Summary:

- If we roll back a lot of Reality Labs R&D, we see an adjusted EBIT that is strong for their core business.

- Apple may have ignited the market’s interest in virtual reality which could spurn increased sales of the Meta Quest 3 in the fall.

- Although we’ve seen a nice bull rally in the Nasdaq this year, Meta Platforms remains down and undervalued.

- Meta has a close commonality with Google in that peeling back the R&D reveals a core business that is way more profitable than GAAP numbers. They also both rely on ad revenue for profit generation.

Kira-Yan

The last of the “cheap”

Many define cheap in different ways. There are several useful valuation models at our disposal that we can use to determine intrinsic value. In software, tech-centric companies like Meta Platforms (NASDAQ:META), Google (GOOG)(GOOGL), and Amazon (AMZN), I tend to use a valuation model that evaluates the companies by backing out research and development and drawing up an adjusted EBIT margin and multiple evaluations from there.

I’ve touted the expensing methods these companies have used to exponentially grow the top line and give less to Uncle Sam. Whether or not the beneficial component of our tax system continues survives is another matter of discussion. The thought process on why this works as pointed out in The Nomad Letters, 100 Baggers: Stocks That Return 100-to-1 and How to Find Them, and prior analysis on why legendary hedge fund manager Bill Miller put a lot of his net worth into Amazon, are abundantly available.

Many would argue that R&D is still an essential component of many industries and is a true expense versus a growth vehicle. This would be true in the case of semiconductors and pharmaceuticals. However, when it comes to businesses outside of that realm, the identification of massive R&D expenses and large CAGRs in revenue growth are excellent places to investigate and apply these adjusted EBIT strategies.

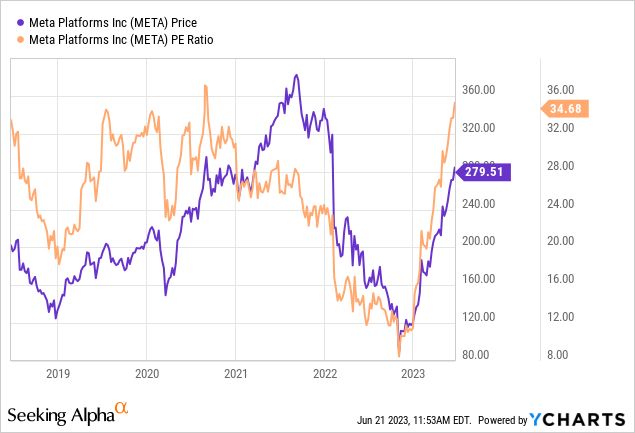

I previously wrote about Meta back in October 2022. Not as in love with the price now as then. However, META stock remains the most fundamentally undervalued of the big tech Nasdaq players.

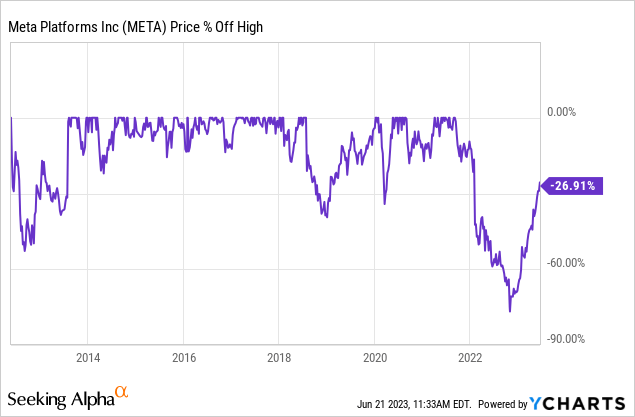

The chart

Although we’ve seen a nice bull rally in the Nasdaq this year, Meta Platforms remain down and undervalued. It might take another year or so for these companies to exceed their old highs, but it seems inevitable that they’re on the trajectory.

The story up to here

Meat Platforms was re-priced to the downside violently when the Fed rates started ratcheting up with each subsequent Fed meeting. Long-duration, high P/E stocks are repriced quickly when the risk-free rates march upwards from near zero to close to 4% today. When cash and cash equivalents yield next to nothing, almost any price on a growing business can be applied and argued for.

The second issue, even when the company was trading below $100 for a brief period and had a GAAP earnings P/E ratio of under 14X, was the Metaverse spending on the meta quest VR products. Many a pundit and commenter thought this spending would drop the share price even further. Now that we see Apple Inc. (AAPL) releasing a $3500 similar product, the market seems to be warming to the idea of virtual and augmented reality.

At $499, that’s an exceptional price difference of $3,000. I understand the Apple product is an all-inclusive wear-anywhere computing device, but the Meta Quest can easily be paired with a high-end PC to perform similar functions. Not only will it be able to perform similar functions, but even including a high-end $2,000 rig with some nice graphics cards, it may be able to outperform the Apple device when it comes to gaming.

The Apple Vision Pro has created a renewed buzz in virtual/augmented reality. I say the marketing will only assist in the sales of new Meta Quest 3 headsets on the horizon. Now that consumers realize that a virtual reality experience could be worth $3,500, it may make those same individuals feel like they are catching a steal of a deal on the Meta product, thus creating an influx of interest. A lot of marketing psychology is convincing your target that your product is more valuable than it is. Apple may have catapulted that perception forward.

Company spending by R&D

All data courtesy of Seeking Alpha

| Company | TTM R&D |

| Amazon | $78.36 Billion |

| $41.84 Billion | |

| Meta | $34.49 Billion |

| Apple | $28.7 Billion |

| Microsoft | $27.305 Billion |

Meta Platforms is about middle of the pack when it comes to R&D spending for these large caps. They have a close commonality with Google in that peeling back the R&D reveals a core business that is way more profitable than GAAP numbers. They also both rely on ad revenue for profit generation.

Valuation

In all calculations below, I am adding back R&D to operating income. We then draw a trailing 5-year PEG based on the metric. The percentage will become the multiplier and the most recent complete year adjusted operating income per share the multiplicand. This is where I am drawing a fair value of PEG 1 in this thesis.

Data courtesy of Seeking Alpha

- Meta 5 year adjusted op income CAGR 13.8%

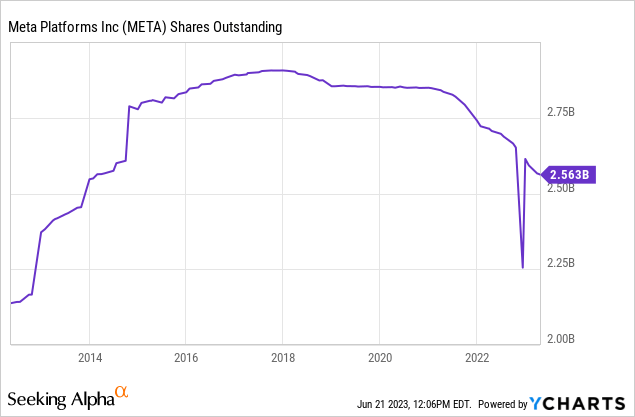

- Meta adjusted op income/share last full year $67,174/2,562 shares outstanding = $26.21 a share adj op income.

- 13.8 multiplier X $26.21 multiplicand = $361.82

Balance sheet trends

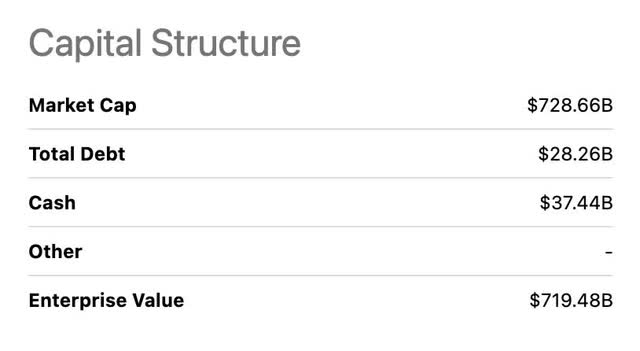

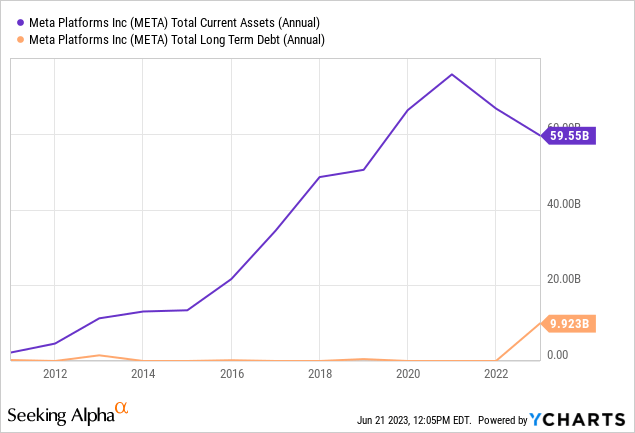

Wow! Peter Lynch would be proud of this balance sheet. Comparing current assets to long-term debt shows a self-sustainable company that can both spend on growth and add to the cash pile. No risks on this balance sheet from this perspective.

Looking at Total Debt compared to cash and cash equivalents shows a rare company that can pay off all of its debt obligations and has money to spare. Mark Zuckerberg doesn’t need L-Tryptophan or melatonin when he has a picture of his balance sheet on the wall. One look and it’s off to sleep for a good night’s rest.

Meta Platforms has increased its share buyback authorization for up to $40 Billion for 2023. This is after they bought back $28 Billion in 2022. The stock has been undervalued for some time. These buybacks are coming at the right time and should be welcomed by the market.

Catalysts

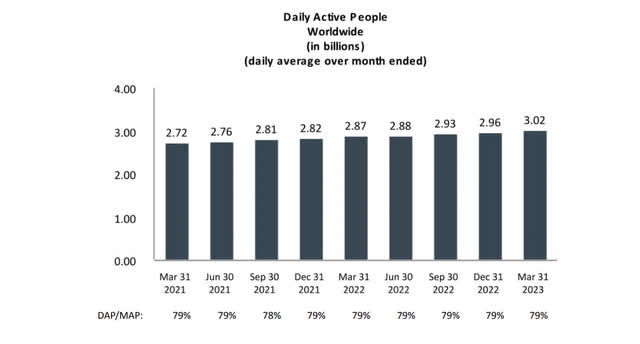

Facebook trends

Both growth in average daily and monthly users is back on an upward trend. The “family of apps” numbers include Facebook, Instagram, and WhatsApp. Since Facebook and the other FOA constituents are largely ad-based revenue, interaction with users is of the utmost importance. The trends are looking healthy here. If they continue, this should assist in getting Meta back close to a $1 Trillion market cap.

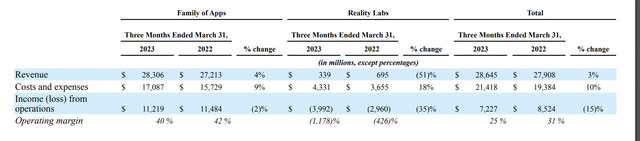

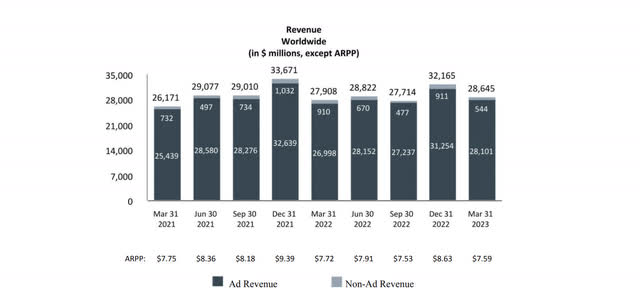

Revenue and income growth quarter over quarter, 2022-2023 are also on a nice upswing. FOA still dominates the top and bottom line and Facebook remains the workhorse. Reality Labs continues to be a money sink with less revenue and higher costs.

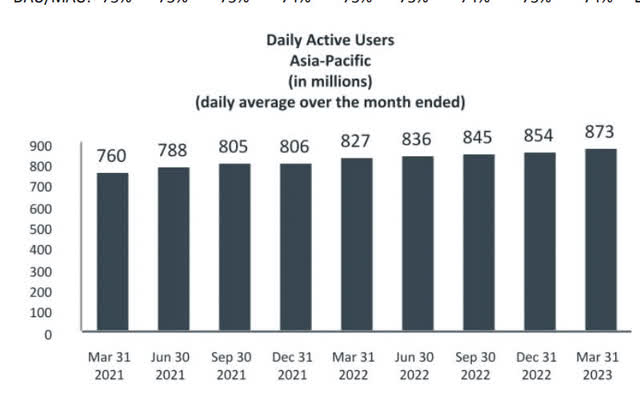

Asia Pacific growth trends in active daily users are one of the most positive stories in the growth trajectory of the FOA. Covid shut off a lot of friends and family communication from Asia/China to the West. Although WeChat dominates China and the areas immediately surrounding it, VPNs are still good enough to get around app blockages and continue to add new users. Hong Kong and Taiwan are also great areas for user growth.

Being in June, we are in a good position at this point to take advantage of the positive news wave ahead during December. The holiday season is strikingly the best month from a top-line perspective as ad payments and marketing are ratcheted up to sell products for Christmas.

Metaquest

Reality labs continue to suffer. Watching the Reality Labs’ revenue from current until Christmas will be very interesting now that Apple may have gotten the market interested in virtual reality. It wouldn’t take much positive news about Meta Quest 3 sales this fall to pump up the share price. Expect pundits to pit sales revenue and volume for Apple and Meta’s products against one another. Even if the effect on the bottom line is insignificant for either company regarding these products, traders get more excited about hype than they do about income statements.

From the META 10-Q:

Other revenue. Other revenue consists of net fees we receive from developers using our Payments infrastructure and revenue from WhatsApp Business Platform and various other sources.

Other revenue is only around $200 million for the most recent quarter. These numbers are still more stable than the Reality Labs numbers with lower deviations from the mean. Enhancing this platform to handle even more payments and having a possible wallet system like WeChat’s Weixin Pay QR system would be a great growth area. More investment in the payment capabilities for India, Africa, and the Middle East seems like an obvious play.

Risks

Risks to Meta certainly aren’t in the realm of the balance sheet or lack of revenue and income from the FOA segment. Reality Labs not increasing the top line in their segment remains the biggest risk in the stock.

From Meta 10-Q

Operating our business is costly, and some of our investments, particularly our investments in Reality Labs, have the effect of reducing our operating margin and profitability. If our investments are not successful longer-term, our business and financial performance will be harmed.

For example, our investments in Reality Labs reduced our 2022 overall operating profit by approximately $13.72 billion, and we expect our Reality Labs investments and operating losses to increase in 2023 and beyond. If our investments are not successful longer-term, our business and financial performance will be harmed.

Meta is deep into the Metaverse at this point. There is no turning back. They have to do everything they can to make this work. As I mentioned, I believe healthy competition can force them to grow in more innovative ways as we now have a formidable foe. Competition brings out the best in many. We will see what the future holds for this product.

Conclusions

I am not as in love with the price in Meta as I was in my first article. The price is up 183% since last October when I wrote that piece. I still am dollar cost averaging into the company. I use Meta Platforms in place of Salesforce (CRM) when I dollar cost average into the Dow Jones 30. Salesforce is the only company I replace since I have never liked their fundamentals. If we roll back a lot of Reality Labs R&D, we see an adjusted EBIT that is strong for their core business. The stock is still a buy for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, AMZN, GOOGL, AAPL, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.