Summary:

- Carnival Corporation reports FQ2’23 earnings on June 26.

- The consensus estimates are for the cruise line to report another large loss for the May quarter due to ongoing high-interest expenses.

- CCL stock still has upside, but Carnival is no longer the favorite in the sector after the big rally.

Ethan Miller

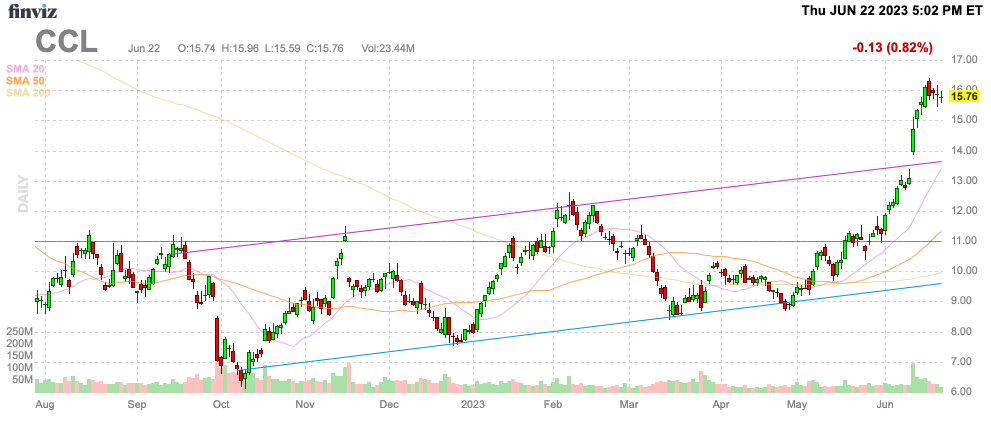

The cruise line sector has already seen a huge run-up heading into the Carnival Corp. (NYSE:CCL) earnings on June 26. The company is still forecast to report a large loss for the quarter in a negative sign for the stock. My investment thesis is still Bullish on the stock following the large run-up to $16, but the call is no longer a Strong Buy.

Source: Finviz

Carnival Is Still Unprofitable

When Carnival reports before the market opens on Monday, the company is forecast to report another large loss. The cruise line will report earnings for the quarter ending May, covering the period prior to the prime summer sailing season.

Analysts forecast the cruise line losing $0.34 in the quarter on revenues of $4.8 billion. Going back to 2019, Carnival reported similar revenues in the May quarter at $4.84 billion and a large profit of $0.66.

The good news is that the sector is back to 2019 levels on sales due to higher prices and onboard revenue, but the profit equation is still being worked out. All of the stocks have rallied ahead of the expected huge profits during the prime summer sailing season.

The issue with Carnival is the massive boost in interest expenses. Beyond higher operating costs from inflation and the ramp up in returning to full capacity, the company is now reporting nearly $500 million in quarterly net interest expenses versus only $50 million pre-Covid.

A prime example of how this is impacting Carnival more than the other cruise lines is that FQ2 operating income was in the $500 million range pre-Covid. The cruise line only had ~$10 billion in net debt with low interest rates, while interest rates have soared now and net debt is up to $30 billion, completely eliminating all of the operating income in the process.

The big focus of the FQ2’23 earnings report will be cash flows. The key to any investment is the nearly $2 billion in additional interest expenses now on the 1.26 billion shares outstanding.

Carnival is taking a nearly $1.50 hit to annual EPS from these higher interest expenses alone. The ability of the cruise line to generate positive cash flows to pay down debt is crucial to climbing out of the current profit struggles.

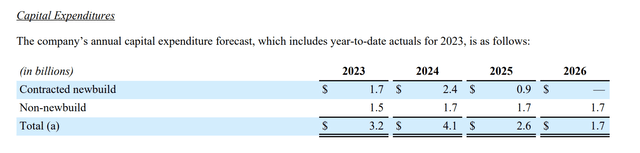

The company has guided to FY23 adjusted EBITDA of $3.9 to $4.1 billion, after only producing $382 million in FQ1. When one adds back the interest expenses, Carnival only ends up with about $2 billion in positive cash flows with a plan for spending $3.2 billion on capex this year.

Outside of higher customer deposits for advanced ticket sales, Carnival wouldn’t have positive free cash flows this year. The cruise line is actually outspending depreciation on new capex over the next couple of years due to aggressively adding new ships to the fleet.

Source: Carnival FQ1’23 earnings report

On the FQ1’23 earnings call, CEO Josh Weinstein discussed the plans for massive free cash flow boosts in FY24:

And looking forward, I expect substantial increases in adjusted free cash flow in 2024 and beyond through durable revenue growth and gross margin improvement to drive down our debt balances on our path back to investment grade.

Carnival was producing closer to $5.5 billion in adjusted EBITDA prior to Covid, with around $3.0 billion in net income. The amount is offset by over $2.0 billion in depreciation costs, plus interest income and limited taxes.

For the company to get back to investment grade at 3.5x EBITDA, Carnival has to either produce over $8.5 billion in annual adjusted EBITDA or significantly cut the debt levels via free cash flows. The prospects for a ton of free cash flow in the next few years is limited due to the large capex, but the market will be keen to see what management says about cash flows now that Carnival is entering the profitable summer quarter.

Least Favorite

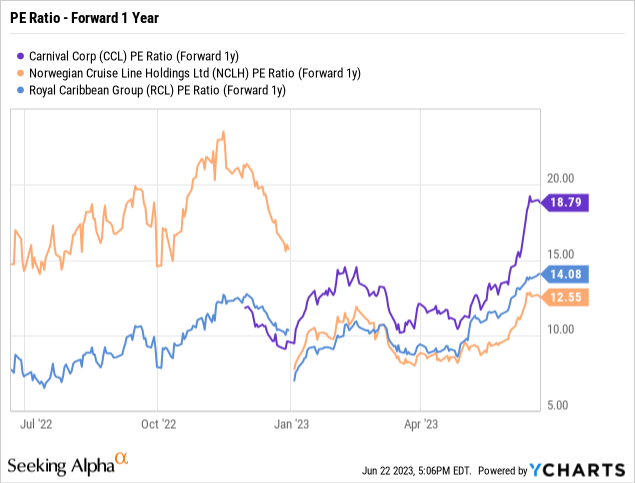

On top of the above reasons, Carnival is quickly becoming the least favorite stock of the major cruise lines. The stock has rallied to $16 from $9 in just weeks, placing Carnival at a far higher forward P/E multiple than Norwegian Cruise Line Holdings (NCLH) and Royal Caribbean Group (RCL).

Of course, the stocks can’t be completely compared based on near-term earnings. As mentioned above, Carnival has massive upside potential from cutting interest expenses and the forward EV/EBITDA multiples are similar, though using EBITDA metrics ignores the huge interest expenses.

Based on FY25 numbers, the stock is still the most expensive in the group at 12.5x the $1.27 EPS target. The other 2 cruise lines are considerably cheaper and don’t face the same debt issues.

In general, though, Carnival likely has more upside ahead based on free cash flows beyond FY25 continuing to cut debt levels and interest expenses providing more EPS upside.

Takeaway

The key investor takeaway is that after the recent rally, Carnival is no longer a Strong Buy or the preferred investment in the sector. The stock should still have plenty of upsides in the years ahead, but the large debt and ongoing high interest expenses reduce the attractiveness of the equity compared to peers.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.