Summary:

- Disney is experiencing subscriber losses, leading to a downgrade in my rating from buy to hold.

- The company faces profitability headwinds in its direct-to-consumer business due to the slowing subscriber growth. In the last quarter, Disney+ lost a massive 4M subscribers.

- The subscriber loss in FQ2’23 followed a loss of 2.4M Disney+ subscribers in the first quarter.

- Disney’s valuation has dropped compared to streaming rivals, and I believe shares face an uncertain future unless Disney reverses its subscriber momentum.

RomoloTavani

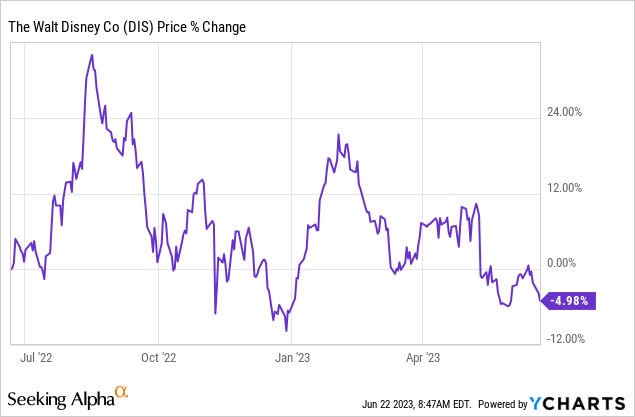

Because of subscriber losses suffered by streaming company The Walt Disney Company’s (NYSE:DIS) in the last two quarters, I am forced to lower my rating for Disney’s stock from buy to hold. Disney has seen a rather steep drop in subscribers for its Disney+ Hotstar streaming offer in the last quarter, and the company recently has experienced some turmoil at the head of the company as well, which led to the ouster of Bob Chapek. Although the company’s direct-to-consumer business is seeing narrowing losses due to aggressive cost savings, the emergence of subscriber losses in the Disney+ subscriber base is a major cause for concern. The loss of subscribers reveals problems with Disney’s content positioning and also poses headwinds for the company’s valuation. Given the increased risk and suboptimal execution in the streaming market, shares of Disney are just a hold right now, in my opinion!

Subscriber losses should lead to profitability headwinds in the important DTC business

Last year, I called Disney a buy, in large part because the company made strong progress in its direct-to-consumer business, which includes the company’s massive streaming library. The company saw strong subscriber growth in 2022 for all of its core streaming offers including Disney+, ESPN+ and Hulu, with ESPN seeing by far the strongest subscriber growth. However, Disney’s subscriber growth has slowed drastically in the last two quarters, causing me to reevaluate my position on the streaming company.

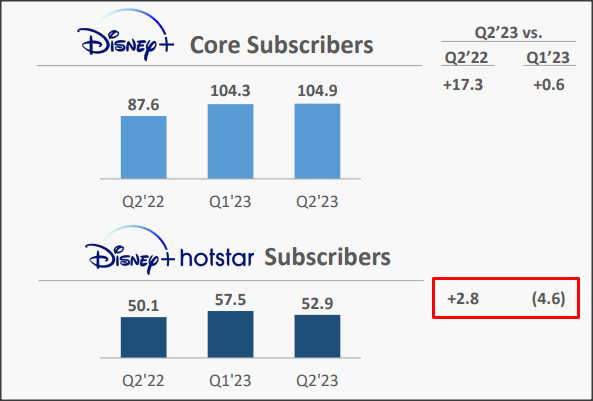

In FQ2’23, Disney disclosed its second consecutive quarter of subscriber losses due to steep declines for Disney+ Hotstar, the firm’s streaming platform for the Southeast Asian and Indian markets. In its second fiscal quarter, Disney+ Hotstar lost 4.6M subscribers. In total, Disney+’s total subscriber losses totaled 4.0M in the second fiscal quarter because it added 600k account in other markets. In the first fiscal quarter, Disney+ Hotstar lost 3.8M subscribers, while Disney+ subscribers fell 2.4M to 161.8M.

The reason for Disney’s weak execution in the Southeast Asian and Indian markets I believe relates to Disney not being able to win streaming rights to Indian Premier League cricket matches in 2022, which made its content offer less attractive to subscribers in those markets.

Source: Disney

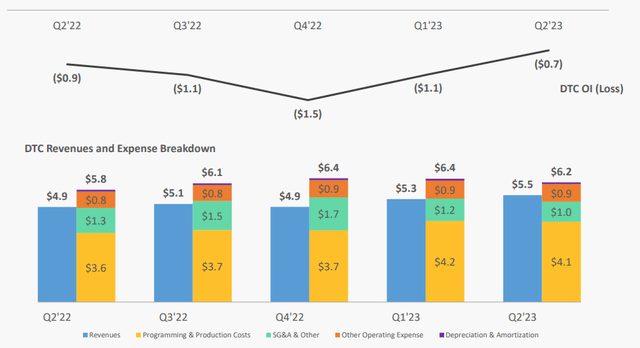

A key problem for Disney related to those subscriber losses is that the company did not yet achieve profitability in its direct-to-consumer segment, which represented approximately 39% of company revenues. It is not the largest division, however: the largest segment, from a revenue contribution perspective, is Disney’s network business, with a revenue share of 46%.

Despite having 157.8M subscribers in the Disney+ platform at the end of the second fiscal quarter, the direct-to-consumer business is still posting big losses. Adding ESPN+ and Hulu subscribers, Disney had 231.3M subscribers across all its streaming services at the end of FQ2’23 which is slightly below Netflix (NFLX)’s subscriber count of 232.5M.

Disney’s DTC losses declined $200M year over year, but with recent subscriber losses, Disney faces an uphill battle regarding profitability, in my opinion. Although the company has laid out a cost-cutting goal of $5.5B which included a payroll reduction of 7,000, it may take the streaming company years to achieve profitability in this segment… especially if the company continues to generate hundreds of millions of losses with some movie releases.

Source: Disney

Disney’s falling revenue trend and valuation compared to streaming rival Netflix

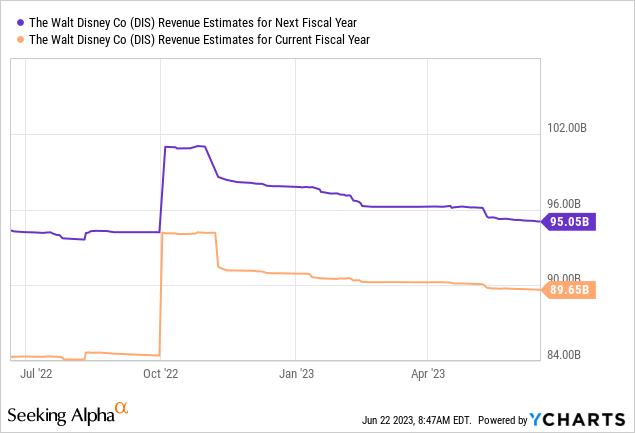

Following the appearance of subscriber losses and the departure of the company’s previous CEO, Disney’s shares have fallen into a new down-trend. As a result, Disney has also experienced a sharp revision of revenue estimates for the years FY 2023 and FY 2024, starting in the fourth-quarter of 2022, which indicates that the market continues to expect headwinds to Disney’s international subscriber roll. Disney is currently expected to grow its top line only 8% in FY 2023 and 6% in FY 2024. For comparison, Netflix is expected to expand its revenues 7% this year and 13% next year.

A key beneficiary of Disney’s problems could be Netflix, the largest internationally-oriented streaming platform, which had 232.5M subscribers at the end of the first-quarter.

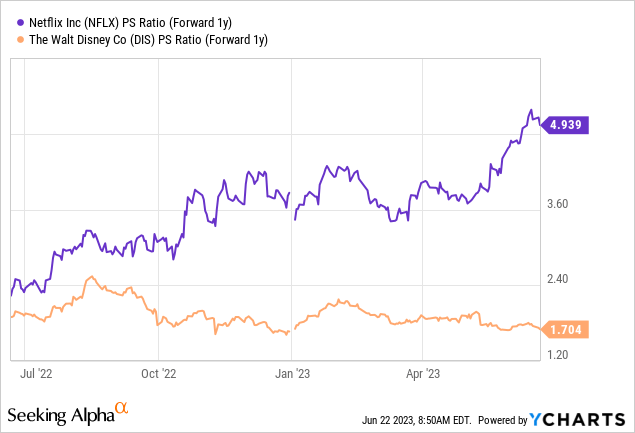

Shares of Disney are currently trading at 1.7X forward revenues while Netflix is trading at a price-to-revenue ratio of 4.9X… which fully reflects the company’s international expansion potential, in my opinion.

Risks with Disney

The risks for Disney have undoubtedly increased after the company reported its second straight quarter of subscriber losses. The second big risk that I see is that Disney’s direct-to-consumer business, which encompasses its different streaming services, is still operating at a loss and major box office blunders, like Strange World — which led to a $200M loss for Disney — raise questions about the company’s content strategy. What would change my mind about Disney is if the firm managed to stem the current subscriber exodus and managed to drive its DTC business to profitability.

Final thoughts

Disney has to grapple with a new problem: a subscriber exodus, especially in Disney’s Southeast Asian/Indian market, which has been a strong driver of growth in recent years. For that reason alone, I see growing profitability headwinds for Disney’s important direct-to-consumer business. Although Disney has managed to narrow its segment losses and announced a $5.5B cost-cutting plan, a continuation of current subscriber trends strongly suggests that Disney will see delayed profitability in the DTC division… which I expect to continue to weigh on Disney’s shares. Considering that Disney’s revenue potential now appears more expensive (in the context of a contracting subscriber base), I must down-grade my previous recommendation from buy to hold!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.