPal continues to innovate in this space. For instance, management publicly addressed three major issues with the BNPL market. The first of these is that the application process that’s required by many lenders creates friction that reduces the probability that a loan is made. The second is that consumers don’t know if they will be approved for a loan. And the third is that any amount approved may not match what’s in a person’s cart. To address this, management has taken the proactive step to communicate to 110 million users across the globe that they are pre-approved for BNPL loans, even going so far as to relate to them how much that approval is for.

This is great in and of itself. But there are some problems that investors should be aware of. To be clear, the data that follows covers the U.S. market only. And as I mentioned before, the sale of loans includes those that are from Europe. But I do believe that a review of European data would likely reveal similar findings. The data in question that I have decided to examine comes from the Consumer Financial Protection Bureau and it was published in March of this year. So it is still quite fresh.

Consumer Financial Protection Bureau

There were many interesting findings announced in the report. For starters, these loans are quite small in terms of their overall size. The average loan amount, for instance, comes out to roughly $135. That amount is typically paid off in about 6 weeks. By comparison, traditional installment loans are usually for around $800 on average and take 8 to 9 months to pay off. Even though the loans typically carry 0% interest rates, there is some data that’s troubling in terms of who uses them and what their spending habits tend to be.

Consumer Financial Protection Bureau

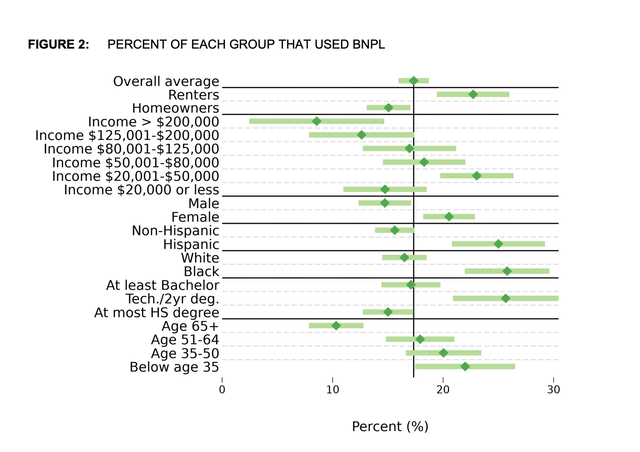

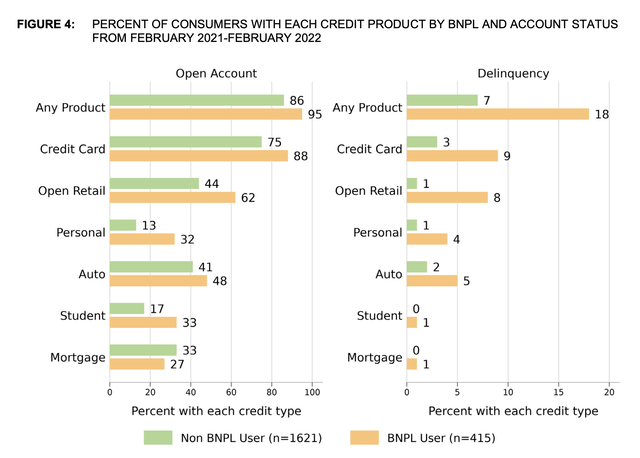

As an example, a user of a BNPL loan is 11% more likely to have a delinquency on their record in the past 30 days. They tend to be lower income, but not necessarily poor. The most common years per year. Borrowers are disproportionately women. 20% of women take out one of these loans compared to 14% of men. Minorities are also typically borrowers. For instance, 26% of African Americans have taken out one of these loans compared to 16% of whites. 24% of Hispanics have taken out one compared to 15% non-Hispanics.

Consumer Financial Protection Bureau

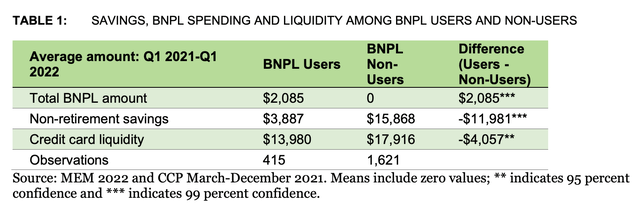

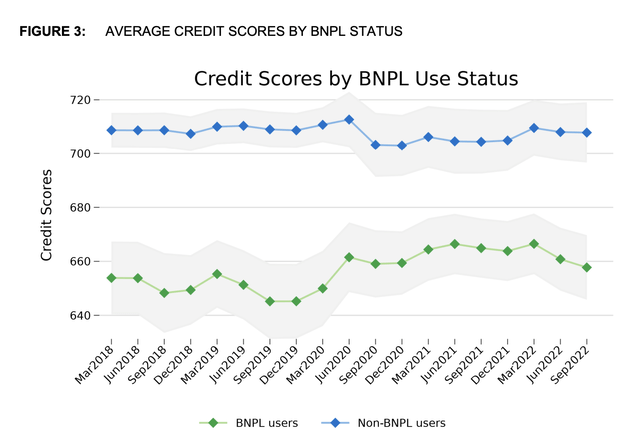

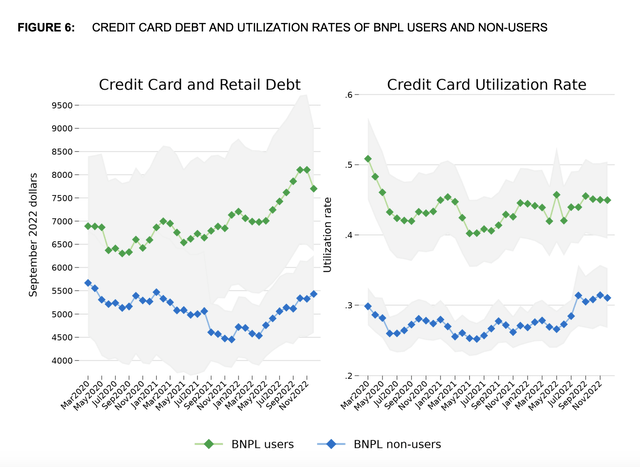

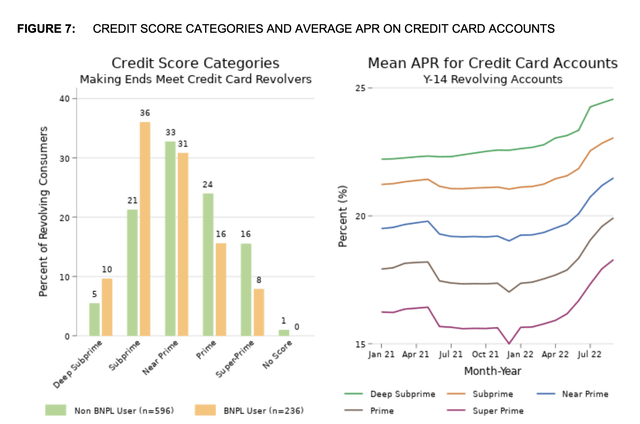

Overwhelmingly, those who take advantage of BNPL opportunities have very little in the way of savings. Those who do not take out these loans tend to have almost $12,000 in additional non-retirement savings than those who do. BNPL borrowers also tend to be less creditworthy. This can be seen in the image above. On top of this, they also tend to have greater amounts of credit card and retail debt, and a higher rate of credit card utilization than those who do not take out these loans.

Consumer Financial Protection Bureau

Consumer Financial Protection Bureau Consumer Financial Protection Bureau

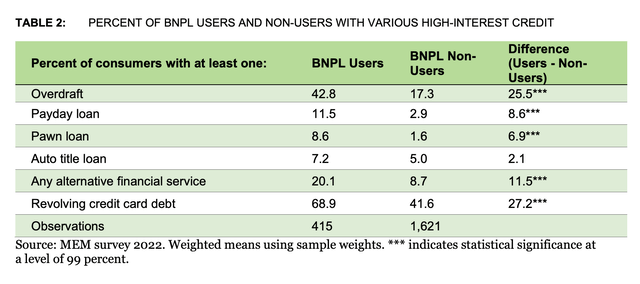

Another interesting data point is that those who take advantage of these loans also tend to fit into categories that require them to pay higher interest rates. An impressive 36% of BNPL borrowers thought into the subprime credit card category compared to 21% for those who have not taken out one of these loans. Deep subprime disparity data is even more significant, with 10% of all BNPL borrowers fitting in this category compared to 5% for those who haven’t taken such loans. The report also found that BNPL borrowers were far more likely to be strapped with other uncomfortable financial burdens. 42.8% of them, for instance, recently had a bank overdraft. That’s up from 17.3% for those who have not had a BNPL loan. 11.5% have payday loans compared to 2.9% of those who are not BNPL borrowers.

Consumer Financial Protection Bureau

What all of this does to me is paint a picture that, while PayPal may be doing fine with these loans so far, they have made the conscious decision to unload loans that are inherently riskier at a time when higher interest rates should make the risk of financial trouble amongst borrowers even greater. I lost something changes from what management already announced, this deal should close sometime in the second half of the current fiscal year. Upon closing, the company will receive cash proceeds of $1.8 billion. Some of this capital will be used for general corporate purposes. However, management intends to allocate $1 billion of the proceeds toward additional share buybacks.

As somebody who has been bullish on PayPal the entire time I have written about it, I see this as a net positive for shareholders. Previously, management was planning to spend about $4 billion this year on share buybacks. That number has now been pushed up 25% to $5 billion. If this sounds like a great deal of money, keep in mind that during the 2022 fiscal year, management spent $4.2 billion on acquiring 41 million shares of stock from the market. In the first quarter of this year, the company allocated $1.4 billion to repurchase 19 million shares of stock. Even after this, the company had $14.4 billion remaining under its June 2022 authorization. Given where shares are currently trading, this extra $1 billion should help to reduce share count by 14.5 million units. On its own, this would mean that current shareholders who don’t sell their stock will own about 1.3% more of the company they may currently own. If $5 billion in total gets allocated this year at a weighted average price that matches what the stock is at right now, then up to 72.6 million shares, or 6.4% of the company’s stock, can be repurchased.

Takeaway

All things considered right now, I must say that I am very impressed with the maneuver made by the management team at PayPal. Even though it’s possible that this could result in less income in the future, monetizing the assets now and removing that risk from its books is a great move in this environment. The ability to buy back additional stock compared to what analysts anticipated is also fantastic. When you combine all of this, you get a situation that, to me at least, reaffirms why I have been bullish on the company for some time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!