Summary:

- Tesla, Inc. CEO Elon Musk has stated that Tesla’s valuation is dependent on the company managing to develop autonomous self-driving, that’s risky.

- A high valuation doesn’t mean you just have to grow into that valuation, it means you have to grow into that valuation plus reasonable returns.

- Toyota Motor Corporation’s battery breakthrough will enable the company to build a mass market value competitively with Tesla.

- Numerous other competitors are emerging from the woodwork, and with each one, we expect Tesla to struggle more and more.

jetcityimage/iStock Editorial via Getty Images

Toyota Motor Corporation (NYSE:TM) recently saw its share price surge, pushing the company back over a $150 billion market capitalization. The company might be the largest automaker by volume, but that’s nothing versus Tesla, Inc. (NASDAQ:TSLA) which has a market capitalization of more than $800 billion, based on, in our view, hopes and dreams.

As we’ll see throughout this article, Tesla’s unreasonable valuation means it will likely struggle to drive future shareholder returns.

A High Valuation Still Needs Growth

One of the standard misses, in our view, is that there’s more to a high valuation than valuation. The company still needs to, at some point, drive returns to shareholders.

Tesla has a $800 billion market capitalization. Let’s move past that. The historical return of the S&P 500 (SP500) is just under 10%. Tesla has no dividends or share buybacks, so those returns have to come through an increase in share price or cash flow accumulated – roughly $80 billion of it per year.

Each year the company misses that target – and you can be sure it’s going to miss it for the next years even if you have long-term ambitions – its long-term earnings need to go up proportionally. Hypothetically, if the company generated no free cash flow (“FCF”) for the next 8 years, it’d need to grow to a $1.6 trillion valuation to continue beating S&P 500 earnings.

That’s a substantial amount of growth, and one that highlights the massive valuation of the company today. Even optimistic forecasts of 2030 vehicle sales of 5 million per year means $16 thousand per vehicle in profit just to justify its valuation today.

Hypothetical Business Lines

Of course, there’s more to the company’s valuation than simply electric vehicles (“EVs”). Even CEO and founder Elon Musk has said the company’s valuation is directly tied to whether it solves autonomous driving.

Really the value of the company is primarily on the basis of autonomy, if you look at our total vehicle output, it’s almost 2 million vehicles this year or something like that. But that’s still only 2% of total vehicle production.

– Elon Musk.

That’s Tesla’s problem. A substantial part of its valuation is tied to accomplishing what’s never happened, and not only might the company never accomplish that, but it’s not even the leader in the field of trying to accomplish that. That’s a massive problem for the company’s ability to continue earning money.

Tesla

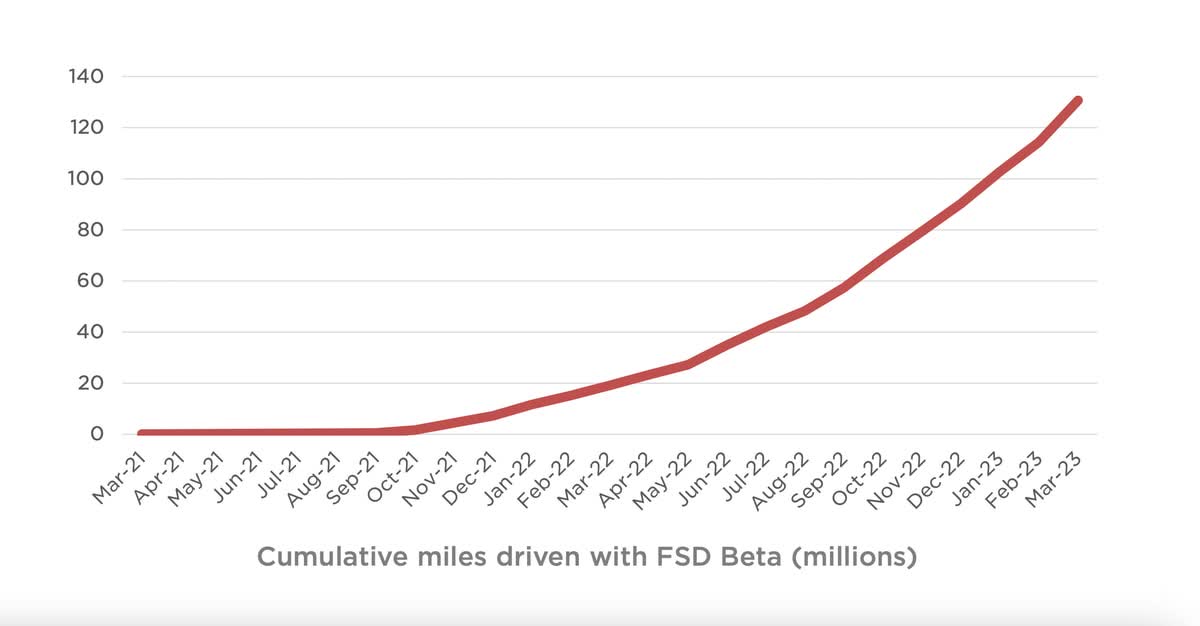

Tesla has a beautiful number above with how popular its full self-driving (“FSD”) beta software is. Of course, that’s less meaningful when the app has a human driver ready for an unexpected situation. A more impressive number is Waymo and Cruise, which have both hit 1 million miles driven without any human in the driver’s seat at all.

Both those companies by the way are already operating robotaxi services in San Francisco. Tesla might have more theoretical miles with its drives on the road, but it’s also getting sued for allegedly misleading customers and safety concerns with those miles. There’s no guarantee in any of this that Tesla comes anywhere close to winning in self-driving.

And if it doesn’t, there goes its valuation.

There are concrete examples of how Tesla is falling behind, and why.

1. Waymo is rich. The company is backed by Alphabet/Google (GOOG), a multi-trillion dollar tech company with the profits to match. That enables Waymo to have a different cost-expensive approach with direct synergies with the very profitable Google Maps business. Here’s a take from an industry expert

Waymo’s hardware is much more robust than Tesla’s. It uses several redundant sensor systems, including lidar, radar, and cameras, to create a real-time picture of where it’s operating. The company also maps areas ahead of time by having human drivers manually drive the vehicles through them. Meanwhile, Tesla vehicles rely exclusively on cameras and ultrasonic sensors.

…

Cameras aren’t as accurate at gauging distance as lidar or radar, and their ability to map an area can be impaired by everyday hazards like snow, dust, or darkness.

– Vox

2. Other car companies have realized the importance of self-driving. Mercedes-Benz Group AG (OTCPK:MBGAF), for example, has achieved higher self-driving approvals than Tesla, and not in Europe, but in Tesla’s home turf of California. The company will be likely rolling out these higher approved features to customers of its EVs in the coming years.

There’s another point to be made here. Even if you disagree with everything above, and feel that Tesla is ahead of Cruise and Waymo, there’s still a valuation issue. What value do you assign to that self-driving segment? Especially when the CEO of Tesla himself has said that he thinks the majority of Tesla’s valuation is based on self-driving and not the core business.

One statistic is that Tesla is worth 10x what Mercedes is despite the difference in self-driving. Cruise is valued at roughly $30 billion, or less than 4% of Tesla’s valuation. Waymo was last valued at $30 billion down from a pinnacle of $200 billion. For $150 billion (<20% of Tesla’s valuation), you can own Cruise, Waymo, and Mercedes.

For $400 billion (<50% of Tesla’s valuation), you can add Toyota to that list. For $450 billion (~56% of Tesla’s valuation), you can add Ford Motor Company (F) to that list. Given that Cruise is worth $50 billion and has a $24 billion stake in Cruise (80%), for $475 billion (60% of Tesla’s valuation) let’s also add General Motors (GM).

Call me naive, but I think if you combine Mercedes, General Motors, Waymo, Toyota, and Ford, you could make not only a company that dominates in the traditional internal combustion engine (“ICE”) business, but you can make one that also beats Tesla at both self-driving and electric vehicles. All that to get a value equivalent to a 40% decline in Tesla.

Oops… Losing The Core Business

At the same time, it might have taken a few years, but Tesla is facing a massive threat to its core business. Tesla has long talked about its goal to launch a mass-market vehicle, one that can enable it to get the volumes of the masses. Unfortunately, it seems like not only is Tesla being beaten in the short term, Toyota can beat it in the long term, too.

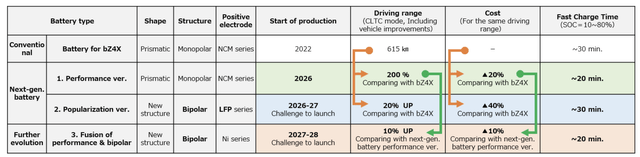

Toyota has announced a battery technological breakthrough. The company, the leader in mass market hybrid vehicles, is expecting several next-gen batteries.

The company’s next battery generation is projected to come in 2026, with double the range and a 20% cost reduction at the same range. Fast charge time will also improve. That will be a game changer, pushing range towards 1000 miles with faster charging, and dramatically increasing the interest of electric vehicles while making cost much lower.

Given that the Model 3 battery costs $5000+, a lower cost battery, can dramatically help margins. The company is going to continue improving past that, and by the end of the decade, it expects to improve that range by another 10% past 1000 miles. That’ll combine with even lower cost and faster charging.

Given that other automakers are also following along, with Ford and General Motors both ramping up their businesses, competition is coming from every side.

None of this includes new upstart companies that are competitive with Tesla in offerings, but still growing. Rivian Automotive, Inc. (RIVN) beat Tesla to the electric truck. Lucid Group (LCID) is another major competitor. Zoox, NIO Inc. (NIO), Polestar, XPeng (XPEV), and BYD Company Limited (OTCPK:BYDDF) are all upstarts here as well. BYD has passed Tesla in annual EV sales.

This massive list of companies will continue to hurt Tesla.

Toyota

Toyota, backed by its hybrid battery is an incredibly strong opportunity in the market.

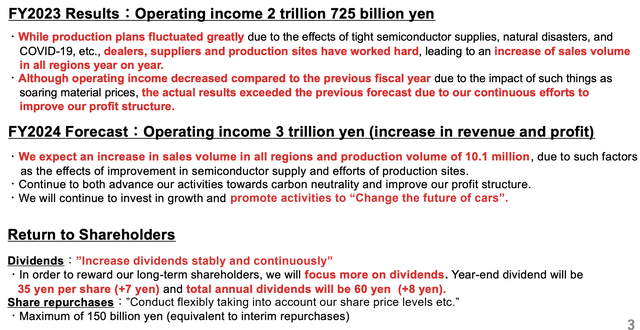

Toyota’s core business has remained incredibly strong despite production struggles. The company’s Corolla, Rav4, and Camry vehicles made 3 of the top 10 best-selling vehicles worldwide last year, with the Corolla and Rav4 clinching the first and second spots. The company earned $14 billion in FY 2023 operating income, with strong revenue despite uncertainty.

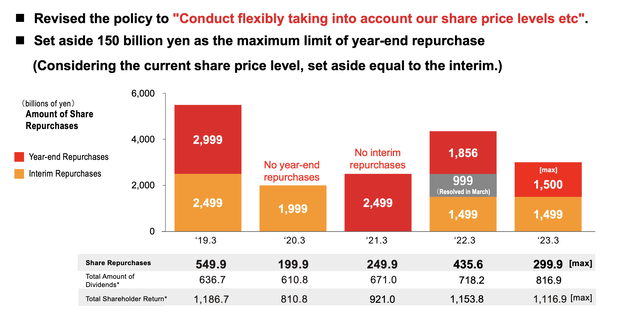

For 2024, the company expects 10.1 million vehicles sold, as it solves shortages, pushing operating income past $20 billion. The company expects repurchases ($1 billion USD) along with continued dividends that will enable shareholder returns.

Combining a strong business currently, a strong future business (EVs) and strong financials, and Toyota could drive substantial returns. Total shareholder returns for the current year are thought to be ~$1.12 trillion yen or almost $10 billion. That’s a mid-single-digit yield. With strong operating profit growth, we expect those returns can increase.

That, combined with the long-term potential, makes Toyota a valuable investment, especially versus Tesla.

Thesis Risk

The largest risk to our thesis is that technology is unproven. Tesla hasn’t announced their new battery tech, but you can be sure they’re working on it. The company does have first-mover advantage in building a massive battery supply pipeline, and it has recognized the value of vertically integrating the supply chain.

That could enable it to outperform its peers.

Conclusion

Unfortunately, in our view, an often ignored fact is that not only do high-valuation companies like Tesla, Inc. need to grow into that valuation, but they also need to provide strong returns above that level. Elon Musk himself, known for having a lofty view of the company’s capabilities (to the tune of being sued for it), has himself said the company’s valuation is dependent on it solving self-driving.

Unfortunately, Tesla apparently is not leading in that field. Additionally, the company’s core business is seeing substantial competition. Even if that issue isn’t solved, the company’s margins will almost certainly be pressured. When the competition has better technology, that’s company-changing, and we expect it’ll cause Tesla to not be able to succeed.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.