Summary:

- Alphabet’s Google Cloud is growing at a faster rate than its competitors, Microsoft Cloud and Amazon AWS, with its revenue increasing by 105.4% between 2020 and 2022.

- Google Cloud has recently turned profitable, generating an operating profit of $191 million in Q1 2023, compared to an operating loss of $706 million in Q1 2022.

- Alphabet’s ecosystem, including AI and machine learning, is expected to drive further growth in its cloud services, benefiting the company in multiple ways.

Alexander Koerner/Getty Images News

Although all of the hype when it comes to technology is currently focused on artificial intelligence, I do believe that one of the biggest opportunities on the market at this time remains cloud computing. There has been some scaling back of investment in this space over the past year or so. But that doesn’t change the fact that the industry is set to grow significantly over the next few years. One of the big players in this space is none other than Google parent Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG). Even though its cloud computing offering, Google Cloud, is smaller than the same types of offerings provided by Microsoft (MSFT) and Amazon (AMZN), it is still a significant player. On top of this, it’s actually generating attractive revenue growth that is allowing it to gain market share relative to these two competitors. It is true that the operation is still losing money in the aggregate. But that picture continues to improve year after year. Add on top of this the potential tie-in with AI that cloud computing has, and I do believe that investors should look upon Alphabet in a very favorable light moving forward.

Fantastic results as of late

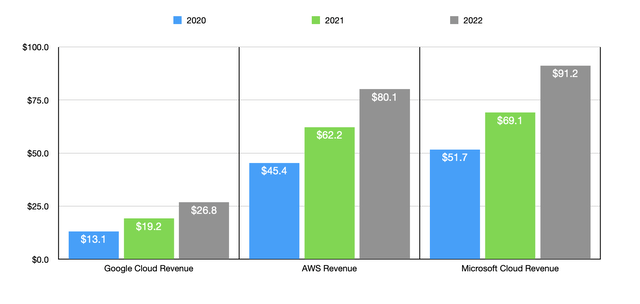

At this time, there are three major players in the cloud computing market. The largest of these is undoubtedly Microsoft. During its latest completed fiscal year, Microsoft Cloud generated revenue of $91.2 billion. To be very clear, this is very different from the Intelligent Cloud segment that the company operates. Although there is significant crossover between the two, there are aspects of Microsoft Cloud that fit outside of the aforementioned segment. For context of the difference between the two, while Microsoft Cloud generated $91.2 billion in revenue during its latest completed fiscal year, its Intelligent Cloud segment reported revenue of $75.3 billion.

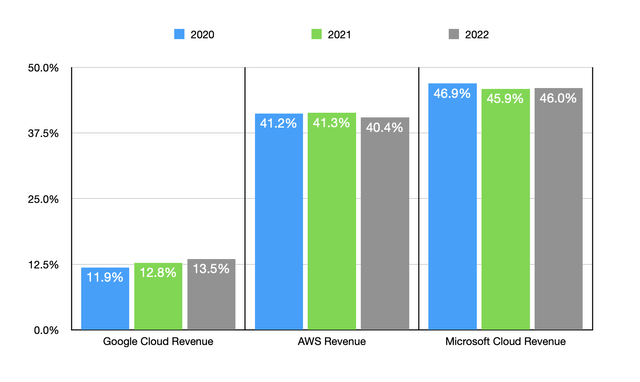

Next in line, we have Amazon with its AWS offering. It generated $80.1 billion in revenue during the 2022 fiscal year. When you use the data covering the most recent completed fiscal years of each firm, this translates to a 40.4% stake of the combined revenue of the three cloud platforms compared to the 46% reported by Microsoft. This leaves Alphabet a distant third with revenue of only $26.8 billion in 2022. That’s a 13.6% stake over the revenue of the three different cloud offerings combined.

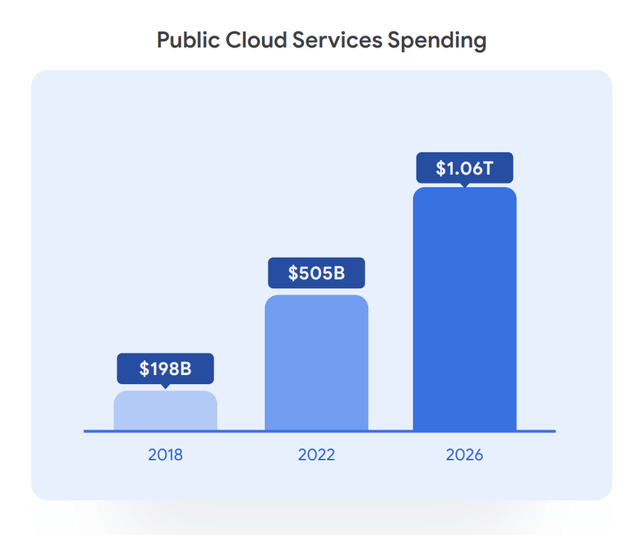

In the technology space, it’s usually the case that there’s only enough room for one or two major firms. All the other players are usually relegated to second class status. But I don’t believe that this is necessarily what will transpire when it comes to the cloud market. According to an estimate provided by Alphabet, the global cloud market was worth about $505 billion in 2022. By 2026, it’s expected to grow to about $1.06 trillion. That’s a 20.4% annualized growth rate over that window of time. Other sources have had an outlook for the industry that’s even more bullish. One source, for instance, pegged the market opportunity at about $2 trillion by 2030, implying an annualized growth rate of 21.6% from the $428 billion it was worth last year.

Whether it’s $1 trillion or $2 trillion, there’s no denying that this implies meaningful upside for all competitors. Add on top of this the fact that Google Cloud has, in some respects, been doing quite well for itself relative to its competitors, and I have no reason to be anything other than bullish. What do I mean by this? Well, if you look at Microsoft, Amazon, and Alphabet, their combined cloud related revenue in 2020 was $110.2 billion. By 2022, this revenue had grown to $198.1 billion. For clarity, Microsoft does have a different ending to its fiscal year than Amazon and Alphabet have. So this data covers the latest completed fiscal year of each firm. But I digress. Over this window of time, the fastest grower of the three has actually been Alphabet. Revenue for Google Cloud jumped 105.4% over this window of time. This compares to the 76.4% reported for Microsoft Cloud and the 76.4% reported for AWS. This rapid growth has allowed Google Cloud to expand from 11.9% of the combined revenue of the three to 13.5% in a relatively short window of time.

Even though the service is still far smaller than its two largest rivals, it is truly global in its reach. As of the latest investor presentation on the matter, Google Cloud was live in 34 different regions and was in the process of building out in nine additional regions. While this may not sound like much, it has allowed the company to provide its services to over 200 countries and territories across the world. In order to grow further, the company was even investing in the development of a subsea cable network. It’s also the case that Google Cloud already has a wide variety of utility. In a prior article that I wrote about Amazon, I talked about its exposure to what is referred to as the Industry Cloud niche. This is a segment of the market that has services that are designed specifically for the needs of various industries. Already, Google Cloud plays in that space. It also, just like its rivals, competes in other market segments. Its Trusted Cloud offerings help to provide protection for software, websites, and more. Its Collaboration Cloud helps to facilitate collaboration for firms that need it. The list goes on.

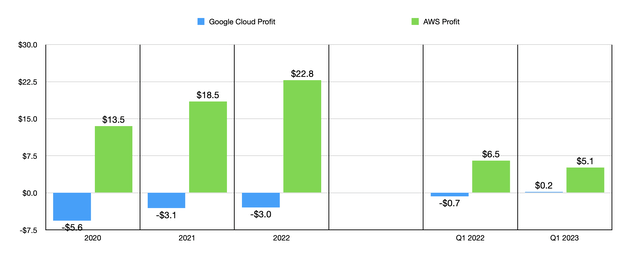

This is not to say that everything has been great regarding the service. Up until very recently, it continued to generate significant losses. The operating loss back in 2020, for instance, totaled $5.61 billion. The good news is that this did improve, narrowing to $2.97 billion in 2022. But when you compare that to something like Amazon, there is a world of difference. In 2022, as an example, AWS generated operating profits of $22.8 billion. I would have liked to have compared Google Cloud to Microsoft Cloud There is profit data when it comes to Microsoft’s Intelligent Cloud segment. But it does not break out profitability data for Microsoft Cloud in its entirety. But given the results seen from Intelligent Cloud, it’s safe to say that it’s in the same camp as AWS.

Even though Google Cloud has had profitability issues, that picture may be changing for the better. During the first quarter of the company’s 2023 fiscal year, Google Cloud generated revenue of $7.45 billion. That’s up 28.1% over the $5.82 billion generated one year earlier. That allowed its share of the big three to grow from 12.2% in the first quarter of last year to 13% the same time this year. The continued scaling allowed the service to go from generating an operating loss of $706 million in the first quarter of last year to generating a profit of $191 million the same time this year. By comparison, AWS saw its operating profit decline from $6.52 billion to $5.12 billion. It’s unclear whether this turn to profitability is here to stay or not. Most likely, it is. But even if not, I don’t have a problem waiting for a couple more years for Google Cloud to get there. After all, Alphabet as a whole generated operating cash flow last year of $91.5 billion. So it is already plenty profitable as-is and has plenty of fuel to grow that service even more.

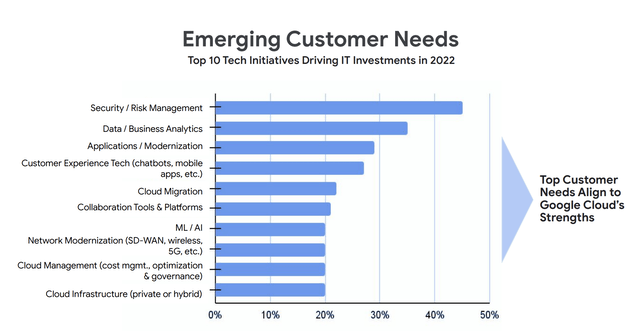

I understand that all of the hype has really shifted from cloud computing to artificial intelligence. However, I do believe that the cloud industry is one of the industries that will benefit the most from AI. I’m not the only one who thinks this. Alphabet also seems to be of that opinion. Multiple times in its most recent investor presentation on the matter, the company mentions AI and machine learning. In fact, it mentioned that these activities are one of the top technology initiatives driving IT investments at this time. Fortunately for investors, AI is already something that Alphabet has been pushing.

Some of you may be rolling your eyes at that statement. After all, earlier this year, Alphabet had something of a hiccup when it comes to AI. During its public presentation revealing Google Bard in February of this year, its chatbot made a factual misstatement that was perceived poorly by the investment community. In short order, Alphabet saw its market capitalization drop by around $100 billion. Fortunately, this was short lived. And as of this writing, shares of Alphabet are now about 14.8% above where they were the day before this blunder. I understand that anecdotal evidence is not all that meaningful in the grand scheme of things. But I have experimented some with both Google Bard and ChatGPT and my own experience has been quite underwhelming. Both make multiple factual misstatements. But the important thing is that the technology should only improve from this point on.

Irrespective of how the technology will change, I would actually make the case that the winner of the AI race is meaningless. And in what was reported as a leaked memo from the company that became public earlier this year, Alphabet claimed that they don’t have a moat and that OpenAI, the creator of ChatGPT, does not have one either. Open source versions of this new technology are achieving remarkable results and, instead, Alphabet has claimed that the real value is in owning the ecosystem. And an ecosystem is exactly what Alphabet has. Add on top of this the fact that continued growth in fields like AI should result in even greater demand for cloud services as time goes on, and the company stands to benefit in multiple ways.

Takeaway

Right now, I believe that Alphabet is in a really promising position in several respects. The company’s cloud offerings continue to grow at a rate that is outpacing its two largest rivals. Up until very recently, Google Cloud was operating at a loss. But when you consider how extremely cash flow positive Alphabet is, I’m not worried about the long run. AI has the potential to benefit the company’s cloud offerings, both because the firm can use AI to increase the appeal of its cloud services, and because. AI’s growth should accelerate cloud demand.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.