Summary:

- Netflix came out as the clear, and maybe the only winner in streaming, sending its stock to a 140% surge from its June 2022 lows.

- The scale of the streaming giant is a major competitive advantage, as it reached positive free cash flows, a goal none of its competitors is close to achieving.

- By leveraging its scale, Netflix should be able to re-accelerate revenue growth, expand margins, and showcase unparalleled free cash flows.

- I rate the stock a Buy, ahead of what I project to be consecutive quarters of better-than-expected results.

wutwhanfoto/iStock Editorial via Getty Images

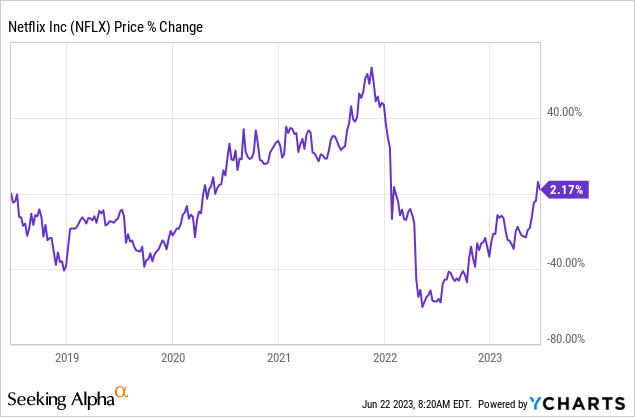

Netflix (NASDAQ:NFLX) took investors for a wild ride in the last five years, ending the period nearly flat, as the company fully recovered from a 75% sell-off. Today, after a 140% surge, the question that’s on investors’ minds is whether or not there’s still room for upside.

In my view, as the company leverages its scale to accelerate growth, expand margins and grow its free cash flows, it’s not too late to buy, yet.

Company Overview

Netflix is one of those companies that need no introduction. We all know what they do, and aside from a few immaterial lines of business like gaming, we also have a pretty good idea of the company’s revenue sources. Netflix revenues are the product of average paying subscribers multiplied by the average revenue generated by each user, which are the two most important growth drivers for the streaming giant.

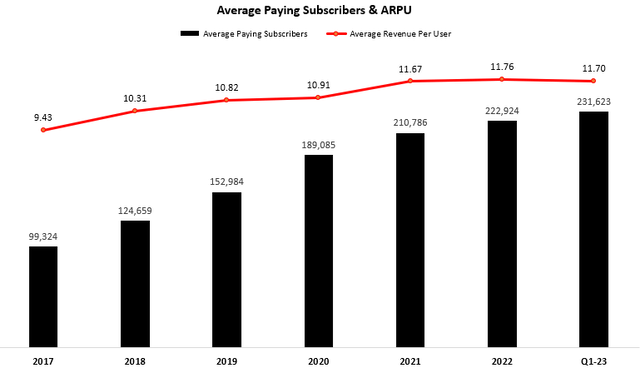

Created by the author using data from Netflix financial reports (10-K); Subscriber amounts in thousands.

As we can see, between 2017-2021, Netflix was able to grow both ARPU and subscribers at a rapid pace, resulting in astounding growth. However, subscriber growth has decelerated, both in terms of percentage and in terms of net additions. So has the ARPU, with Netflix introducing cheaper price points in certain geographies, and consumers trading down to cheaper subscriptions.

And with growth deceleration, the price followed. If you invested in Netflix five years ago, you’d receive a miserable 2.2% return, after two extraordinary selloffs, which were the result of unexpected subscriber loss and a significant margin contraction.

Right around the bottom, Netflix’s management has set forward a clear strategy to re-accelerate growth and achieve positive free cash flows. While growth re-acceleration is yet to materialize, positive free cash flows came quickly, at a time when competitors are still losing billions each quarter.

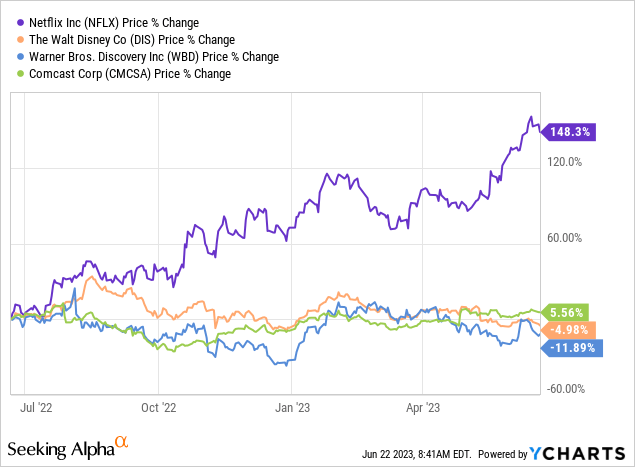

With that, investors realized that the competitive landscape is easing and that Netflix has reached a scale no other streamer would achieve in the foreseeable future. And with early signs of success from the growth re-acceleration initiatives, namely the password-sharing crackdown and the introduction of an ad tier, the stock has surged more than 140% from its June 2022 lows.

Now, the question is did we miss the train or not, and my answer, is that it isn’t too late, yet.

Investment Thesis

For the majority of its years operating as a streaming business, investors were focused on one thing and one thing only – subscribers. The idea was that as long as Netflix is able to grow subscribers at a rapid pace, there’s no reason to interfere with that by seeking short-term profitability.

With the war in Russia and right around the 230 million subscribers threshold, it became clear to both investors and management that subscriber growth is slowing down, and it’s time to emphasize profits. Luckily for Netflix, it has already reached a massive scale at this point, and it seems management has been preparing for this moment for many years. Thus, unlike many of its streaming peers, Netflix was able to achieve positive free cash flows pretty quickly.

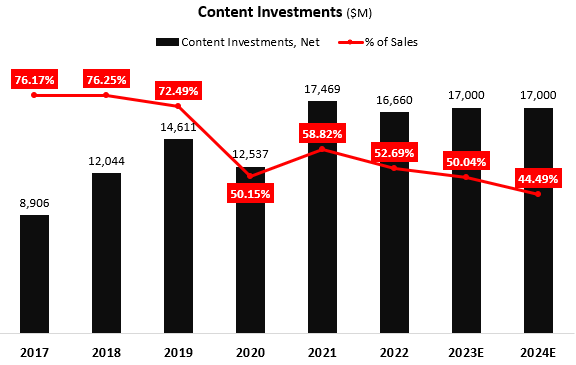

Building on that foundation, my investment thesis in Netflix is simple. Looking at its historical content investments, we realize that right around the $17B level is where the company is able to grow subscribers and keep them satisfied. Thus, as it reaches scalability, every incremental dollar of revenues should lead to a better operating margin and a better free cash flow margin.

And while most of Netflix’s peers are struggling, most of the data suggests that Netflix’s trough is behind us. So the investment thesis is based on three legs. One, growth re-acceleration due to success in password crackdown and ad tiers, as well as overall market growth and market share gains; Two, continued margin expansion leveraging economies of scale and-; Three, sequential free cash flow growth as content investments become a lower portion of sales.

Growth Re-acceleration

Let’s begin with growth re-acceleration. After two decades of double-digit growth, Netflix has reached a plateau, growing revenues by a mere 6.4% in 2022. While revenue growth remained low in the first quarter of 2023, there’s plenty of evidence that suggests we’re going to see revenue growth accelerate.

Password Sharing & Ads

Beginning with the company’s password crackdown ambition. Netflix has repeatedly said it estimates there are over 100 million shared passwords in its ecosystem, meaning that if every household was a separate subscriber it would see its subscriber count grow by approximately 43%. This led the company to initiate a password crackdown initiative, which basically means that if two households share an account, they’ve received an E-Mail stating they need to either pay for an extended account (an additional $7.99 in the U.S.), or separate into two accounts, or, god forbid, give up Netflix.

So far, Netflix said it’s seeing great response from subscribers, and third-party data backs that up. I firmly expect Netflix to report a significant beat in subscriber growth in the second and third quarters, which by itself could mean near-term upside. Additionally, the company’s ad tier is also experiencing positive acceptance, with nearly 5 million users in just a few months.

The Falling Of Other Streaming Businesses

One company’s demise could be another one’s success. And what company knows that better than Netflix, who’s exclusively responsible for the death of Blockbuster. While the failure of its streaming peers is yet to reach Blockbuster’s bankruptcy magnitude, Netflix should still be able to enjoy the struggles of the likes of Comcast’s Peacock (CMCSA), Warner Bros. Discovery’s HBO Max (WBD), Disney (DIS), and others.

And nothing tells the story better than the graph above. Other streaming businesses are struggling, hard. And Netflix could exploit their struggles to take market share and grow its library. Already, there are rumors about a potential content licensing agreement between HBO and Netflix, and even Disney’s CEO might be open to licensing the company’s content to rivals, as it struggles to generate cash. Clearly, if those companies are looking to license their own content, they’ll struggle even more to compete with Netflix on bids for smaller libraries.

Not only that Netflix will be able to offer its subscribers an even more attractive value proposition with a larger library, but it is also probable that some streamers will just sell their businesses, sending their subscribers into the arms of Netflix.

Still Room For Market Growth

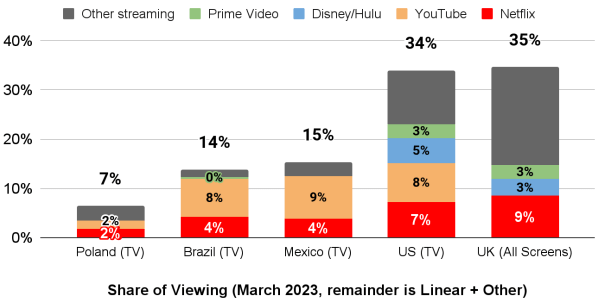

Nielsen released data that in Q1 of 2023, Netflix was the most watched of any broadcaster or streamer in the U.S. by a pretty nice margin. And we have plenty of room to grow. Even with that tremendous amount of watching, we are about 10% of total TV time in our most established markets like the U.S. and the U.K.

— Ted Sarandos, Co-CEO, Q1-23 Earnings Call

In Q1-23, streaming had a 34% share of TV in the U.S., according to Nielsen data, with Netflix holding a 20% share of total streaming.

Netflix Q1-23 Letter To Shareholders

And Netflix has two trends going its way. First, it’s constantly taking market share from its peers, and second, streaming as a whole is taking a larger share of TV time. With its growth re-acceleration initiatives and upcoming content slate filled with potential hits like Avatar, Squid Game 2, and Stranger Things 5, I estimate we’ll see better-than-expected growth for Netflix in the near to mid-term.

Margin Expansion

So we understand the revenue growth upside, but as we mentioned, the days of growth at all costs are over. For continued upside, it’s crucial that Netflix will showcase operating leverage as well.

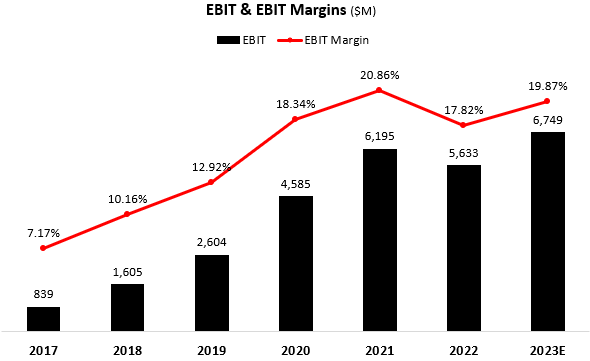

Created and calculated by the author using data from Netflix financial reports (10-K).

Currently, management is guiding for EBIT margins at the range of 18.0%-20.0% in 2023, which is still below 2021 levels. However, it’s pretty clear that with the introduction of the much more profitable ad tier and with its growing scale, margins could easily top that 20% threshold in the near term.

There’s 1 billion-plus broadband households and even today, roughly 450 million, 500 million of those being connected TV households and we only have 230 million-ish paying members today roughly, right? So that’s why we are so focused on addressing with paid sharing and then just making our business and the value that we bring to the service better each day to bring in more members. So that’s really what we are working towards.

And then long term, we don’t see ourselves approaching a near-term ceiling. There’s lots of proxies out there. Entertainment services and networks at scale traditionally have been well above our roughly 20% operating margin. So we believe we have a long way to go and we have some inherent advantages. We are a truly global entertainment network, perhaps the first, with really healthy leading engagement and a really scalable content model. So we believe we have got a long way to go, but not really putting more specific guidance out for now.

— Spence Neumann, Chief Financial Officer, Q1-23 Earnings Call

Free Cash Flow Scalability

[Regarding content investments] We expect to be back to about the $17 billion level in 2024 and the rate of growth depends on the rate of revenue growth for sure. We said, we would stay at roughly $17 billion on average over a few year period over that 2022 to 2024 period, but there’s a big entertainment market to go after beyond that. So as we reaccelerate revenue, we see a lot of opportunity to grow into that viewing and engagement and business opportunity ahead. So we expect to be there and we just have to build into it.

— Spence Neumann, Chief Financial Officer, Q1-23 Earnings Call

With expected revenues of more than $33B solely from streaming, Netflix’s streaming business is 57% larger than its closest rival Disney. And while Disney has to worry about a declining linear network business, every additional dollar Netflix generates from streaming is accretive.

To put it simply, Netflix is more than 5 years ahead of its closest rival in terms of scale, and it’s not like the company is waiting for anybody. As it currently seems, Netflix is only going to increase the gap even further in the upcoming years.

Created and calculated by the author using data from Netflix financial reports (10-K).

Looking at the graph, it’s pretty clear what scale does for a company like Netflix. Even if content investments remain steady at the 45% range from 2024 and beyond, Netflix’s free cash flow should grow in the mid-teens annually for the foreseeable future.

Valuation

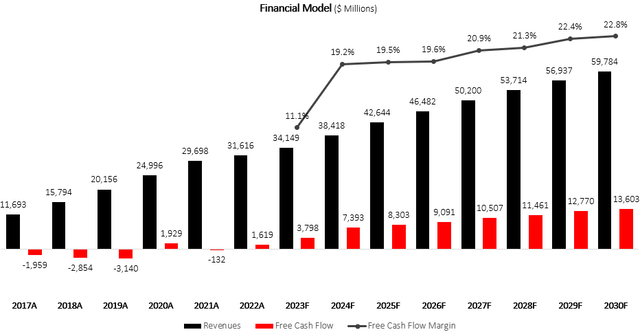

I used a discounted cash flow methodology to evaluate Netflix’s fair value. I assume the company will grow revenues at a CAGR of 8.3% between 2023-2030, based on the growth prospects discussed above.

I project free cash flow margins to increase incrementally up to 22.8% in 2030, as the company’s scale will cause content investments and operating costs to become a significantly lower portion of total sales.

Created and calculated by the author based on Netflix financial reports and the author’s projections

Taking a WACC of 8.0% and adding its net debt position, I estimate Netflix’s fair value at $206.2B or $463.9 per share, representing a 10.1% upside. While 10.1% might not seem that attractive, I think it’s highly likely Netflix will beat my expectations and provide additional upside.

Risks

The main risk I find concerning Netflix at current prices is the potential failure of re-accelerating its growth. At current prices, the market expects revenue to grow at a 7% pace for the rest of this decade. To put this into context, it means current prices reflect expectations of approximately $55B in revenues by 2030.

While this is significantly lower than management’s guidance for double-digit growth, this still requires growth to accelerate from its current pace. Obviously, I estimate Netflix will be able to beat those expectations, based on what we discussed under the growth acceleration section.

In my view, the most reasonable mix between ARPU and subscribers which will combine to reach that $55B level will be $15.3 and 300 million, respectively, reflecting a 3.3% CAGR in both metrics. You can think for yourself if you can picture Netflix achieving these metrics by 2030.

Overall, the only way I see Netflix failing to achieve those numbers is if it loses its leadership in streaming, which currently seems highly unlikely.

Conclusion

After a 140% surge from its lows, Netflix came out of 2022 as the clear, and maybe the only, winner in streaming. Even after the increase, I estimate there’s still attractive upside, as growth re-accelerates and margins expand. With its amazing upcoming content slate and high probability of beating subscriber growth expectations in the coming quarters, I rate Netflix a Buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.