Summary:

- Intel investors attempted a breakout last week, but the momentum fizzled out this week, as buyers likely took profits.

- Intel Foundry Services is expected to lift the company’s competitiveness and accountability, bolstering margin accretion and improving shareholder value.

- Intel needs to announce a flagship customer, with speculation suggesting Nvidia could be a potential partner, but investors should be cautious about putting too much hope in this deal.

- However, INTC appears to have bottomed out in October 2022, with its momentum potentially reversing into a bullish bias. At the current levels, INTC remains attractive.

hapabapa

Intel Corporation (NASDAQ:INTC) investors had much to cheer last week as momentum buyers returned to boost its upward surge well above its April high level of about $34.

However, that momentum fizzled out this week, as dip buyers likely took profits, battering investors who bought late into last week’s spike. INTC has outperformed its semiconductor peers in the iShares Semiconductor ETF (SOXX) since bottoming out in late May. However, Intel investors should also be reminded that it remains in a medium-term downtrend. As such, I don’t expect dip buyers to remain steadfast in holding their INTC positions if they see substantial gains.

Management tried to reassure investors in a conference this week, unveiling more details about its Intel Foundry Services or IFS model. Notably, CFO David Zinsner stressed that IFS would transition internally from “cost allocation to market-based pricing.”

As such, it’s expected to improve the competitiveness and accountability of Intel’s internal product divisions as they compete on a level footing with Intel’s external foundry customers. In addition, it will also bolster the accountability and urgency of its manufacturing groups, “compelling” them to compete for business against external foundries.

However, IFS starts with an “initial negative operating margin,” as a much larger scale is needed to improve efficiencies, allowing Intel to lift its gross margin over time.

Intel is confident that its ongoing cost reduction efforts will help achieve $8B to $10B in incremental cost savings by 2025, with $3B expected to be achieved this year. As such, the company continues to target margin accretion toward its long-term outlook of 60% in gross margins and 40% in operating margins.

However, Intel highlighted that the design and foundry groups are critical to the company’s technological roadmap. Therefore, investors should not consider a potential spinoff currently. In addition, management also reminded investors that “the product business units will have strong financial incentives to choose the internal foundry.” As such, I believe Intel wants to make sure that its IFS business can leverage the opportunities from its internal product groups as it attempts to scale.

Still, I think Intel must follow up with an announcement of a flagship customer. Zinsner suggested that Intel “could reveal a significant foundry customer later in the year.” Speculation is rife that Intel’s flagship customer could be Nvidia (NVDA) as Nvidia CEO Jensen Huang looks to diversify the company’s manufacturing. If Intel is successful in convincing Huang to commit capacity, it will be a significant win for Intel. Moreover, it could also enhance the competition between Intel and Taiwan Semiconductor (TSM), improving their price competitiveness and benefiting Nvidia.

However, recent reporting by DIGITIMES suggests that it’s not considered a done deal at the moment, leaving the potential for disappointment if Nvidia sticks with TSMC to fab all its AI chips. DIGITIMES highlighted:

Nvidia and AMD (AMD) have committed to using TSMC’s 3/2nm manufacturing processes for their next-generation chips to avoid additional costs associated with switching manufacturing partners. – DIGITIMES

As such, I think investors must be cautious in putting too much hope in Intel’s ability to win the deal with Nvidia. I gleaned that the recent optimism in INTC’s surge over the past week could be attributed to investors expecting a favorable response. However, the price action this week suggests that investors aren’t willing to go all in with that bet, as they took profits, sending INTC down for the week and possibly losing most of the gains it made last week.

However, INTC appears to be on the verge of emerging from its incredible battering, suggesting a medium-term bottom could be in play. With that in mind, the subsequent pullback could unveil significant clues into INTC’s buying sentiment, possibly attracting more buyers back into the fold.

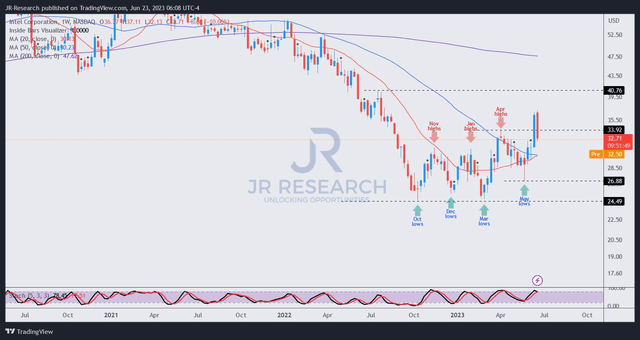

INTC price chart (weekly) (TradingView)

As seen above, INTC is close to forming a golden cross (the 20-week MA crossing above the 50-week MA), a pivotal development in its price action, suggesting positive momentum in favor of dip buying.

I gleaned that INTC’s bottom in May was a powerful bullish reversal, as dip buyers returned robustly to defend an initial selloff. Hence, it suggests that INTC could be emerging from its significant battering over the past year, with October 2022 lows potentially marking its medium-term bottom.

Considering that, I expect INTC to consolidate close to the $30 to $31 levels, as INTC is not overvalued. Intel’s IFS roadmap and business model underscore progress, and that’s the most critical factor currently. With INTC expected to see margin accretion over the next three years and significant cost savings, I gleaned that market operators are likely looking past Intel’s previous challenges and miscalculations.

Moreover, INTC’s constructive price action suggests that investors are willing to support its significant pullbacks, presenting dip buyers with a remarkable opportunity to get back in at an attractive level.

Rating: Buy (Revised from Hold).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC, NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!