Summary:

- Amazon stock continues to surge on AI hopes, but two factors make me bearish: lagging generative AI efforts and high investor expectations.

- The $100 million investment in Amazon’s Generative AI Innovation Center falls short compared to Microsoft’s $10 billion investment in OpenAI, indicating a technological gap.

- Morgan Stanley describes Amazon’s AI prospects as “structurally challenged” and notes investor concerns about its technological lag.

- AMZN stock’s valuation, with a market cap of $1.4 trillion, leaves little room for upside potential in the next 2-3 years, especially considering modest growth expectations and uncertain leadership in the AI space.

da-kuk

Investment Thesis

Amazon’s (NASDAQ:AMZN) share price continues to surge higher on AI hopes. Day after day, the stock continues to climb higher.

Nevertheless, here I discuss two reasons that make me bearish on the stock.

I note that Amazon’s generative AI prospects are playing catch up. Also, I make a note of investors’ high expectations, relative to Amazon’s realistic AI outcomes.

Rapid Recap

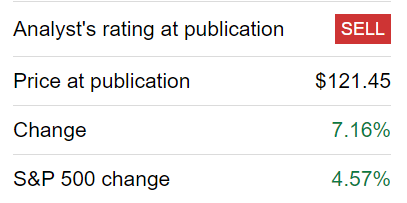

In my previous analysis of Amazon, I explained why I had a sell rating on the stock. I noted that Amazon would not be a leading AI player, irrespective of the hype around AI.

I’ll be the first to admit, that since I wrote those words down, in the past month the stock has been on an absolute tear.

SA Premium

As you can see above, Amazon’s share price has significantly outperformed the S&P 500 (SPY) in the same time period.

Now, with this background in mind, let’s press ahead.

Why I’m Still Bearish on Amazon?

In the first instance, yesterday’s news that Amazon is spending $100 million on its Generative AI Innovation Center program reinforces my view of how far behind Amazon is relative to the likes of Microsoft (MSFT).

Recall, Microsoft invested $10 billion in OpenAI. Amazon’s figure is 1% of the scope of Microsoft’s.

Amazon goes on to remind stakeholders that it has more than 25 years of AI experience. And indeed, AI is not new. But this new version of generative AI, which uses machine learning algorithms, is relatively new. And this is what I’m discussing here.

As a matter of fact, I’m not the only one that’s skeptical about Amazon’s near-term AI prospects. Case in point, Morgan Stanley notes that Amazon’s AI prospects are “structurally challenged” and that some of its investors have declared that Amazon’s AI is technologically “behind”.

Needless to say that Morgan Stanley concluded their investor note with a buy rating. Incidentally, anyone that follows sell-side research knows that in +90% of cases, the sell-side has a buy rating on a stock. After all, it’s just bad business to issue anything less than a buy rating, particularly on a company as big as Amazon, that’s likely to offer Morgan Stanley future business.

Secondly, and admittedly more nebulous, I’m bearish on the question of valuation.

AMZN’s Stock Valuation

Before I irk readers (even further) with such a plebian argument as valuation concerns, allow me to state the following.

Many people believe that Amazon’s valuation is immaterial. This is false. Amazon’s valuation does matter. It’s simply that, for a large proportion of its life, it convincingly grew its revenues at such a rapid clip and at such scale that investors gave its valuation a wide pass.

But at the end of the day, those investors were right, because today Amazon is capable of generating significant cash flows from operations.

Accordingly, I’m not discussing the past. I’m looking ahead from its $1.4 trillion market cap. Here, I stating that its valuation today relative to the next 2-3 years doesn’t leave investors much room for upside.

Before we go further, I want to make something crystal clear. I have zero doubts that AI will be massive. Similarly, I have zero doubts that, in time, AI will be more relevant and profitable than the internet has been.

My critical contention here is just because AI will be massive, this doesn’t necessarily mean that Amazon is going to be the “default” leader, as it was with the cloud.

The distinction is subtle. But its conclusion carries a very large price tag. To put this more concretely, AI-based applications are not the same as cloud-based services.

Again, I don’t doubt that AI tools will see massive user adoption and use cases in the very near term. My critical contention is that there are limited objective reasons to believe that AWS will be in a prime position to benefit from this outcome.

In my previous analysis, I spoke about Warren Buffett’s quote without actually noting it. This led some readers to reach out to me for more details. Therefore, now I’ll flesh out my assertion further. Here’s the quote,

[Bezos] thought he would have two years of runway. He got seven years. You do not want to give Jeff Bezos a seven-year head start.

This quote goes to the heart of my argument. Amazon does have a 7 years head start in generative AI. It doesn’t even have a 2-year head start. In fact, it’s playing catch-up.

Investors are asked to pay more than 40x 2024 EPS figures for a business that is growing at less than 15x CAGR on the top line. And it’s unlikely to grow faster than this anytime soon, even if it so happens that its AI business suddenly dramatically improves.

The Bottom Line

Amazon’s remarkable stock surge driven by AI expectations has caught the attention of investors.

However, as I assess the situation, I find myself bearish on the stock for two key reasons.

Firstly, Amazon’s generative AI efforts are lagging behind competitors such as Microsoft, evident in their comparatively smaller investment in the field. Morgan Stanley also expresses skepticism about Amazon’s near-term AI prospects.

Secondly, I have concerns about the stock’s valuation, as its current market cap leaves limited room for significant upside in the next few years.

While I acknowledge the massive potential of AI, I question whether Amazon will be the dominant leader in this space, unlike its success with cloud services.

Despite Warren Buffett’s praise for Jeff Bezos’ Amazon, Amazon’s generative AI progress suggests it is playing catch-up rather than leading the pack.

Considering a high valuation of over 40x 2024 EPS figures, coupled with modest growth expectations, I remain skeptical about the stock’s prospects even if its AI business experiences a sudden improvement.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.